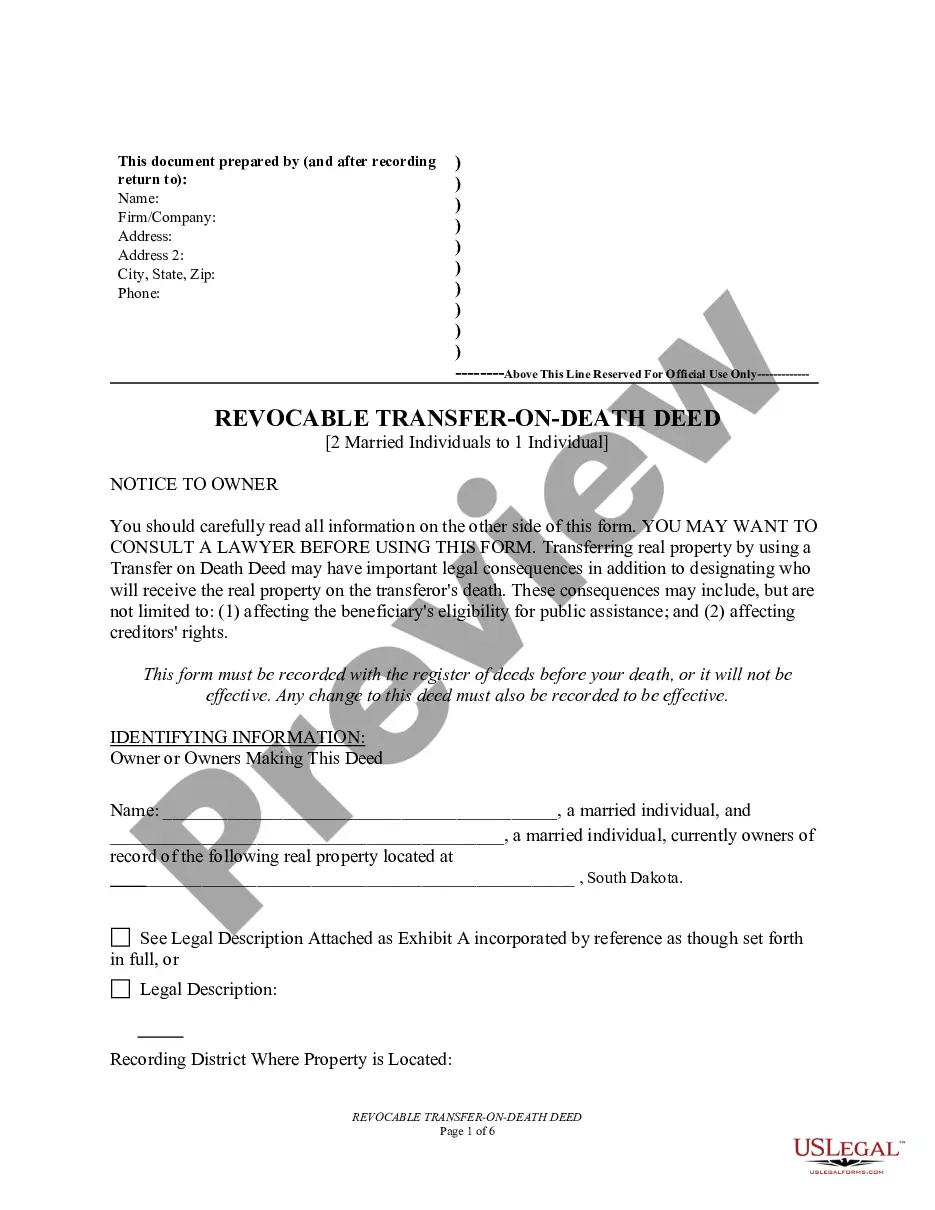

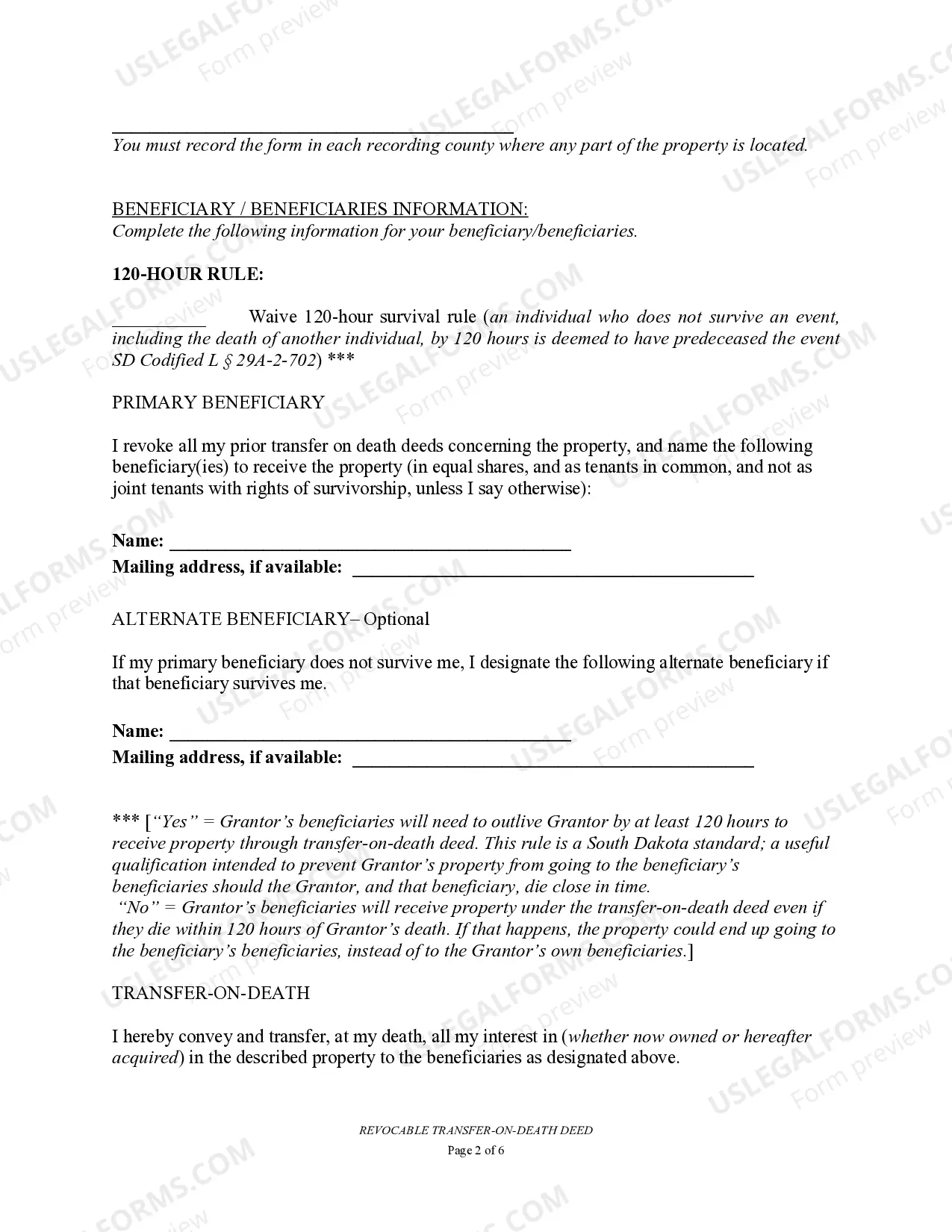

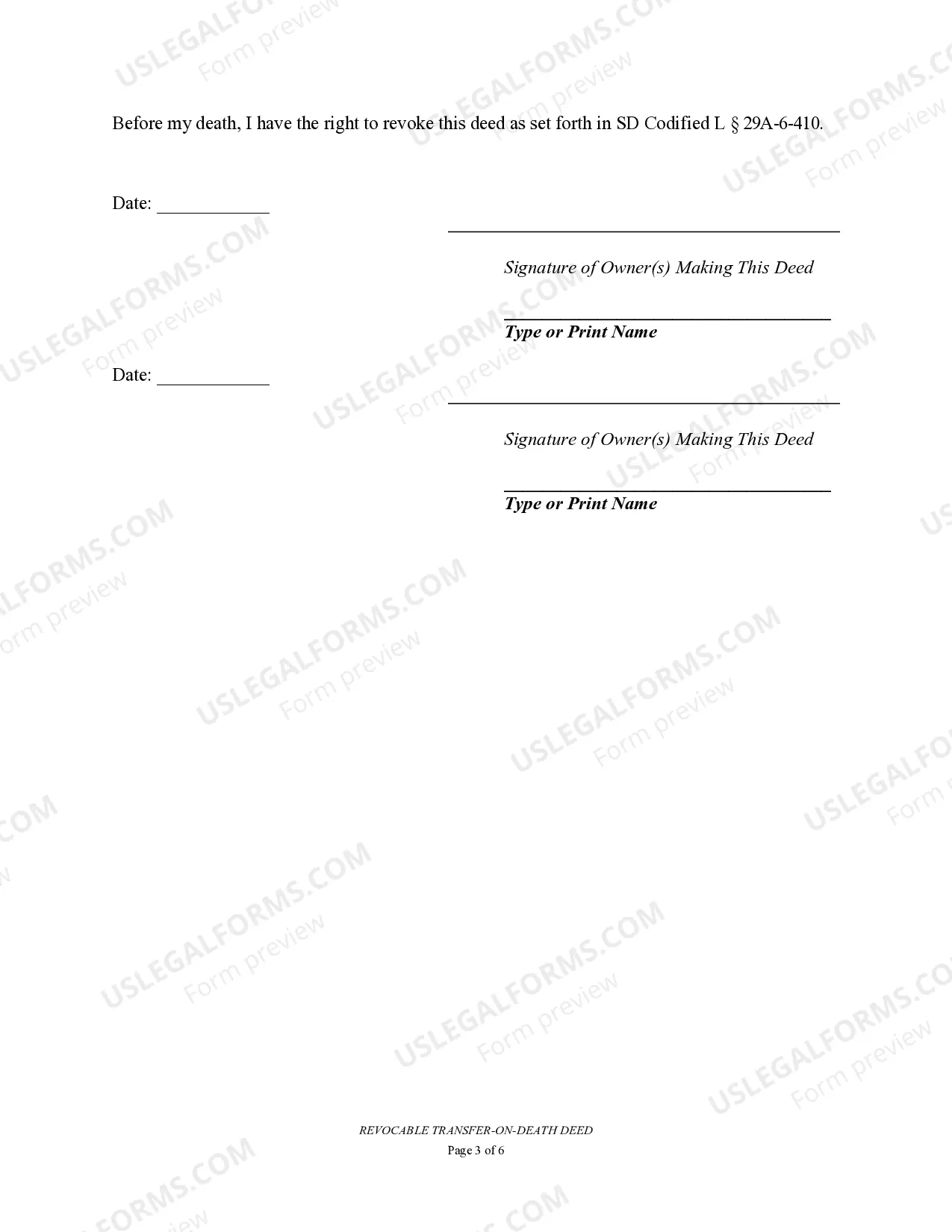

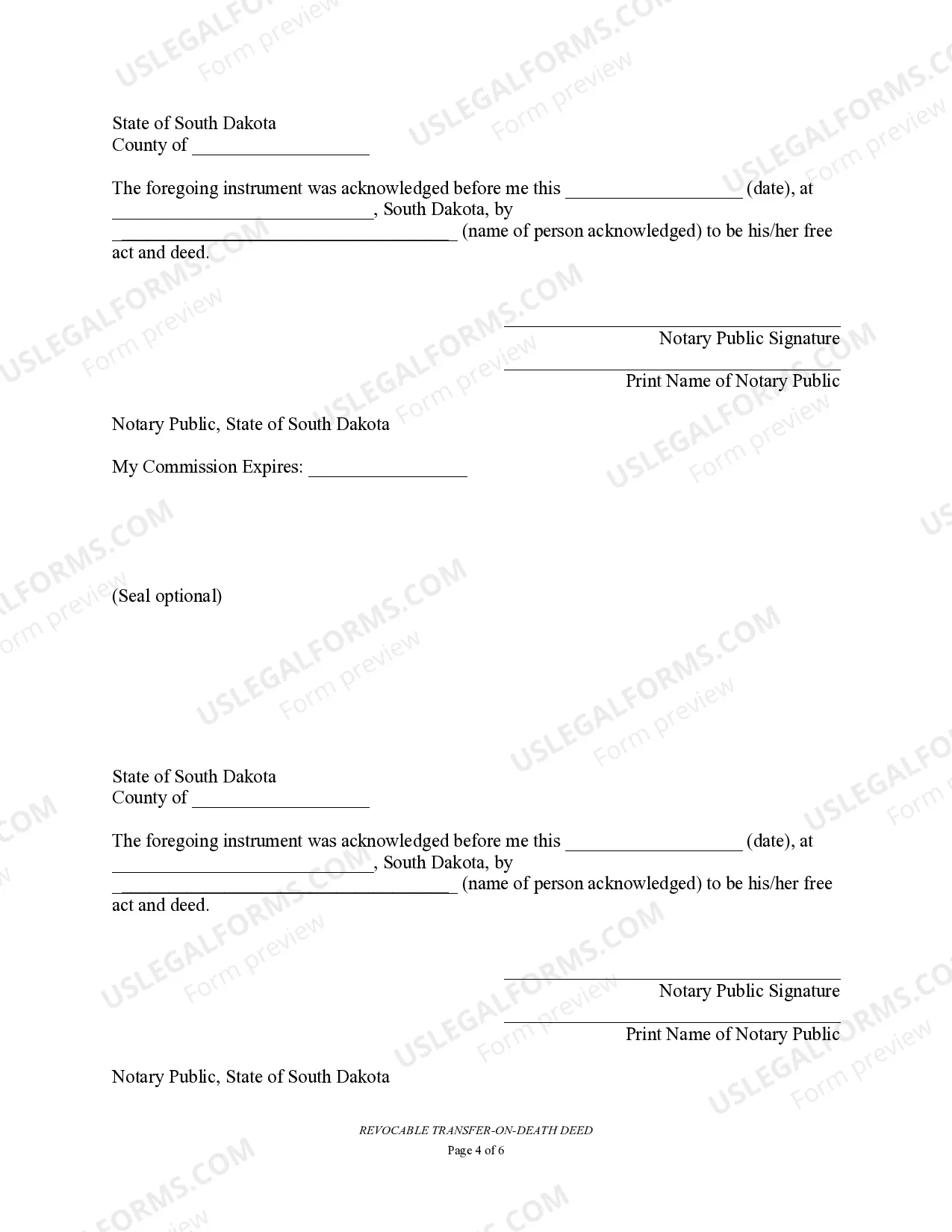

Sioux Falls South Dakota Transfer on Death Deed, also known as TOD — Beneficiary Deed, is a legal instrument that allows property owners in Sioux Falls, South Dakota, to transfer their real estate assets to a designated beneficiary upon their death, bypassing the need for probate. In the case of two married individuals jointly owning a property in Sioux Falls, they can utilize a specific type of TOD — Beneficiary Deed known as "Two Married Individuals to Individual" deed. This deed is tailored for couples who wish to ensure that their property is smoothly transferred to a named individual beneficiary, such as their spouse or child, upon the last surviving spouse's