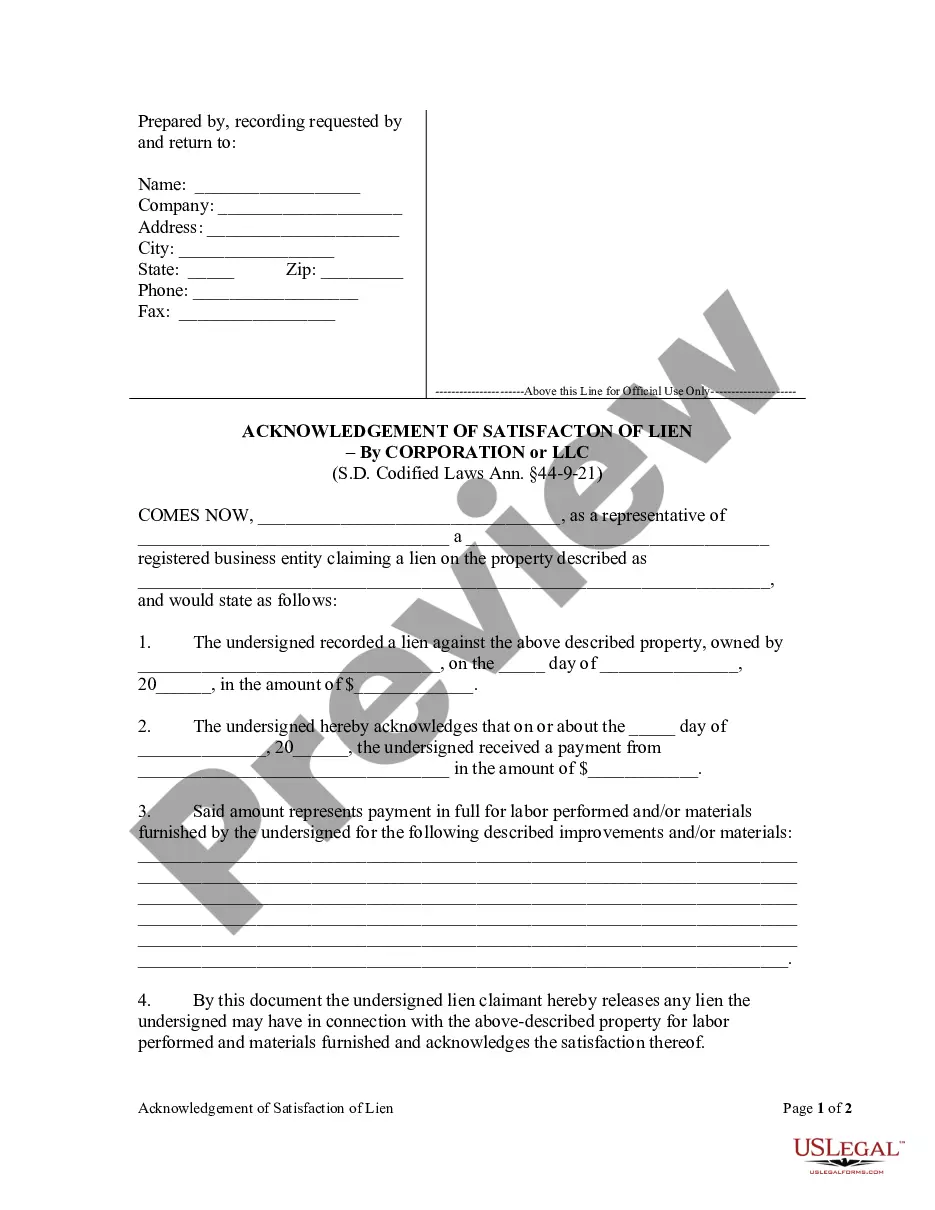

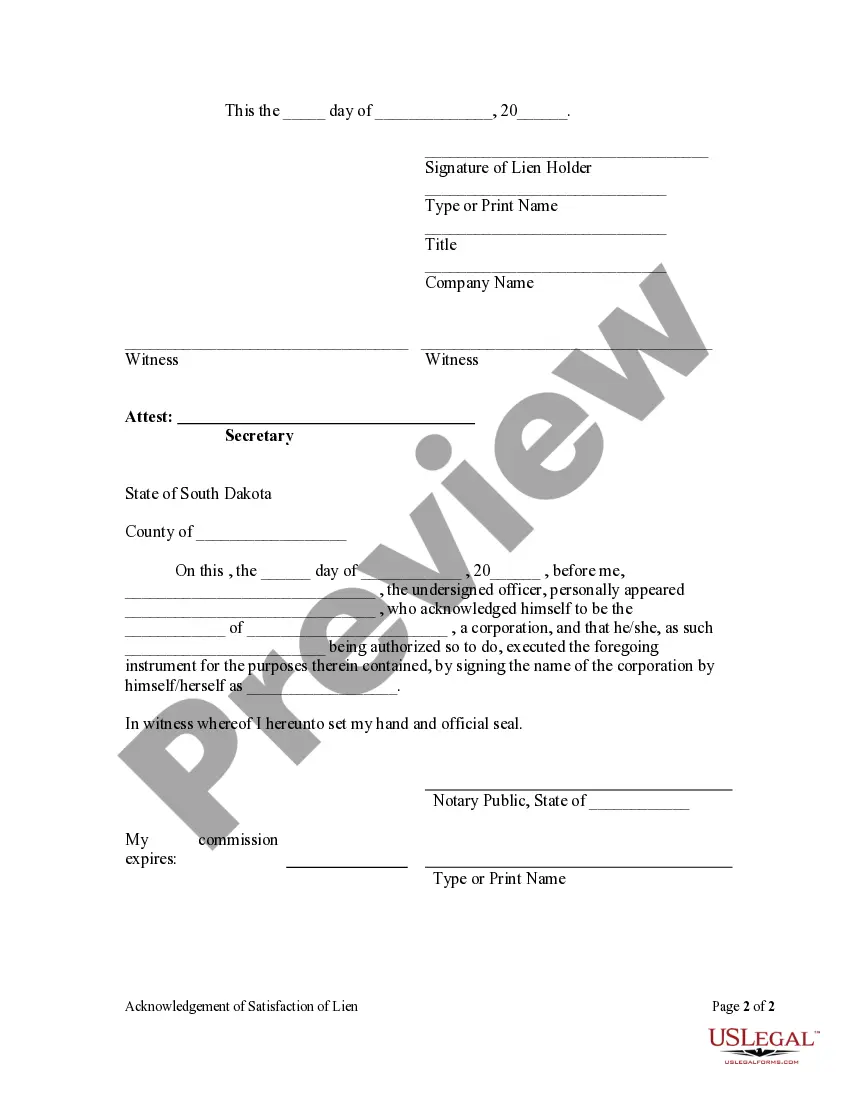

Whenever a lien has been claimed by filing the same in the office of the register of deeds and it is afterward satisfied by payment, foreclosure, compromise, or other method, the creditor shall execute and deliver to the owner of the property a satisfaction describing the lien by its date, date of filing, amount claimed, description of the property, and the names of the lien claimants and owner of the property. Such satisfaction shall be executed before two witnesses or acknowledged before a notary public, and upon presentation to the register of deeds, he shall file the same and cancel the said lien of record.

Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC is a legal document used to acknowledge the satisfaction of a debt or obligation by a corporation or limited liability company (LLC) in Sioux Falls, South Dakota. This acknowledgment serves as proof that the debt has been fulfilled or the obligation has been completed. The Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC is an important legal form that provides protection for both parties involved, ensuring that the financial obligations have been met. This document is typically signed by a representative of the corporation or LLC who is authorized to act on behalf of the entity and fulfill the obligations. There are several types of Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC forms, each catering to specific situations or requirements. Some of these forms include: 1. General Acknowledgment of Satisfaction — Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has fulfilled a debt or obligation and the creditor wants to acknowledge and confirm the satisfaction of the debt or obligation. 2. Mortgage Satisfaction — Corporation or LLC: This acknowledgment is used when a mortgage held by a corporation or LLC has been fully paid off or satisfied. It provides confirmation that the mortgage has been discharged and the property is now free of any liens or encumbrances. 3. Promissory Note Satisfaction — Corporation or LLC: This acknowledgment is used when a promissory note held by a corporation or LLC has been paid in full. It provides evidence that the obligation outlined in the promissory note has been fulfilled and the debt is considered satisfied. 4. Release of Lien — Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has satisfied a lien held against them. It confirms that the lien has been released and the property or assets involved are no longer encumbered. 