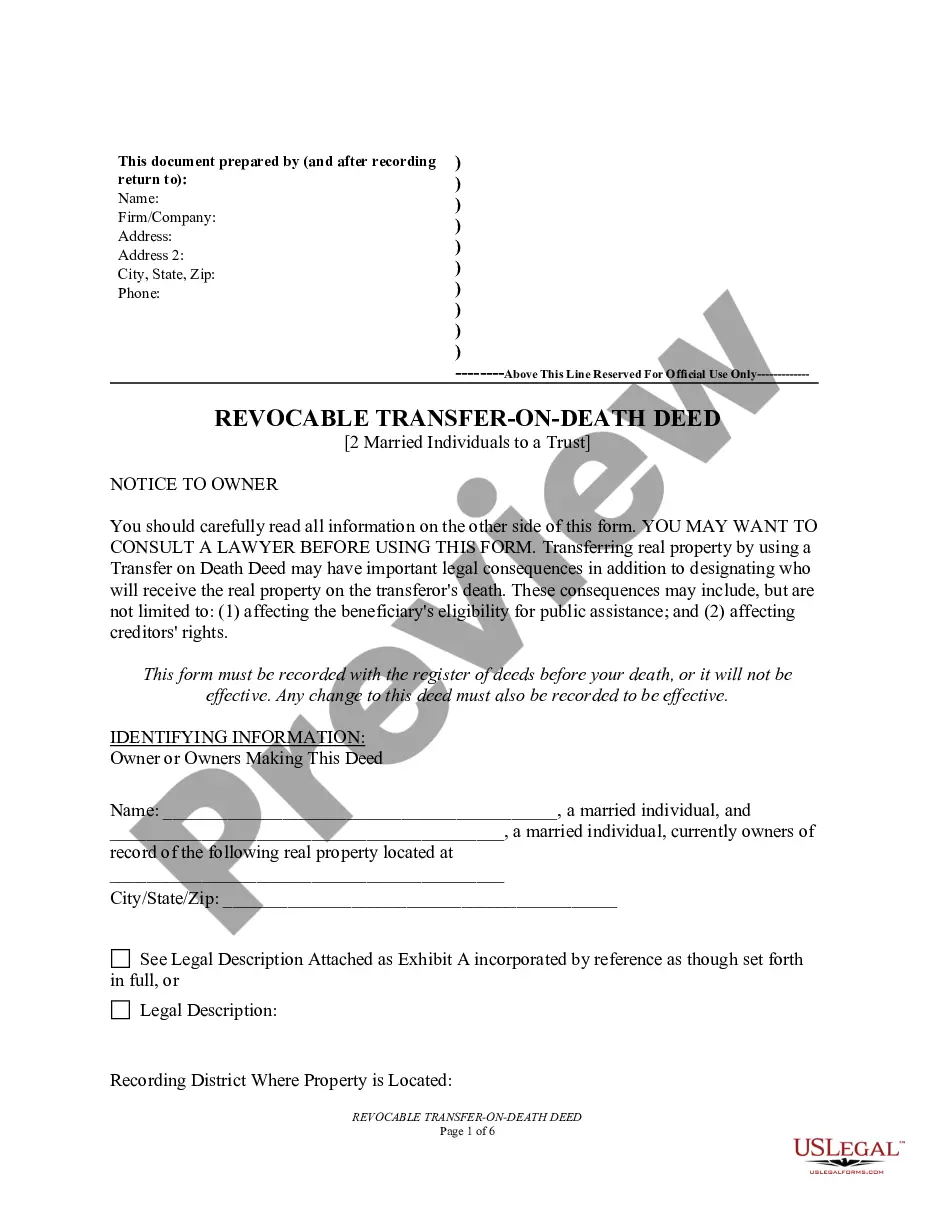

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust

Description

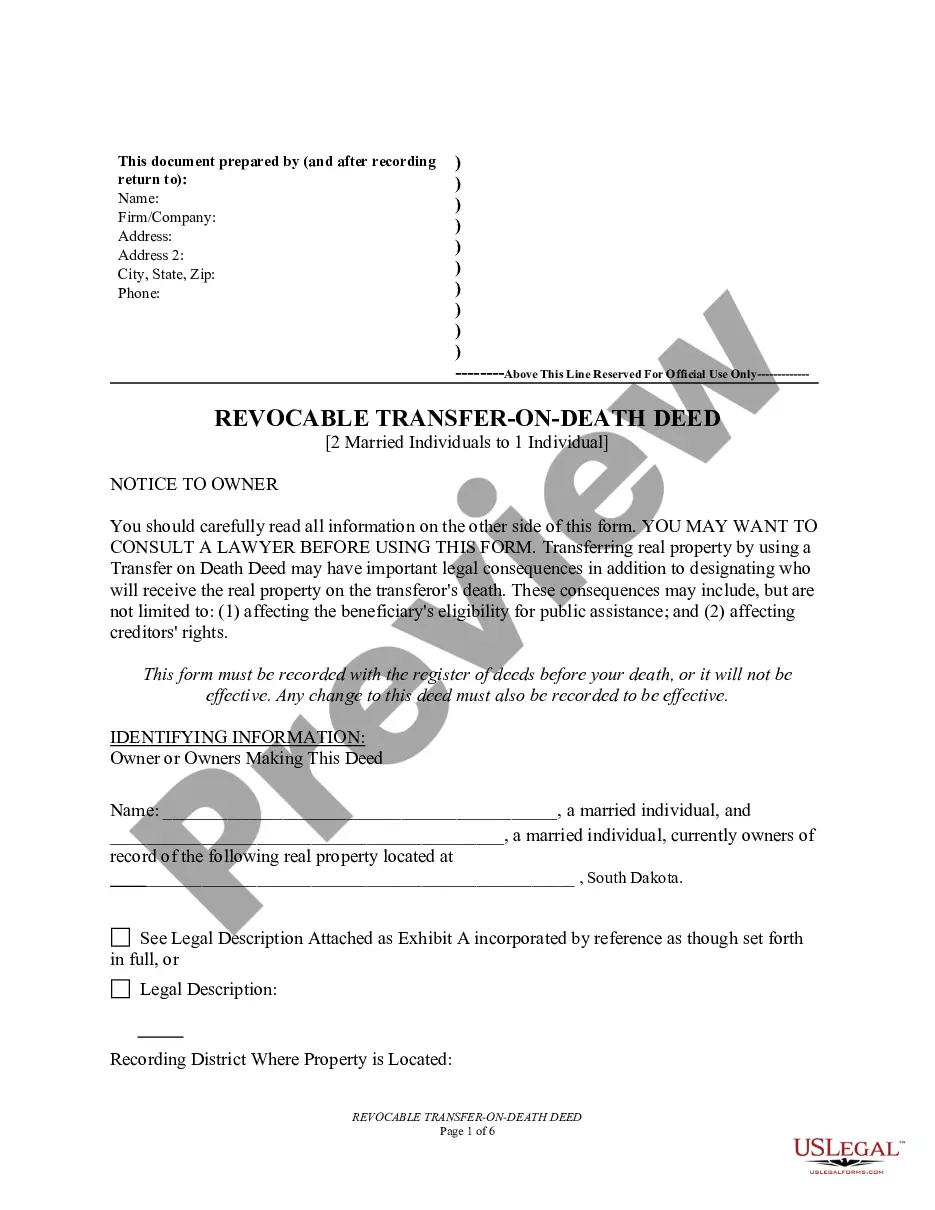

How to fill out South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Two Married Individuals To A Trust?

We consistently aim to diminish or avert legal complications when engaging with intricate law-related or financial issues.

To achieve this, we enlist legal solutions that are typically quite costly.

However, not all legal challenges are of the same level of complexity. Many of them can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button adjacent to it. Should you misplace the document, you can always re-download it from the My documents section.

- Our library empowers you to manage your matters independently without needing to consult an attorney.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are customized to state-specific and local details, making the search process considerably easier.

- Utilize US Legal Forms whenever you need to locate and retrieve the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust or any other form effortlessly and securely.

Form popularity

FAQ

To transfer a title after death in South Dakota, you must provide the deceased's original title, a death certificate, and complete any required forms. If the property is included in a Transfer on Death Deed, you can directly transfer the property to the designated beneficiary without probate. This process can significantly reduce complications and delays, especially for married individuals using the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust.

