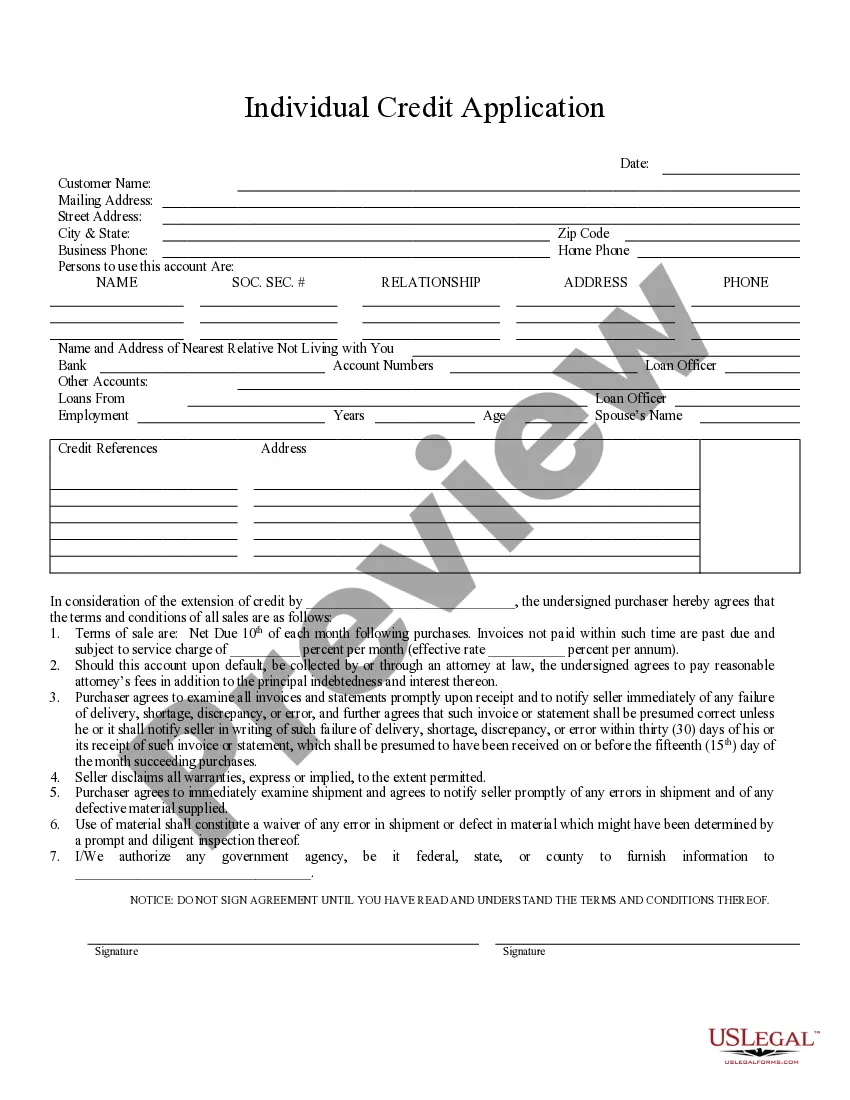

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Sioux Falls South Dakota Individual Credit Application: A Comprehensive Guide Introduction: The Sioux Falls South Dakota Individual Credit Application is a vital document used by individuals residing in Sioux Falls, South Dakota, who are seeking credit from financial institutions or lenders. This credit application assists lenders in assessing an individual's creditworthiness, thereby enabling them to make informed decisions regarding loan approvals. Keywords: Sioux Falls, South Dakota, Individual Credit Application, creditworthiness, loan approvals, financial institutions, lenders. Overview: The Sioux Falls South Dakota Individual Credit Application is designed to collect specific personal and financial information from applicants. It aims to provide lenders with a comprehensive understanding of the applicant's financial standing, employment history, and credit history. Types of Sioux Falls South Dakota Individual Credit Application: 1. Mortgage Loan Application: A mortgage loan application is specifically designed for individuals seeking credit to finance their new home, refinance their existing mortgage, or acquire rental properties. This application collects detailed information about the applicant's income, assets, and liabilities, helping the lender evaluate their eligibility for a mortgage loan. Keywords: mortgage loan, finance, refinance, rental properties, eligibility. 2. Auto Loan Application: An auto loan application caters to individuals who require credit for purchasing a new or used vehicle. This type of credit application focuses on the applicant's income, employment status, and credit history to assess their ability to repay the auto loan. Keywords: auto loan, vehicle purchase, income, employment status, credit history, repayment. 3. Personal Loan Application: A personal loan application is applicable when individuals seek credit for personal expenses, such as medical bills, debt consolidation, or home improvements. This credit application focuses on the applicant's income, employment history, credit score, and purpose of the loan. Keywords: personal loan, personal expenses, medical bills, debt consolidation, home improvements, credit score, purpose. 4. Student Loan Application: A student loan application targets individuals pursuing higher education who require financial assistance to cover tuition fees, textbooks, and living expenses. This credit application concentrates on the applicant's educational background, program of study, income (if applicable), and financial need. Keywords: student loan, higher education, tuition fees, textbooks, living expenses, educational background, program of study, financial need. Key Information Collected in Sioux Falls South Dakota Individual Credit Application: 1. Personal Information: Funnymanam— - Date of birth - Social Security number — Contact details (address, phone number, email) 2. Employment Information: — Current employment status (employed, self-employed, unemployed) — EmployeNamam— - Position/title - Length of employment 3. Income Details: — Total annuaincomeom— - Additional sources of income (if applicable) — Income stability 4. Financial History: — Bank account details (checking, saving, investments) — Debt obligations (existing loans, mortgages, credit card debt) — Monthly expenses (rent, utilities, insurance, etc.) — Credit history (credit score, payment history, bankruptcy, delinquencies) Conclusion: The Sioux Falls South Dakota Individual Credit Application serves as a comprehensive tool for individuals in Sioux Falls seeking credit from financial institutions or lenders. By collecting essential personal and financial information, lenders can effectively evaluate an applicant's creditworthiness and make informed decisions about loan approvals. Whether it's a mortgage loan, auto loan, personal loan, or student loan, submitting a complete and accurate credit application increases