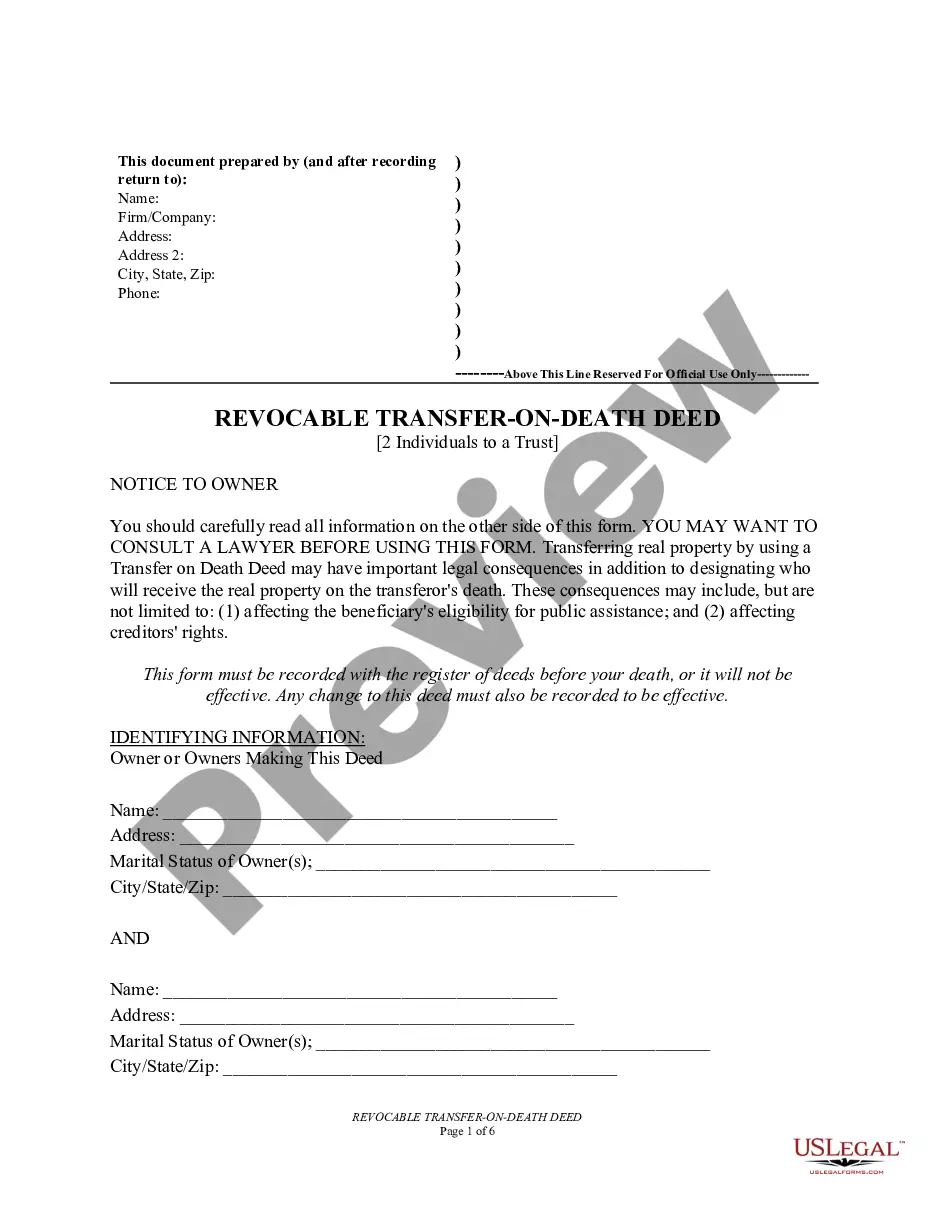

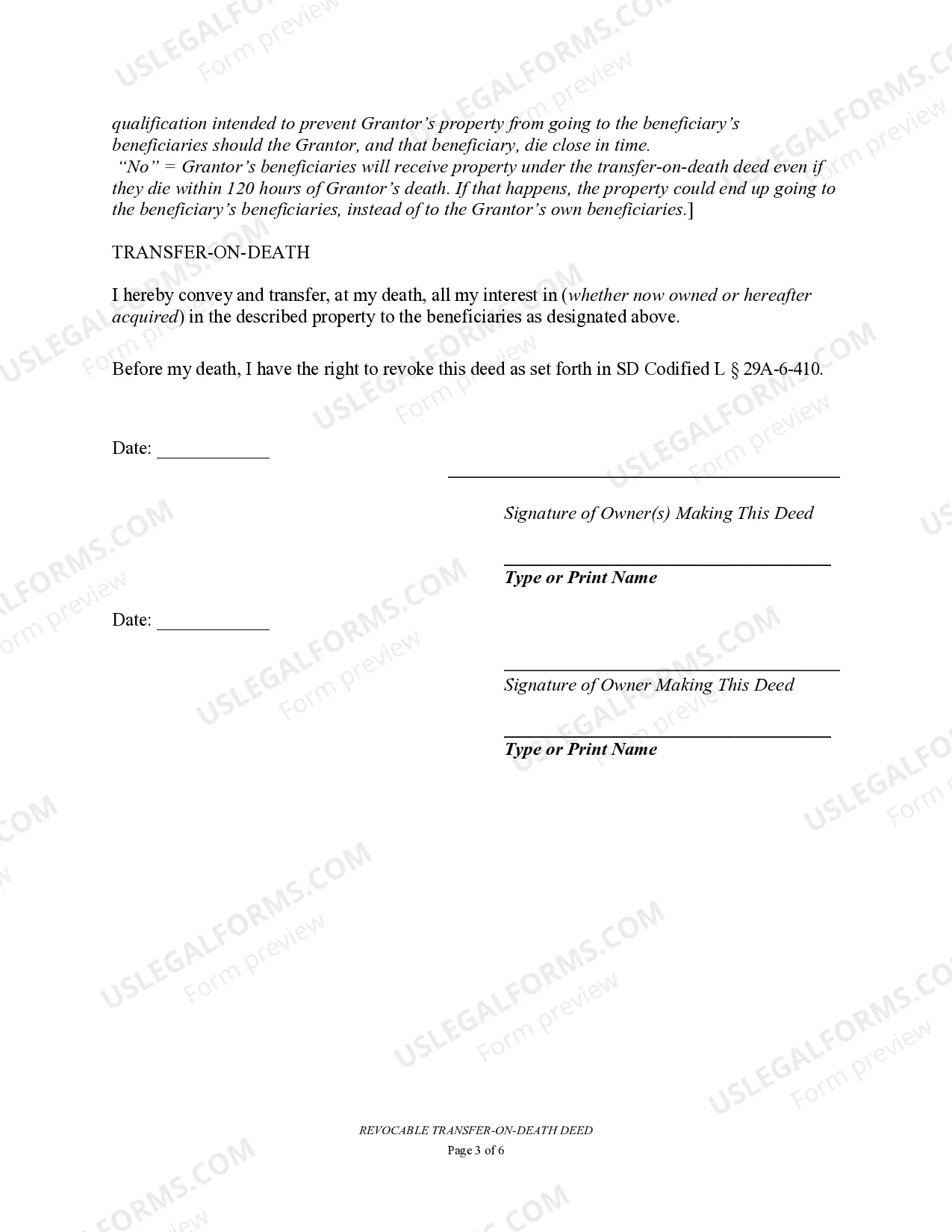

Sioux Falls Transfer on Death Deed or TOD — Beneficiary Deed for Two Individuals to a Trust is a legal document that allows individuals to transfer real estate property to a designated trust upon their death without going through probate. This instrument ensures a seamless transfer of assets to the intended beneficiaries while avoiding the lengthy and costly probate process. Keywords: Sioux Falls, South Dakota, Transfer on Death Deed, TOD, Beneficiary Deed, Two Individuals, Trust. There are two types of Transfer on Death Deeds or Beneficiary Deeds available in Sioux Falls, South Dakota for two individuals to transfer real estate property to a trust: 1. Joint Tenancy with Rights of Survivorship (TWOS) TOD — Beneficiary Deed: This type of deed allows two individuals, usually spouses or partners, to jointly own the property and transfer it to a trust upon the death of either individual. The surviving individual automatically becomes the sole owner of the property, and upon their death, the property transfers to the designated trust. 2. Tenancy in Common TOD — Beneficiary Deed: With this type of deed, two individuals can retain an ownership interest in the property in equal or unequal shares and designate a trust as the beneficiary upon their death. Each individual's share of the property will pass to the trust, allowing for the distribution of assets according to the terms stated in the trust documents. The Sioux Falls Transfer on Death Deed or TOD — Beneficiary Deed for Two Individuals to a Trust provides several advantages, including: 1. Avoidance of Probate: Assets transferred through a TOD — Beneficiary Deed do not go through the probate process, saving time and money for both the deceased individuals' estates and the beneficiaries. 2. Privacy: Probate proceedings are public record, but by utilizing a Transfer on Death Deed, the transfer of property can remain private and confidential. 3. Flexibility: The designated trust can outline specific instructions for asset distribution, ensuring that the wishes of the property owners are carried out. 4. Continuity of Ownership: The property ownership remains unchanged during the lifetime of the individuals. They retain complete control and can sell, mortgage, or alter the property as desired. To create a valid Sioux Falls Transfer on Death Deed or TOD — Beneficiary Deed for Two Individuals to a Trust: 1. Obtain the necessary legal documents from a qualified attorney experienced in estate planning. 2. Clearly identify the property being transferred, including a legal description. 3. Include the names and contact information of both individuals granting the deed. 4. Specify the name of the trust, identifying it as the sole beneficiary. 5. Clearly state any specific conditions or instructions for the transfer. 6. Sign and date the document in the presence of a notary public. 7. File the completed deed with the appropriate county recorder's office. It is important to understand that transfer on death deeds and beneficiary deeds can have significant legal implications. Seeking professional legal advice is highly recommended ensuring a proper and valid transfer of property and to meet any specific requirements in Sioux Falls, South Dakota.

Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust

Description

How to fill out Sioux Falls South Dakota Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To A Trust?

Acquiring verified templates tailored to your regional regulations can prove difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms addressing personal and professional requirements along with various real-life scenarios.

All documents are appropriately categorized by usage area and jurisdictional regions, making it as simple and straightforward as ABC to search for the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust.

Acquire the document. Hit the Buy Now button and choose your desired subscription plan. You should register for an account to access the resources of the library. Complete your purchase. Provide your credit card information or use your PayPal account to settle the payment for the service. Download the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. Store the template on your device for completion and gain access to it again in the My documents section of your profile whenever necessary. Maintaining documentation orderly and compliant with legal standards is crucial. Leverage the US Legal Forms library to consistently have vital document templates for any requirements right at your fingertips!

- For those already familiar with our catalog and have previously used it, acquiring the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust takes merely a few clicks.

- All you have to do is Log Into your account, select the document, and click Download to save it on your device.

- This procedure will require just a few additional steps to finalize for new users.

- Examine the Preview mode and document description. Ensure you’ve chosen the appropriate one that fulfills your needs and aligns with your local jurisdictional requirements.

- Search for another template if necessary. If you detect any discrepancies, employ the Search tab above to locate the correct one. If it meets your criteria, proceed to the subsequent step.

Form popularity

FAQ

The difference between a trust and a Transfer on Death Deed (TOD) lies primarily in how they manage and transfer assets. A trust allows you to place your assets under the management of a trustee, who preserves and distributes them based on your instructions. In contrast, a Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust directly passes property to beneficiaries upon your death, avoiding probate. While both options serve to transfer assets, a trust provides a more comprehensive estate plan, while a TOD is simpler and more straightforward.

The terms 'beneficiary deed' and 'transfer on death deed' are often used interchangeably, but they serve different purposes. A beneficiary deed allows property owners to transfer their assets to designated beneficiaries upon their death, while a transfer on death deed conveys ownership without going through probate. When considering the Sioux Falls South Dakota Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust, it's essential to understand how each option aligns with your estate planning goals. You can explore uslegalforms to find the necessary documents and resources to assist you in making the best choice.

While a Transfer on Death Deed can be beneficial, there are some disadvantages to consider. For example, the deed does not offer protection from creditors, meaning that your estate might still be liable for debts. Moreover, if you change your mind about the beneficiaries, you must revoke the deed formally. Consulting resources on uslegalforms can provide insights into these factors, helping you make informed decisions.

