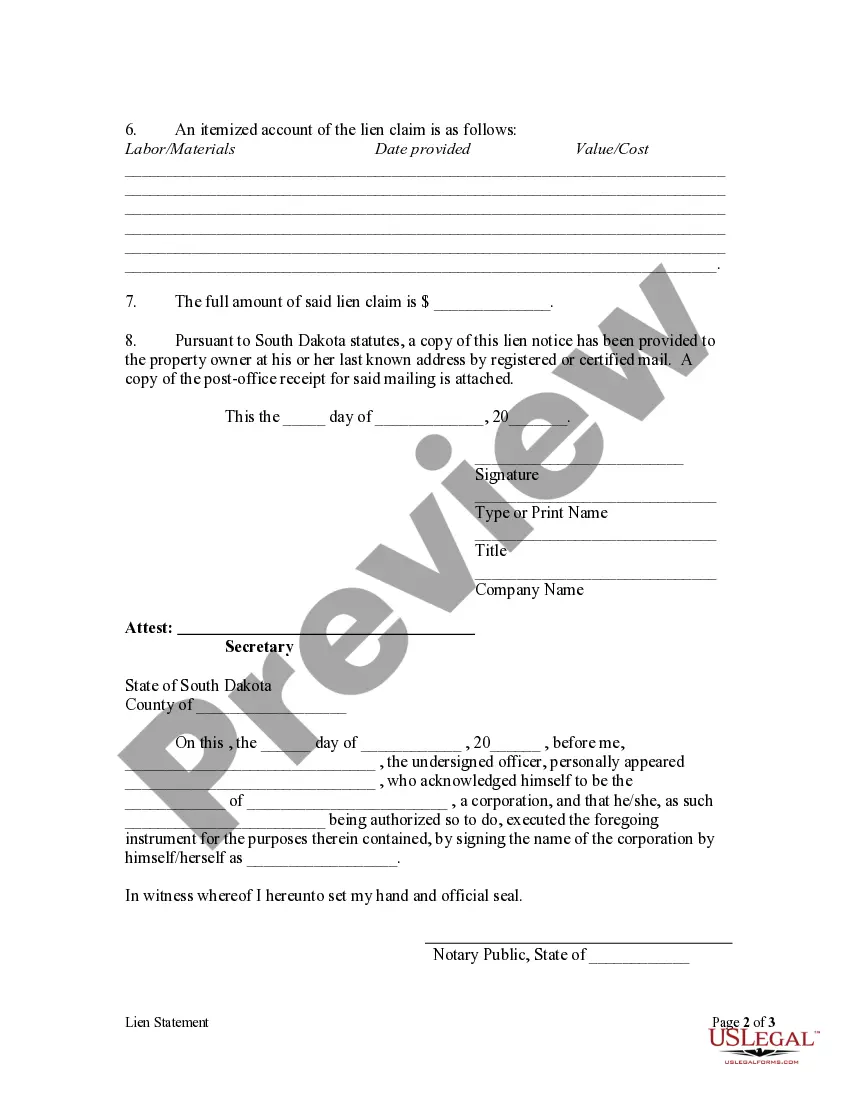

The lien shall cease at the end of one hundred and twenty days after doing the last of such work, or furnishing the last item of such skill, services, material, or machinery, unless within such period a statement of the claim therefor be filed with the register of deeds of the county in which the improved premises are situated, or of the county to which such county is attached for judicial purposes, or if the claim be under the provisions of subdivision 44-9-1 (2), with the secretary of state.