death. By executing a Sioux Falls South Dakota Transfer on Death Deed or TOD — Beneficiary Deed, married individuals can enjoy the benefits of easy transfer of their real estate assets, without the complexities and costs associated with probate. Here's a closer look at the benefits and key features of this deed: 1. Avoidance of Probate: This type of deed bypasses the probate process, which is time-consuming and expensive. Upon the death of the last surviving spouse, the property automatically transfers to the named individual beneficiary, allowing for a seamless ownership transition. 2. Flexibility in Designation: The deed grants married individuals the freedom to designate any individual as the beneficiary of their property. This ensures that their intended recipient receives ownership rights without interference or potential challenges. 3. Retained Control and Ownership: Despite naming a beneficiary, the individuals retain complete ownership and control of the property during their lifetime. They can sell, mortgage, or transfer the property as they wish, without any restrictions. 4. Revocability: Sioux Falls South Dakota Transfer on Death Deed or TOD — Beneficiary Deed can be revoked or amended at any time during the lifetime of the individuals who executed it. This provides flexibility should their circumstances or wishes change. 5. Financial Protection: By utilizing this deed, married individuals can safeguard against potential creditors' claims against their beneficiaries' share of the property. The property remains unaffected by the beneficiary's financial obligations. It is important to note that there may be variations or additional types of Sioux Falls South Dakota Transfer on Death Deed or TOD — Beneficiary Deed based on individual circumstances or preferences. Consulting with a qualified attorney or legal professional who specializes in estate planning and real estate law can provide personalized guidance on selecting the most suitable type of deed to meet specific needs. In conclusion, Sioux Falls South Dakota Transfer on Death Deed or TOD — Beneficiary Deed for Two Married Individuals to Individual is a valuable estate planning tool that enables seamless property transfer to a named individual beneficiary upon the last spouse's death. Its benefits include the avoidance of probate, flexibility in designating beneficiaries, retained control and ownership, revocability, and financial protection. Seek legal advice to determine the most appropriate deed based on individual circumstances.