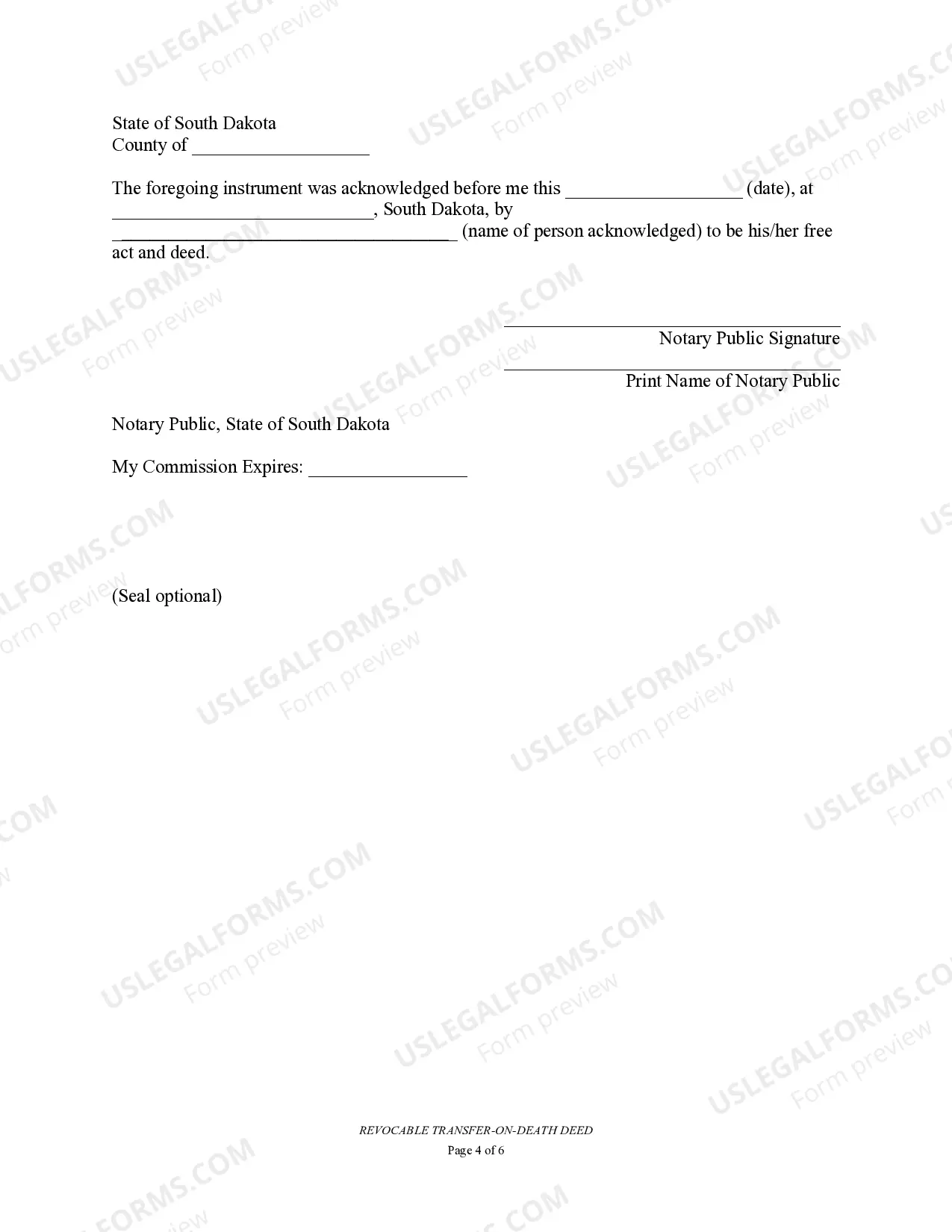

To execute a Transfer on Death Deed in South Dakota, you need to complete the necessary form that identifies the property and the beneficiaries. After filling out the deed, sign it in accordance with state laws, and ensure it is recorded with the county register of deeds. Keeping copies for your records is important, and you may want to inform your beneficiaries about the deed. Using uslegalforms can simplify this process with ready-to-use templates.

Yes, South Dakota legally permits a Transfer on Death Deed. This deed allows individuals to designate beneficiaries who will receive property upon their death, thus simplifying the transfer process. It is a valuable tool for estate planning and avoiding probate. For assistance in preparing and filing this deed, consider using uslegalforms for easy access to forms and guidance.

To avoid probate in South Dakota, consider using a Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. This approach allows property to pass directly to your beneficiaries without going through the probate process. Additionally, creating certain types of accounts, like jointly held property or payable-on-death accounts, can also help you bypass probate. Explore solutions on uslegalforms to learn how these options can be utilized effectively.

While it's possible to file a Transfer on Death Deed without a lawyer in South Dakota, consulting one can be beneficial. A lawyer can ensure that the deed complies with state requirements and accurately reflects your intentions. Additionally, they can help address any unique questions about your situation, providing peace of mind as you navigate this process. Our platform at uslegalforms provides legal forms and guidance if you wish to handle it independently.

Filing a will in South Dakota involves submitting the document to the local probate court after the death of the individual. You must include a petition for probate along with the signed will. It's advisable to check with your local court for specific requirements and necessary documents. Using our resources at uslegalforms can make the process clearer and more efficient.

To transfer a title after death in South Dakota, you need to complete a Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. This document allows you to designate beneficiaries who will receive the property upon your passing, avoiding the probate process. It's essential to ensure that the deed is properly executed and recorded with the appropriate county office. Utilizing platforms like uslegalforms can help streamline this process.