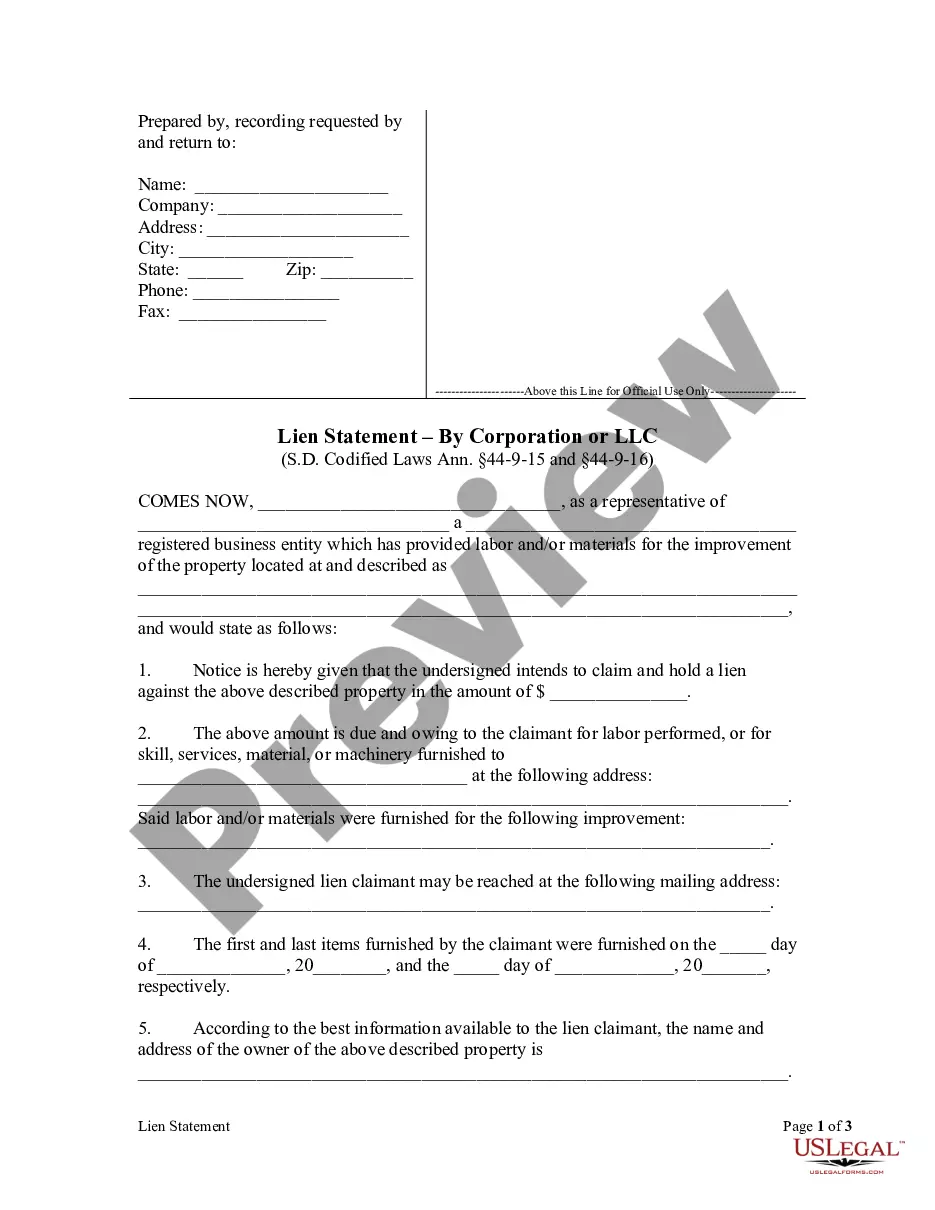

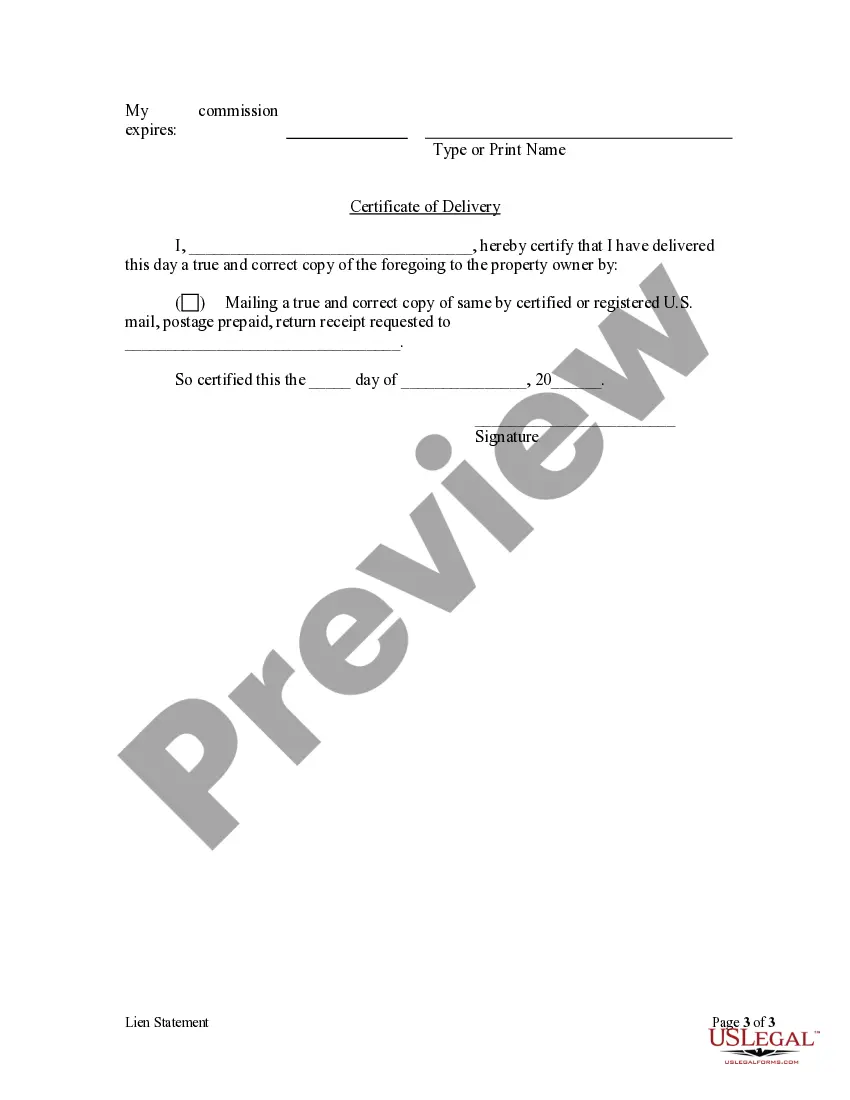

Sioux Falls South Dakota Lien Statement by Corporation or LLC is a legal document that serves as a notice of a claim made by a corporation or limited liability company (LLC) against a property in Sioux Falls, South Dakota. This statement is filed to establish a lien, which secures the corporation or LLC's right to collect a debt owed to them. A lien is a legal right granted to a creditor that allows them to keep possession of the debtor's property until the debt is fully paid or resolved. By filing a lien statement, the corporation or LLC alerts other parties, such as potential buyers or lenders, that there is an existing claim on the property. The Sioux Falls South Dakota Lien Statement by Corporation or LLC provides detailed information about the lien claim, including the name and contact information of the corporation or LLC filing the statement. It also includes the legal description of the property being claimed, along with the exact amount of the debt owed by the debtor. There are different types of Sioux Falls South Dakota Lien Statements that may be filed by Corporation or LLC. Some common variations include: 1. Mechanics' Lien Statement: This type of lien is filed by a corporation or LLC that has provided labor, materials, or services to improve the property. It allows them to claim a portion of the property's value until they are fully compensated for their work. 2. Judgment Lien Statement: In cases where a corporation or LLC is awarded a judgment by a court against a debtor, they can file a lien statement to secure their claim on the debtor's property. This ensures that they receive the court-ordered payment. 3. Tax Lien Statement: When a corporation or LLC has unpaid taxes or owes money to the government, a tax lien statement can be filed against their property. This lien ensures that the government has a legal claim to the property until the outstanding taxes are paid. 4. Contractual Lien Statement: If a corporation or LLC has entered into a contract with another party that includes a provision for a lien, they can file a contractual lien statement. This ensures that they have a secured interest in the property until the contractual obligations are fulfilled. It is important for corporations and LCS in Sioux Falls, South Dakota, to understand the specific requirements and procedures for filing a lien statement. Consulting with an attorney or legal professional experienced in real estate and lien laws is recommended to ensure compliance