This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

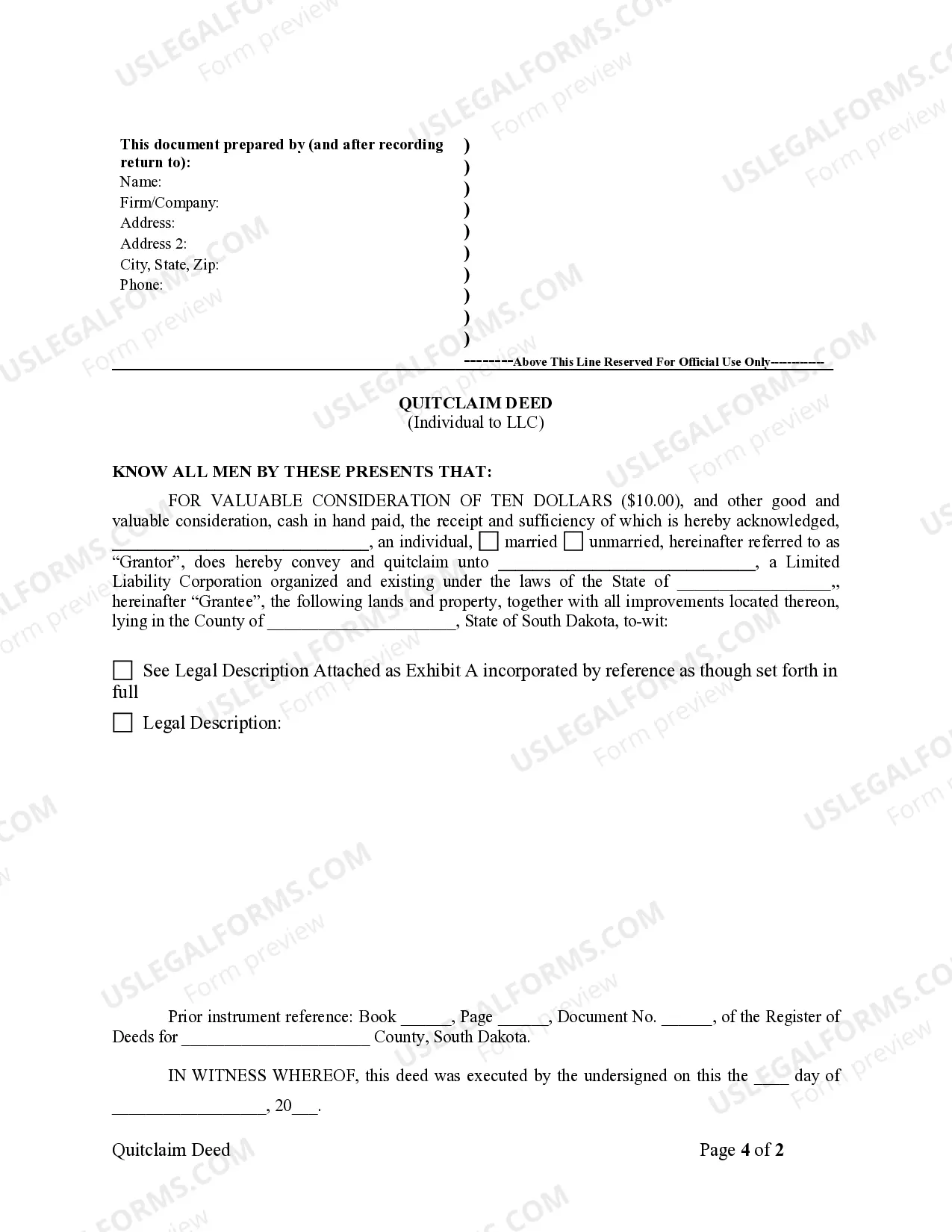

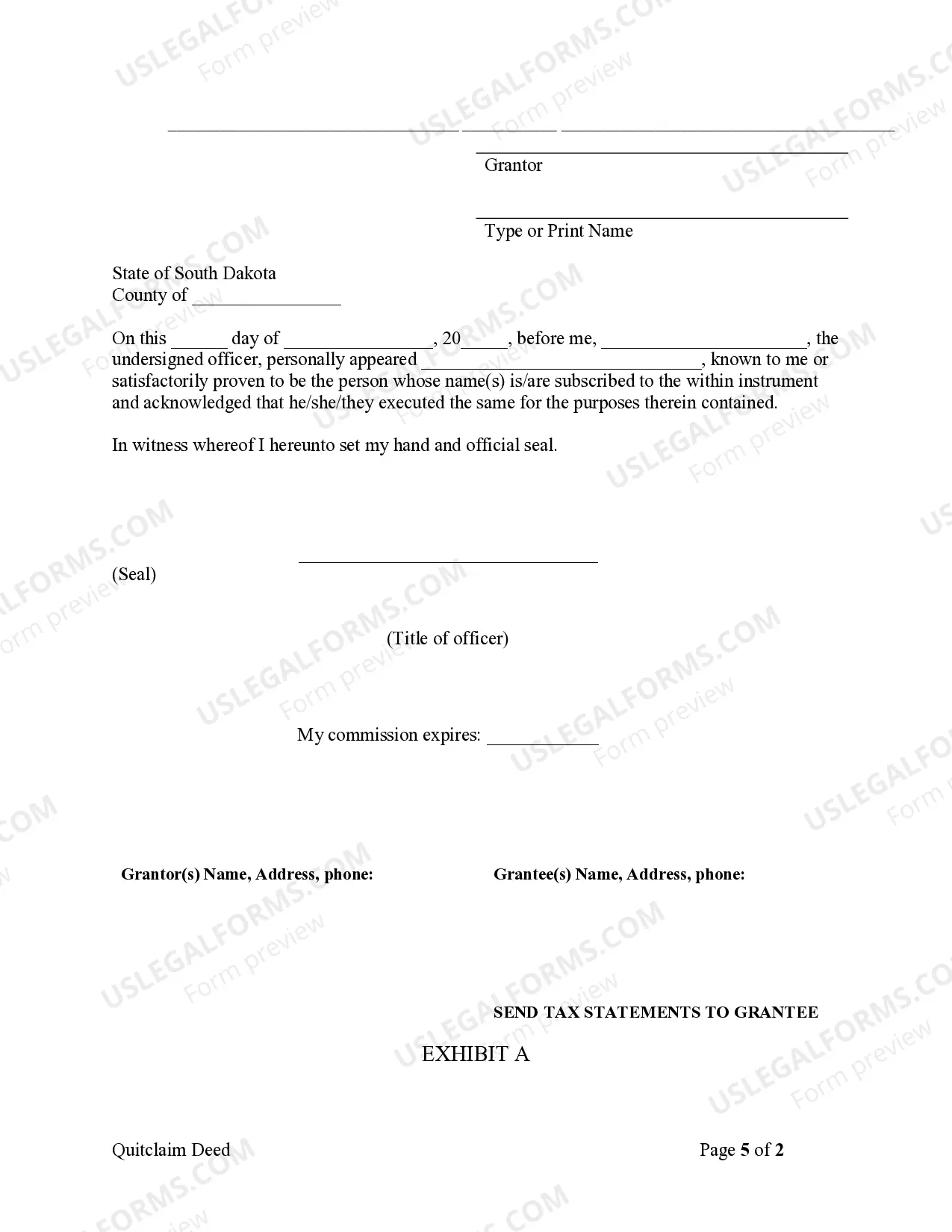

Sioux Falls, South Dakota Quitclaim Deed from Individual to LLC: A Comprehensive Overview Introduction: In Sioux Falls, South Dakota, a quitclaim deed is a vital legal document used for transferring ownership of real estate from an individual to a Limited Liability Company (LLC). This method allows for a smooth and straightforward transfer of assets, granting rights, interests, and title in a property. Understanding the variations and uses of quitclaim deeds in Sioux Falls is essential when engaging in real estate transactions. This article aims to provide a detailed description of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC, along with insightful information on different types, legal implications, and commonly associated terms. 1. Basic Components of a Sioux Falls, South Dakota Quitclaim Deed: Granteror and Grantee: The Grantor is the individual transferring the property ownership, and the Grantee is the LLC receiving the property. — Property Description: Detailed information about the property, including the address, legal description, and parcel number. — Consideration: The consideration is the financial aspect of the transfer, usually a nominal amount. — Acknowledgment: A notary public or authorized official witnesses the Granter's signature. — Acceptance: The Grantee must accept the transfer to complete the deed. 2. Types of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC: — Individual to Single-Member LLC: When the property is transferred from an individual to an LLC with only one member or owner. — Individual to Multi-Member LLC: If the LLC has multiple members, the individual can transfer the property to the LLC accordingly. — Limited Partnership LLC: In some cases, a limited partnership LLC may be formed to receive the property. 3. Legal Implications: — Transfer of Ownership: A Sioux Falls quitclaim deed signifies a voluntary transfer of ownership rights from an individual to an LLC, ensuring legal recognition and protection for both parties. — No Warranty of Title: Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty of the property's title. It transfers only the interest the Granter has in the property, if any. — Related Recording and Taxes: After execution, the quitclaim deed must be recorded in the office of the Register of Deeds in Sioux Falls. Recording fees and potential transfer taxes may apply. — Liability Protection: One of the primary advantages of transferring ownership to an LLC is the limited liability protection it offers to members. This protection helps safeguard personal assets from potential legal issues related to the property. 