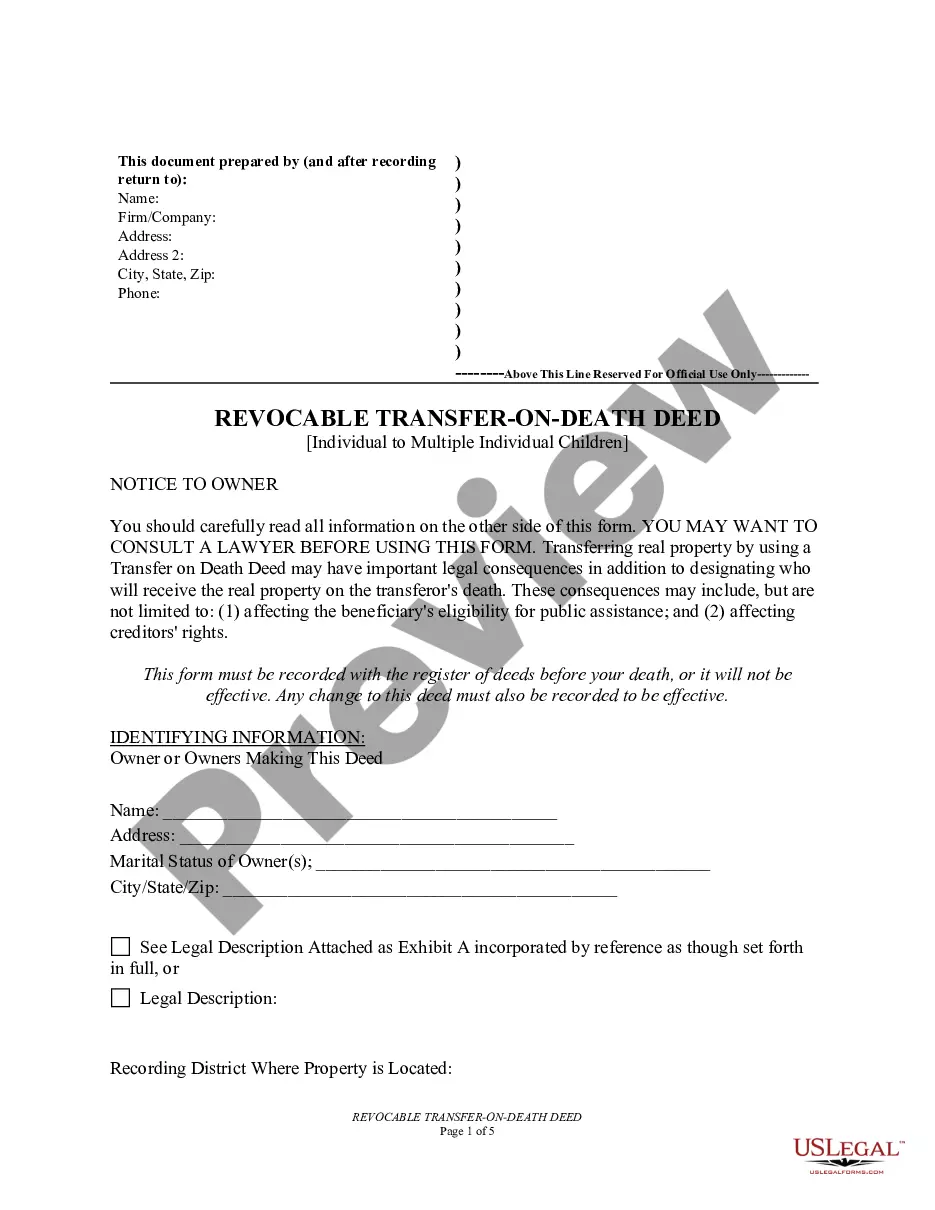

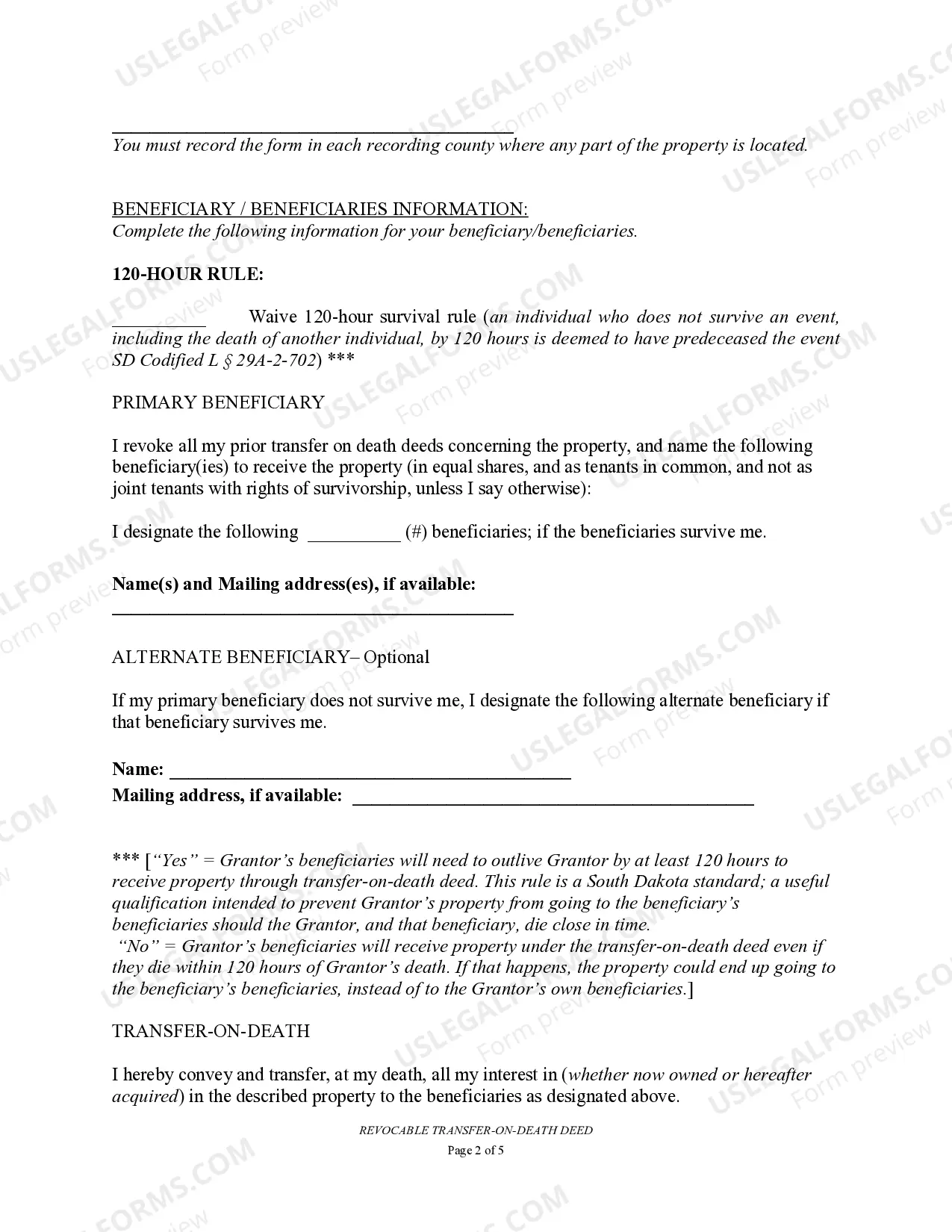

A Sioux Falls South Dakota Transfer on Death Deed, also known as a TOD-Beneficiary Deed, is a legal document that allows an individual to transfer their property to multiple individuals upon their death, without the need to go through probate. This type of deed is commonly used to ensure a smooth and efficient transfer of property ownership, avoiding the complexities and costs associated with probate court proceedings. One type of Sioux Falls South Dakota Transfer on Death Deed or TOD-Beneficiary Deed is the "Individual to Multiple Individuals" deed. This form of deed is used when one person wishes to transfer their property to multiple beneficiaries. It is a convenient and flexible option that allows the granter to specify different shares or proportions of ownership for each beneficiary. With a Sioux Falls South Dakota Transfer on Death Deed or TOD-Beneficiary Deed, the granter retains full ownership and control of the property during their lifetime. They can freely use, sell, or mortgage the property, and even revoke the deed if they choose to do so. It provides the granter with peace of mind, knowing that their property will be transferred to their chosen beneficiaries smoothly and according to their wishes upon their passing. The Sioux Falls South Dakota Transfer on Death Deed or TOD-Beneficiary Deed offers several advantages. Firstly, it bypasses the probate process, which can be time-consuming and costly. This means that the beneficiaries can avoid the