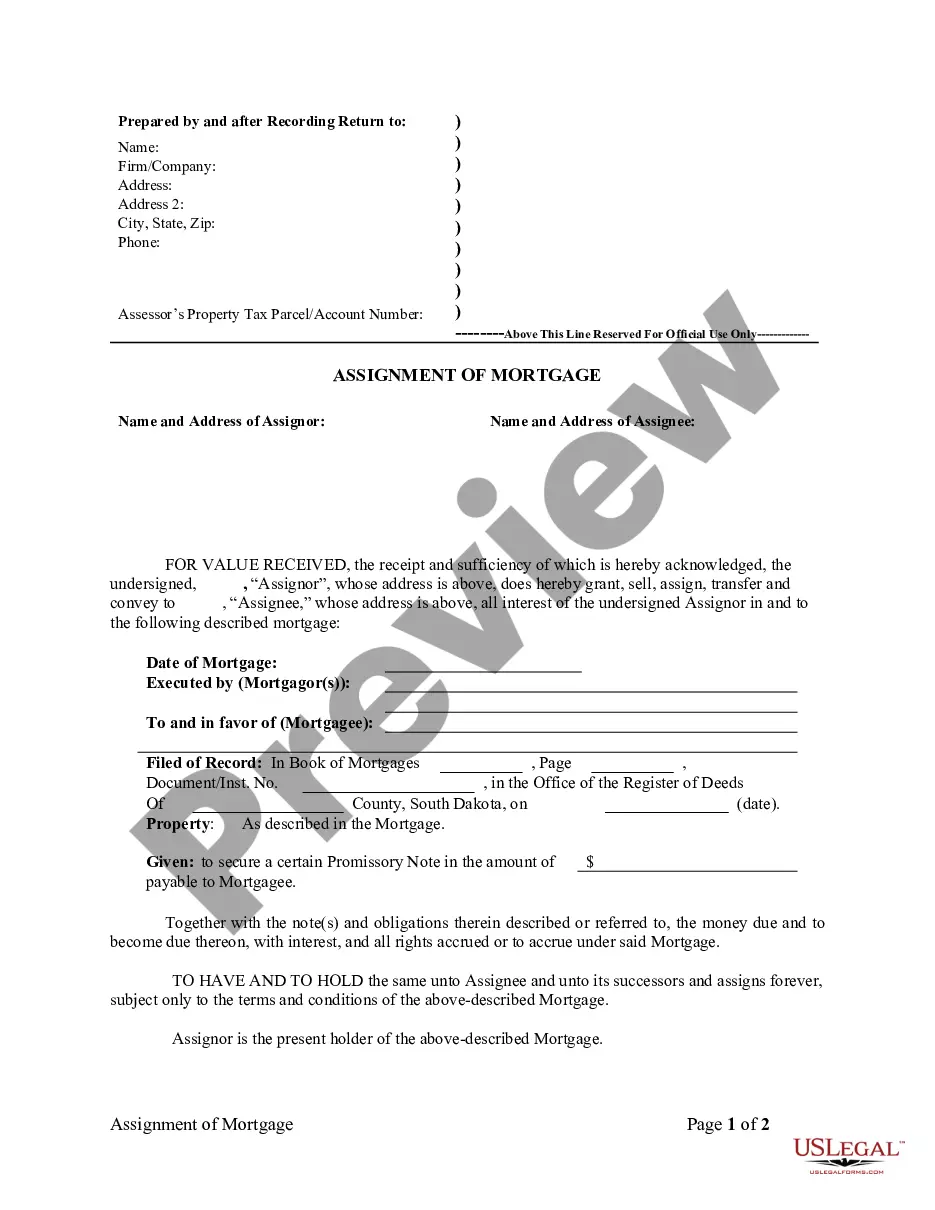

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

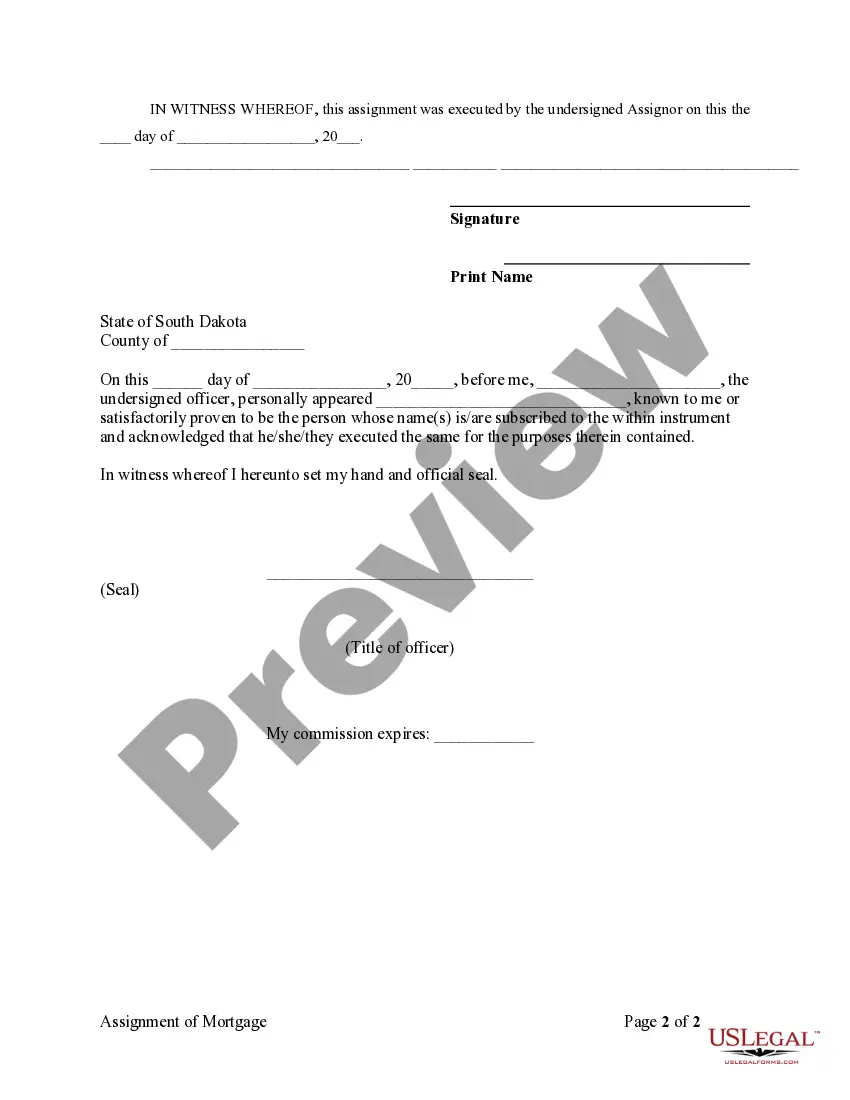

Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder: A Comprehensive Overview In Sioux Falls, South Dakota, the Assignment of Mortgage by an Individual Mortgage Holder refers to a legal document that transfers the rights and interests of a mortgage from one individual mortgage holder to another. This assignment is commonly used when a property owner decides to sell their mortgage or transfer it to a new lender. It is crucial to understand the intricacies of this process to ensure a smooth and legally sound transaction. Keywords: Sioux Falls, South Dakota, Assignment of Mortgage, Individual Mortgage Holder 1. Importance of Assignment of Mortgage: The Assignment of Mortgage holds significant importance in Sioux Falls, South Dakota, as it facilitates the smooth transfer of mortgage ownership between individual mortgage holders. This legal process safeguards the interests of both the original mortgage holder and the subsequent mortgage holder, ensuring a lawful transfer of rights. 2. Process of Assignment of Mortgage: To initiate the Assignment of Mortgage by an Individual Mortgage Holder in Sioux Falls, South Dakota, several steps must be followed. These may include preparing the necessary legal documentation, notifying the original mortgage holder about the assignment, executing the assignment agreement, and recording the assignment with the county or city clerk's office. 3. Types of Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder: a. Assumption Agreement: This type of assignment occurs when an individual mortgage holder sells their mortgage to another party. The new mortgage holder assumes all rights and obligations associated with the mortgage, including payment collection and property foreclosure rights. b. Novation Agreement: In this type of assignment, the original mortgage holder is completely released from their obligations, and a new contract is created between the new mortgage holder and the property owner. This type of assignment requires the consent of all parties involved to be legally valid. 