4. Commonly Associated Terms: Granteror: The individual relinquishing ownership rights. — Grantee: The LLC receiving the property rights. — Title: Legal ownership rights in a property. — Property Description: A detailed description of the property, including its boundaries and location. — Notary Public: An authorized official who witnesses the signing of the deed and verifies the Granter's identity. Conclusion: Understanding the intricacies and specificities of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC is crucial when engaging in real estate transactions. These deeds ensure a smooth transfer of property ownership from an individual to an LLC, providing legal protection, liability limitation, and establishing a clear record of ownership. Proper execution, recording, and consideration of the legal implications associated with these deeds are vital for a successful property transfer and a secure investment in Sioux Falls, South Dakota.Sioux Falls, South Dakota Quitclaim Deed from Individual to LLC: A Comprehensive Overview Introduction: In Sioux Falls, South Dakota, a quitclaim deed is a vital legal document used for transferring ownership of real estate from an individual to a Limited Liability Company (LLC). This method allows for a smooth and straightforward transfer of assets, granting rights, interests, and title in a property. Understanding the variations and uses of quitclaim deeds in Sioux Falls is essential when engaging in real estate transactions. This article aims to provide a detailed description of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC, along with insightful information on different types, legal implications, and commonly associated terms. 1. Basic Components of a Sioux Falls, South Dakota Quitclaim Deed: Granteror and Grantee: The Grantor is the individual transferring the property ownership, and the Grantee is the LLC receiving the property. — Property Description: Detailed information about the property, including the address, legal description, and parcel number. — Consideration: The consideration is the financial aspect of the transfer, usually a nominal amount. — Acknowledgment: A notary public or authorized official witnesses the Granter's signature. — Acceptance: The Grantee must accept the transfer to complete the deed. 2. Types of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC: — Individual to Single-Member LLC: When the property is transferred from an individual to an LLC with only one member or owner. — Individual to Multi-Member LLC: If the LLC has multiple members, the individual can transfer the property to the LLC accordingly. — Limited Partnership LLC: In some cases, a limited partnership LLC may be formed to receive the property. 3. Legal Implications: — Transfer of Ownership: A Sioux Falls quitclaim deed signifies a voluntary transfer of ownership rights from an individual to an LLC, ensuring legal recognition and protection for both parties. — No Warranty of Title: Unlike a warranty deed, a quitclaim deed does not provide any guarantee or warranty of the property's title. It transfers only the interest the Granter has in the property, if any. — Related Recording and Taxes: After execution, the quitclaim deed must be recorded in the office of the Register of Deeds in Sioux Falls. Recording fees and potential transfer taxes may apply. — Liability Protection: One of the primary advantages of transferring ownership to an LLC is the limited liability protection it offers to members. This protection helps safeguard personal assets from potential legal issues related to the property. 4. Commonly Associated Terms: Granteror: The individual relinquishing ownership rights. — Grantee: The LLC receiving the property rights. — Title: Legal ownership rights in a property. — Property Description: A detailed description of the property, including its boundaries and location. — Notary Public: An authorized official who witnesses the signing of the deed and verifies the Granter's identity. Conclusion: Understanding the intricacies and specificities of Sioux Falls, South Dakota Quitclaim Deeds from Individual to LLC is crucial when engaging in real estate transactions. These deeds ensure a smooth transfer of property ownership from an individual to an LLC, providing legal protection, liability limitation, and establishing a clear record of ownership. Proper execution, recording, and consideration of the legal implications associated with these deeds are vital for a successful property transfer and a secure investment in Sioux Falls, South Dakota.