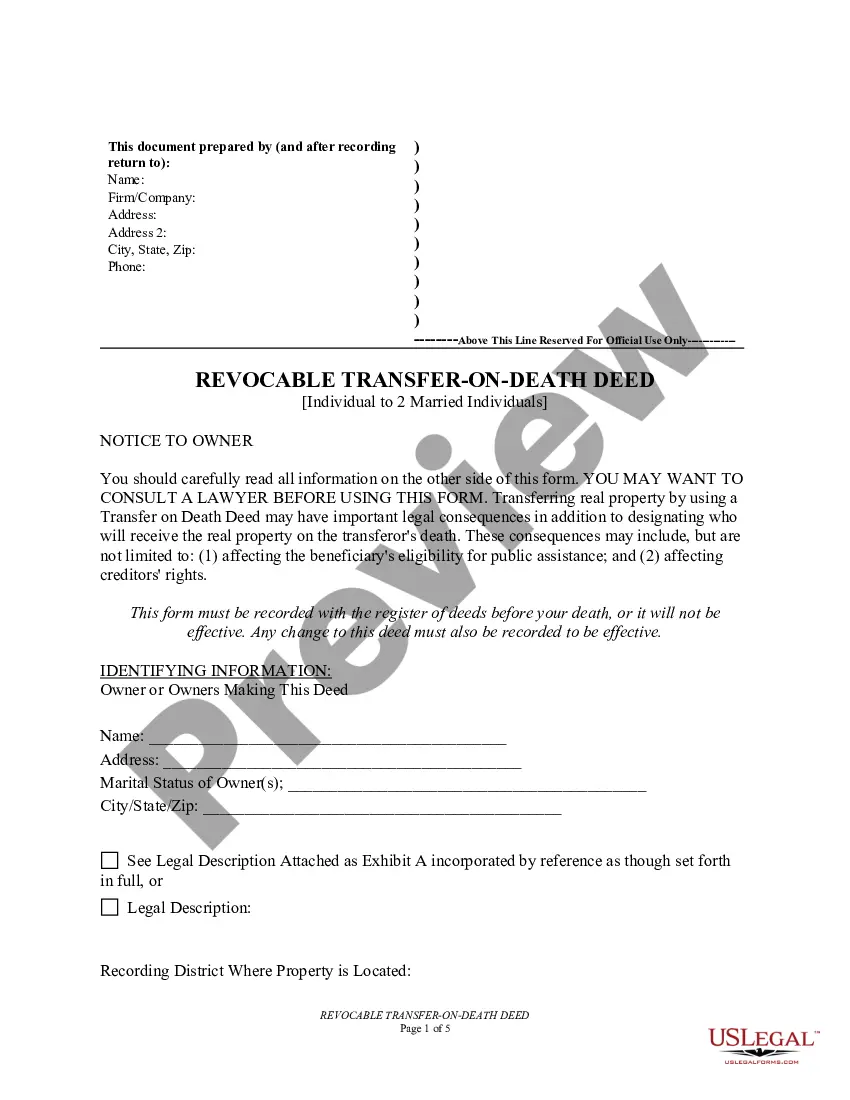

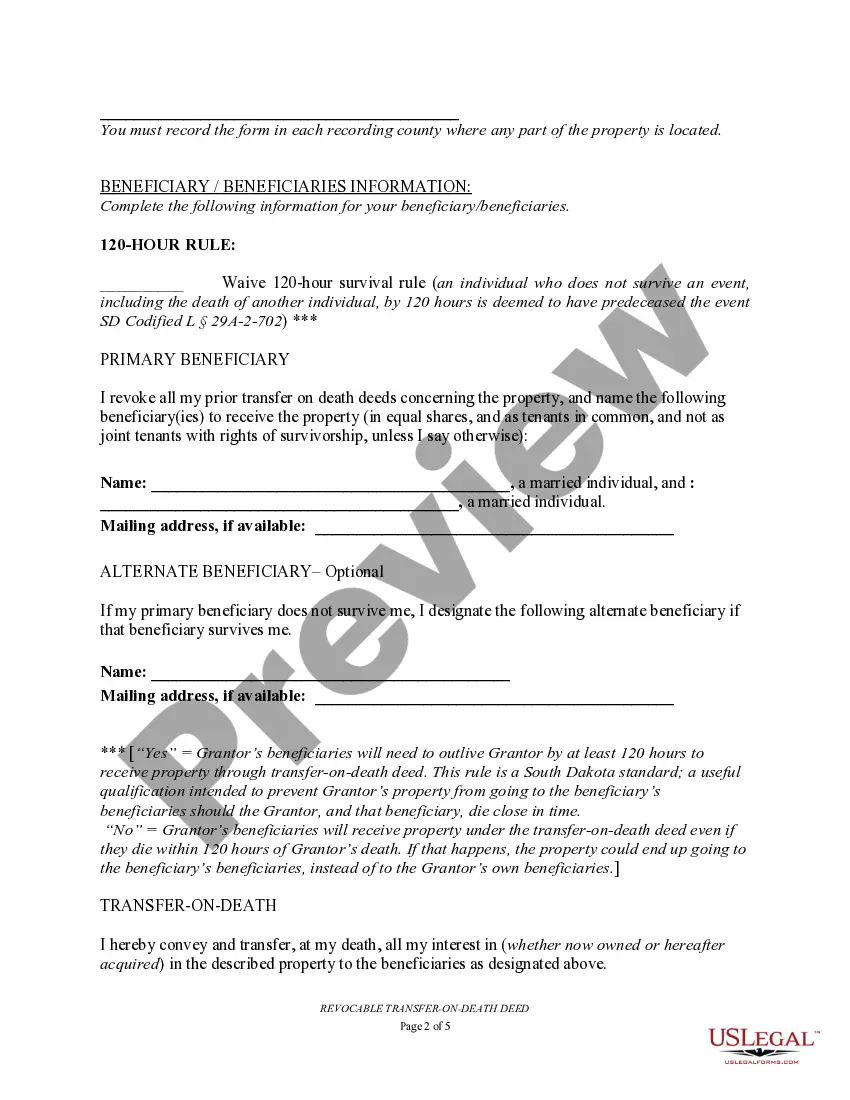

Sioux Falls South Dakota Transfer on Death Deed (TOD) or Beneficiary Deed for Individual to Married Beneficiaries is a legal document that allows an individual to designate married beneficiaries to inherit their real estate or property after their death without going through the probate process. This type of deed is commonly used in estate planning to simplify the transfer of property and ensure a smooth transition for married beneficiaries. There are different types of Sioux Falls South Dakota Transfer on Death Deeds or TOD — Beneficiary Deeds that cater to specific situations and preferences. Some common variations include: 1. Joint Tenancy Transfer on Death Deed: This type of TOD deed allows married individuals to designate their spouse as the primary beneficiary, and upon the spouse's death, the property automatically transfers to the secondary beneficiaries, such as children or other family members. 2. Revocable Transfer on Death Deed: This variation of the TOD deed provides flexibility as it allows the individual to revoke or change the designated beneficiaries at any point during their lifetime. 3. Irrevocable Transfer on Death Deed: In contrast to the revocable TOD deed, the irrevocable TOD deed cannot be altered or revoked once it is executed. This provides a sense of certainty and finality in the transfer of property. 