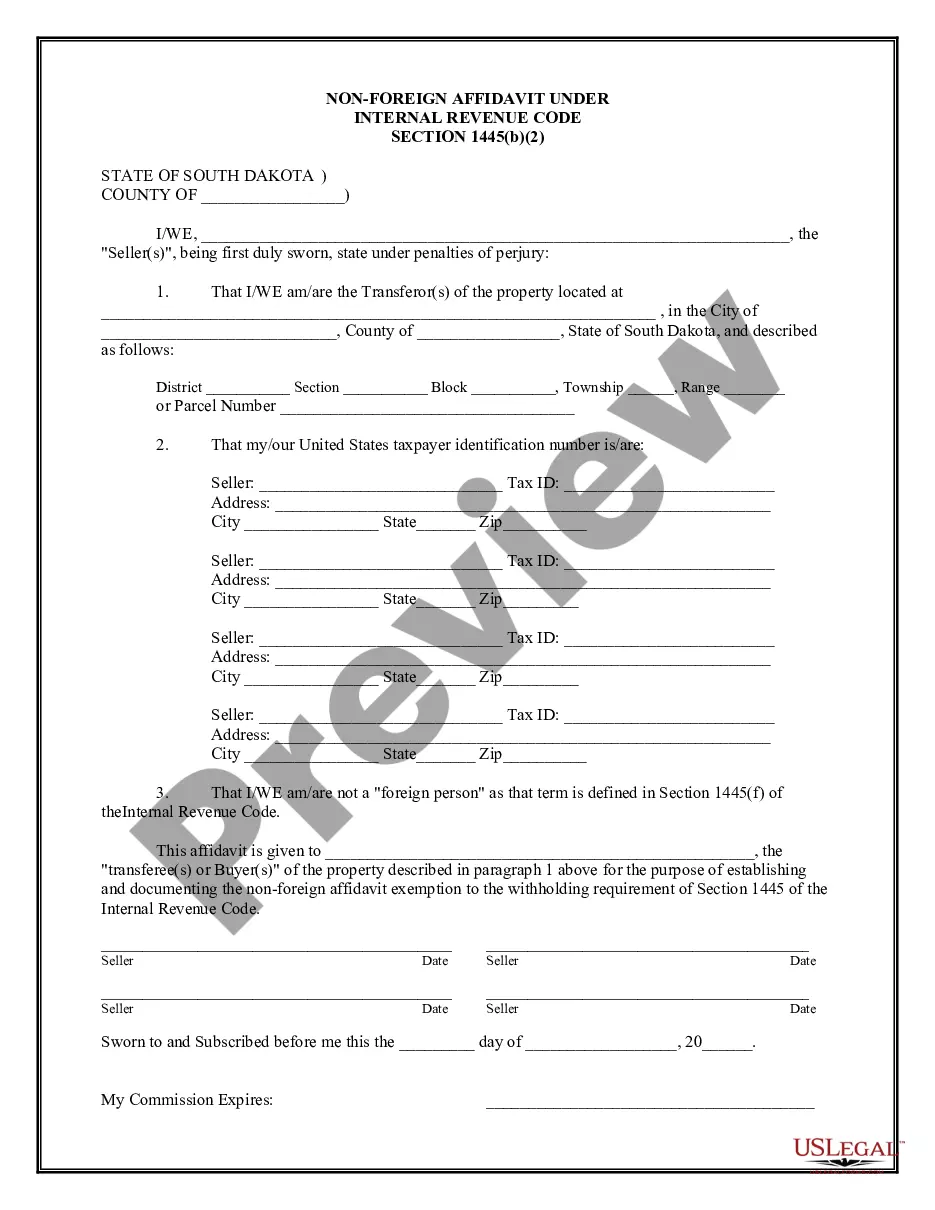

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview Sioux Falls, South Dakota, is a bustling city known for its economic growth, diverse population, and vibrant real estate market. As a hub for domestic and international investment, it is essential for individuals or entities engaged in real estate transactions to familiarize themselves with the Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445. What is IRC 1445? The Internal Revenue Code (IRC) Section 1445 is a provision that outlines the withholding requirements for the disposition of U.S. real property interests by foreign individuals or entities. It mandates the buyer or transferee of real property to withhold a portion of the payment and remit it to the Internal Revenue Service (IRS) if the seller is a foreign person. The purpose of IRC 1445 is to ensure the collection of taxes on gains derived from the sale or exchange of U.S. real property interests. Understanding Sioux Falls South Dakota Non-Foreign Affidavit The Sioux Falls South Dakota Non-Foreign Affidavit is a legal document used in real estate transactions to establish that the seller is not a foreign person under IRC 1445 regulations. This affidavit is required from the seller to confirm their non-foreign status, allowing the buyer to be exempted from withholding funds from the transaction. Types of Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445 There are several types of Sioux Falls South Dakota Non-Foreign Affidavit documents under IRC 1445, depending on the specific real estate transaction. Some common types include: 1. Individual Non-Foreign Affidavit: This affidavit is used when the seller is an individual who is a U.S. citizen, U.S. resident alien, or domestic corporation. It certifies that the seller falls under one of these categories and is exempt from IRC 1445 withholding requirements. 2. Entity Non-Foreign Affidavit: If the seller is an entity, such as a partnership, limited liability company, or foreign corporation, this affidavit confirms the entity's status as a U.S. entity under IRC 1445 and declares its eligibility for withholding exemption. 3. Trust Non-Foreign Affidavit: In cases where the seller is a trust, this affidavit verifies the trust's status as a U.S. trust and its exemption from IRC 1445 withholding. Benefits of Providing Sioux Falls South Dakota Non-Foreign Affidavit Supplying a valid Sioux Falls South Dakota Non-Foreign Affidavit as a seller offers multiple advantages. These include: 1. Avoiding Withholding: By proving non-foreign status, the seller ensures the buyer does not have to withhold a portion of the payment, enabling a smoother and faster transaction. 2. Streamlined Real Estate Process: Eliminating the need for withholding simplifies the administrative process and reduces potential complications associated with tax compliance. 3. Encourages Investment: Easy access to non-foreign affidavits promotes investment by foreign buyers, providing a favorable environment for business growth and fostering economic development in Sioux Falls. With the Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445, individuals and entities engaging in real estate transactions can comply with relevant tax regulations, facilitate transactions, and contribute to the vibrant real estate landscape of Sioux Falls. It is crucial to consult with legal and tax professionals to ensure appropriate documentation and adherence to all applicable laws and regulations.Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445: A Comprehensive Overview Sioux Falls, South Dakota, is a bustling city known for its economic growth, diverse population, and vibrant real estate market. As a hub for domestic and international investment, it is essential for individuals or entities engaged in real estate transactions to familiarize themselves with the Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445. What is IRC 1445? The Internal Revenue Code (IRC) Section 1445 is a provision that outlines the withholding requirements for the disposition of U.S. real property interests by foreign individuals or entities. It mandates the buyer or transferee of real property to withhold a portion of the payment and remit it to the Internal Revenue Service (IRS) if the seller is a foreign person. The purpose of IRC 1445 is to ensure the collection of taxes on gains derived from the sale or exchange of U.S. real property interests. Understanding Sioux Falls South Dakota Non-Foreign Affidavit The Sioux Falls South Dakota Non-Foreign Affidavit is a legal document used in real estate transactions to establish that the seller is not a foreign person under IRC 1445 regulations. This affidavit is required from the seller to confirm their non-foreign status, allowing the buyer to be exempted from withholding funds from the transaction. Types of Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445 There are several types of Sioux Falls South Dakota Non-Foreign Affidavit documents under IRC 1445, depending on the specific real estate transaction. Some common types include: 1. Individual Non-Foreign Affidavit: This affidavit is used when the seller is an individual who is a U.S. citizen, U.S. resident alien, or domestic corporation. It certifies that the seller falls under one of these categories and is exempt from IRC 1445 withholding requirements. 2. Entity Non-Foreign Affidavit: If the seller is an entity, such as a partnership, limited liability company, or foreign corporation, this affidavit confirms the entity's status as a U.S. entity under IRC 1445 and declares its eligibility for withholding exemption. 3. Trust Non-Foreign Affidavit: In cases where the seller is a trust, this affidavit verifies the trust's status as a U.S. trust and its exemption from IRC 1445 withholding. Benefits of Providing Sioux Falls South Dakota Non-Foreign Affidavit Supplying a valid Sioux Falls South Dakota Non-Foreign Affidavit as a seller offers multiple advantages. These include: 1. Avoiding Withholding: By proving non-foreign status, the seller ensures the buyer does not have to withhold a portion of the payment, enabling a smoother and faster transaction. 2. Streamlined Real Estate Process: Eliminating the need for withholding simplifies the administrative process and reduces potential complications associated with tax compliance. 3. Encourages Investment: Easy access to non-foreign affidavits promotes investment by foreign buyers, providing a favorable environment for business growth and fostering economic development in Sioux Falls. With the Sioux Falls South Dakota Non-Foreign Affidavit Under IRC 1445, individuals and entities engaging in real estate transactions can comply with relevant tax regulations, facilitate transactions, and contribute to the vibrant real estate landscape of Sioux Falls. It is crucial to consult with legal and tax professionals to ensure appropriate documentation and adherence to all applicable laws and regulations.