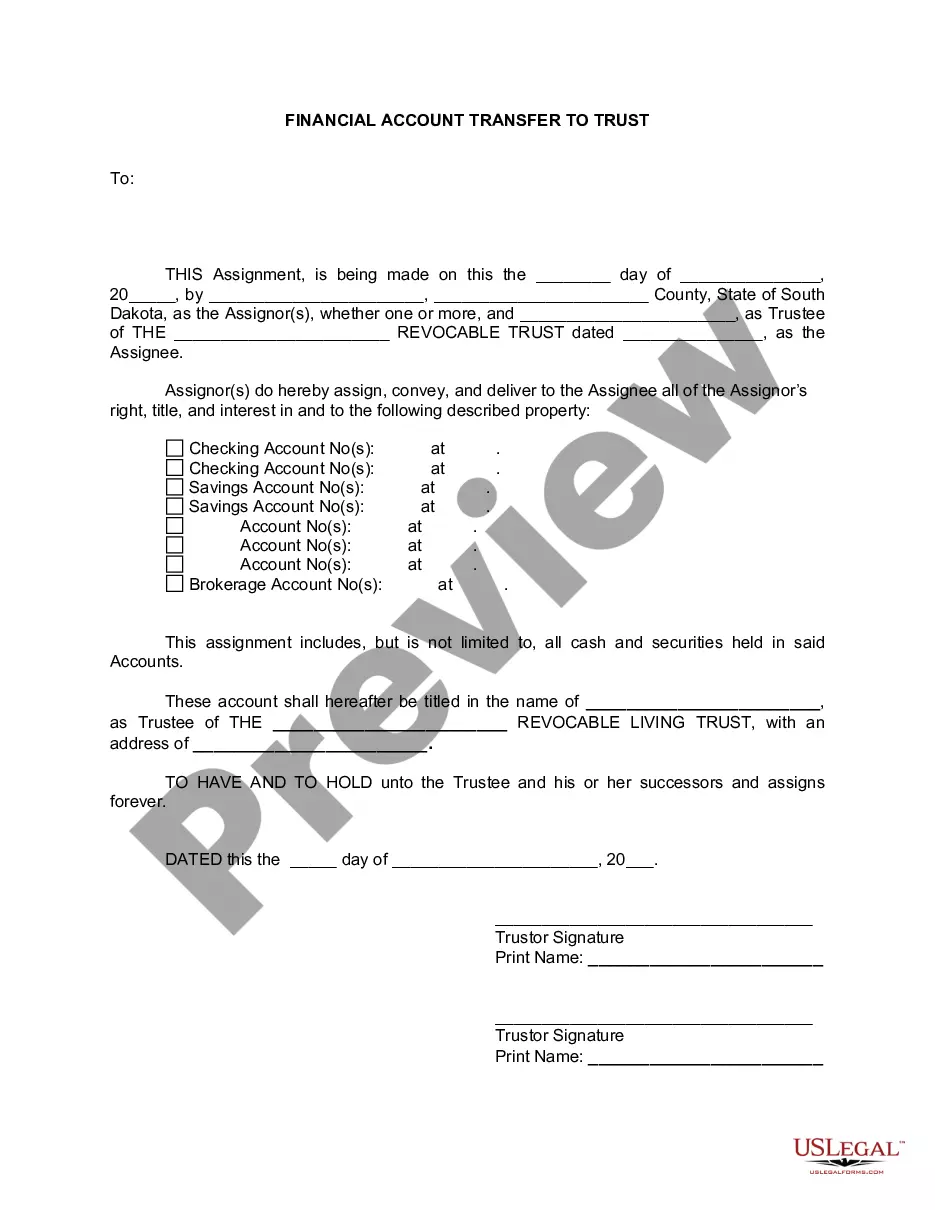

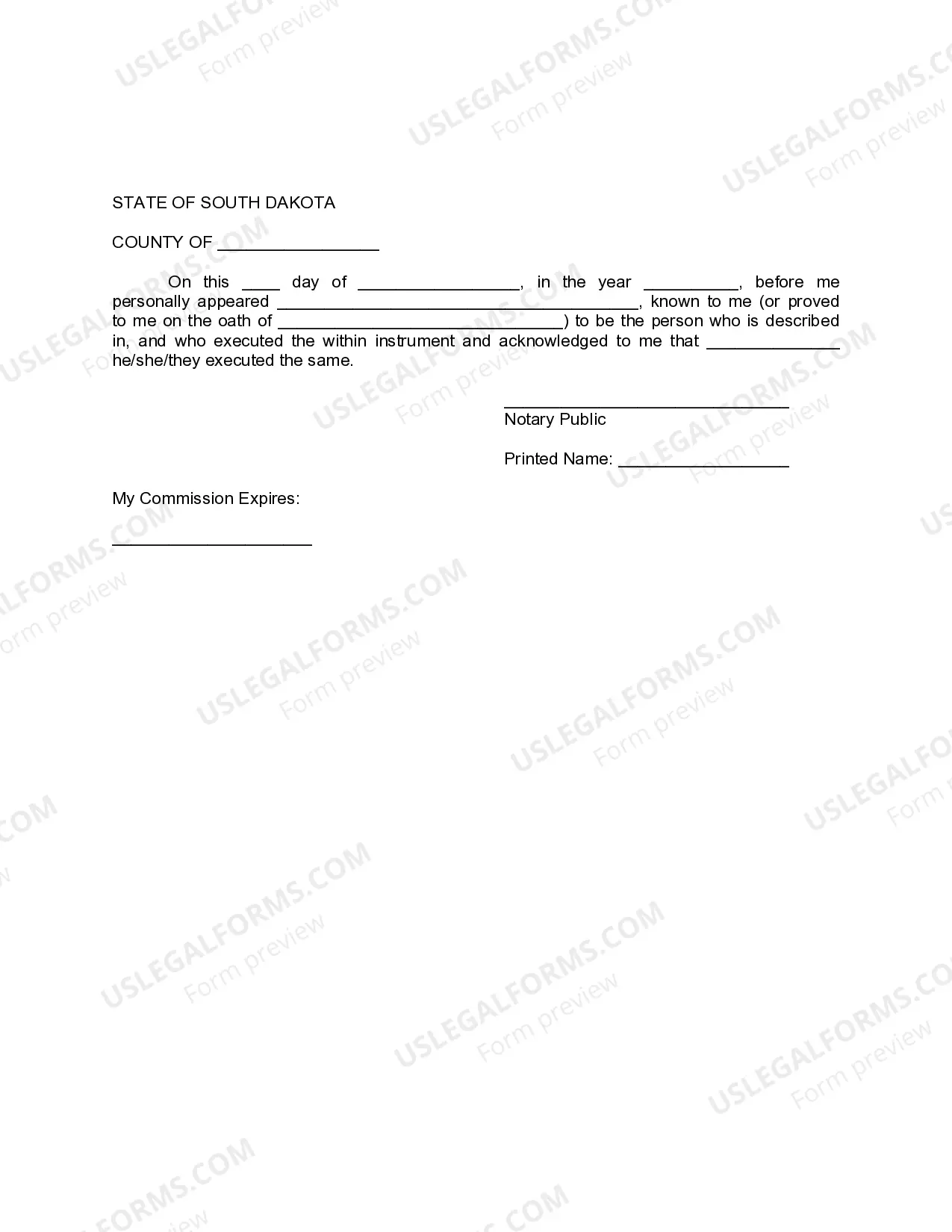

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Sioux Falls South Dakota Financial Account Transfer to Living Trust is an essential process that allows individuals in the region to protect their financial assets and plan for the future. By transferring their accounts to a living trust, individuals can ensure the smooth transition of their assets to their chosen beneficiaries after their passing. The process of Sioux Falls South Dakota Financial Account Transfer to Living Trust involves a series of steps that must be followed meticulously. Firstly, individuals need to create a living trust, which is a legal document that outlines their wishes and the distribution of their assets. This document must comply with South Dakota state laws and be signed by both the granter (the person creating the trust) and a notary public. Once the living trust has been created, individuals must then transfer their financial accounts to the trust. Common types of financial accounts that can be transferred to a living trust include bank accounts, investment accounts, retirement accounts, and insurance policies. Each of these account types may have specific requirements or processes that need to be followed during the transfer. For instance, regarding bank accounts, individuals need to complete the necessary paperwork provided by their financial institution. This may involve filling out a form provided by the bank, which includes information such as the account numbers, the name of the trust, and the name of the trustee who will manage the account. Similarly, investment accounts, including stocks, bonds, and mutual funds, need to be transferred to the living trust by changing the ownership of the account. This typically requires contacting the broker or investment firm and providing them with the necessary documentation, such as a copy of the trust agreement. Retirement accounts, such as IRAs or 401(k)s, require a different process known as a "beneficiary designation." The account owner needs to contact the account custodian