delays and expenses associated with probate court proceedings, allowing for a quicker and more cost-effective transfer of property ownership. Secondly, the TOD-Beneficiary Deed provides privacy for the granter and beneficiaries. Unlike a will, which becomes a public record upon probate, the transfer of property through a TOD-Beneficiary Deed remains private. This can be particularly beneficial for individuals who prefer to keep their financial affairs confidential. Furthermore, the Sioux Falls South Dakota Transfer on Death Deed or TOD-Beneficiary Deed is a versatile estate planning tool. It allows the granter to easily modify or revoke the deed if circumstances change, such as the addition or removal of beneficiaries, or if the granter decides to sell the property during their lifetime. In conclusion, a Sioux Falls South Dakota Transfer on Death Deed or TOD-Beneficiary Deed is an effective way for individuals to transfer their property to multiple beneficiaries without probate. It offers flexibility, convenience, and privacy, making it a valuable estate planning option. Knowing the different types available, such as the "Individual to Multiple Individuals" deed, and understanding the advantages it provides can empower individuals to make informed decisions regarding the transfer of their property.

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals

Description

How to fill out Sioux Falls South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Multiple Individuals?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our practical platform featuring thousands of templates simplifies the process of locating and acquiring nearly any document sample you require.

You can export, fill out, and validate the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals in just a few minutes instead of spending hours online trying to find the appropriate template.

Employing our catalog is an excellent method to enhance the security of your document filing. Our experienced attorneys routinely examine all the records to ensure that the forms are suitable for a specific state and compliant with recent laws and regulations.

Initiate the saving process. Click Buy Now and select your desired pricing plan. Then, register for an account and complete your order using a credit card or PayPal.

Preserve the document. Choose the format to obtain the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals and modify, complete, or sign it according to your preferences.

- How can you access the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals.

- If you possess a subscription, simply Log In to your account. The Download button will be activated on all the documents you access.

- Additionally, you can retrieve all your previously saved documents in the My documents section.

- If you have yet to create an account, follow the instructions outlined below.

- Access the page containing the template you require. Ensure it is the form you are looking for: confirm its title and description, and utilize the Preview function if it is available. If not, use the Search field to locate the required one.