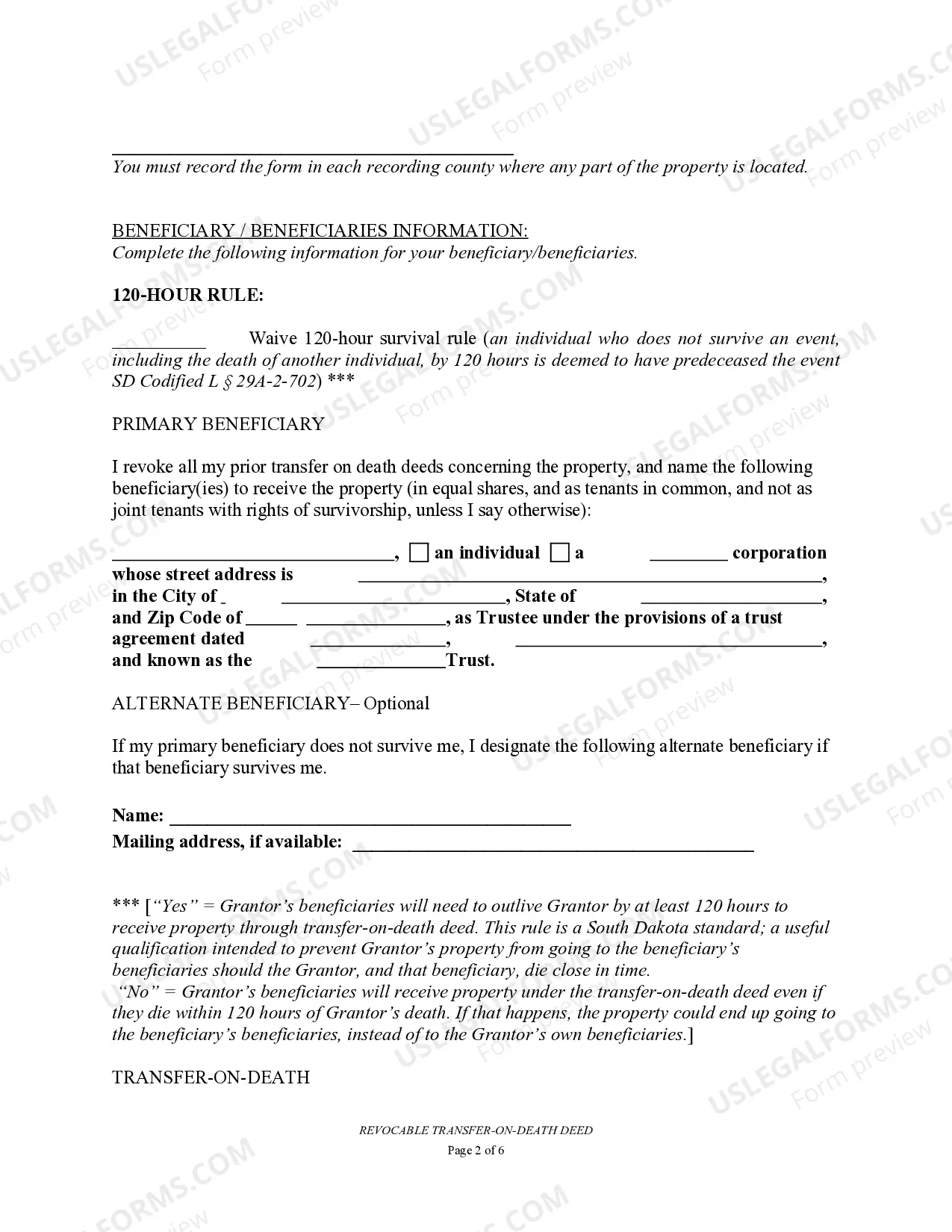

A beneficiary deed allows property to be transferred to designated beneficiaries upon the owner's death without going through probate. In contrast, a transfer on death deed is another term for a beneficiary deed and functions in the same way, ensuring a smooth transition of ownership. If you’re considering options, the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust is a notable strategy for many couples.

Avoiding probate in South Dakota can often be achieved through strategies like using Transfer on Death Deeds, establishing trusts, and holding assets in joint ownership. Utilizing a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust is one effective way to transfer property outside of probate court. These arrangements can help your heirs inherit with greater ease and fewer legal complications.

Selling a car without a title in South Dakota is generally not allowed. The title serves as proof of ownership, and without it, potential buyers may be hesitant to proceed. To avoid complications, ensure you have all necessary documents ready when selling your vehicle. For property transactions, utilizing the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust can help manage ownership transitions effectively.

Yes, South Dakota does offer a Transfer on Death Deed. This deed allows property owners to transfer their real estate directly to beneficiaries without going through probate after death. This tool is ideal for married couples looking to streamline the transfer process, such as the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust.