4. Legal Considerations: Sioux Falls, South Dakota follows specific legal guidelines and regulations when it comes to assigning mortgages by individual mortgage holders. It is essential to ensure compliance with the state laws, including proper documentation, contractual agreements, and recording requirements, to avoid any legal complications in the future. 5. Benefits of Assigning a Mortgage: The Assignment of Mortgage offers advantages to both the original mortgage holder and the subsequent mortgage holder. For the original holder, it allows the opportunity to sell a mortgage and potentially profit from it. For the subsequent holder, it provides an avenue to invest in real estate by acquiring an existing mortgage, thereby collecting regular payments and potentially earning interest. In conclusion, understanding the Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder is crucial to successfully navigate the transfer of mortgage ownership. By adhering to legal requirements, both parties can protect their interests and ensure a smooth transaction.Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder: A Comprehensive Overview In Sioux Falls, South Dakota, the Assignment of Mortgage by an Individual Mortgage Holder refers to a legal document that transfers the rights and interests of a mortgage from one individual mortgage holder to another. This assignment is commonly used when a property owner decides to sell their mortgage or transfer it to a new lender. It is crucial to understand the intricacies of this process to ensure a smooth and legally sound transaction. Keywords: Sioux Falls, South Dakota, Assignment of Mortgage, Individual Mortgage Holder 1. Importance of Assignment of Mortgage: The Assignment of Mortgage holds significant importance in Sioux Falls, South Dakota, as it facilitates the smooth transfer of mortgage ownership between individual mortgage holders. This legal process safeguards the interests of both the original mortgage holder and the subsequent mortgage holder, ensuring a lawful transfer of rights. 