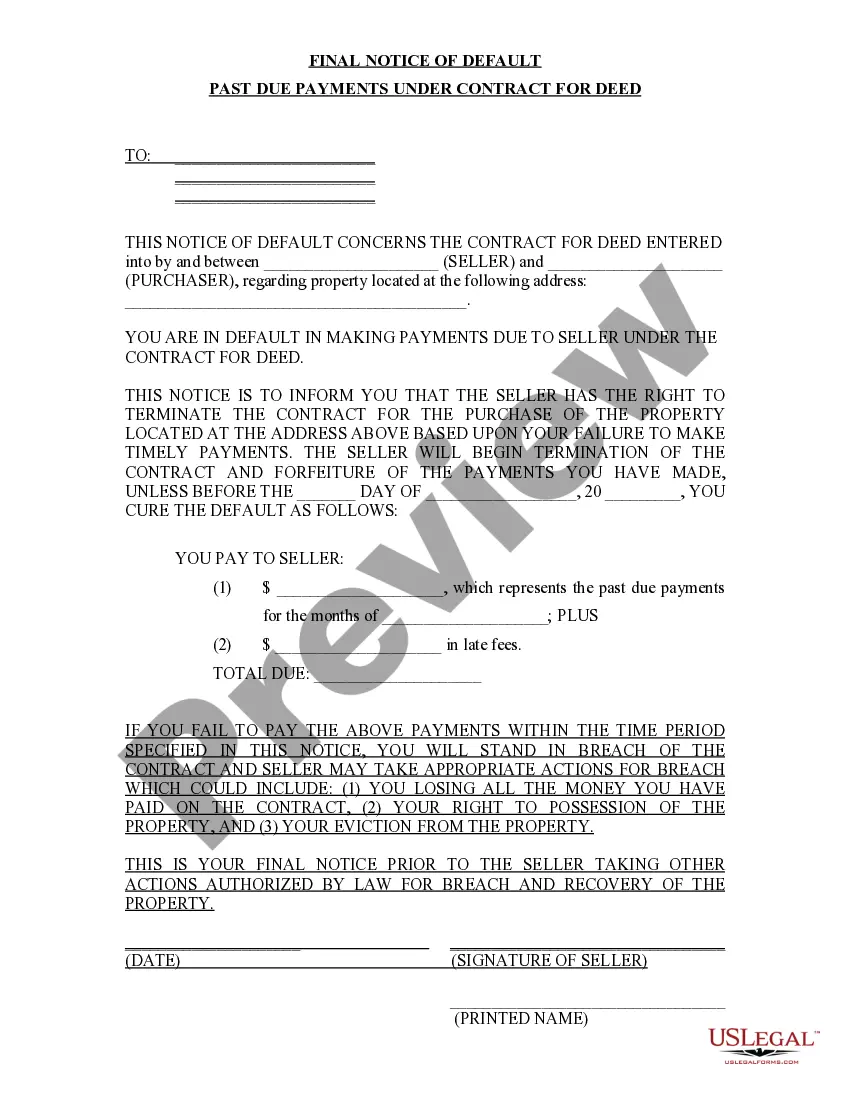

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed When entering into a Contract for Deed in Sioux Falls, South Dakota, it is crucial for both parties involved to fulfill their payment obligations consistently. In the event that a buyer fails to make their payments in a timely manner, they may receive a Final Notice of Default. This notice serves as a formal notification to the buyer that they are in violation of the terms of the contract and must take immediate action to rectify the situation. The Final Notice of Default is issued by the seller or the designated entity responsible for managing the contract. Its purpose is to inform the buyer that they are in arrears and have a specified amount of time to bring their payments up to date. This notice acts as a warning that failure to resolve the delinquency within the given time frame may result in severe consequences, such as foreclosure or legal action. Key points to include in a Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Proper Identification: The notice should clearly identify the buyer and seller involved in the Contract for Deed. Names, contact information, and relevant property details should be provided for clear identification. 2. Specificity of the Default: The notice must explicitly state the nature of the default, emphasizing the past due payments and the amount outstanding. Including a breakdown of each missed payment and the total balance owed can help the buyer understand the gravity of the situation. 3. Time Frame for Cure: The notice should specify the period within which the buyer must remedy the default. This timeline typically ranges from 30 to 90 days, depending on the terms stated in the contract or any applicable state laws. 4. Consequences of Non-Compliance: The notice should inform the buyer of the potential consequences they may face if they fail to bring their payments up to date within the specified time frame. This may include foreclosure, legal action, or additional fees and interest charges. Different types of Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed: There might not be different types of Final Notices of Default for past due payments specific to Sioux Falls, South Dakota, as the content of the notices generally remains similar. However, variations may occur depending on the terms outlined in individual Contract for Deed agreements, state laws, or the preferences of the issuing party. These variations could include the styles or formatting of the notice, additional disclosures, or specific state-mandated language. It is crucial for both buyers and sellers involved in a Contract for Deed to review their agreement thoroughly to be aware of any specific provisions or requirements related to default notices. Seeking legal advice or consulting with a real estate professional familiar with South Dakota laws can provide further clarity on the matter.Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed When entering into a Contract for Deed in Sioux Falls, South Dakota, it is crucial for both parties involved to fulfill their payment obligations consistently. In the event that a buyer fails to make their payments in a timely manner, they may receive a Final Notice of Default. This notice serves as a formal notification to the buyer that they are in violation of the terms of the contract and must take immediate action to rectify the situation. The Final Notice of Default is issued by the seller or the designated entity responsible for managing the contract. Its purpose is to inform the buyer that they are in arrears and have a specified amount of time to bring their payments up to date. This notice acts as a warning that failure to resolve the delinquency within the given time frame may result in severe consequences, such as foreclosure or legal action. Key points to include in a Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Proper Identification: The notice should clearly identify the buyer and seller involved in the Contract for Deed. Names, contact information, and relevant property details should be provided for clear identification. 2. Specificity of the Default: The notice must explicitly state the nature of the default, emphasizing the past due payments and the amount outstanding. Including a breakdown of each missed payment and the total balance owed can help the buyer understand the gravity of the situation. 3. Time Frame for Cure: The notice should specify the period within which the buyer must remedy the default. This timeline typically ranges from 30 to 90 days, depending on the terms stated in the contract or any applicable state laws. 4. Consequences of Non-Compliance: The notice should inform the buyer of the potential consequences they may face if they fail to bring their payments up to date within the specified time frame. This may include foreclosure, legal action, or additional fees and interest charges. Different types of Sioux Falls South Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed: There might not be different types of Final Notices of Default for past due payments specific to Sioux Falls, South Dakota, as the content of the notices generally remains similar. However, variations may occur depending on the terms outlined in individual Contract for Deed agreements, state laws, or the preferences of the issuing party. These variations could include the styles or formatting of the notice, additional disclosures, or specific state-mandated language. It is crucial for both buyers and sellers involved in a Contract for Deed to review their agreement thoroughly to be aware of any specific provisions or requirements related to default notices. Seeking legal advice or consulting with a real estate professional familiar with South Dakota laws can provide further clarity on the matter.