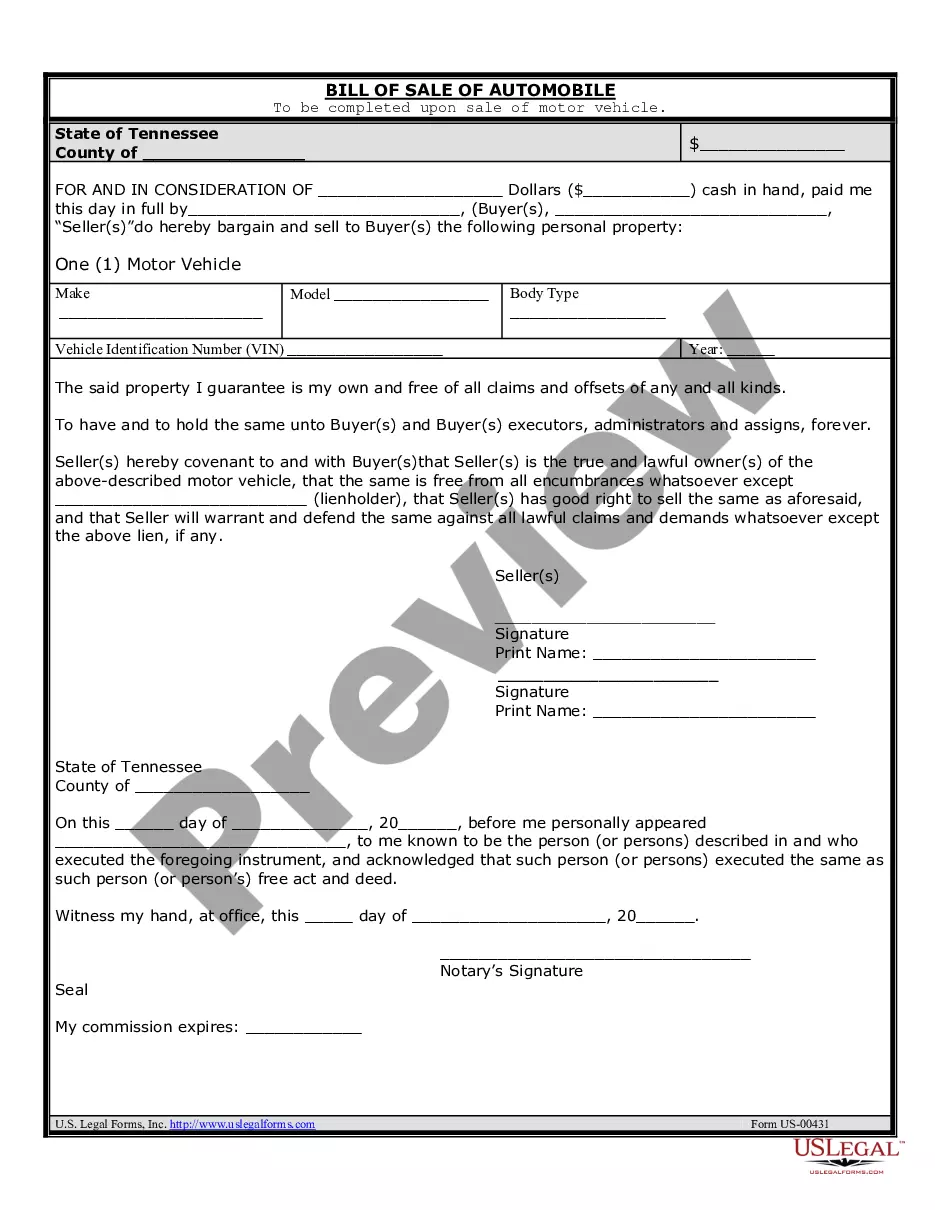

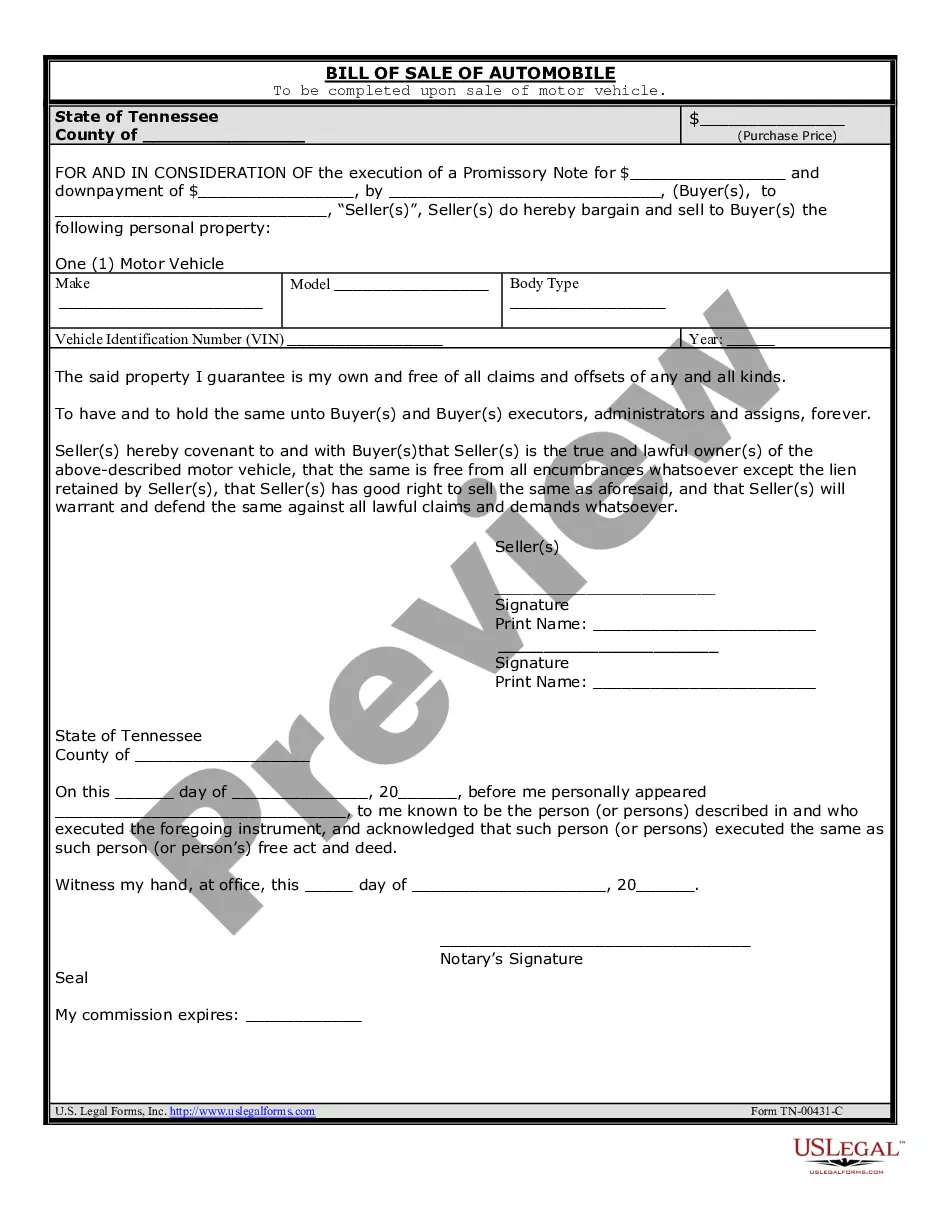

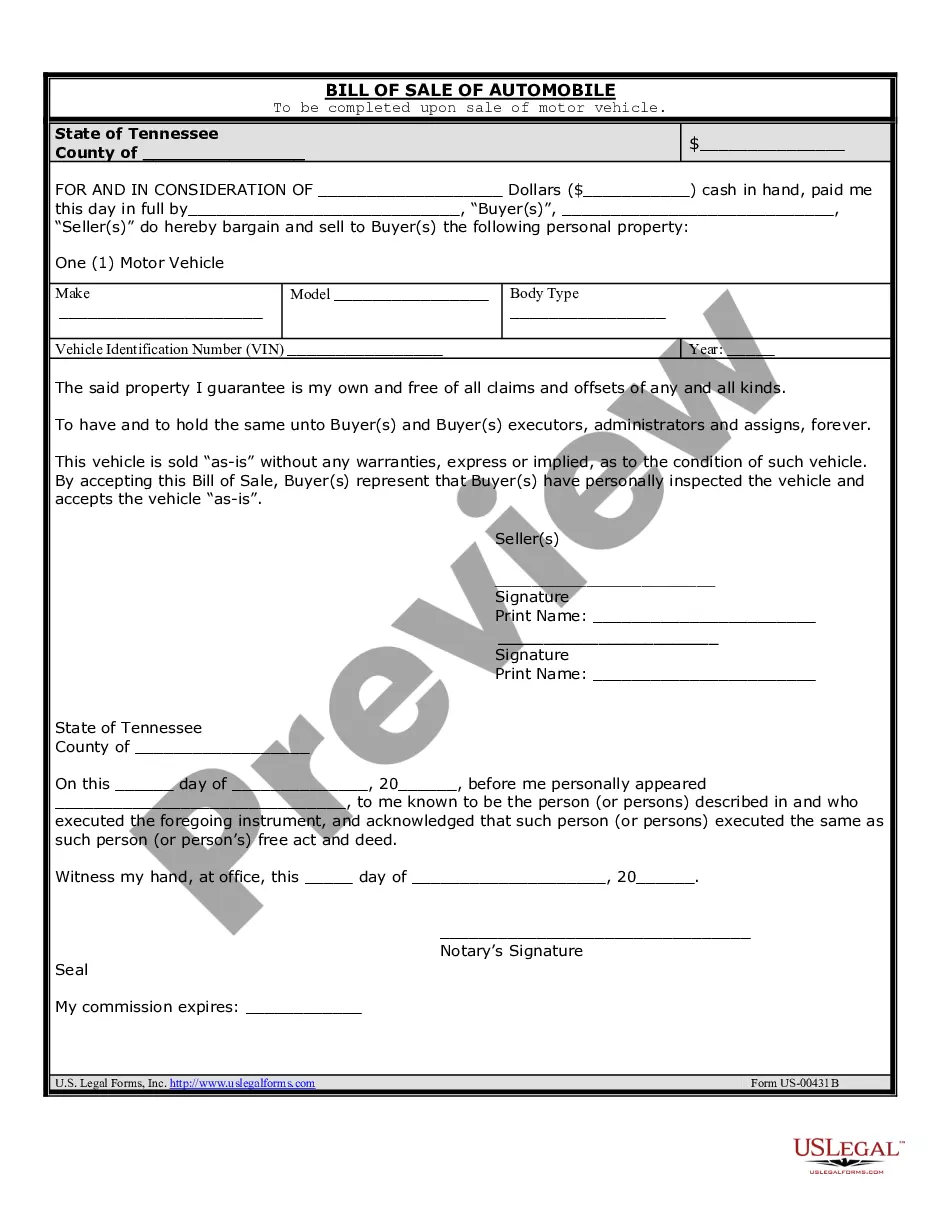

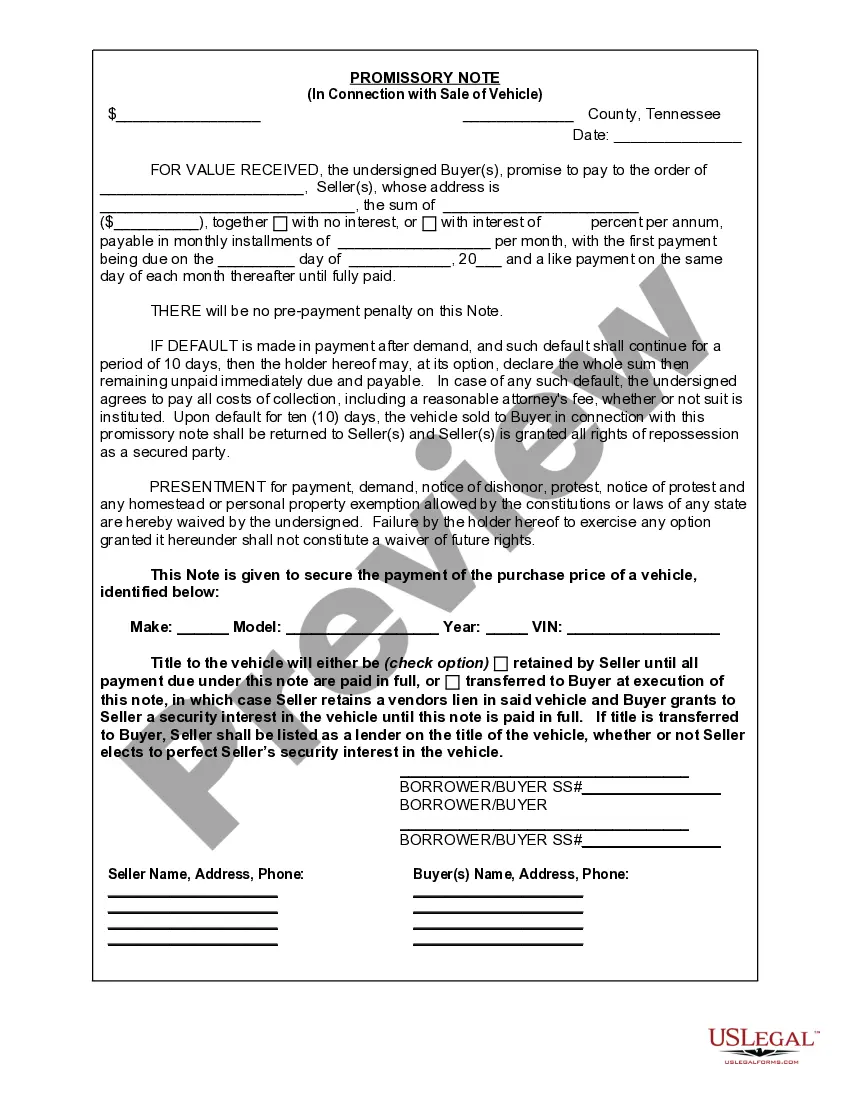

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions under which a buyer agrees to repay the seller for the purchase of a vehicle. This promissory note serves as evidence of the buyer's obligation to make payments according to the agreed-upon terms. It is an essential document that protects the seller's interests and ensures the buyer's commitment to fulfilling payments. In Chattanooga, Tennessee, there are primarily two types of promissory notes used in connection with the sale of a vehicle or automobile: 1. Straight Promissory Note: This type of promissory note establishes a straightforward repayment plan, where the buyer agrees to make fixed periodic payments over a specified period of time. The note will include details such as the total amount owed, interest rate (if applicable), payment schedule, and consequences for defaulting on payments. 2. Balloon Promissory Note: A balloon promissory note, also known as an installment note with a balloon payment, includes smaller periodic payments for a specific period, followed by a larger lump-sum