Form popularity

FAQ

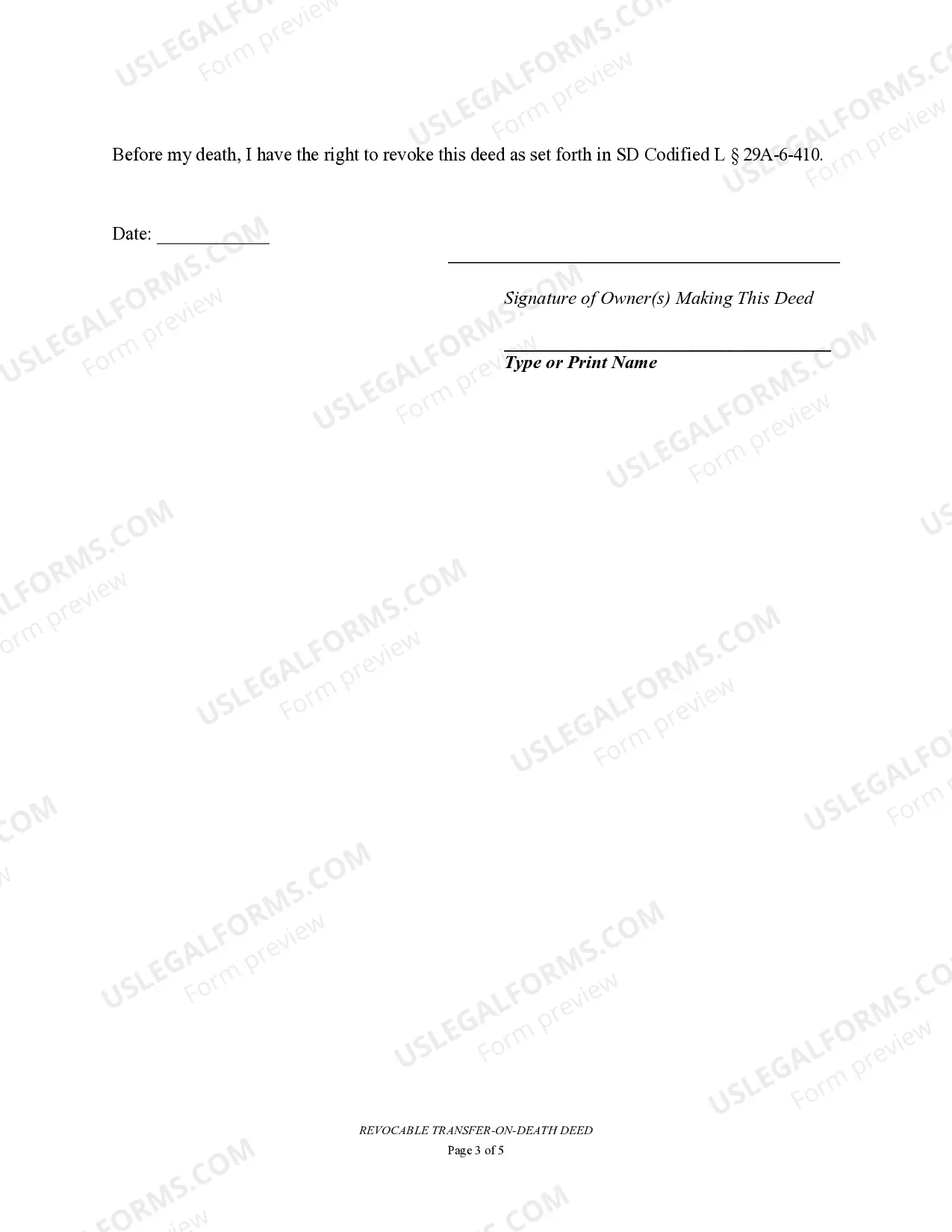

Although you can file a transfer on death deed without a lawyer, it is often advisable to consult one. A legal professional can provide valuable guidance to ensure that the deed is correctly prepared and executed according to South Dakota laws. Using a reliable service like UsLegalForms can also simplify the process and help ensure that your TOD deed meets all necessary requirements.

While a transfer on death deed offers many benefits, it also has some disadvantages. For instance, it does not provide protection against creditors, meaning that if there are outstanding debts, creditors can still claim the property. Additionally, it may not be the best choice for everyone; therefore, consulting a legal expert about the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals is wise.

TOD stands for Transfer on Death. It refers to the legal mechanism that allows an individual to transfer property to one or more named beneficiaries after their death. In the context of the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals, it streamlines inheritance and ensures that your wishes regarding property distribution are honored.

Yes, South Dakota permits a transfer on death deed, known as a TOD. This legally allows property owners to designate one or more beneficiaries who will inherit their property upon their death, bypassing the probate process. This option makes it easier for those in Sioux Falls, as it simplifies the transfer of property, making it a popular choice for many.

South Dakota does not impose a capital gains tax on the sale of real estate. This can be advantageous for homeowners and investors alike. If you're considering the financial aspects of transferring property using a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals, the absence of a capital gains tax can simplify your financial planning.

Codified law 43-4-38 outlines provisions for Transfer on Death Deeds in South Dakota. This law allows property owners to designate beneficiaries who will receive the property upon their death without entering probate. For those considering a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals, understanding this law is essential.

To avoid probate in South Dakota, you can use tools such as a Transfer on Death Deed (TOD) or a beneficiary deed. These methods allow you to transfer property directly to beneficiaries upon your passing, bypassing the lengthy probate process. Utilizing a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals can be an effective strategy for estate management.

The property tax rate in South Dakota varies, but it generally falls between 1.1% and 1.8% of the assessed property value. It is essential to check with local authorities for the exact rate in Sioux Falls. If you are planning to use a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals, understanding property taxes is crucial for estate planning.

