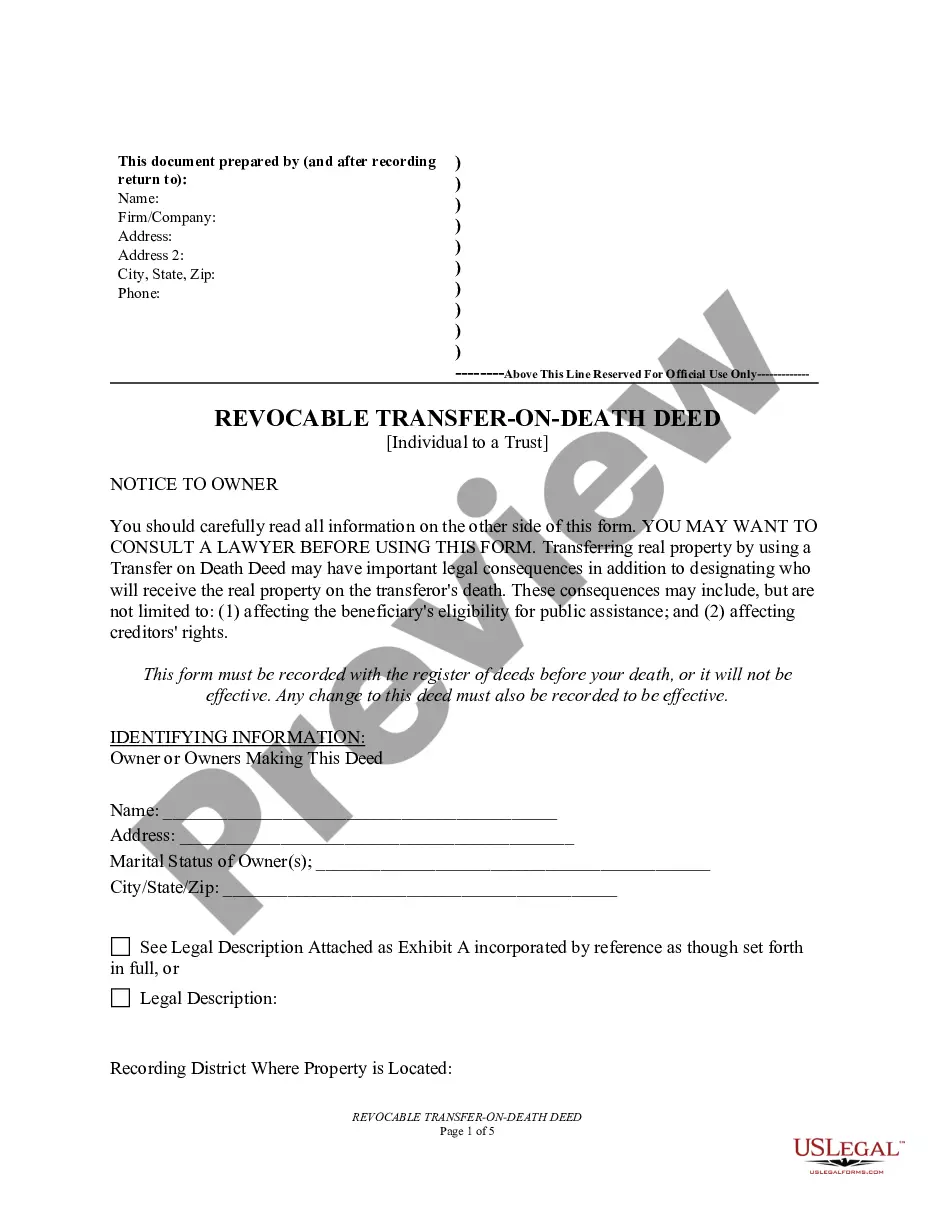

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust

Description

How to fill out South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Trust?

Regardless of social or occupational standing, completing legal documents is an unfortunate requirement in today's society.

Frequently, it is nearly unachievable for an individual lacking any legal expertise to articulate these types of documents independently, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms becomes invaluable.

Confirm that the form you selected is appropriate for your location because the regulations of one state or area may not apply to another.

Examine the form and review a brief overview (if provided) of the situations in which the document can be utilized.

- Our service offers a vast collection of over 85,000 ready-to-use state-specific forms applicable for nearly every legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors wishing to enhance their time efficiency by utilizing our DIY documents.

- Whether you require the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust or any other paperwork suitable for your region, US Legal Forms has everything readily available.

- Here’s how to swiftly obtain the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust using our reliable service.

- If you are already a subscriber, feel free to Log In to your account to access the necessary form.

- However, if you are unfamiliar with our library, make sure to follow these instructions before downloading the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust.

