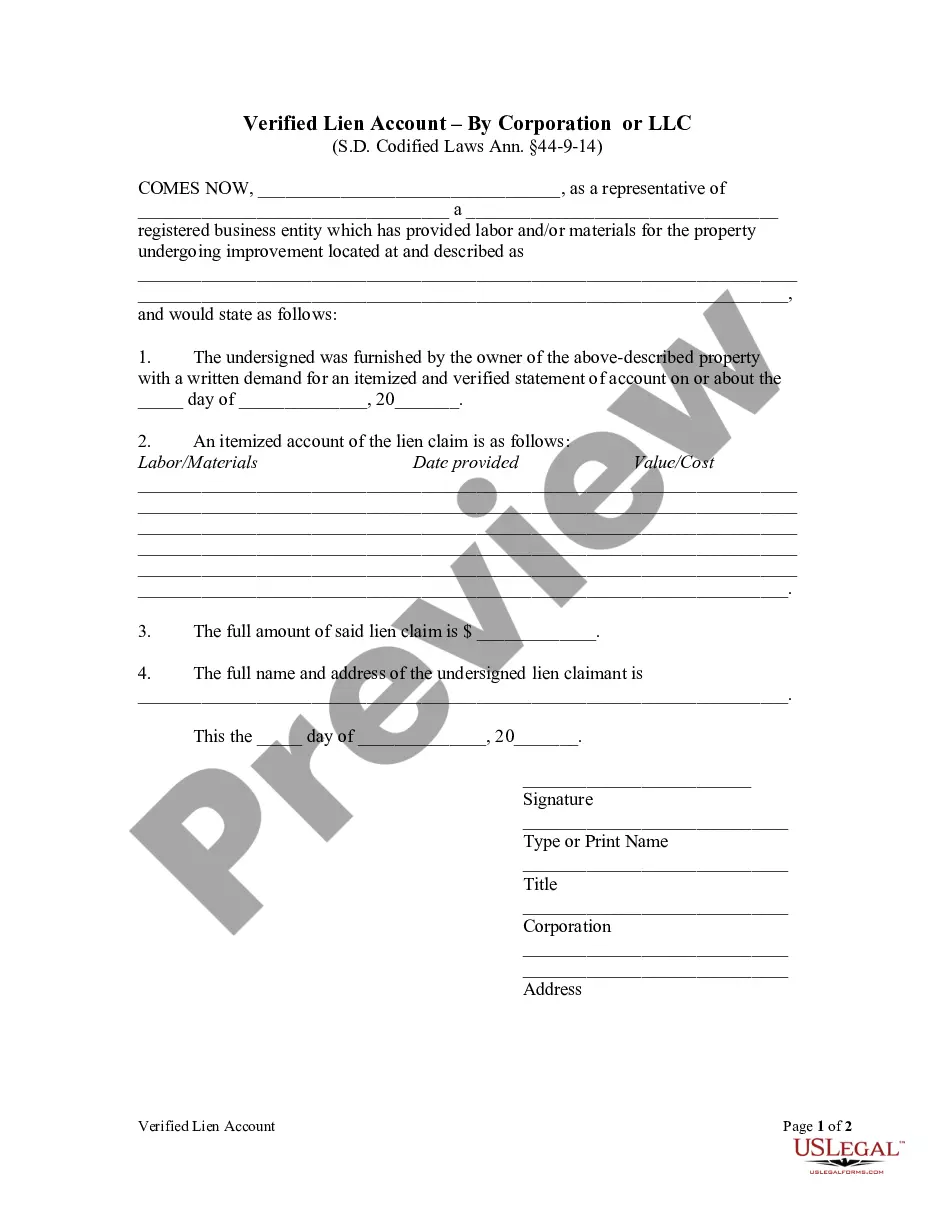

The owner, by serving written request within fifteen days after the completion of the contract, may require any person who may have a lien under the provisions of this chapter, to furnish him an itemized and verified account of his lien claim, the amount thereof, and his name and address. No action or other proceeding shall be commenced for the enforcement of such lien until ten days after such statement is so furnished pursuant to the request of the owner.

Sioux Falls South Dakota Lien Account by Corporation or LLC: In Sioux Falls, South Dakota, a lien account by corporation or LLC refers to a financial tool used by businesses to secure their interests in various assets. A lien, in this context, represents a legal claim that grants the creditor (corporation or LLC) the right to sell or seize the debtor's property if a debt or obligation is not fulfilled. By establishing a lien account, corporations and LCS aim to protect themselves and ensure their debts are repaid. There are different types of Sioux Falls South Dakota Lien Account by Corporation or LLC, including: 1. Mechanic's Lien Account: This type of lien account is applicable in the construction industry. When a corporation or LLC provides labor, materials, or services for the improvement or construction of a property, and the debtor (property owner) fails to make the necessary payment, the entity can file a mechanic's lien account to assert their rights and potentially foreclose the property to recover their debt. 2. Tax Lien Account: A tax lien account is created when a corporation or LLC fails to pay its taxes to the state or federal government. The government has the right to place a lien on the business's assets, including real estate, personal property, and bank accounts, to ensure the debt is repaid. 3. Judgment Lien Account: A judgment lien account arises when a court rules in favor of a corporation or LLC in a lawsuit, and the debtor fails to satisfy the judgment. The entity can then create a judgment lien account, enabling them to use legal means to collect the debt, such as garnishing wages or seizing assets. 4. UCC Lien Account: Under the Uniform Commercial Code (UCC), corporations and LCS can establish a UCC lien account to secure their interests in personal property, including inventory, equipment, accounts receivable, and more. This type of lien account serves as a notice to other potential creditors that the corporation or LLC has a legal claim over specific assets. In conclusion, Sioux Falls South Dakota Lien Account by Corporation or LLC refers to the various types of financial claims that businesses can establish on assets to protect their interests and ensure debt repayment. These types include mechanic's lien accounts, tax lien accounts, judgment lien accounts, and UCC lien accounts.Sioux Falls South Dakota Lien Account by Corporation or LLC: In Sioux Falls, South Dakota, a lien account by corporation or LLC refers to a financial tool used by businesses to secure their interests in various assets. A lien, in this context, represents a legal claim that grants the creditor (corporation or LLC) the right to sell or seize the debtor's property if a debt or obligation is not fulfilled. By establishing a lien account, corporations and LCS aim to protect themselves and ensure their debts are repaid. There are different types of Sioux Falls South Dakota Lien Account by Corporation or LLC, including: 1. Mechanic's Lien Account: This type of lien account is applicable in the construction industry. When a corporation or LLC provides labor, materials, or services for the improvement or construction of a property, and the debtor (property owner) fails to make the necessary payment, the entity can file a mechanic's lien account to assert their rights and potentially foreclose the property to recover their debt. 2. Tax Lien Account: A tax lien account is created when a corporation or LLC fails to pay its taxes to the state or federal government. The government has the right to place a lien on the business's assets, including real estate, personal property, and bank accounts, to ensure the debt is repaid. 3. Judgment Lien Account: A judgment lien account arises when a court rules in favor of a corporation or LLC in a lawsuit, and the debtor fails to satisfy the judgment. The entity can then create a judgment lien account, enabling them to use legal means to collect the debt, such as garnishing wages or seizing assets. 4. UCC Lien Account: Under the Uniform Commercial Code (UCC), corporations and LCS can establish a UCC lien account to secure their interests in personal property, including inventory, equipment, accounts receivable, and more. This type of lien account serves as a notice to other potential creditors that the corporation or LLC has a legal claim over specific assets. In conclusion, Sioux Falls South Dakota Lien Account by Corporation or LLC refers to the various types of financial claims that businesses can establish on assets to protect their interests and ensure debt repayment. These types include mechanic's lien accounts, tax lien accounts, judgment lien accounts, and UCC lien accounts.