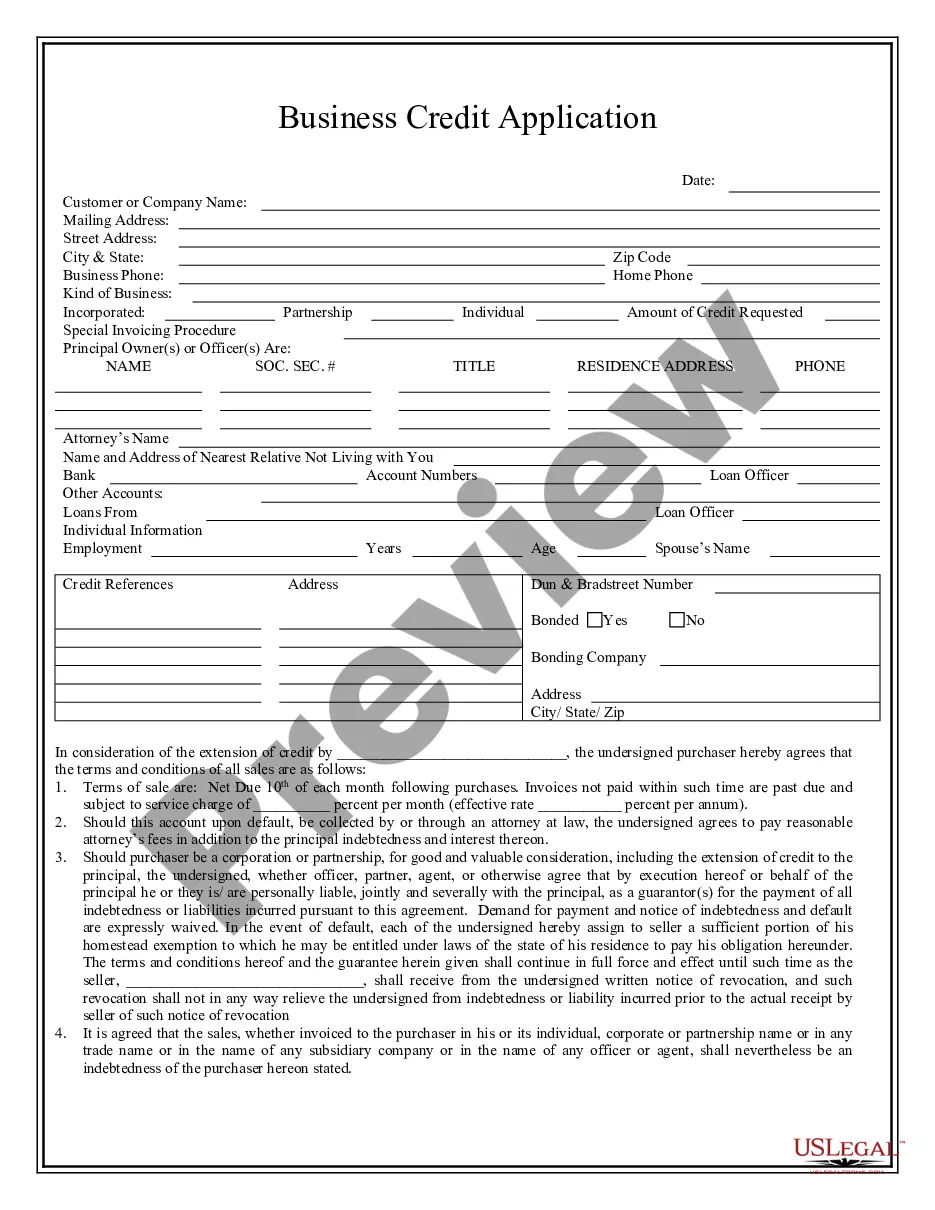

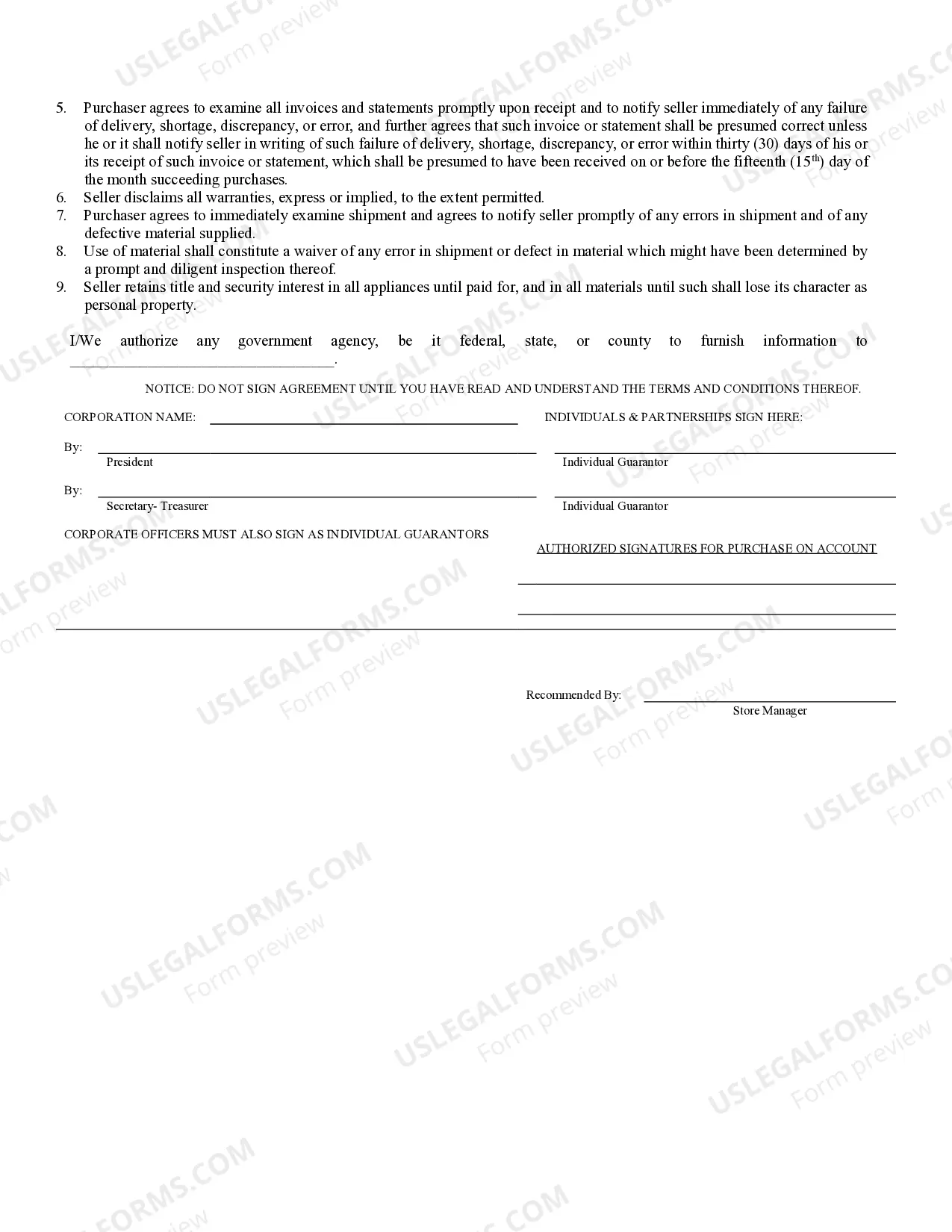

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Sioux Falls South Dakota Business Credit Application is a comprehensive document that individuals or business entities in Sioux Falls, South Dakota can use when applying for credit facilities or loans for their businesses. This application is specifically designed to gather all the necessary information required by the lender or financial institution to evaluate the creditworthiness of the applicant. Keywords: Sioux Falls South Dakota, business credit application, credit facilities, loans, business entities, creditworthiness, lender, financial institution. There are several types of Sioux Falls South Dakota Business Credit Applications that vary based on the purpose and nature of the loan being sought. Here are some of the commonly used forms: 1. Small Business Loan Application: This application targets small businesses seeking loans for expansion, working capital, equipment purchase, or other business-related expenses. 2. Start-up Business Loan Application: Designed specifically for new businesses or start-ups looking to secure capital for business establishment, initial investments, and operational costs. 3. Business Line of Credit Application: This application is for businesses that require revolving credit, giving them access to a specific amount of funds that can be borrowed and repaid as needed. 4. Commercial Real Estate Loan Application: Aimed at businesses looking to acquire, refinance, or develop commercial properties for their operations or investment purposes. 5. Business Credit Card Application: Designed for businesses seeking corporate credit cards to manage their day-to-day expenses, earn rewards, and separate personal finances from business transactions. 6. Equipment Financing Application: This application is tailored for businesses looking to purchase or lease equipment or machinery necessary for their operations. 7. Invoice Financing Application: Intended for businesses that need immediate cash flow by leveraging their unpaid invoices as collateral. When completing a Sioux Falls South Dakota Business Credit Application, applicants are generally required to provide detailed information about their business, including business name, legal structure, current financial status, proposed loan amount, purpose of loan, industry type, projected revenue, and expense statements. Additionally, they may need to provide personal information of the business owner(s), such as social security numbers, contact details, and personal financial statements. Overall, Sioux Falls South Dakota Business Credit Application serves as a crucial tool for both lenders and businesses in facilitating credit evaluations, ensuring