Form popularity

FAQ

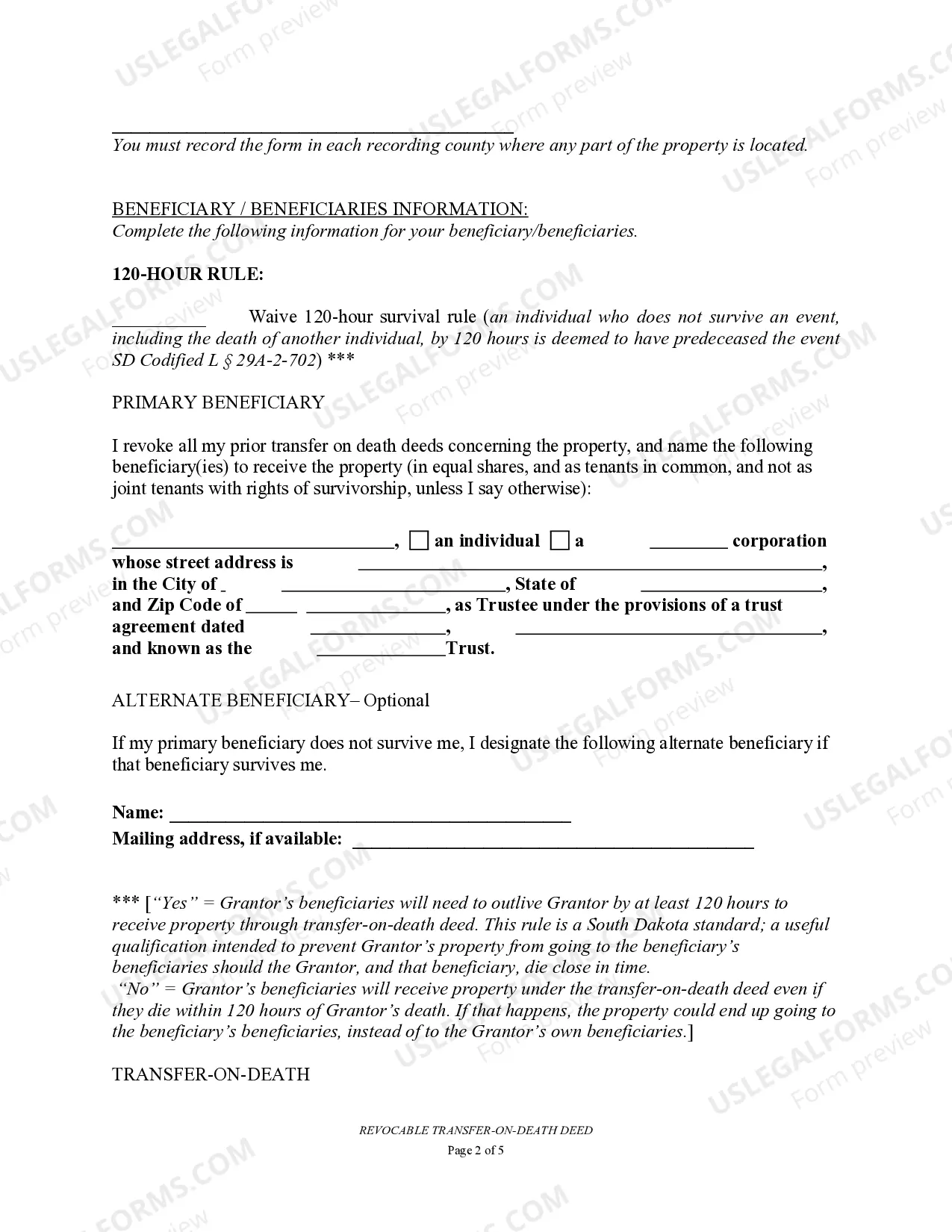

Yes, South Dakota allows for Transfer on Death Deeds, which permit property owners to designate a beneficiary to receive their property directly upon death. This method helps avoid the complexities associated with probate, making the process quicker and simpler for beneficiaries. If you are looking to establish such a transfer, consider the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust as a reliable solution.

To transfer a title in South Dakota, you need to provide the original title, a signed bill of sale, and identification. Depending on the type of property being transferred, you may also need a completed application for the new title. If you're using a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, remember that the process can bypass probate, making it a more efficient option.

Yes, selling a car without a title in South Dakota is illegal, as a title is necessary to verify ownership and facilitate a legal sale. Buyers typically want to see the title to ensure that the seller has the legal right to sell the vehicle. If you're dealing with situations involving property transfers, such as through a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, ensuring all necessary documentation is in order will make the process smoother.

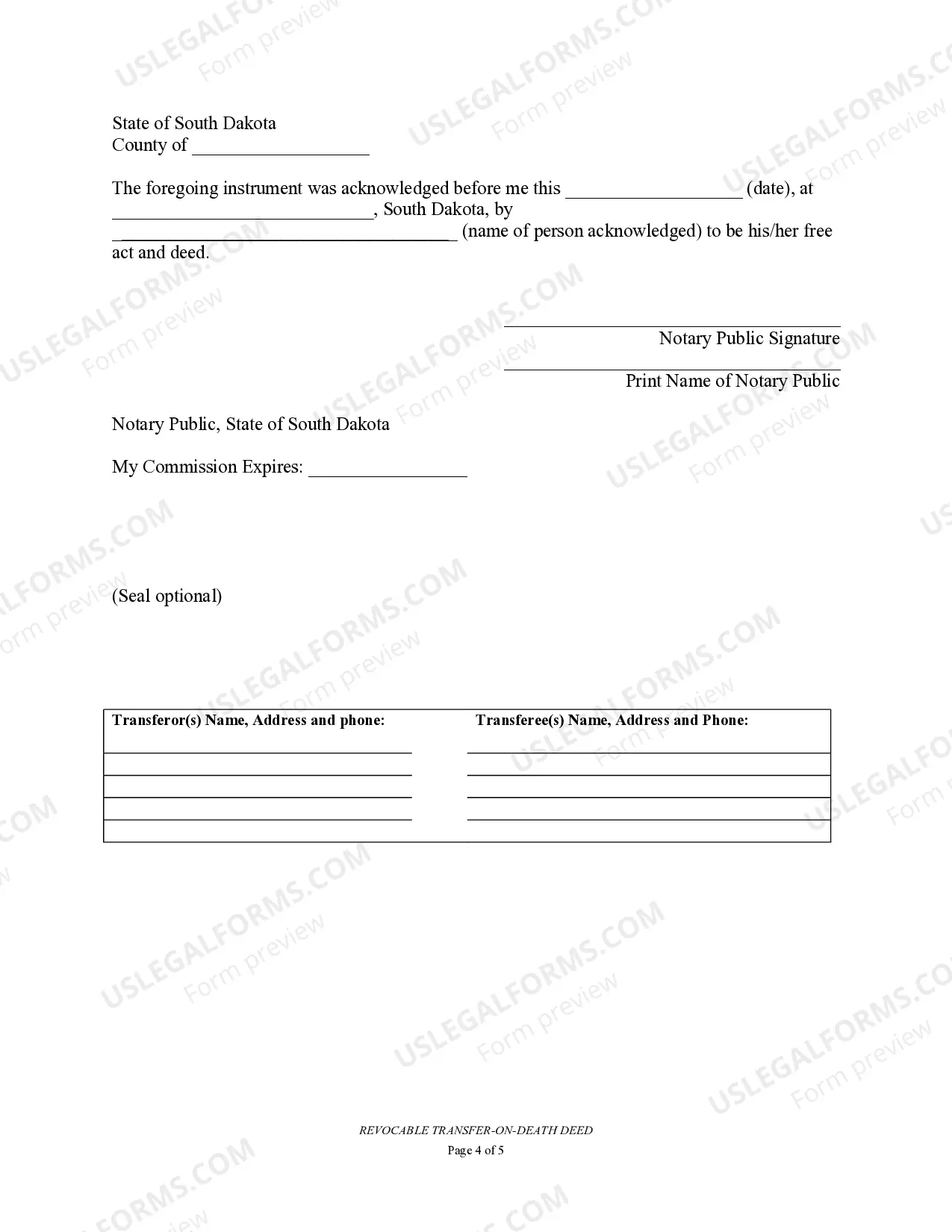

In South Dakota, a bill of sale does not require notarization to be legally valid, but having it notarized can add an extra layer of protection. This notarization can help prove the authenticity of the transaction, ensuring both parties are protected. If you're using a bill of sale in conjunction with property transfers, especially with a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, consider having it notarized for added security.

Yes, South Dakota allows for a transfer on death deed, which facilitates the transfer of real estate directly to a beneficiary upon the owner's death. This method is an effective way to manage your assets while bypassing the probate process. Make sure to comply with state guidelines and properly record the deed. If you're uncertain about the requirements, resources like uslegalforms can help you through the legal intricacies involved.

To avoid probate in South Dakota, consider using tools like a transfer on death deed or setting up a revocable trust. These methods allow your assets to transfer directly to beneficiaries without going through the probate process. It's also advisable to maintain clear records and ensure your estate planning documents are in order. Services like uslegalforms can assist you in creating an effective plan to avoid probate.

