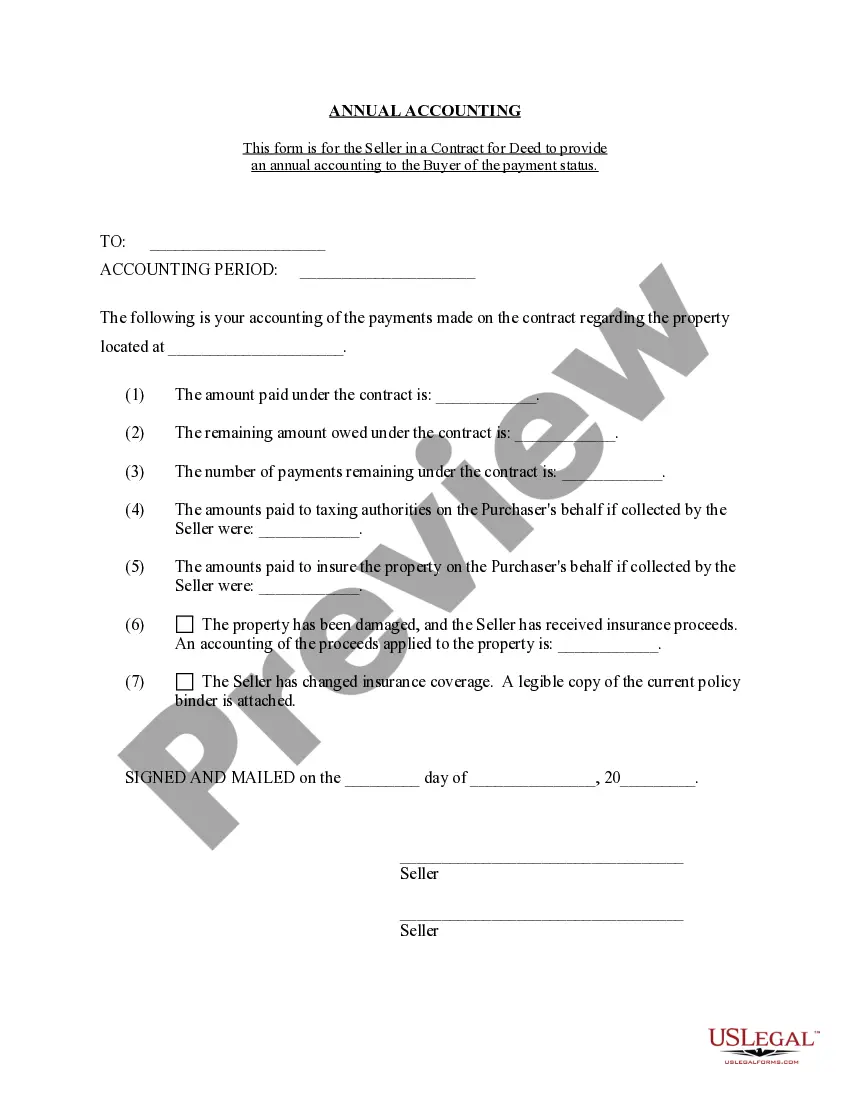

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Sioux Falls South Dakota Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out South Dakota Contract For Deed Seller's Annual Accounting Statement?

We consistently aim to lessen or circumvent legal repercussions when navigating intricate legal or financial matters.

To achieve this, we enroll in legal services that are generally very expensive.

However, not every legal challenge is similarly intricate.

Many can be managed independently.

Utilize US Legal Forms whenever you need to swiftly and securely locate and download the Sioux Falls South Dakota Contract for Deed Seller's Annual Accounting Statement or any other document. Just Log In to your account and click the Get button next to it. If you misplace the form, you can always download it again in the My documents tab.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your matters independently without resorting to legal advisors.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

Form popularity

FAQ

The sale, lease, or rental of tangible personal property or products transferred electronically is subject to sales tax.

Transfer Tax (Local Treasurer's Office): this tax is for the barter, sale, or any other method of ownership or title of real property transfer, at the maximum rate of 50% of 1%, or 75% of 1% in cities and municipalities within Metro Manila, of a property's worth.

Imposition and amount of real estate transfer fee. A fee is hereby imposed at the rate of fifty cents for each five hundred dollars of value or fraction thereof upon the privilege of transferring title to real property in the State of South Dakota, which fee shall be paid by the grantor.

How to Avoid Probate in South Dakota? Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

A South Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property to one or more beneficiaries named in the document on the death of the owner. South Dakota TOD deeds were first authorized by the South Dakota Real Property Transfer on Death Act in 2014.

If you don't have a will or a Transfer on Death Deed, your real estate must go through the probate court and your property will pass to your heirs according to Texas law. Probate can be lengthy and expensive, with attorney fees and court costs paid from your estate.

Keep in mind that closing costs in South Dakota do not include realtor fees. These are an extra 5.66% on average ? and they're nearly always paid by the seller. Who pays closing costs in South Dakota? Buyers and sellers each pay unique closing costs to finalize a home sale.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.