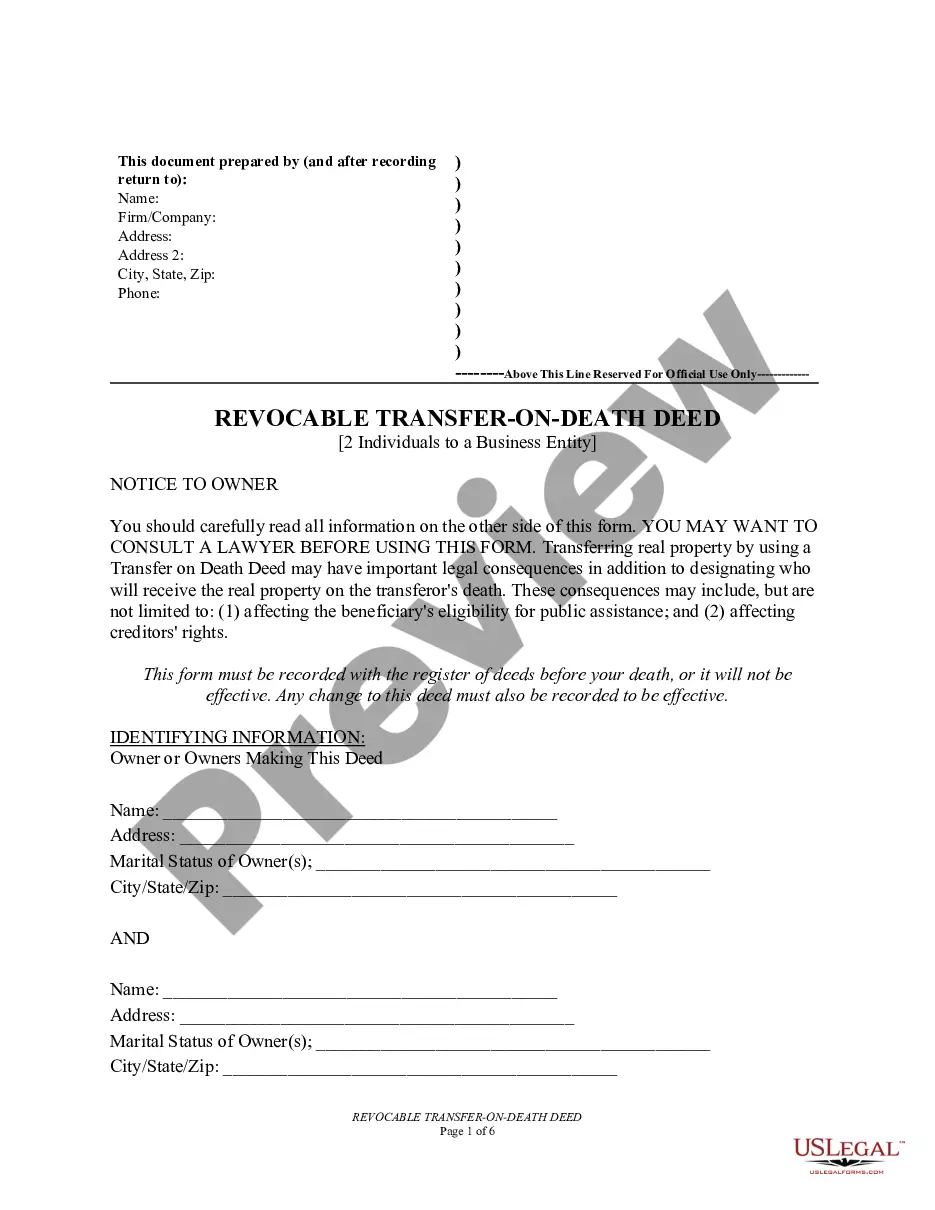

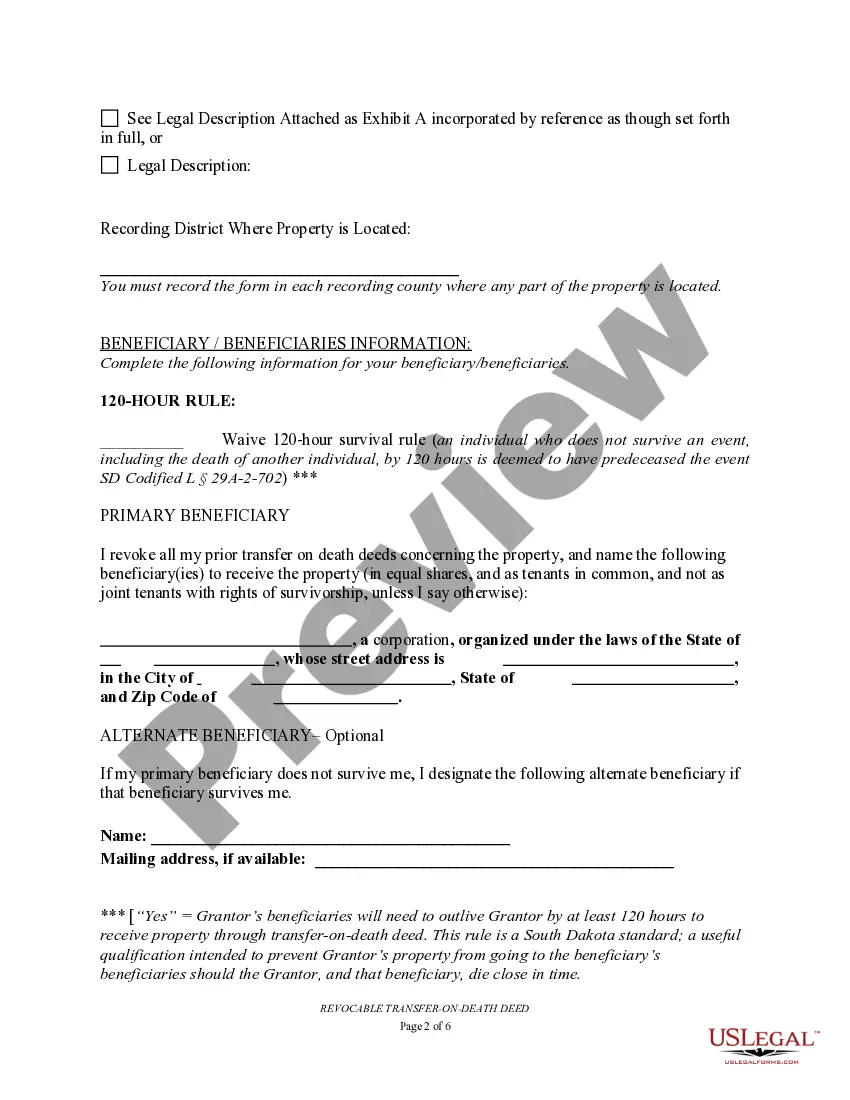

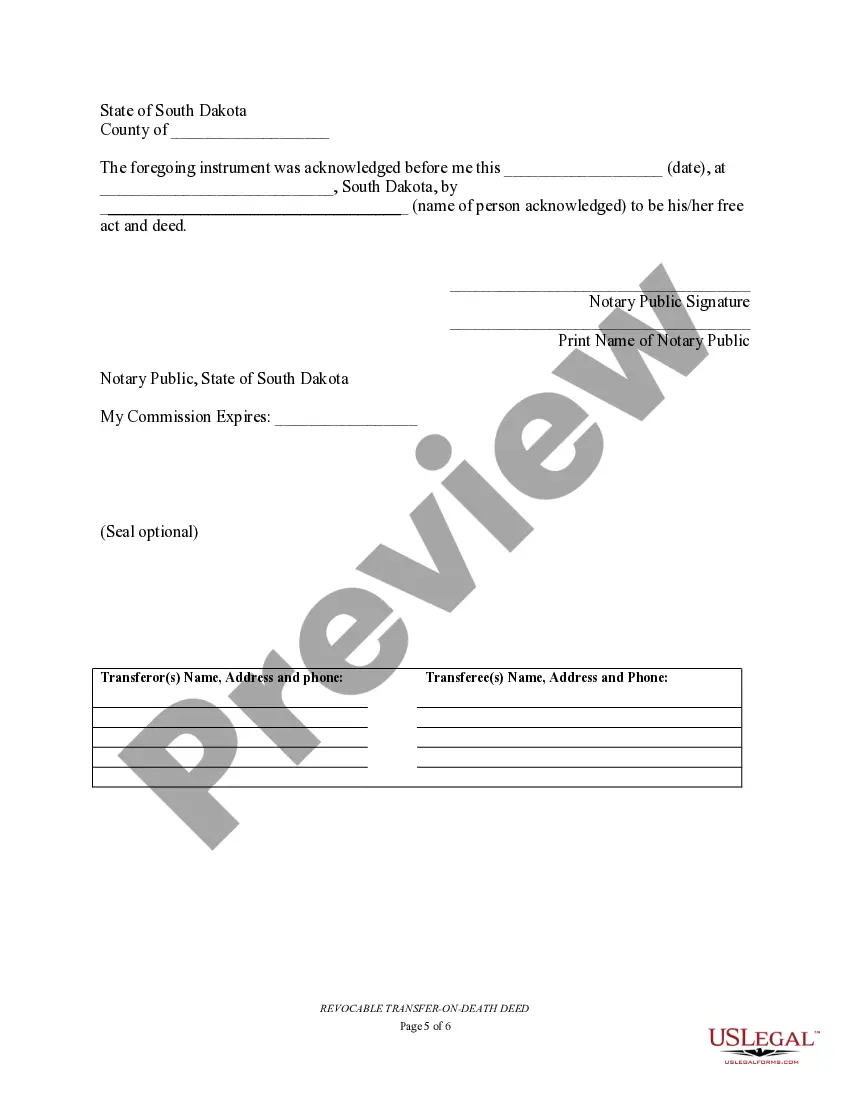

Sioux Falls South Dakota Transfer on Death Deed, also known as TOD-Beneficiary Deed, is a legal document that allows an individual or individuals to transfer their real estate property to a business entity upon their death. This type of deed ensures a smooth and efficient transfer of property ownership while avoiding the probate process. Here are a few types of TOD-Beneficiary Deeds for two individuals to a business entity commonly used in Sioux Falls, South Dakota: 1. Joint Tenancy with Right of Survivorship TOD-Beneficiary Deed: — In this type of deed, two individuals jointly own the property and upon the death of one owner, the property automatically transfers to the surviving owner(s) as well as the designated business entity. 2. Tenants in Common TOD-Beneficiary Deed: — This deed type allows two individuals to have equal or unequal shares in a property. Upon the death of one owner, their share transfers to the surviving owner(s) and the designated business entity according to their designated percentages. 3. Community Property with Right of Survivorship TOD-Beneficiary Deed: — This type of deed is available to married couples in South Dakota. It allows the property to transfer automatically to the surviving spouse, and then subsequently to the designated business entity upon the death of both spouses. 