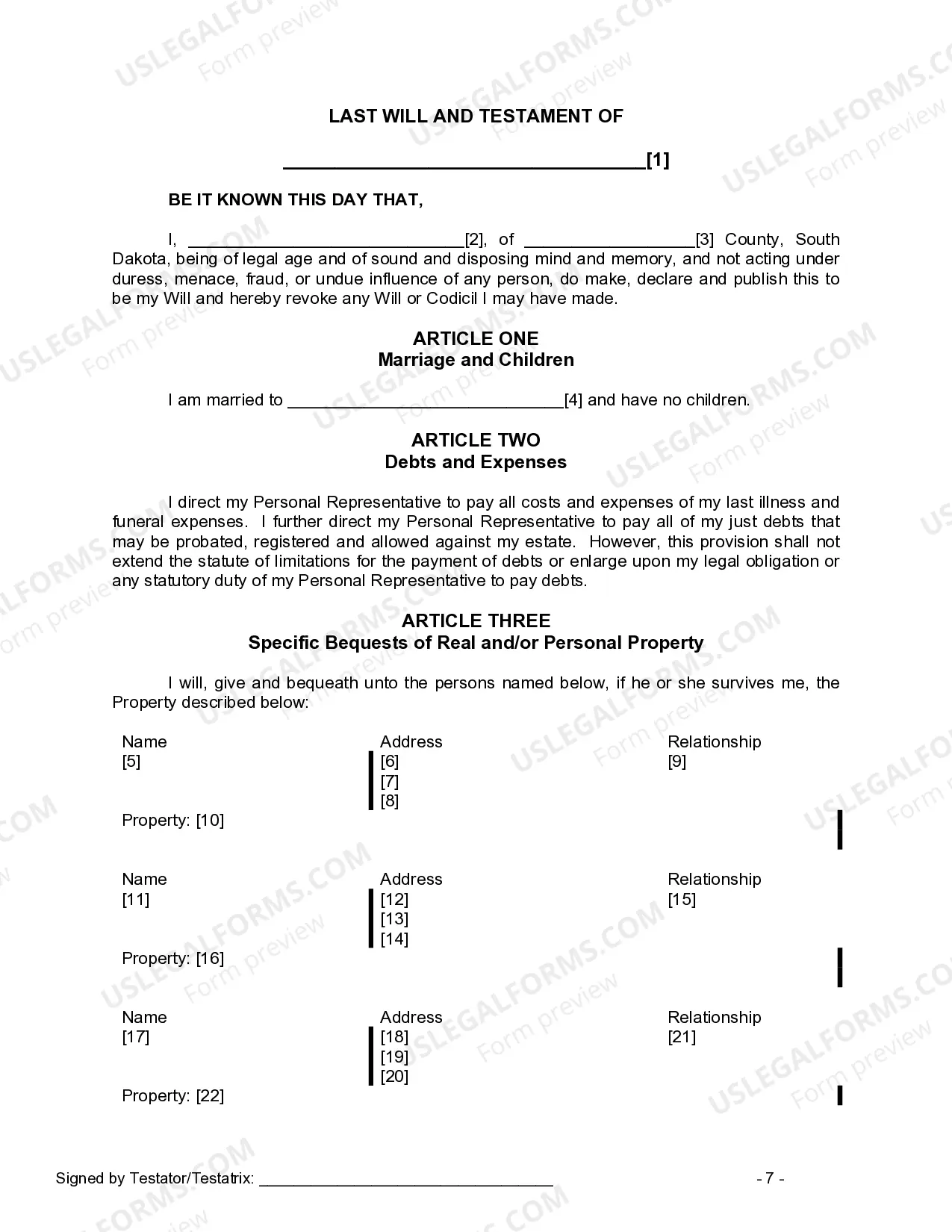

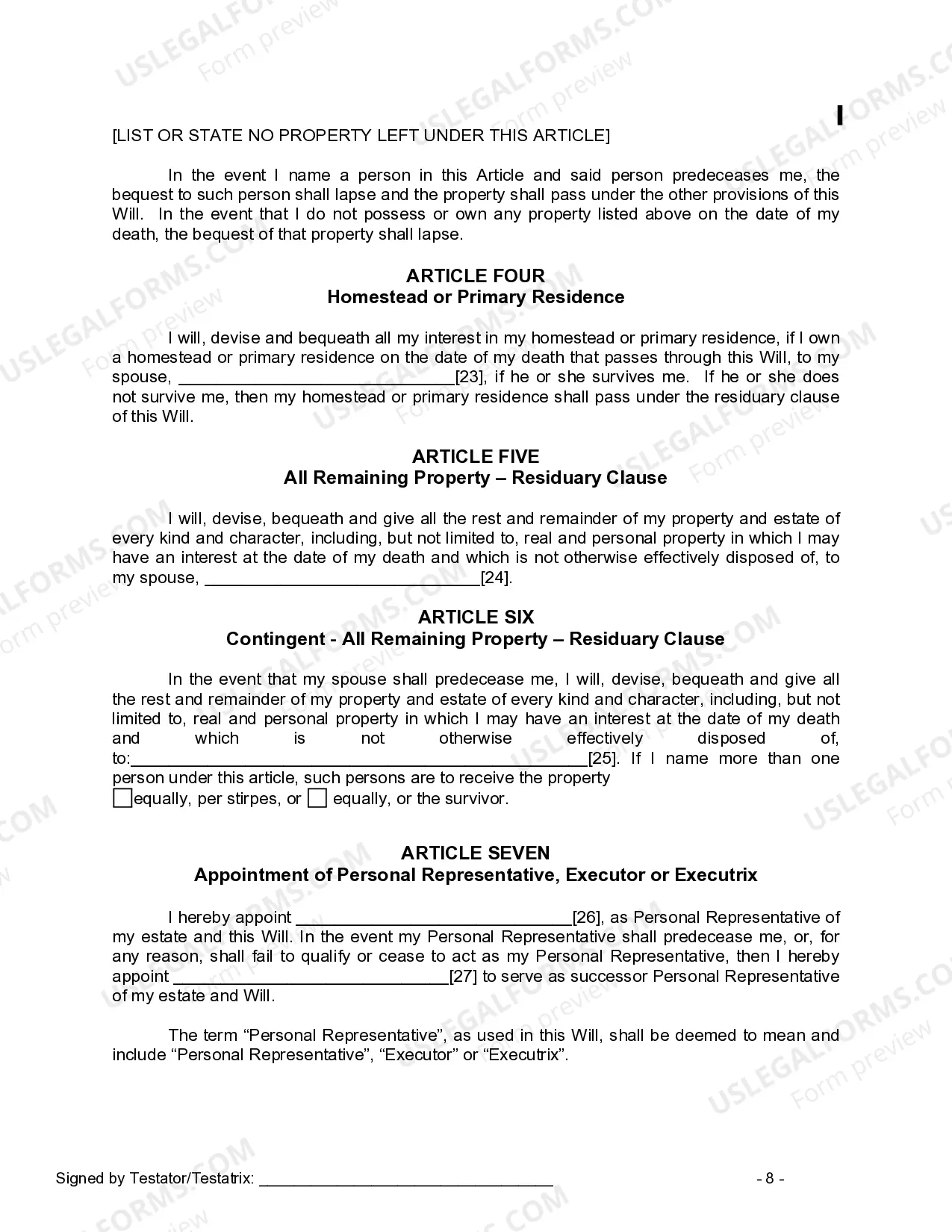

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

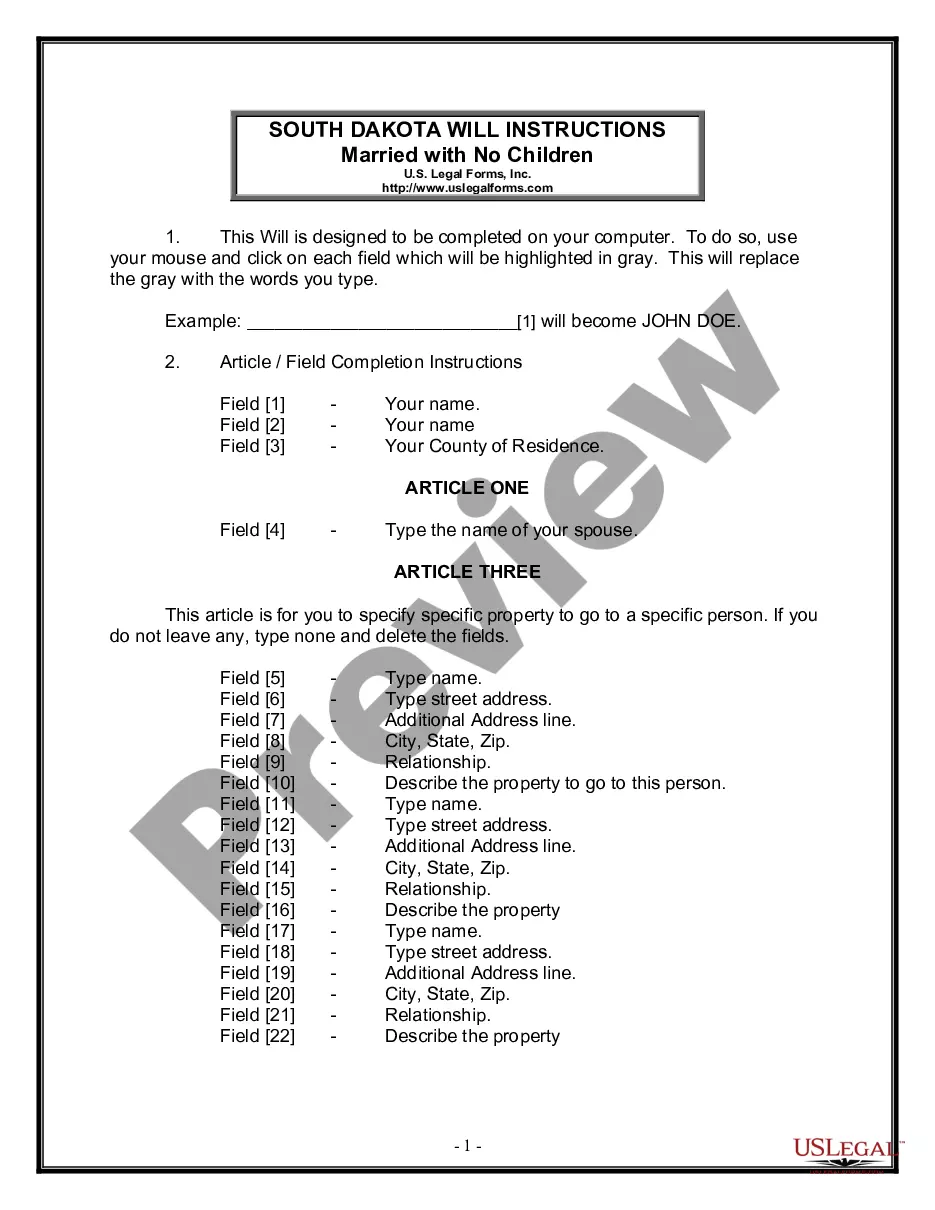

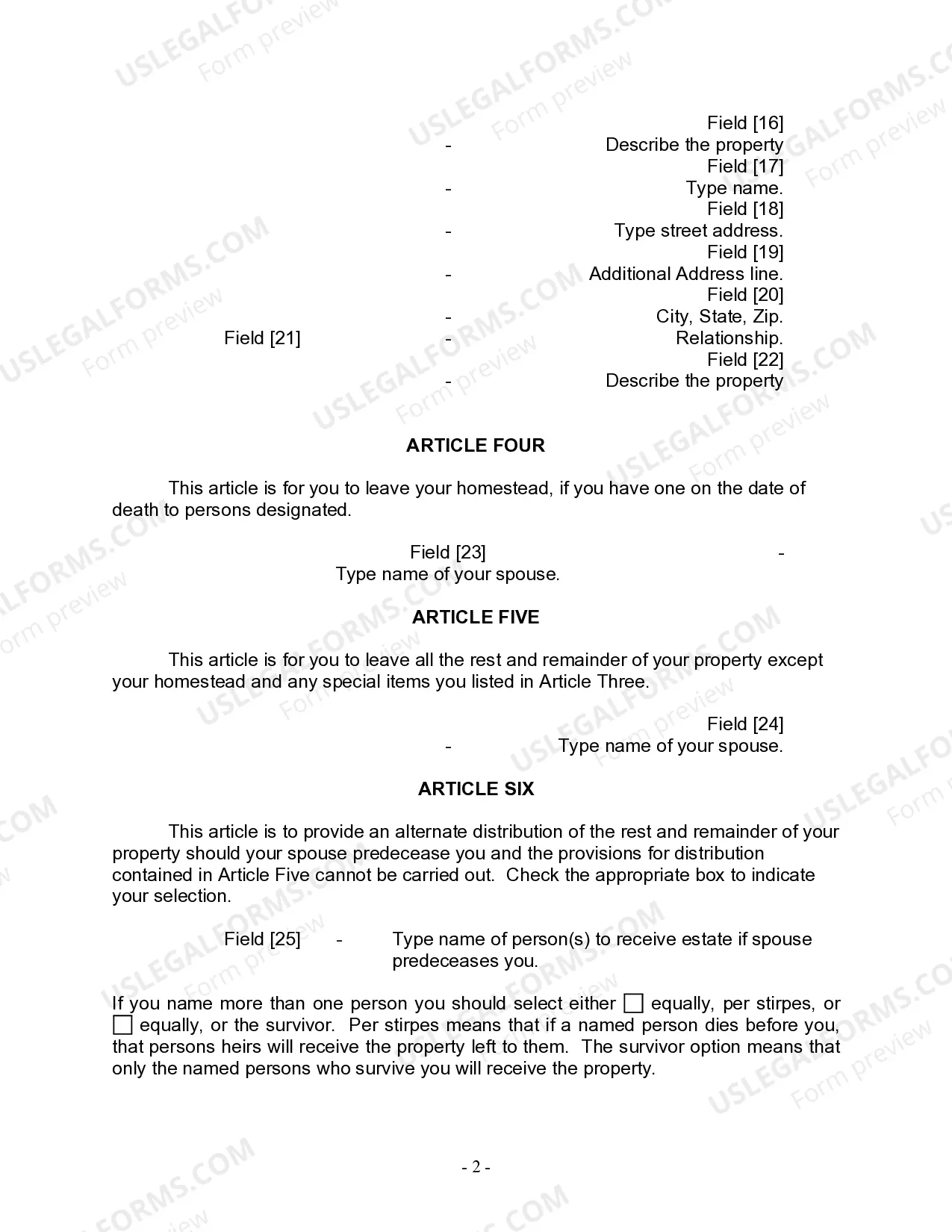

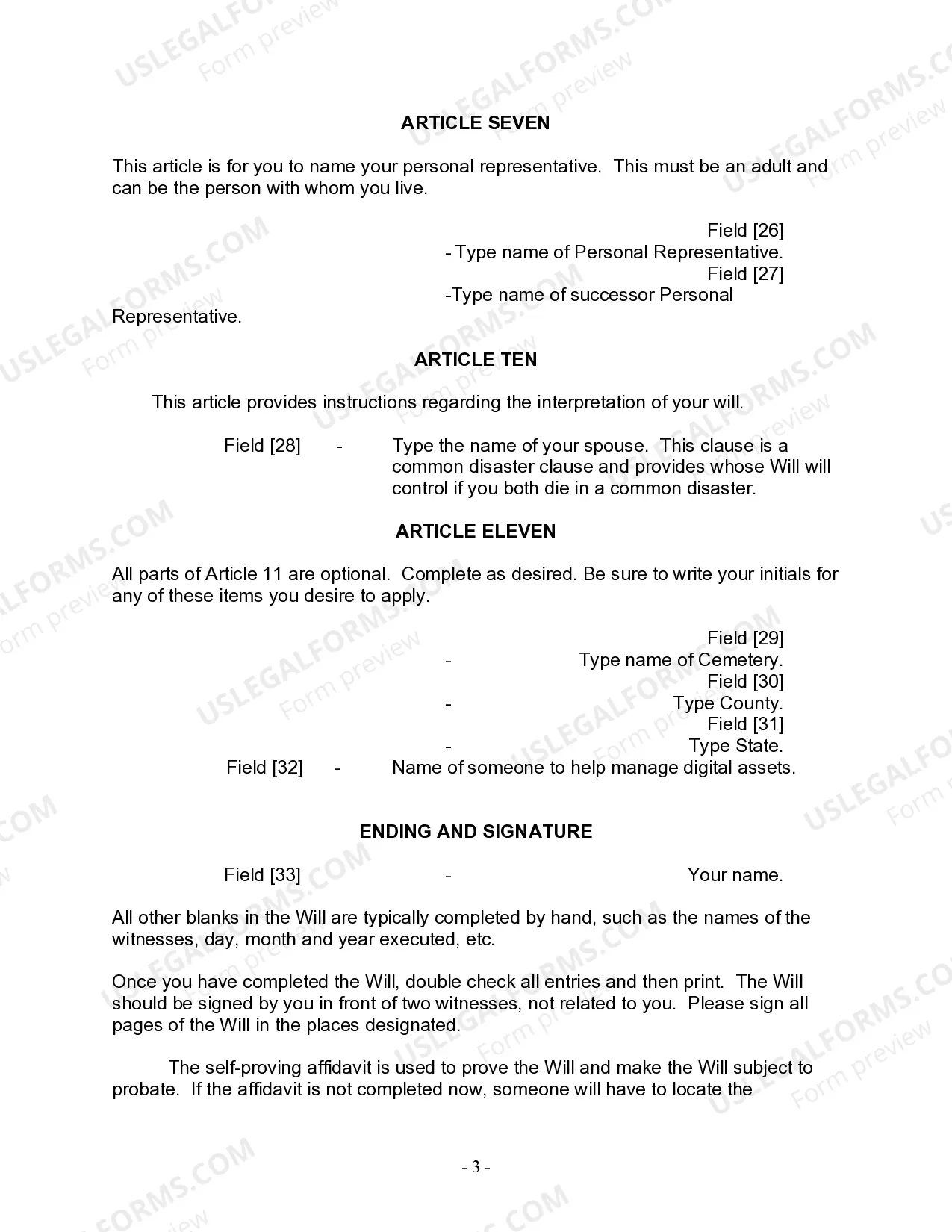

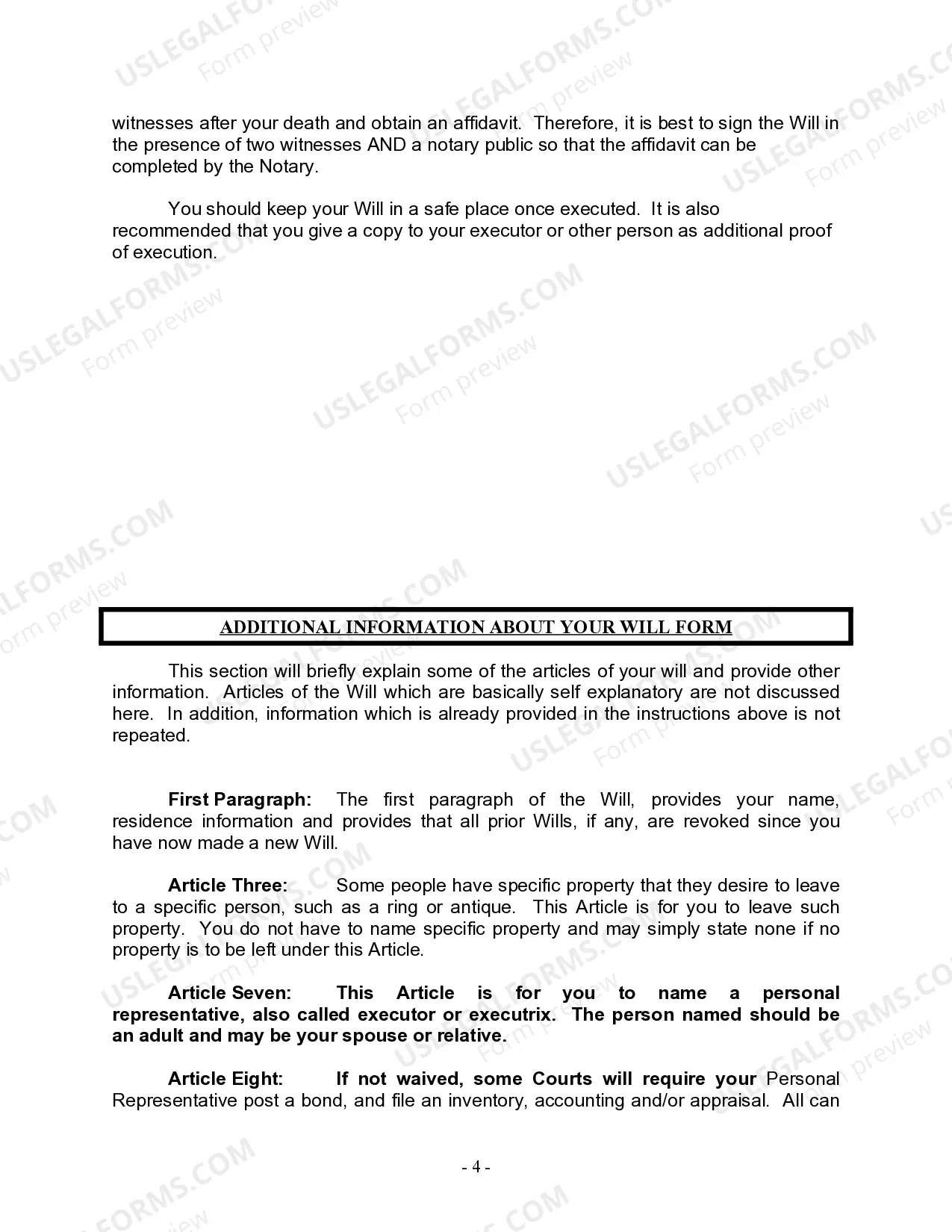

A Legal Last Will and Testament Form for a Married Person with No Children in Sioux Falls, South Dakota is a crucial legal document that ensures your final wishes are followed and your assets are distributed as per your instructions after your demise. This legally binding document allows you to designate how your property, possessions, and assets, both financial and sentimental, should be distributed among your chosen beneficiaries. By utilizing the Sioux Falls South Dakota Legal Last Will and Testament Form for a Married Person with No Children, you can protect your loved ones from potential disputes and ensure that your legacy is properly managed. This legal form encompasses various key aspects, such as: 1. Personal Information: The form includes spaces to enter your full legal name, address, and other essential details, including your marital status. 