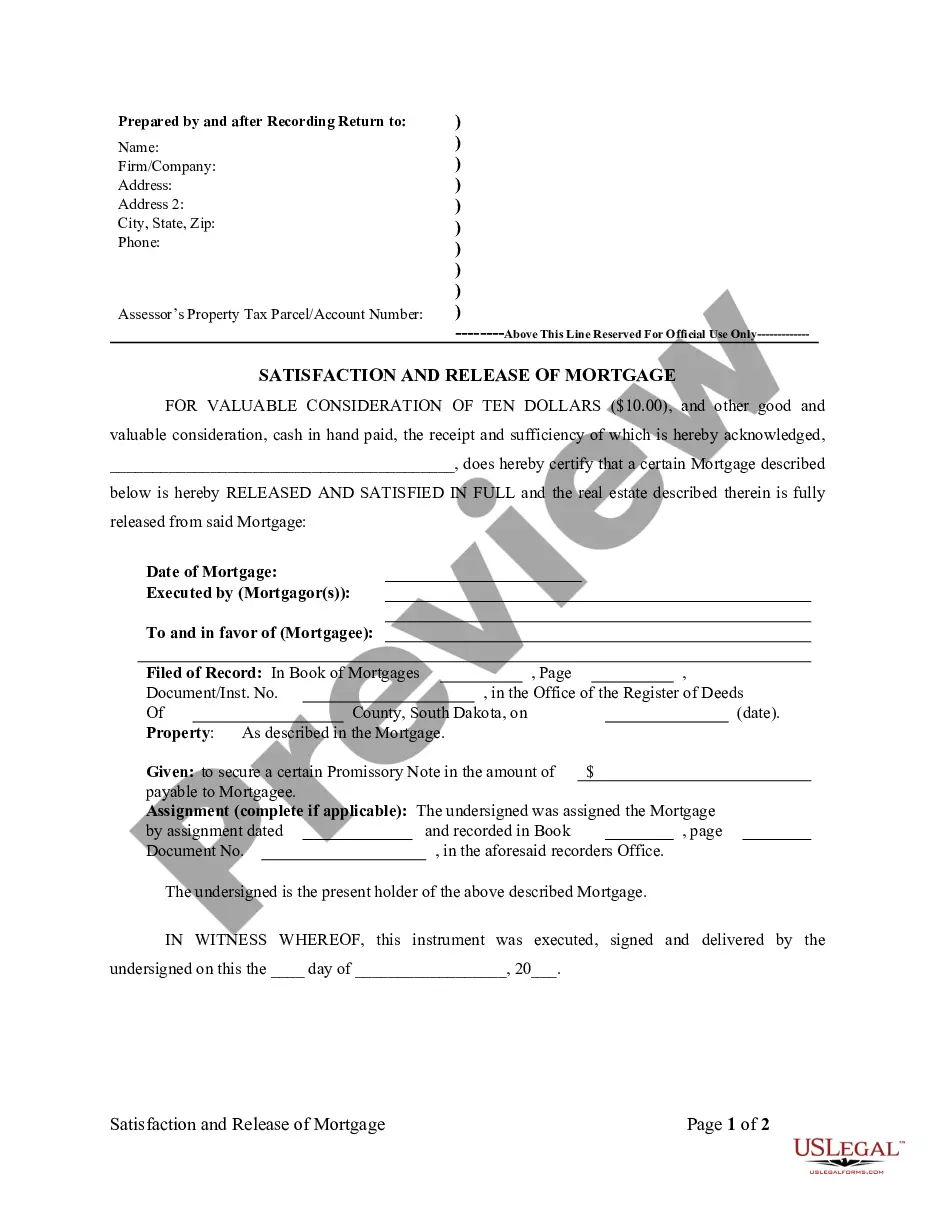

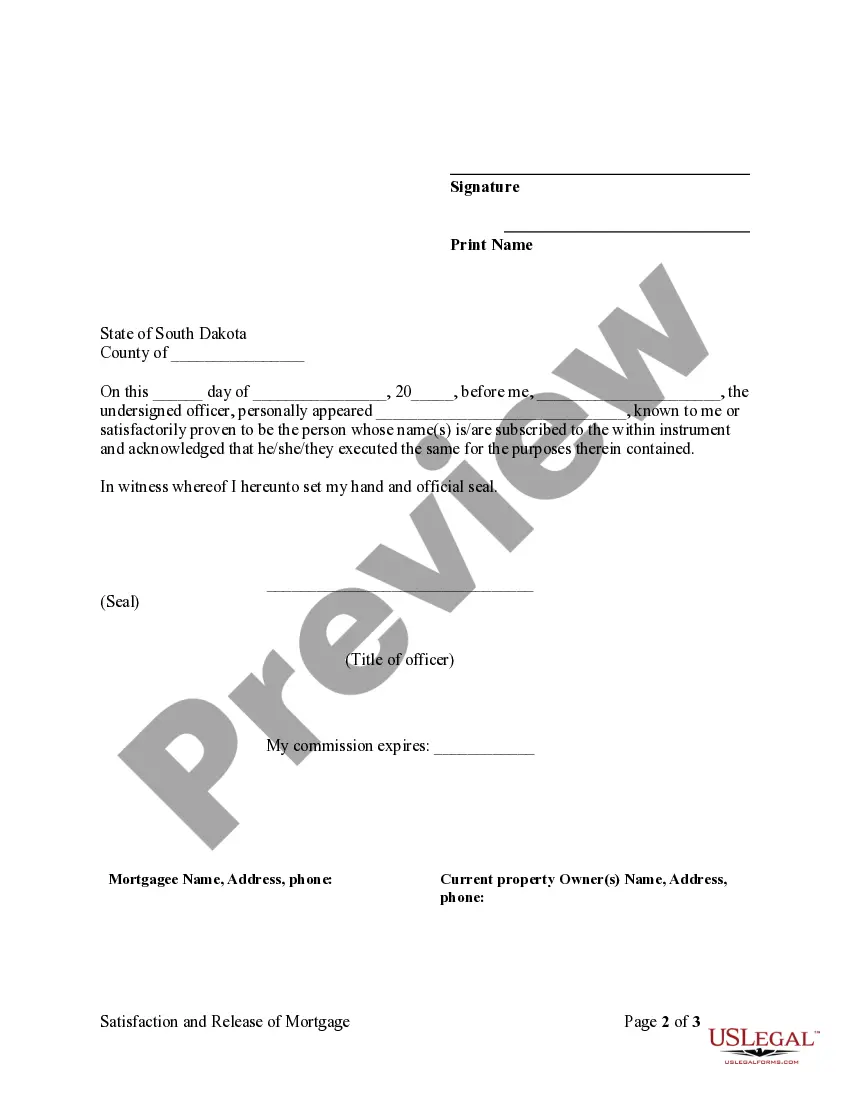

This form is for the satisfaction or release of a deed of trust for the state of South Dakota by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Sioux Falls, South Dakota Release of Mortgage by Lender — Individual Lender or Holder is an important legal document that signifies the successful completion of a mortgage agreement in the city of Sioux Falls, South Dakota. This document is executed when a lender or holder of a mortgage, usually a financial institution or an individual, releases their claim on a property after the mortgage debt has been fully paid off or satisfied. The purpose of the Release of Mortgage is to legally release the property from the lien or encumbrance caused by the mortgage, granting the property owner full ownership rights. It is a crucial step in the home buying process as it provides the homeowner with clear title and eliminates any outstanding obligations towards the lender. In Sioux Falls, South Dakota, there may be different types of Release of Mortgage by Lender — Individual Lender or Holder depending on the circumstances and parties involved. Some common types include: 1. Prepayment Release of Mortgage: This type of release is executed when the borrower pays off the mortgage loan in full before the designated term ends. It typically states that the borrower has met all obligations associated with the loan, leading to the release of the mortgage lien. 2. Satisfaction of Mortgage: This type of release is executed when the borrower successfully fulfills all repayment obligations over the agreed period, resulting in the satisfaction of the mortgage. The lender or holder formally releases the property from the mortgage lien, confirming full repayment. 3. Subordination Release of Mortgage: In some cases, a lender may agree to subordinate their mortgage lien, allowing another lender to take a higher priority position. When the specified conditions are met, the original lender releases their interest in the property, allowing the second lender to assume the primary lien position. The process of executing a Release of Mortgage typically involves drafting a legally binding document that outlines relevant details such as the names and addresses of the lender, borrower, and property, as well as the original mortgage amount. It will also include a statement of release and satisfaction, indicating the discharge of the mortgage debt. Both parties involved must sign the document in the presence of a notary public for it to be considered legally valid and enforceable. In conclusion, the Sioux Falls, South Dakota Release of Mortgage by Lender — Individual Lender or Holder is a vital document that acknowledges the completion of a mortgage agreement and releases any claim the lender or holder may have on the property. It ensures that