2. Process of Assignment of Mortgage: To initiate the Assignment of Mortgage by an Individual Mortgage Holder in Sioux Falls, South Dakota, several steps must be followed. These may include preparing the necessary legal documentation, notifying the original mortgage holder about the assignment, executing the assignment agreement, and recording the assignment with the county or city clerk's office. 3. Types of Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder: a. Assumption Agreement: This type of assignment occurs when an individual mortgage holder sells their mortgage to another party. The new mortgage holder assumes all rights and obligations associated with the mortgage, including payment collection and property foreclosure rights. b. Novation Agreement: In this type of assignment, the original mortgage holder is completely released from their obligations, and a new contract is created between the new mortgage holder and the property owner. This type of assignment requires the consent of all parties involved to be legally valid. 4. Legal Considerations: Sioux Falls, South Dakota follows specific legal guidelines and regulations when it comes to assigning mortgages by individual mortgage holders. It is essential to ensure compliance with the state laws, including proper documentation, contractual agreements, and recording requirements, to avoid any legal complications in the future. 5. Benefits of Assigning a Mortgage: The Assignment of Mortgage offers advantages to both the original mortgage holder and the subsequent mortgage holder. For the original holder, it allows the opportunity to sell a mortgage and potentially profit from it. For the subsequent holder, it provides an avenue to invest in real estate by acquiring an existing mortgage, thereby collecting regular payments and potentially earning interest. In conclusion, understanding the Sioux Falls South Dakota Assignment of Mortgage by Individual Mortgage Holder is crucial to successfully navigate the transfer of mortgage ownership. By adhering to legal requirements, both parties can protect their interests and ensure a smooth transaction.