2. Executor: You have the opportunity to appoint an executor who will oversee the administration of your estate and ensure your wishes are carried out accurately. The executor should be someone you trust implicitly, as they will be responsible for managing your assets and property. 3. Asset Distribution: With this form, you can specify precisely how your assets should be distributed among your beneficiaries. You can distribute your assets equally or allocate specific percentages or amounts to each beneficiary. 4. Alternative Beneficiaries: It's always wise to include alternative beneficiaries in case your primary beneficiaries predecease you or are unable to inherit your assets for any reason. By identifying alternative beneficiaries, you can ensure that your estate doesn't go through intestacy, which means the state decides how your assets are distributed. 5. Specific Bequests: In addition to general instructions for asset distribution, you can include specific bequests within your Last Will and Testament Form. These bequests may include sentimental items such as heirlooms, family photographs, or treasured possessions that hold sentimental value. 6. Digital Assets: With the increasing digitalization of our lives, it's essential to consider your digital assets as well. You can use this form to leave instructions on how your digital assets, like social media accounts or online banking, should be handled after your passing. Different types of Sioux Falls South Dakota Legal Last Will and Testament Forms for a Married Person with No Children may include variations or additional sections based on specific circumstances. Some possible variations could include provisions for charitable donations, establishment of trusts, or guardianship arrangements for dependent adults, among others. However, the basic format remains consistent. Regardless of the variations, it is highly recommended consulting an attorney or legal professional