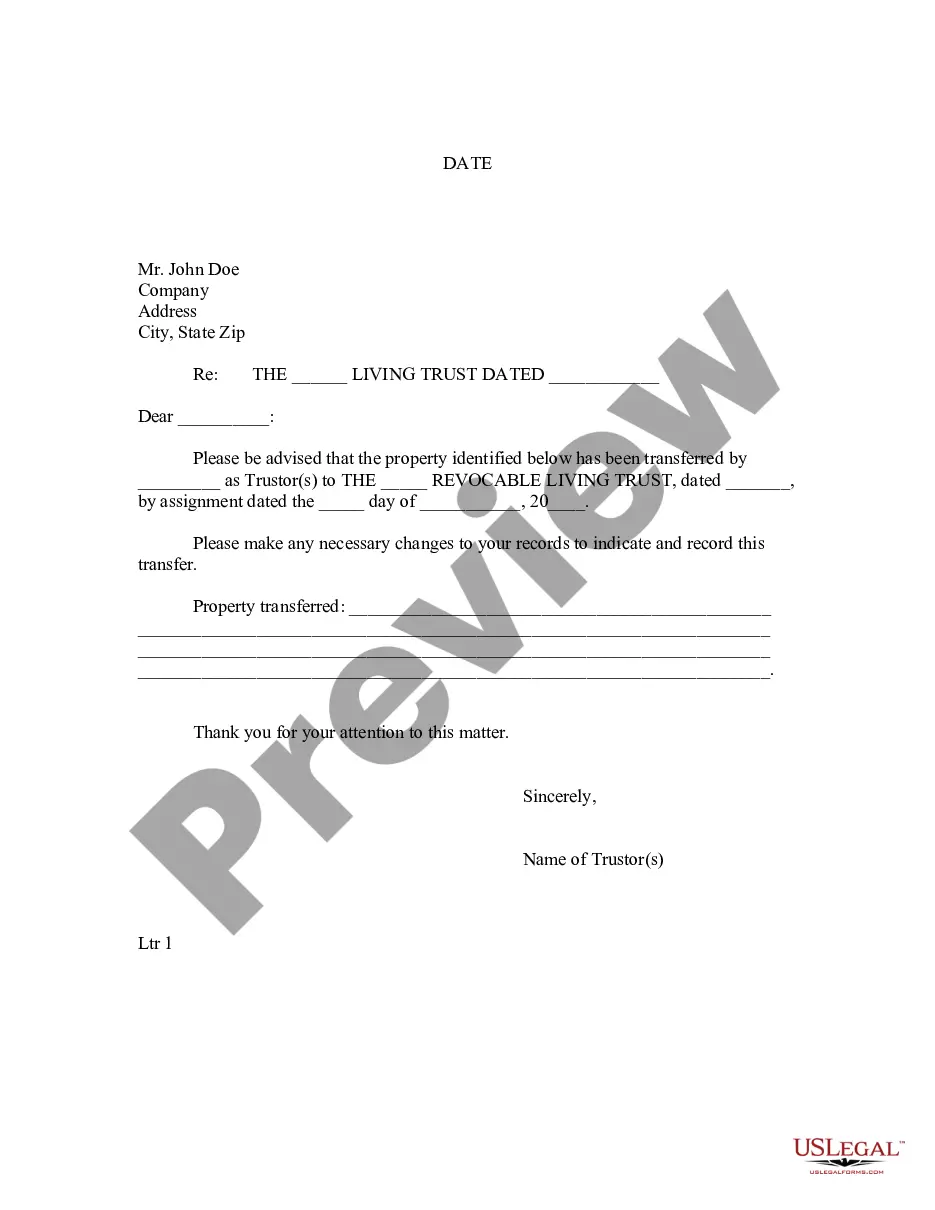

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

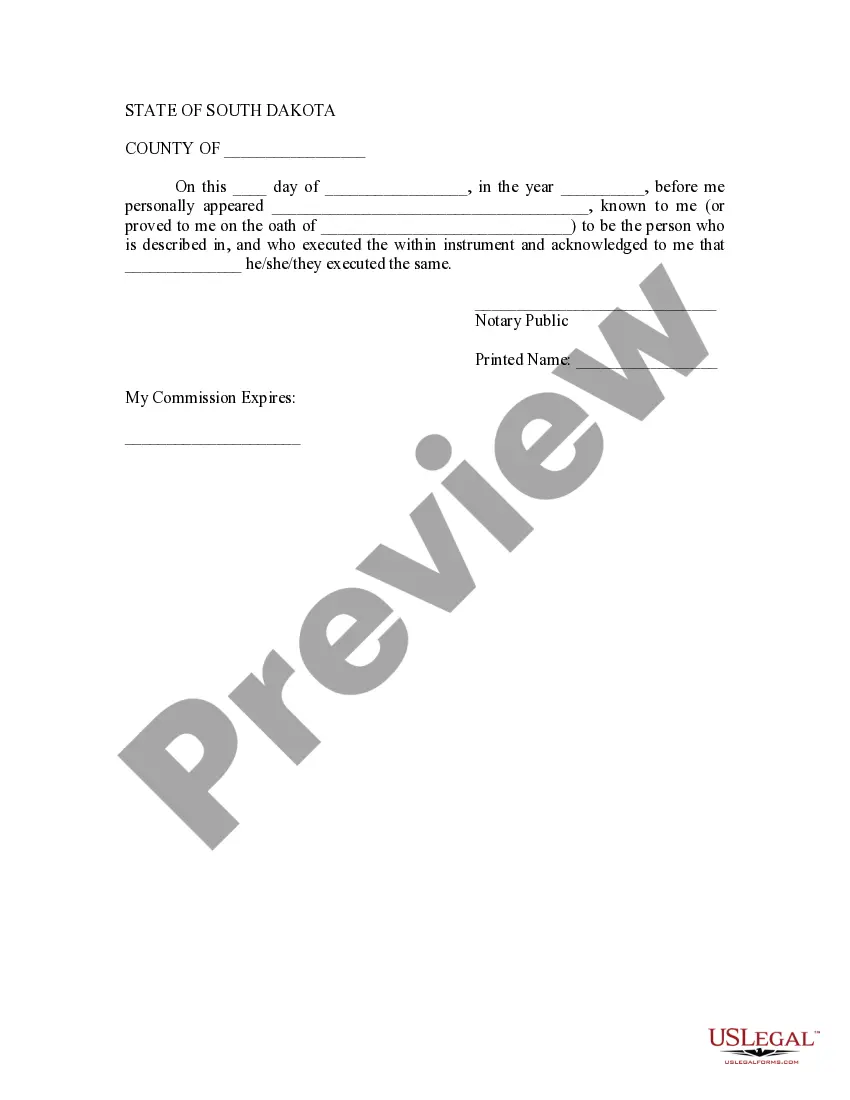

Sioux Falls, South Dakota Letter to Lien holder to Notify of Trust is a crucial document that serves to inform lien holders about the existence and terms of a trust agreement. This letter is typically sent by the settler or trustee of the trust, acting as a formal notification to the lien holder regarding changes in ownership or management of an asset. It ensures that the lien holder is aware of the trust's existence, limiting any potential disputes or confusion. The content of the letter may vary depending on the specific circumstances and assets involved, but it generally includes the following important details: 1. Header: The letter should begin with the sender's information, such as name, address, phone number, and email address. The lien holder's information, including their name, address, and account number, should also be mentioned. 2. Salutation: Begin the letter with a polite greeting, addressing the lien holder or the appropriate department. 3. Introductory Paragraph: State the purpose of the letter clearly. It should include a statement indicating that the sender is writing to notify the lien holder about the existence of a trust agreement and its impact on the asset or assets under the lien. 4. Description of Trust: Provide an overview of the trust agreement, including the date of establishment, the trust's name, and the identity of the settler(s) involved. It may be necessary to include a copy or reference to the trust document for the lien holder's reference. 5. Trustee(s) Information: Specify the name(s) and contact details of the trustee(s) responsible for managing the trust. If applicable, note any co-trustees involved. 6. Asset Details: List the specific asset(s) covered by the lien and state that it is now held in the trust. Include pertinent information such as the asset's description, make, model, Vehicle Identification Number (VIN), real estate address, or any other relevant details. 7. Lien holder's Rights: Assure the lien holder that their lien will not be affected by the trust and that they retain the same rights and remedies as outlined in the original lien agreement. 