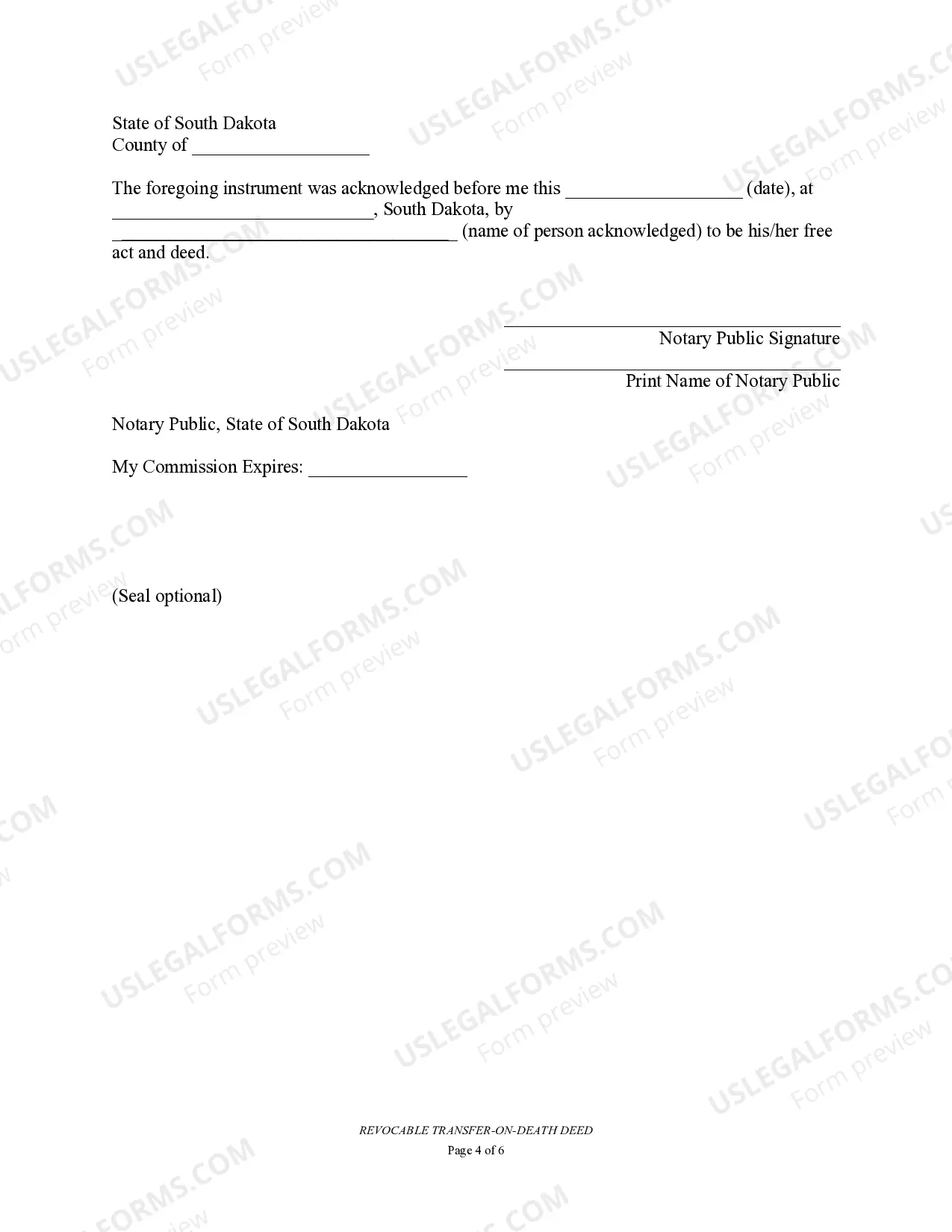

In South Dakota, a bill of sale does not necessarily need to be notarized to be valid. However, notarization adds a layer of authenticity and can be beneficial for significant transactions, such as vehicle sales. It is always good practice to document the sale clearly and keep a copy for your records. Using the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust can ensure clarity in property transactions.