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Individual

Description

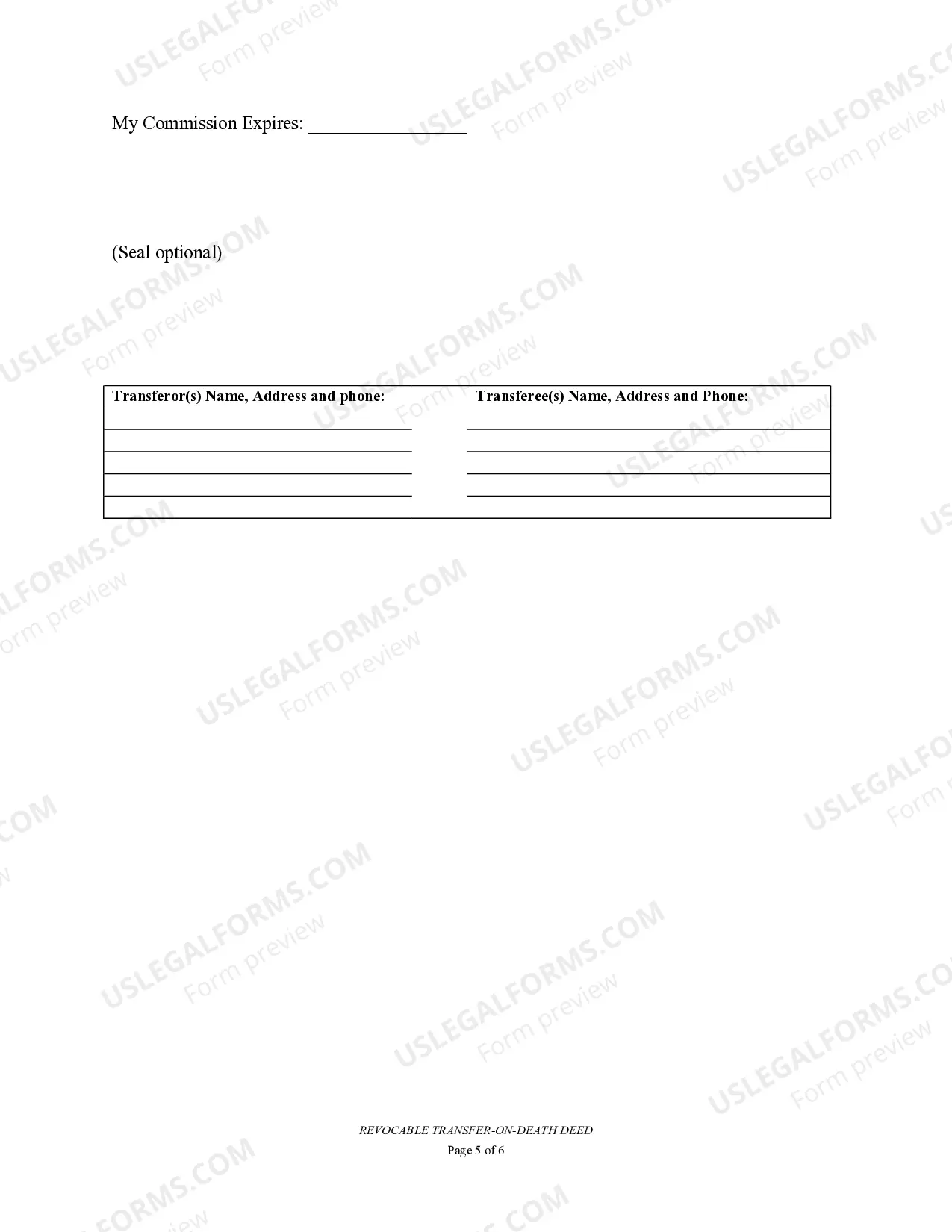

How to fill out Sioux Falls South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To Individual?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Individual? US Legal Forms is your go-to solution.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and county.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Individual conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over if the form isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Individual in any provided format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal paperwork online for good.