8. Contact Information: Provide contact details for the trustee(s), including their addresses, phone numbers, and email addresses. Encourage the lien holder to reach out with any questions or concerns and ensure they know how to contact the trustee(s) regarding the asset(s) in question. 9. Conclusion: Express gratitude for the lien holder's attention to the matter and their cooperation. Encourage them to update any records or systems with the new information and mention any additional documents or steps required by the lien holder to verify the trust's existence or the trustee's authority. Possible variations of the Sioux Falls, South Dakota Letter to Lien holder to Notify of Trust based on the asset type could include: — Sioux Falls, South Dakota Letter to Auto Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Mortgage Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Boat Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Property Lien holder to Notify of Trust These variations simply involve specifying the type of asset held by the trust, allowing for more specific information relevant to each asset type within the content of the letter.Sioux Falls, South Dakota Letter to Lien holder to Notify of Trust is a crucial document that serves to inform lien holders about the existence and terms of a trust agreement. This letter is typically sent by the settler or trustee of the trust, acting as a formal notification to the lien holder regarding changes in ownership or management of an asset. It ensures that the lien holder is aware of the trust's existence, limiting any potential disputes or confusion. The content of the letter may vary depending on the specific circumstances and assets involved, but it generally includes the following important details: 1. Header: The letter should begin with the sender's information, such as name, address, phone number, and email address. The lien holder's information, including their name, address, and account number, should also be mentioned. 2. Salutation: Begin the letter with a polite greeting, addressing the lien holder or the appropriate department. 