and complete the required forms designating the living trust as the primary or contingent beneficiary. Insurance policies, including life insurance and annuities, can also be transferred to a living trust. Individuals need to contact their insurance company and submit a change of ownership form, naming the trust as the new owner and beneficiary. It is worth noting that while Sioux Falls South Dakota Financial Account Transfer to Living Trust typically refers to the transfer of various financial accounts, the process may extend beyond these accounts. Individuals can also transfer other valuable assets such as real estate, vehicles, and valuable personal belongings to their living trust for comprehensive estate planning. In conclusion, Sioux Falls South Dakota Financial Account Transfer to Living Trust is a vital step in securing one's financial assets and ensuring a seamless transition for loved ones. By understanding the specific requirements for different types of accounts, individuals can successfully transfer their assets to a living trust and enjoy the peace of mind that comes with comprehensive estate planning.Sioux Falls South Dakota Financial Account Transfer to Living Trust is an essential process that allows individuals in the region to protect their financial assets and plan for the future. By transferring their accounts to a living trust, individuals can ensure the smooth transition of their assets to their chosen beneficiaries after their passing. The process of Sioux Falls South Dakota Financial Account Transfer to Living Trust involves a series of steps that must be followed meticulously. Firstly, individuals need to create a living trust, which is a legal document that outlines their wishes and the distribution of their assets. This document must comply with South Dakota state laws and be signed by both the granter (the person creating the trust) and a notary public. Once the living trust has been created, individuals must then transfer their financial accounts to the trust. Common types of financial accounts that can be transferred to a living trust include bank accounts, investment