This form is a Warranty Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Sioux Falls South Dakota Warranty Deed from Individual to LLC

Description

How to fill out South Dakota Warranty Deed From Individual To LLC?

We consistently aim to reduce or avert legal repercussions when navigating complex legal or financial situations.

To achieve this, we engage attorney services that are generally quite expensive.

Nevertheless, not all legal concerns are similarly intricate.

A majority of them can be managed independently.

Take advantage of US Legal Forms whenever you need to find and download the Sioux Falls South Dakota Warranty Deed from Individual to LLC or any other document smoothly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for termination.

- Our collection enables you to handle your own affairs without relying on legal representation.

- We provide access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

Form popularity

FAQ

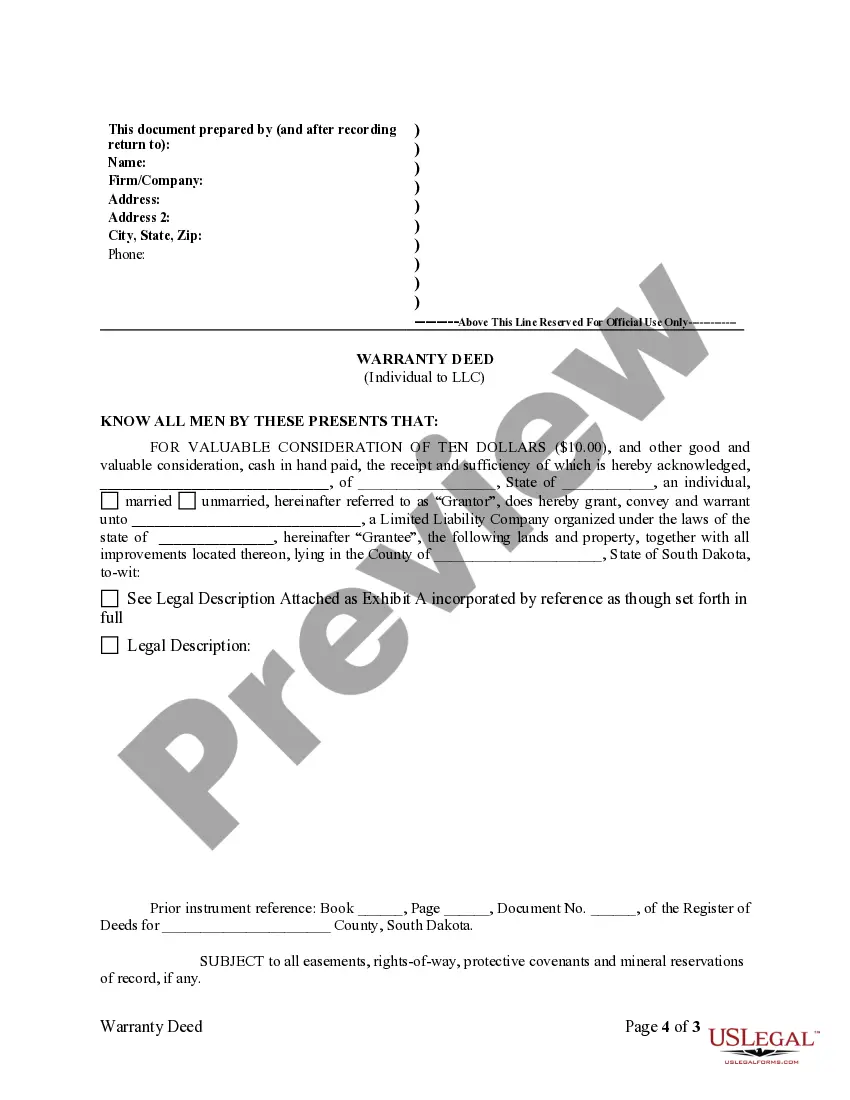

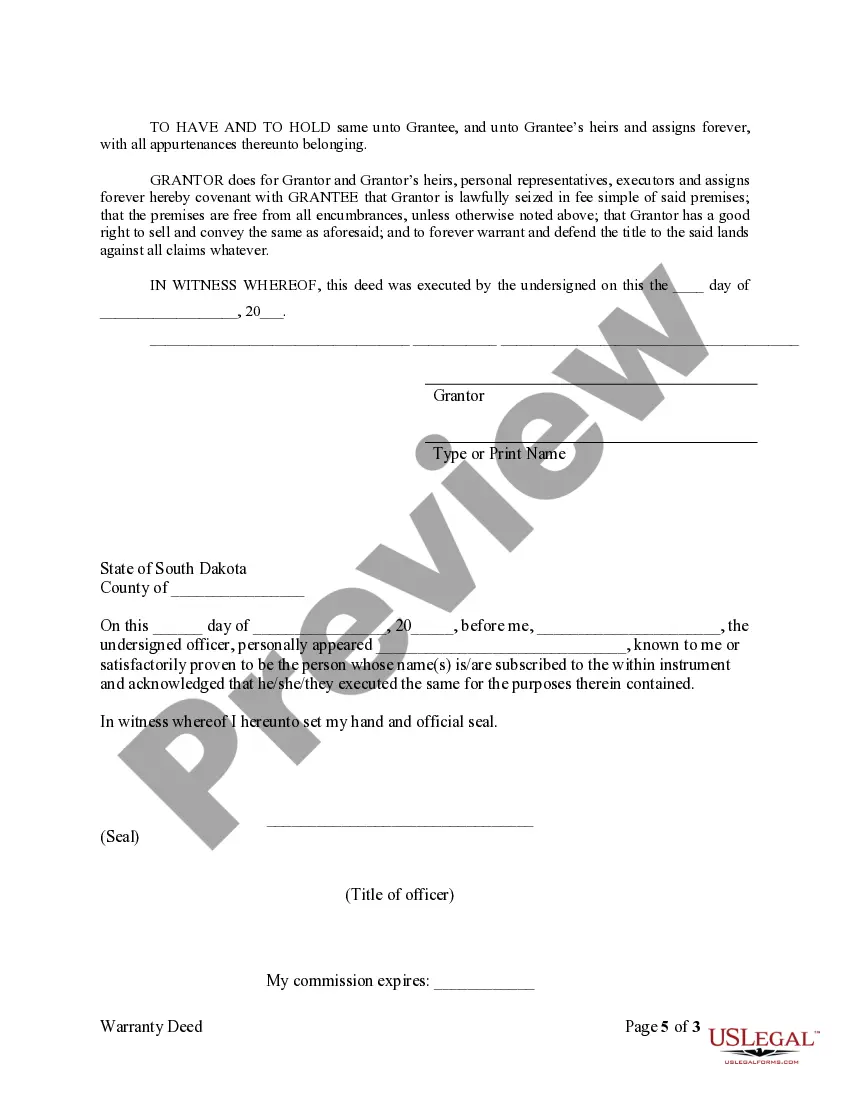

In South Dakota, property ownership is typically held by individuals or legal entities, such as LLCs. When it comes to the Sioux Falls South Dakota Warranty Deed from Individual to LLC, this process enables individuals to transfer their property rights to a limited liability company. This transfer can provide benefits like liability protection and potential tax advantages. Utilizing platforms like UsLegalForms can streamline the creation of this deed, ensuring a smooth and compliant transfer for property owners.

Yes, South Dakota recognizes beneficiary deeds, which allow property owners to designate a beneficiary who will automatically inherit the property upon the owner's death. This type of deed simplifies the transfer process, avoiding probate, and maintains privacy. If you're contemplating a Sioux Falls South Dakota Warranty Deed from Individual to LLC, a beneficiary deed can serve as a strategic estate planning tool. It's wise to discuss these options with a qualified professional to align with your long-term plans.