when completing any Last Will and Testament form to ensure compliance with relevant state laws and to guarantee the accurate execution of your final wishes.A Legal Last Will and Testament Form for a Married Person with No Children in Sioux Falls, South Dakota is a crucial legal document that ensures your final wishes are followed and your assets are distributed as per your instructions after your demise. This legally binding document allows you to designate how your property, possessions, and assets, both financial and sentimental, should be distributed among your chosen beneficiaries. By utilizing the Sioux Falls South Dakota Legal Last Will and Testament Form for a Married Person with No Children, you can protect your loved ones from potential disputes and ensure that your legacy is properly managed. This legal form encompasses various key aspects, such as: 1. Personal Information: The form includes spaces to enter your full legal name, address, and other essential details, including your marital status. 2. Executor: You have the opportunity to appoint an executor who will oversee the administration of your estate and ensure your wishes are carried out accurately. The executor should be someone you trust implicitly, as they will be responsible for managing your assets and property. 3. Asset Distribution: With this form, you can specify precisely how your assets should be distributed among your beneficiaries. You can distribute your assets equally or allocate specific percentages or amounts to each beneficiary. 4. Alternative Beneficiaries: It's always wise to include alternative beneficiaries in case your primary beneficiaries predecease you or are unable to inherit your assets for any reason. By identifying alternative beneficiaries, you can ensure that your estate doesn't go through intestacy, which means the state decides how your assets are distributed. 5. Specific Bequests: In addition to general instructions for asset distribution, you can include specific bequests within your Last Will and Testament Form. These bequests may include sentimental items such as heirlooms, family photographs, or treasured possessions that hold sentimental value. 6. Digital Assets: With the increasing digitalization of our lives, it's essential to consider your digital assets as well. You can use this form to leave instructions on how your digital assets, like social media accounts or online banking, should be handled after your passing. Different types of Sioux Falls South Dakota Legal Last Will and Testament Forms for a Married Person with No Children may include variations or additional sections based on specific circumstances. Some possible variations could include provisions for charitable donations, establishment of trusts, or guardianship arrangements for dependent adults, among others. However, the basic format remains consistent. Regardless of the variations, it is highly recommended consulting an attorney or legal professional when completing any Last Will and Testament form to ensure compliance with relevant state laws and to guarantee the accurate execution of your final wishes.