4. Specific Property Transfer on Death Deed: This type of TOD deed allows the individual to specify certain real estate or specific properties to be transferred to married beneficiaries upon their death. This enables them to control the distribution of their assets more precisely. 5. General Transfer on Death Deed: In contrast to the specific property TOD deed, the general TOD deed allows the individual to transfer all of their real estate or property to married beneficiaries without specifying particular assets. Sioux Falls South Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Individual to Married Beneficiaries offers a convenient way to pass on property to married beneficiaries upon the owner's death while avoiding probate. It is essential to consult with a legal professional experienced in estate planning to choose the most suitable type of TOD deed and ensure compliance with the applicable laws and regulations.

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries

Description

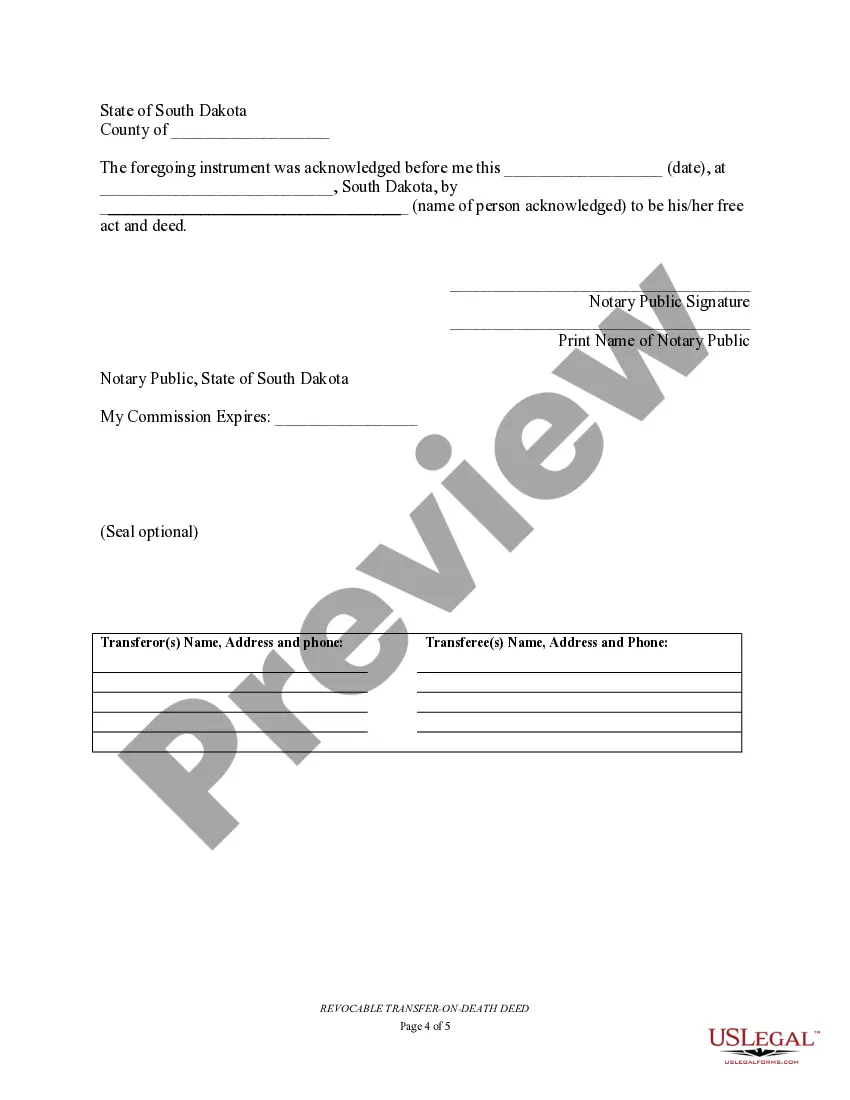

How to fill out Sioux Falls South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Married Beneficiaries?

Do you need a trustworthy and affordable legal forms provider to buy the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over in case the form isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficiaries in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal paperwork online once and for all.