a fair and transparent process for accessing financial assistance.Sioux Falls South Dakota Business Credit Application is a comprehensive document that individuals or business entities in Sioux Falls, South Dakota can use when applying for credit facilities or loans for their businesses. This application is specifically designed to gather all the necessary information required by the lender or financial institution to evaluate the creditworthiness of the applicant. Keywords: Sioux Falls South Dakota, business credit application, credit facilities, loans, business entities, creditworthiness, lender, financial institution. There are several types of Sioux Falls South Dakota Business Credit Applications that vary based on the purpose and nature of the loan being sought. Here are some of the commonly used forms: 1. Small Business Loan Application: This application targets small businesses seeking loans for expansion, working capital, equipment purchase, or other business-related expenses. 2. Start-up Business Loan Application: Designed specifically for new businesses or start-ups looking to secure capital for business establishment, initial investments, and operational costs. 3. Business Line of Credit Application: This application is for businesses that require revolving credit, giving them access to a specific amount of funds that can be borrowed and repaid as needed. 4. Commercial Real Estate Loan Application: Aimed at businesses looking to acquire, refinance, or develop commercial properties for their operations or investment purposes. 5. Business Credit Card Application: Designed for businesses seeking corporate credit cards to manage their day-to-day expenses, earn rewards, and separate personal finances from business transactions. 6. Equipment Financing Application: This application is tailored for businesses looking to purchase or lease equipment or machinery necessary for their operations. 7. Invoice Financing Application: Intended for businesses that need immediate cash flow by leveraging their unpaid invoices as collateral. When completing a Sioux Falls South Dakota Business Credit Application, applicants are generally required to provide detailed information about their business, including business name, legal structure, current financial status, proposed loan amount, purpose of loan, industry type, projected revenue, and expense statements. Additionally, they may need to provide personal information of the business owner(s), such as social security numbers, contact details, and personal financial statements. Overall, Sioux Falls South Dakota Business Credit Application serves as a crucial tool for both lenders and businesses in facilitating credit evaluations, ensuring a fair and transparent process for accessing financial assistance.