and protect their rights as creditors.Sioux Falls South Dakota Lien Statement by Corporation or LLC is a legal document that serves as a notice of a claim made by a corporation or limited liability company (LLC) against a property in Sioux Falls, South Dakota. This statement is filed to establish a lien, which secures the corporation or LLC's right to collect a debt owed to them. A lien is a legal right granted to a creditor that allows them to keep possession of the debtor's property until the debt is fully paid or resolved. By filing a lien statement, the corporation or LLC alerts other parties, such as potential buyers or lenders, that there is an existing claim on the property. The Sioux Falls South Dakota Lien Statement by Corporation or LLC provides detailed information about the lien claim, including the name and contact information of the corporation or LLC filing the statement. It also includes the legal description of the property being claimed, along with the exact amount of the debt owed by the debtor. There are different types of Sioux Falls South Dakota Lien Statements that may be filed by Corporation or LLC. Some common variations include: 1. Mechanics' Lien Statement: This type of lien is filed by a corporation or LLC that has provided labor, materials, or services to improve the property. It allows them to claim a portion of the property's value until they are fully compensated for their work. 2. Judgment Lien Statement: In cases where a corporation or LLC is awarded a judgment by a court against a debtor, they can file a lien statement to secure their claim on the debtor's property. This ensures that they receive the court-ordered payment. 3. Tax Lien Statement: When a corporation or LLC has unpaid taxes or owes money to the government, a tax lien statement can be filed against their property. This lien ensures that the government has a legal claim to the property until the outstanding taxes are paid. 4. Contractual Lien Statement: If a corporation or LLC has entered into a contract with another party that includes a provision for a lien, they can file a contractual lien statement. This ensures that they have a secured interest in the property until the contractual obligations are fulfilled. It is important for corporations and LCS in Sioux Falls, South Dakota, to understand the specific requirements and procedures for filing a lien statement. Consulting with an attorney or legal professional experienced in real estate and lien laws is recommended to ensure compliance and protect their rights as creditors.