the likelihood of receiving the desired credit.Sioux Falls South Dakota Individual Credit Application: A Comprehensive Guide Introduction: The Sioux Falls South Dakota Individual Credit Application is a vital document used by individuals residing in Sioux Falls, South Dakota, who are seeking credit from financial institutions or lenders. This credit application assists lenders in assessing an individual's creditworthiness, thereby enabling them to make informed decisions regarding loan approvals. Keywords: Sioux Falls, South Dakota, Individual Credit Application, creditworthiness, loan approvals, financial institutions, lenders. Overview: The Sioux Falls South Dakota Individual Credit Application is designed to collect specific personal and financial information from applicants. It aims to provide lenders with a comprehensive understanding of the applicant's financial standing, employment history, and credit history. Types of Sioux Falls South Dakota Individual Credit Application: 1. Mortgage Loan Application: A mortgage loan application is specifically designed for individuals seeking credit to finance their new home, refinance their existing mortgage, or acquire rental properties. This application collects detailed information about the applicant's income, assets, and liabilities, helping the lender evaluate their eligibility for a mortgage loan. Keywords: mortgage loan, finance, refinance, rental properties, eligibility. 2. Auto Loan Application: An auto loan application caters to individuals who require credit for purchasing a new or used vehicle. This type of credit application focuses on the applicant's income, employment status, and credit history to assess their ability to repay the auto loan. Keywords: auto loan, vehicle purchase, income, employment status, credit history, repayment. 3. Personal Loan Application: A personal loan application is applicable when individuals seek credit for personal expenses, such as medical bills, debt consolidation, or home improvements. This credit application focuses on the applicant's income, employment history, credit score, and purpose of the loan. Keywords: personal loan, personal expenses, medical bills, debt consolidation, home improvements, credit score, purpose. 4. Student Loan Application: A student loan application targets individuals pursuing higher education who require financial assistance to cover tuition fees, textbooks, and living expenses. This credit application concentrates on the applicant's educational background, program of study, income (if applicable), and financial need. Keywords: student loan, higher education, tuition fees, textbooks, living expenses, educational background, program of study, financial need. Key Information Collected in Sioux Falls South Dakota Individual Credit Application: 1. Personal Information: Funnymanam— - Date of birth - Social Security number — Contact details (address, phone number, email) 2. Employment Information: — Current employment status (employed, self-employed, unemployed) — EmployeNamam— - Position/title - Length of employment 3. Income Details: — Total annuaincomeom— - Additional sources of income (if applicable) — Income stability 4. Financial History: — Bank account details (checking, saving, investments) — Debt obligations (existing loans, mortgages, credit card debt) — Monthly expenses (rent, utilities, insurance, etc.) — Credit history (credit score, payment history, bankruptcy, delinquencies) Conclusion: The Sioux Falls South Dakota Individual Credit Application serves as a comprehensive tool for individuals in Sioux Falls seeking credit from financial institutions or lenders. By collecting essential personal and financial information, lenders can effectively evaluate an applicant's creditworthiness and make informed decisions about loan approvals. Whether it's a mortgage loan, auto loan, personal loan, or student loan, submitting a complete and accurate credit application increases the likelihood of receiving the desired credit.