accounts, retirement accounts, and insurance policies. Each of these account types may have specific requirements or processes that need to be followed during the transfer. For instance, regarding bank accounts, individuals need to complete the necessary paperwork provided by their financial institution. This may involve filling out a form provided by the bank, which includes information such as the account numbers, the name of the trust, and the name of the trustee who will manage the account. Similarly, investment accounts, including stocks, bonds, and mutual funds, need to be transferred to the living trust by changing the ownership of the account. This typically requires contacting the broker or investment firm and providing them with the necessary documentation, such as a copy of the trust agreement. Retirement accounts, such as IRAs or 401(k)s, require a different process known as a "beneficiary designation." The account owner needs to contact the account custodian and complete the required forms designating the living trust as the primary or contingent beneficiary. Insurance policies, including life insurance and annuities, can also be transferred to a living trust. Individuals need to contact their insurance company and submit a change of ownership form, naming the trust as the new owner and beneficiary. It is worth noting that while Sioux Falls South Dakota Financial Account Transfer to Living Trust typically refers to the transfer of various financial accounts, the process may extend beyond these accounts. Individuals can also transfer other valuable assets such as real estate, vehicles, and valuable personal belongings to their living trust for comprehensive estate planning. In conclusion, Sioux Falls South Dakota Financial Account Transfer to Living Trust is a vital step in securing one's financial assets and ensuring a seamless transition for loved ones. By understanding the specific requirements for different types of accounts, individuals can successfully transfer their assets to a living trust and enjoy the peace of mind that comes with comprehensive estate planning.