5. Satisfaction of Judgment — Corporation or LLC: This acknowledgment is used when a judgment against a corporation or LLC has been paid in full. It provides proof that the judgment has been satisfied, and any legal actions related to the judgment can be resolved. It is crucial to properly fill out and execute the Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC to ensure its validity and enforceability. Furthermore, it is recommended to consult with legal professionals familiar with South Dakota state laws and regulations to ensure compliance and accuracy in completing this document.Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC is a legal document used to acknowledge the satisfaction of a debt or obligation by a corporation or limited liability company (LLC) in Sioux Falls, South Dakota. This acknowledgment serves as proof that the debt has been fulfilled or the obligation has been completed. The Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC is an important legal form that provides protection for both parties involved, ensuring that the financial obligations have been met. This document is typically signed by a representative of the corporation or LLC who is authorized to act on behalf of the entity and fulfill the obligations. There are several types of Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC forms, each catering to specific situations or requirements. Some of these forms include: 1. General Acknowledgment of Satisfaction — Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has fulfilled a debt or obligation and the creditor wants to acknowledge and confirm the satisfaction of the debt or obligation. 2. Mortgage Satisfaction — Corporation or LLC: This acknowledgment is used when a mortgage held by a corporation or LLC has been fully paid off or satisfied. It provides confirmation that the mortgage has been discharged and the property is now free of any liens or encumbrances. 3. Promissory Note Satisfaction — Corporation or LLC: This acknowledgment is used when a promissory note held by a corporation or LLC has been paid in full. It provides evidence that the obligation outlined in the promissory note has been fulfilled and the debt is considered satisfied. 4. Release of Lien — Corporation or LLC: This type of acknowledgment is used when a corporation or LLC has satisfied a lien held against them. It confirms that the lien has been released and the property or assets involved are no longer encumbered. 5. Satisfaction of Judgment — Corporation or LLC: This acknowledgment is used when a judgment against a corporation or LLC has been paid in full. It provides proof that the judgment has been satisfied, and any legal actions related to the judgment can be resolved. It is crucial to properly fill out and execute the Sioux Falls, South Dakota Acknowledgment of Satisfaction — Corporation or LLC to ensure its validity and enforceability. Furthermore, it is recommended to consult with legal professionals familiar with South Dakota state laws and regulations to ensure compliance and accuracy in completing this document.