3. Introductory Paragraph: State the purpose of the letter clearly. It should include a statement indicating that the sender is writing to notify the lien holder about the existence of a trust agreement and its impact on the asset or assets under the lien. 4. Description of Trust: Provide an overview of the trust agreement, including the date of establishment, the trust's name, and the identity of the settler(s) involved. It may be necessary to include a copy or reference to the trust document for the lien holder's reference. 5. Trustee(s) Information: Specify the name(s) and contact details of the trustee(s) responsible for managing the trust. If applicable, note any co-trustees involved. 6. Asset Details: List the specific asset(s) covered by the lien and state that it is now held in the trust. Include pertinent information such as the asset's description, make, model, Vehicle Identification Number (VIN), real estate address, or any other relevant details. 7. Lien holder's Rights: Assure the lien holder that their lien will not be affected by the trust and that they retain the same rights and remedies as outlined in the original lien agreement. 8. Contact Information: Provide contact details for the trustee(s), including their addresses, phone numbers, and email addresses. Encourage the lien holder to reach out with any questions or concerns and ensure they know how to contact the trustee(s) regarding the asset(s) in question. 9. Conclusion: Express gratitude for the lien holder's attention to the matter and their cooperation. Encourage them to update any records or systems with the new information and mention any additional documents or steps required by the lien holder to verify the trust's existence or the trustee's authority. Possible variations of the Sioux Falls, South Dakota Letter to Lien holder to Notify of Trust based on the asset type could include: — Sioux Falls, South Dakota Letter to Auto Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Mortgage Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Boat Lien holder to Notify of Trust — Sioux Falls, South Dakota Letter to Property Lien holder to Notify of Trust These variations simply involve specifying the type of asset held by the trust, allowing for more specific information relevant to each asset type within the content of the letter.