4. Life Estate TOD-Beneficiary Deed: — This deed grants two individuals ownership of a property for their lifetime. After the death of either owner, the property transfers to the surviving owner and then to the designated business entity upon the death of both owners. Regardless of the specific type of TOD-Beneficiary Deed chosen, it is essential to consult with a qualified attorney or real estate professional specializing in South Dakota law to ensure compliance with all legal requirements. By utilizing a Sioux Falls South Dakota Transfer on Death Deed, individuals can carefully plan and secure the transfer of their property to a business entity, providing peace of mind for themselves and their beneficiaries.

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity

Description

How to fill out Sioux Falls South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Business Entity?

If you are looking for a pertinent form template, it’s impossible to locate a more user-friendly platform than the US Legal Forms website – arguably the most exhaustive online repositories.

Here you can discover thousands of form examples for corporate and individual needs by categories and jurisdictions, or keywords.

Utilizing our enhanced search capability, locating the most up-to-date Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the format and save it on your device.

- Additionally, the relevance of each document is confirmed by a team of professional attorneys who routinely assess the templates on our platform and adjust them according to the latest state and county regulations.

- If you are already familiar with our system and have an account, all you need to do to obtain the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity is to Log In to your user profile and click the Download button.

- If you use US Legal Forms for the first time, simply follow the steps below.

- Ensure you have selected the template you need. Review its description and utilize the Preview functionality (if available) to view its content. If it doesn’t meet your needs, use the Search option located at the top of the page to find the right document.

- Verify your selection. Click on the Buy now button. After that, choose your desired subscription plan and input your information to register for an account.

Form popularity

FAQ

TOD beneficiaries on file refer to individuals designated in a transfer on death deed who will inherit property upon the owner's death. This designation avoids probate and streamlines the transfer process, making it easier for heirs to claim their property rights. For those exploring Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity, understanding how and who to designate as beneficiaries can significantly impact your estate planning strategy.

To transfer a title in South Dakota, you typically need the original title signed over by the seller, a completed title application form, and payment for any applicable fees. If there’s an outstanding lien, it must be cleared prior to the transfer. Furthermore, when it pertains to a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity, following these steps can ensure a clear and straightforward transfer process.

Selling a car without a title in South Dakota is not permitted, as title transfer is a legal requirement. A vehicle title serves as proof of ownership, and selling without one can lead to legal complications. When managing property or vehicles, especially in relation to Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity, always secure the necessary documentation to ensure a smooth transaction.

In South Dakota, a bill of sale does not necessarily need to be notarized; however, notarization can add an extra layer of security and authenticity. For specific transactions, such as the sale of a vehicle, having a notarized bill of sale may simplify the title transfer process. If you’re involved in a transaction regarding a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity, ensuring proper documentation can help prevent issues down the line.

The key difference between a beneficiary deed and a transfer on death (TOD) deed is how they operate upon the property owner's death. A beneficiary deed allows the property to pass directly to the named beneficiaries without going through probate. In contrast, a transfer on death deed specifically allows real estate to transition to a named individual, or individuals, upon the owner’s death, making the process simpler and more efficient. Understanding these distinctions can help you better utilize Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity.

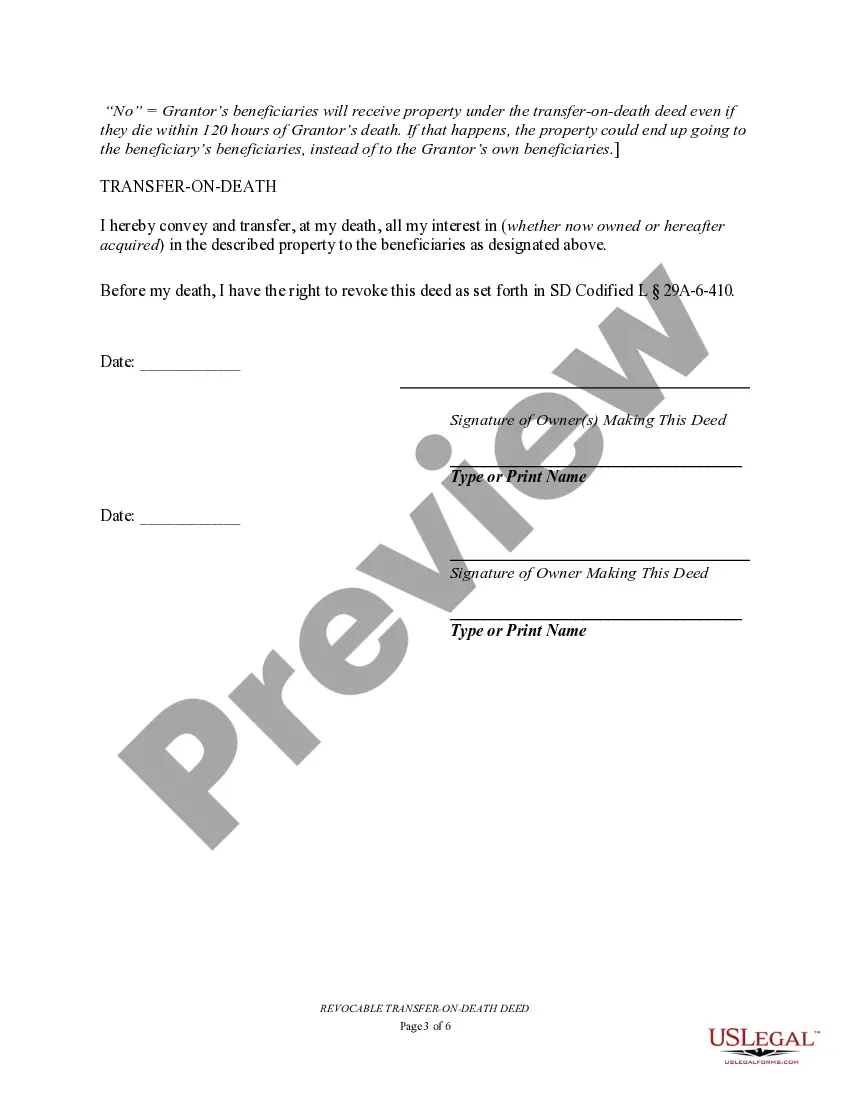

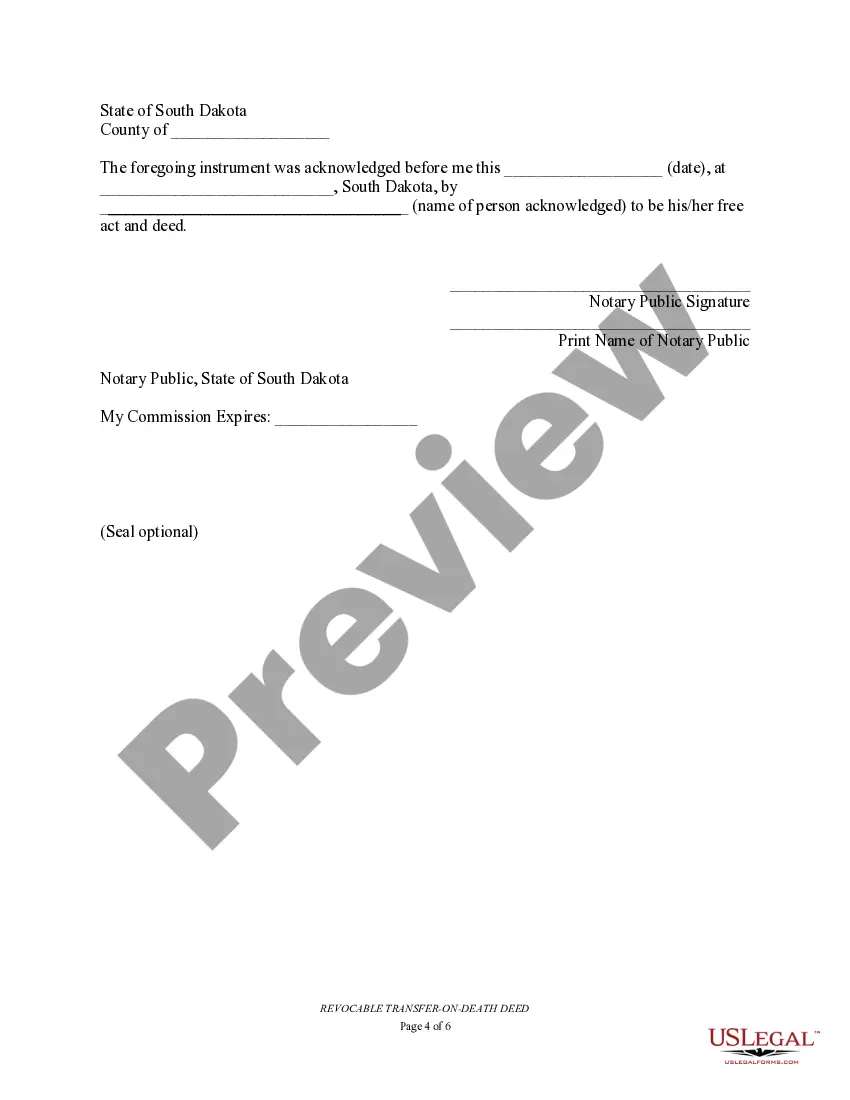

To execute a transfer on death deed in South Dakota, you need to create a written document that clearly identifies the property and the beneficiaries. Sign and date the deed, then file it with the local county register of deeds. By using a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity, you can ensure a seamless transition of assets to your chosen beneficiaries upon your passing.

The statute for the transfer on death deed in Nebraska is defined under Nebraska Revised Statute 30-2348. This statute outlines how property can be transferred upon the death of the owner without going through probate. Familiarizing yourself with this statute can help you take full advantage of the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity.

Filing a transfer on death deed in Nebraska involves drafting the deed with clear language identifying the beneficiaries. Once completed and signed, you must file the deed with your local county register of deeds. This step is crucial to ensure the transfer aligns with your intentions under the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity.

To transfer a title after death in Nebraska, first determine if a transfer on death deed was executed. If so, you can file a copy of the deed with the county register of deeds to transfer property ownership. This process is straightforward and aligns with the benefits of using a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity.

In Nebraska, a transfer on death deed must be in writing and signed by the property owner. It should also include clear identification of both the grantor and the beneficiary. For a successful transfer, it is essential to follow the specific regulations pertaining to the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Business Entity.