A contract for deed in South Dakota allows the buyer to make payments directly to the seller, rather than obtaining a mortgage. The seller retains legal title to the property until the buyer completes all payments. For those considering a Sioux Falls South Dakota warranty deed from Individual to LLC, this arrangement can be a suitable alternative to traditional financing methods. Understanding this option can help buyers make informed decisions.

To find out who owns property in South Dakota, you can access the county’s register of deeds office or their online databases. These resources provide public records regarding property ownership, including warranty deeds. If you're interested in a specific property related to a Sioux Falls South Dakota warranty deed from Individual to LLC, these records are an excellent starting point. Additionally, using platforms like USLegalForms can streamline the process of obtaining property information.

A warranty deed in South Dakota is a legal document that guarantees the seller holds clear title to the property. This deed provides protection for the buyer against any future claims on the property. In transactions involving a Sioux Falls South Dakota warranty deed from Individual to LLC, this document assures the LLC of its rightful ownership. Understanding this is crucial for anyone engaging in property transactions in the state.

Yes, South Dakota does allow a transfer on death deed. This type of deed allows the owner to transfer property to someone after their death, avoiding probate. It's a powerful tool for estate planning and can simplify the inheritance process. For those interested in Sioux Falls South Dakota warranty deed from Individual to LLC, this option provides flexibility in managing property ownership.

How to Avoid Probate in South Dakota? Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

The sale, lease, or rental of tangible personal property or products transferred electronically is subject to sales tax.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.