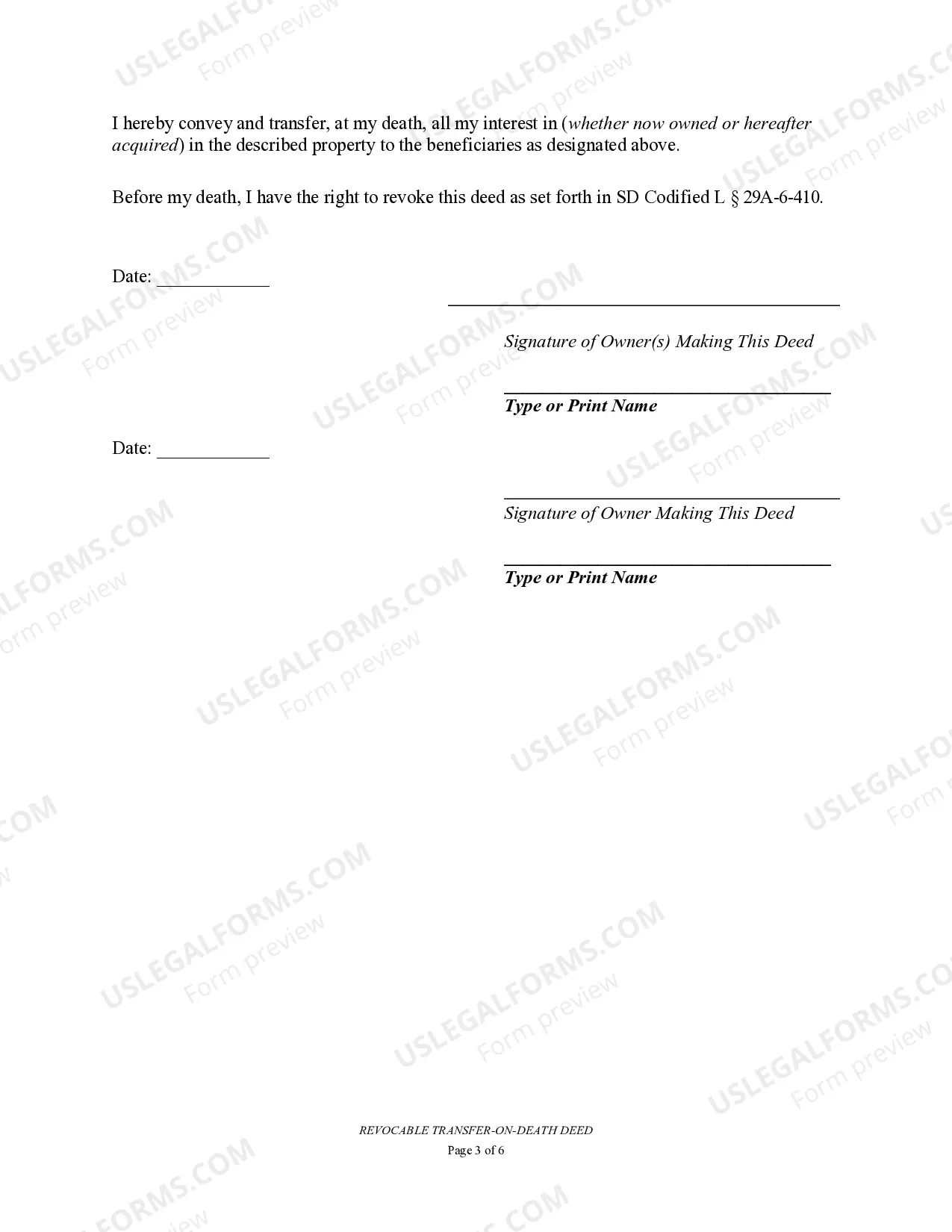

To execute a Transfer on Death Deed in South Dakota, you must complete a form that names the beneficiary and provides a legal description of the property. After preparing the deed, you will need to sign it in the presence of a notary public. Finally, you must file the deed with the appropriate county register of deeds. This process helps ensure a smooth transition of property without going through probate, especially for married individuals utilizing the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust.

Inheritance laws in South Dakota dictate how property is distributed after someone passes away. These laws outline the rights of heirs and the legal processes involved in transferring assets, including the use of the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust. Understanding these laws can help ensure your estate is handled according to your wishes, and using resources like uslegalforms can assist you in managing your estate effectively.

A TOD deed and a beneficiary deed serve similar purposes but have slight differences. The Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust allows property to pass directly to beneficiaries upon the owner’s death, without going through probate. In contrast, a beneficiary deed is a specific type of deed that can be employed for real estate and may have differing legal implications based on state laws.

While it is not mandatory to hire a lawyer for a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Trust, doing so can offer significant advantages. A lawyer can provide valuable legal advice, ensure proper document preparation, and help avoid potential pitfalls. If you choose to navigate the process without legal assistance, it’s essential to understand the regulations and requirements specific to South Dakota.