homeowners have clear title, free from any encumbrances, and provides legal evidence of the mortgage debt satisfaction.Sioux Falls, South Dakota Release of Mortgage by Lender — Individual Lender or Holder is an important legal document that signifies the successful completion of a mortgage agreement in the city of Sioux Falls, South Dakota. This document is executed when a lender or holder of a mortgage, usually a financial institution or an individual, releases their claim on a property after the mortgage debt has been fully paid off or satisfied. The purpose of the Release of Mortgage is to legally release the property from the lien or encumbrance caused by the mortgage, granting the property owner full ownership rights. It is a crucial step in the home buying process as it provides the homeowner with clear title and eliminates any outstanding obligations towards the lender. In Sioux Falls, South Dakota, there may be different types of Release of Mortgage by Lender — Individual Lender or Holder depending on the circumstances and parties involved. Some common types include: 1. Prepayment Release of Mortgage: This type of release is executed when the borrower pays off the mortgage loan in full before the designated term ends. It typically states that the borrower has met all obligations associated with the loan, leading to the release of the mortgage lien. 2. Satisfaction of Mortgage: This type of release is executed when the borrower successfully fulfills all repayment obligations over the agreed period, resulting in the satisfaction of the mortgage. The lender or holder formally releases the property from the mortgage lien, confirming full repayment. 3. Subordination Release of Mortgage: In some cases, a lender may agree to subordinate their mortgage lien, allowing another lender to take a higher priority position. When the specified conditions are met, the original lender releases their interest in the property, allowing the second lender to assume the primary lien position. The process of executing a Release of Mortgage typically involves drafting a legally binding document that outlines relevant details such as the names and addresses of the lender, borrower, and property, as well as the original mortgage amount. It will also include a statement of release and satisfaction, indicating the discharge of the mortgage debt. Both parties involved must sign the document in the presence of a notary public for it to be considered legally valid and enforceable. In conclusion, the Sioux Falls, South Dakota Release of Mortgage by Lender — Individual Lender or Holder is a vital document that acknowledges the completion of a mortgage agreement and releases any claim the lender or holder may have on the property. It ensures that homeowners have clear title, free from any encumbrances, and provides legal evidence of the mortgage debt satisfaction.