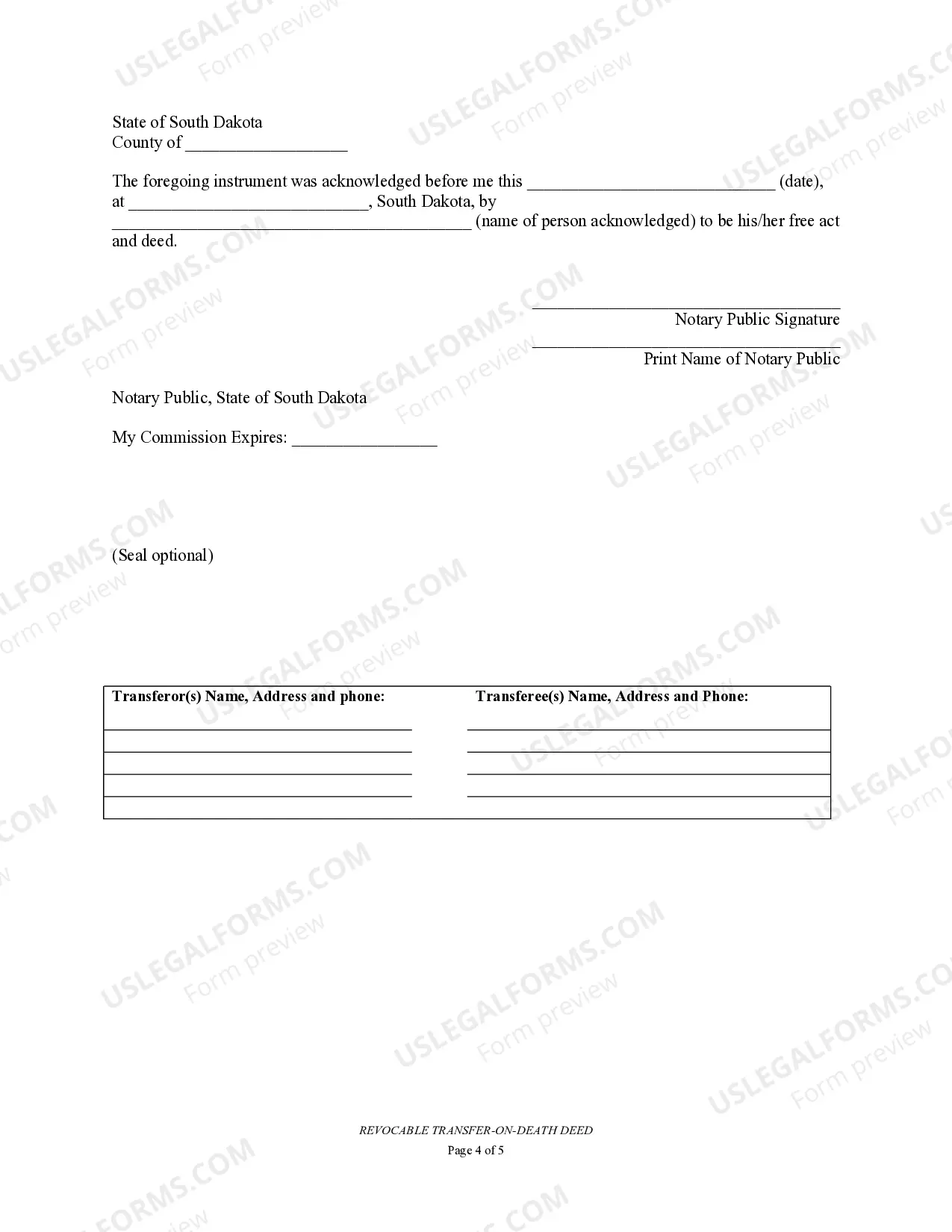

To execute a Transfer on Death Deed in South Dakota, you need to complete a specific form that designates your beneficiaries. Once completed, the deed must be filed with the local register of deeds. By using resources such as uslegalforms, you can efficiently navigate the steps required for the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals.

In slang, TOD can refer to 'Time of Death.' It is often associated with discussions about mortality or significant events. However, when discussing estate planning and property transfers, it's important to focus on its official definition as Transfer on Death to fully understand the implications of the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals.