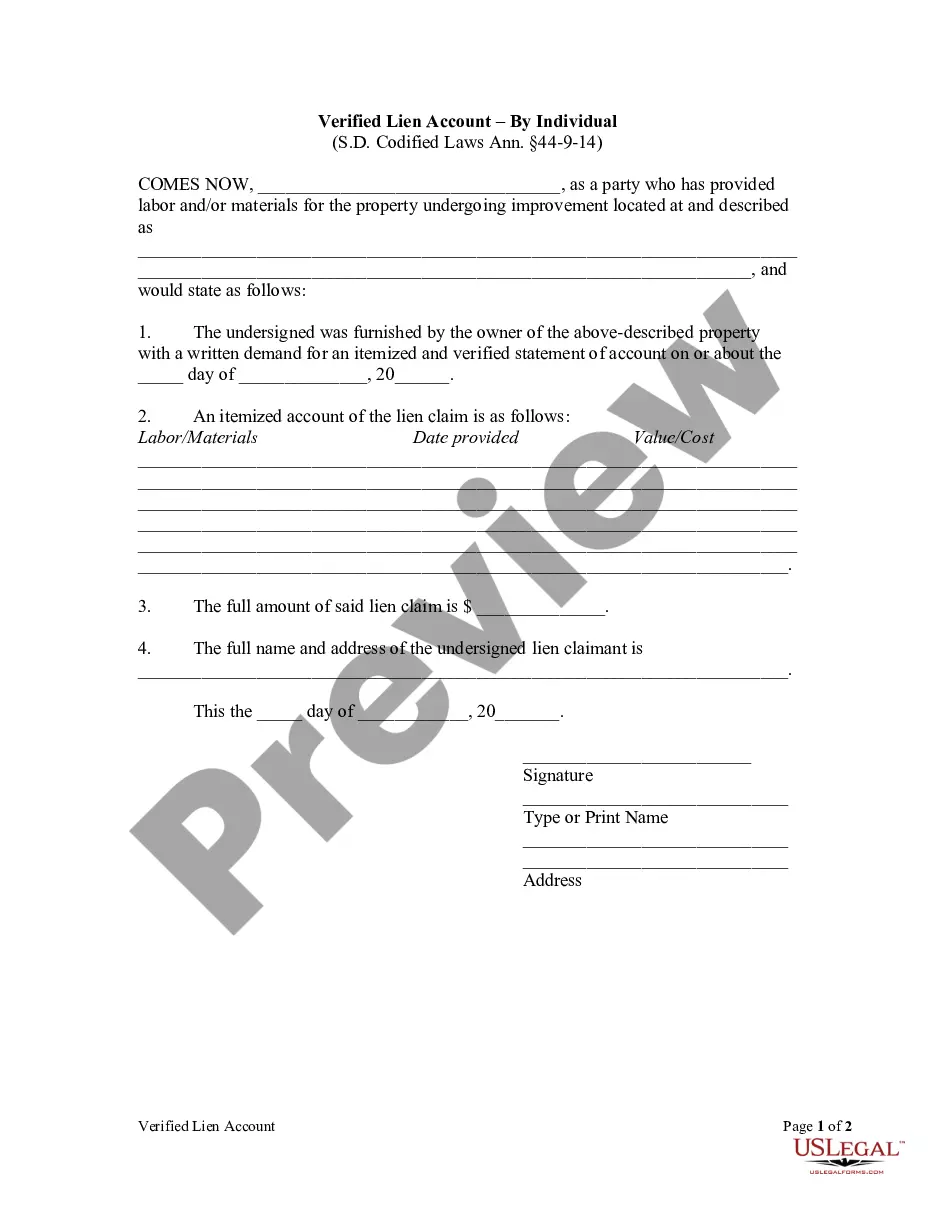

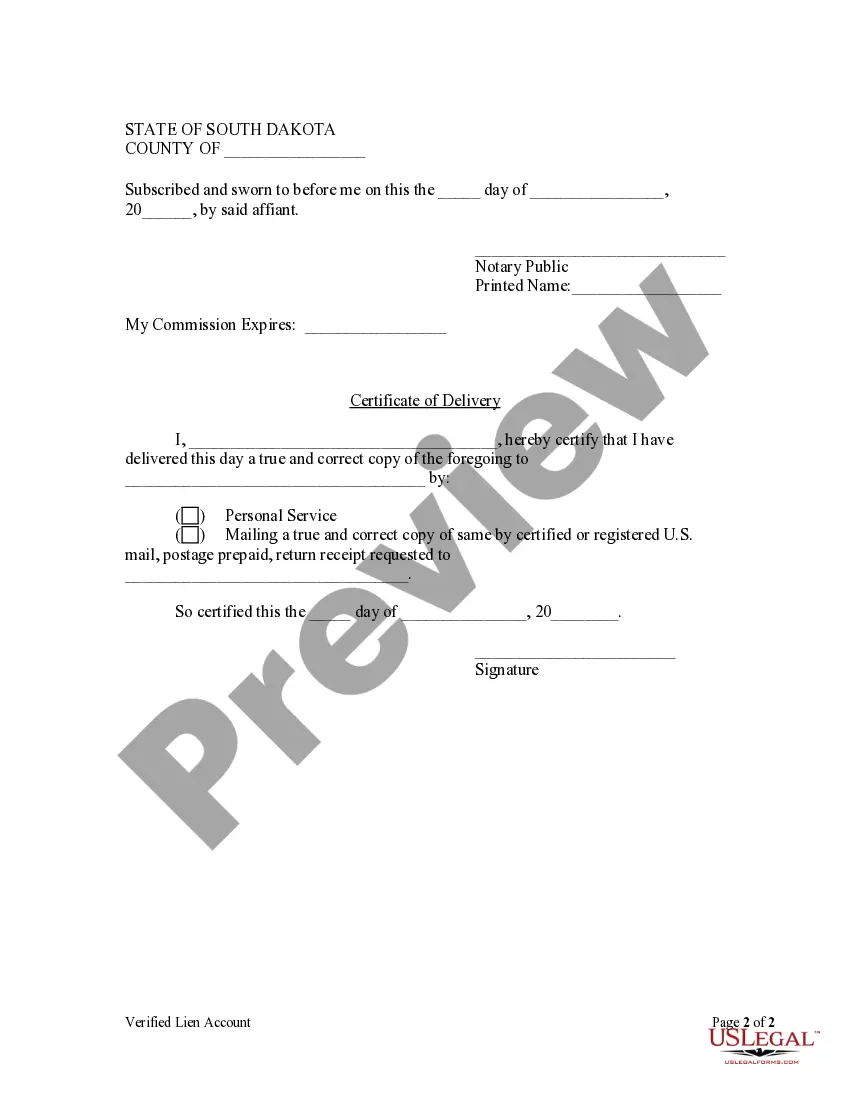

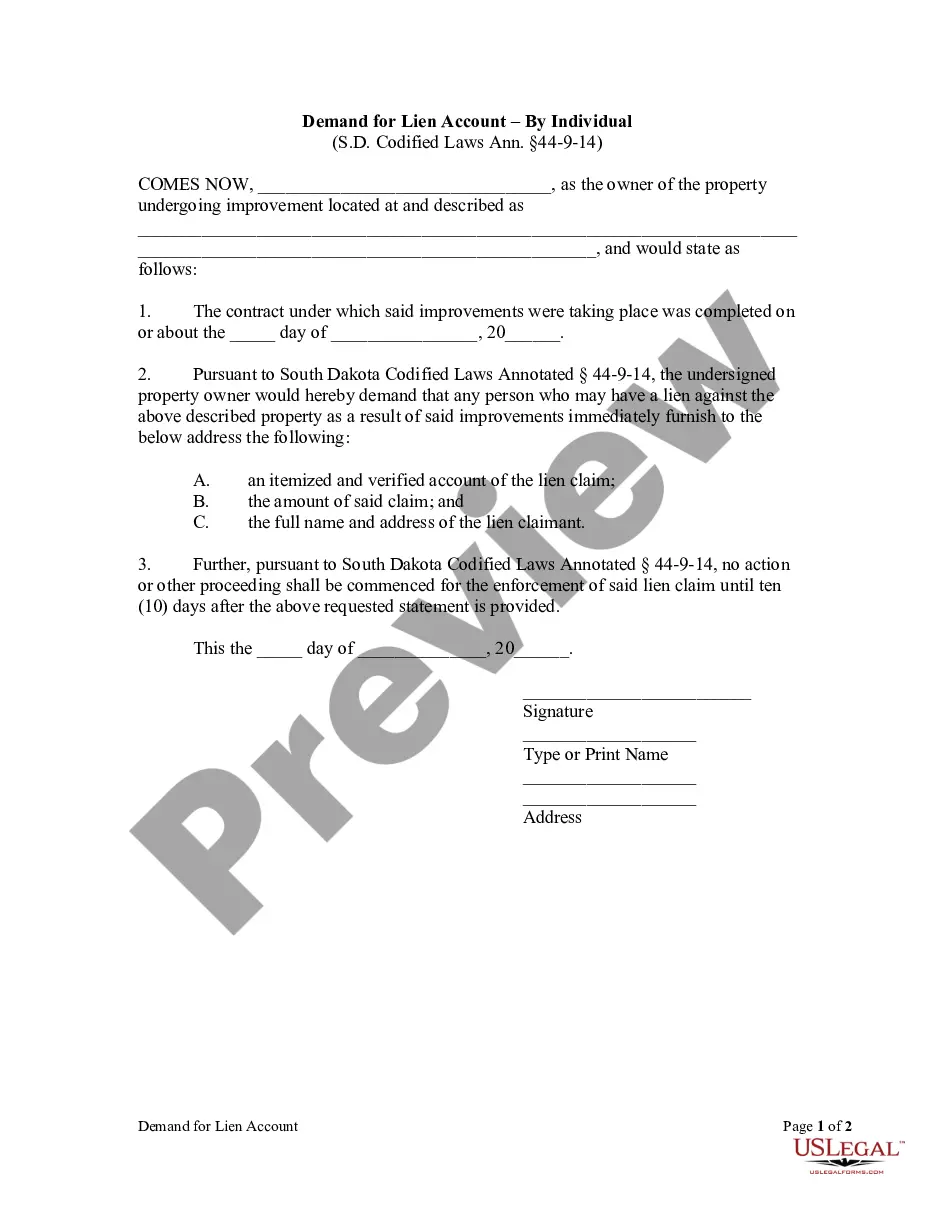

The owner, by serving written request within fifteen days after the completion of the contract, may require any person who may have a lien under the provisions of this chapter, to furnish him an itemized and verified account of his lien claim, the amount thereof, and his name and address. No action or other proceeding shall be commenced for the enforcement of such lien until ten days after such statement is so furnished pursuant to the request of the owner.

Sioux Falls South Dakota Lien Account - Individual

Description

How to fill out South Dakota Lien Account - Individual?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our advantageous platform, equipped with thousands of templates, streamlines the process of locating and acquiring virtually any document sample you require.

You can save, complete, and validate the Sioux Falls South Dakota Lien Account - Individual in just a few minutes, instead of spending hours searching online for the correct template.

Accessing our library is an excellent method to enhance the security of your document filing.

If you do not have an account, follow the instructions below.

Open the page with the template you seek. Ensure it is the template you need: verify its title and description, and use the Preview feature if it's available. Otherwise, use the Search field to locate the correct one.

- Our experienced attorneys routinely review all documents to ensure that the templates are suitable for a specific state and comply with current laws and regulations.

- How can you acquire the Sioux Falls South Dakota Lien Account - Individual.

- If you have a subscription, simply Log In to your account.

- The Download button will be available for all the samples you access.

- Additionally, you can find all your previously saved files in the My documents section.

Form popularity

FAQ

Yes, non-residents can register a car in South Dakota. However, they must meet specific requirements, including providing proof of ownership and completing necessary paperwork. Utilizing the US Legal feature can simplify this process, especially for those managing a Sioux Falls South Dakota Lien Account - Individual. By understanding the rules and having the right forms, you can easily navigate car registration in South Dakota.

Filling out a South Dakota title transfer requires specific information about both the seller and buyer, along with details of the vehicle. You must complete the title transfer form and ensure all sections are accurately filled out, including signatures and dates. The US Legal Forms platform offers resources to help you navigate the title transfer process effectively for your Sioux Falls South Dakota Lien Account - Individual.

To file a lien in South Dakota, you must complete the necessary forms and submit them to the appropriate office. Typically, this involves filling out the lien document, then filing it with the county register of deeds in the county where the property is located. Using the US Legal Forms platform can simplify this process by providing you with the correct forms and guidance tailored to a Sioux Falls South Dakota Lien Account - Individual.

Filing a lien in South Dakota involves completing a lien form and submitting it to the appropriate filing office. You must provide detailed information about the debt and the parties involved. Using the US Legal platform simplifies this process by offering templates and guidance, which can be particularly helpful for those managing a Sioux Falls South Dakota Lien Account - Individual. By following these steps carefully, you can protect your rights to payment.

To transfer a title in South Dakota, you need the original title document signed by the seller, a completed title application, and payment for any applicable fees. Additionally, it is wise to include a bill of sale to provide proof of the transaction. With a Sioux Falls South Dakota Lien Account - Individual, it becomes easier to track any liens associated with the title, ensuring a smoother transfer process. Make sure to have all documents organized before your visit to the DMV.

Filing a mechanics lien in South Dakota typically takes a few days to several weeks depending on the completeness of your documents. Once you gather all necessary information, you can submit your lien claim to the appropriate office. If done through the US Legal platform, the process can become more efficient, helping you ensure that your Sioux Falls South Dakota Lien Account - Individual is established without unnecessary delays. Always double-check local requirements to ensure compliance.

Registering a car in South Dakota without a title can be challenging; however, it is sometimes possible with a Sioux Falls South Dakota Lien Account - Individual. To do so, you will need to obtain a secure statement or affidavit regarding the vehicle's ownership to verify your claim. This process may require additional documentation and inspections to establish ownership. Our platform, uslegalforms, provides guidance and forms to help navigate these requirements effectively.

Yes, you can register your car in South Dakota even if you live out of state, particularly if you have a Sioux Falls South Dakota Lien Account - Individual. You will need to provide proof of ownership, such as the title, and comply with the state's registration requirements. It's important to gather all necessary documents to ensure a smooth registration process. If you require assistance, consider using our resources at uslegalforms to simplify the procedure.