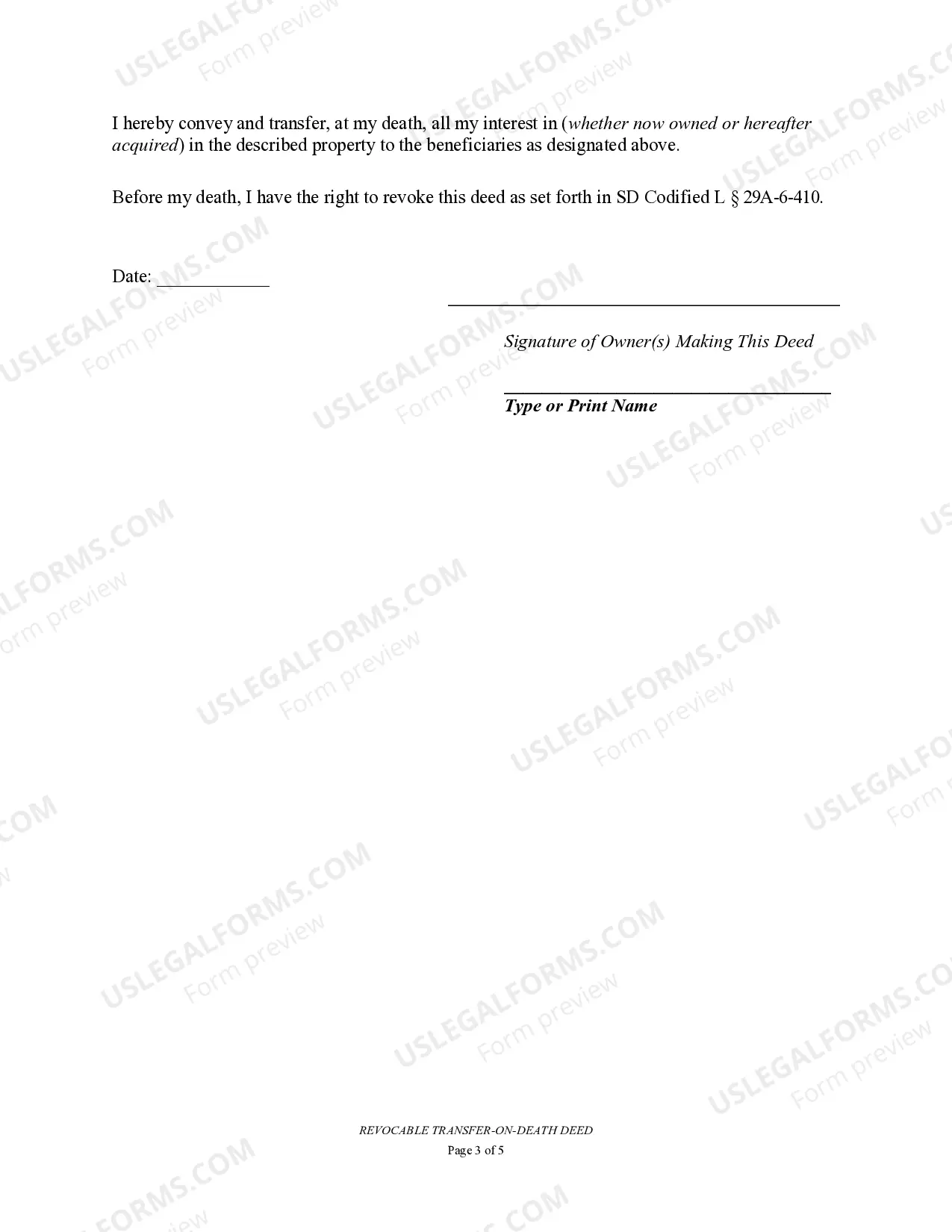

You are not required to hire a lawyer to file a transfer on death deed in South Dakota, as the process can be completed independently. However, legal expertise can be beneficial to ensure all requirements are met and to minimize the risk of potential issues later. Platforms such as uslegalforms can offer tools and guidance, making it easier for you to manage your deed without legal representation.

To transfer title after death in South Dakota, you generally need to obtain a death certificate and the will, if available. You will file the will with the probate court to initiate the process. Once the court validates the will, the executor can then transfer the title to the beneficiaries as specified. Resources like uslegalforms can help you navigate the necessary paperwork and make the process smoother.

While a transfer on death deed can provide benefits such as avoiding probate, there are some disadvantages to consider. If the grantor needs to sell or refinance the property, they must do so before death to avoid complications. Additionally, if there are disputes among heirs, a transfer on death deed can sometimes lead to legal challenges. It's wise to weigh these factors against your personal circumstances.

To create a transfer on death deed in South Dakota, you first need to ensure you understand the necessary requirements for your property. You must fill out the appropriate form detailing the property and the beneficiary. After signing the document before a notary public, it's crucial to file it with the county register of deeds to make it legally binding. Utilizing platforms like uslegalforms can guide you through each step of this process with ease.