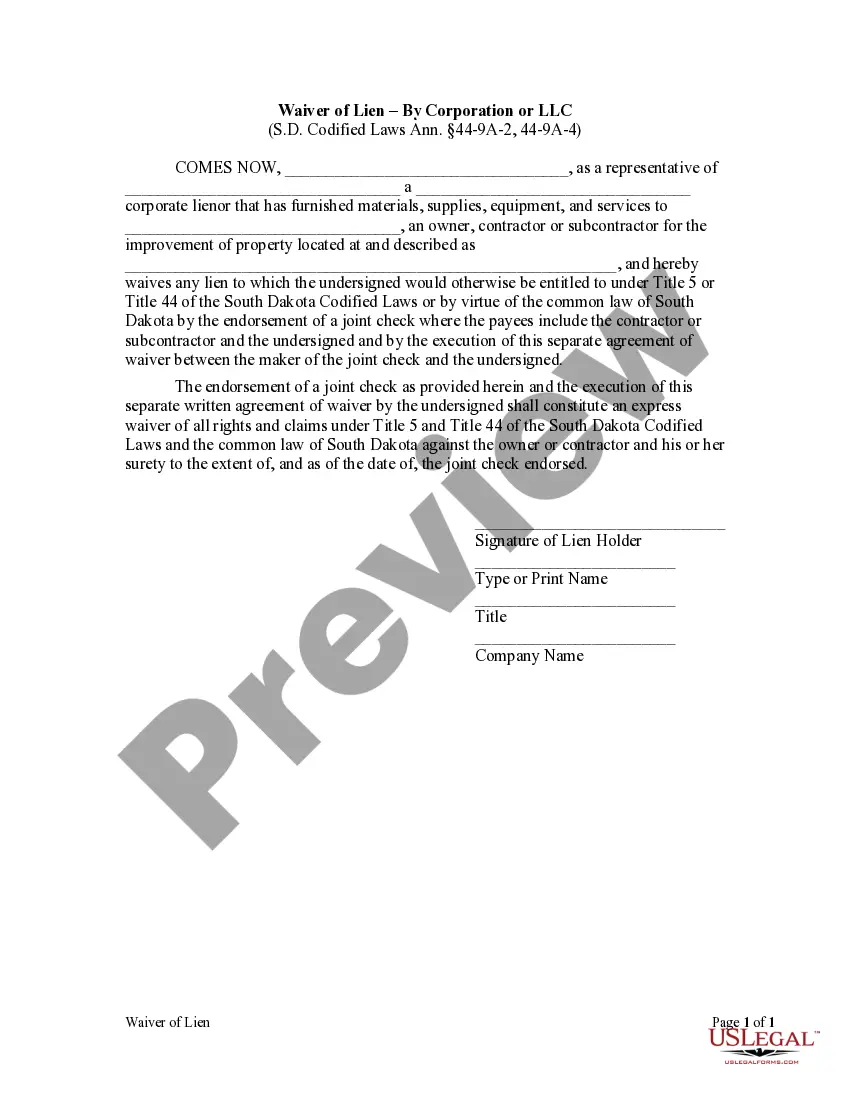

This Waiver of Lien form is for use by a corporate lienor that has furnished materials, supplies, equipment, and services to an owner, contractor or subcontractor for the improvement of property to waive any lien to which the lienor would otherwise be entitled to under Title 5 or Title 44 of the South Dakota Codified Laws or by virtue of the common law of South Dakota by the endorsement of a joint check where the payees include the contractor or subcontractor and the lienor and by the execution of a separate agreement of waiver between the maker of the joint check and the lienor.

Sioux Falls South Dakota Waiver of Lien — Corporation or LLC A waiver of lien is an important legal document that is commonly used in Sioux Falls, South Dakota by corporations or limited liability companies (LCS) involved in construction or property improvement projects. This document serves as a formal agreement between the entities involved, typically the contractor and property owner, to release any potential lien rights that could arise due to non-payment or other disputes related to the project. By signing a waiver of lien, the corporation or LLC acknowledges that they have received full and satisfactory payment for the services or materials provided, and therefore, they waive their right to file a lien against the property. This helps to protect the property owner from any future claims or legal actions related to unpaid bills or incomplete work. There are different types of Sioux Falls South Dakota Waiver of Lien — Corporation or LLC, including: 1. Conditional Waiver: This type of waiver is used when the corporation or LLC agrees to waive their lien rights only upon receiving a specific payment. It becomes effective once the specified conditions have been met, such as the clearing of a check or a wire transfer. 2. Unconditional Waiver: By signing an unconditional waiver, the corporation or LLC agrees to waive their lien rights immediately, regardless of whether they have received payment. This type of waiver is typically used when the parties involved have already reached a settlement or when the payment has been made in full. 3. Partial Waiver: In some cases, the corporation or LLC may agree to waive their lien rights only to a partial amount of the total amount owed. This is known as a partial waiver and is usually used in scenarios where the payment has been partially made or where a specific portion of the work has been completed. It is important for corporations or LCS in Sioux Falls, South Dakota to understand the implications of signing a waiver of lien. Consulting with a legal professional to ensure that the waiver is correctly drafted and protects their rights is highly recommended. By utilizing the appropriate type of waiver and adhering to the legal requirements, corporations or LCS can effectively manage their lien rights while maintaining a positive working relationship with clients and securing timely payments for their services or materials.Sioux Falls South Dakota Waiver of Lien — Corporation or LLC A waiver of lien is an important legal document that is commonly used in Sioux Falls, South Dakota by corporations or limited liability companies (LCS) involved in construction or property improvement projects. This document serves as a formal agreement between the entities involved, typically the contractor and property owner, to release any potential lien rights that could arise due to non-payment or other disputes related to the project. By signing a waiver of lien, the corporation or LLC acknowledges that they have received full and satisfactory payment for the services or materials provided, and therefore, they waive their right to file a lien against the property. This helps to protect the property owner from any future claims or legal actions related to unpaid bills or incomplete work. There are different types of Sioux Falls South Dakota Waiver of Lien — Corporation or LLC, including: 1. Conditional Waiver: This type of waiver is used when the corporation or LLC agrees to waive their lien rights only upon receiving a specific payment. It becomes effective once the specified conditions have been met, such as the clearing of a check or a wire transfer. 2. Unconditional Waiver: By signing an unconditional waiver, the corporation or LLC agrees to waive their lien rights immediately, regardless of whether they have received payment. This type of waiver is typically used when the parties involved have already reached a settlement or when the payment has been made in full. 3. Partial Waiver: In some cases, the corporation or LLC may agree to waive their lien rights only to a partial amount of the total amount owed. This is known as a partial waiver and is usually used in scenarios where the payment has been partially made or where a specific portion of the work has been completed. It is important for corporations or LCS in Sioux Falls, South Dakota to understand the implications of signing a waiver of lien. Consulting with a legal professional to ensure that the waiver is correctly drafted and protects their rights is highly recommended. By utilizing the appropriate type of waiver and adhering to the legal requirements, corporations or LCS can effectively manage their lien rights while maintaining a positive working relationship with clients and securing timely payments for their services or materials.