payment (balloon payment) due at the end of the term. This note allows buyers to make smaller monthly payments while expecting a larger final payment. The note will indicate the amount of these periodic payments, the balloon payment amount, interest rate (if applicable), and consequences for non-payment. Regardless of the type, a Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile must include specific key details, such as: 1. Identification of Parties: The note should clearly identify both the buyer (debtor) and the seller (creditor), along with their contact information and signatures. 2. Vehicle Details: It is crucial to include comprehensive information about the vehicle being sold, such as make, model, year, Vehicle Identification Number (VIN), and license plate number. This ensures there is no confusion about the specific vehicle tied to the promissory note. 3. Total Amount and Payment Terms: Clearly state the total purchase price of the vehicle, the amount financed (if any), interest rate (if applicable), and the agreed-upon payment terms (monthly, bi-weekly, etc.). Specify the due date and payment method (check, electronic transfer, etc.) for each payment. 4. Default and Collection Terms: Outline the consequences of defaulting on payments, including late fees, penalty interest rates, repossession rights, and any legal actions that may be taken to recover the debt. 5. Governing Law: Specify that the promissory note is subject to the laws of Chattanooga, Tennessee, ensuring that any dispute resolution or legal actions will be governed by the local jurisdiction. In conclusion, a Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile is a vital legal document that protects both the buyer and the seller in the transaction. Whether it is a straight promissory note or a balloon promissory note, it is essential to include all relevant information to ensure clarity, enforceability, and a smooth transaction process.A Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions under which a buyer agrees to repay the seller for the purchase of a vehicle. This promissory note serves as evidence of the buyer's obligation to make payments according to the agreed-upon terms. It is an essential document that protects the seller's interests and ensures the buyer's commitment to fulfilling payments. In Chattanooga, Tennessee, there are primarily two types of promissory notes used in connection with the sale of a vehicle or automobile: 1. Straight Promissory Note: This type of promissory note establishes a straightforward repayment plan, where the buyer agrees to make fixed periodic payments over a specified period of time. The note will include details such as the total amount owed, interest rate (if applicable), payment schedule, and consequences for defaulting on payments. 2. Balloon Promissory Note: A balloon promissory note, also known as an installment note with a balloon payment, includes smaller periodic payments for a specific period, followed by a larger lump-sum payment (balloon payment) due at the end of the term. This note allows buyers to make smaller monthly payments while expecting a larger final payment. The note will indicate the amount of these periodic payments, the balloon payment amount, interest rate (if applicable), and consequences for non-payment. Regardless of the type, a Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile must include specific key details, such as: 1. Identification of Parties: The note should clearly identify both the buyer (debtor) and the seller (creditor), along with their contact information and signatures. 2. Vehicle Details: It is crucial to include comprehensive information about the vehicle being sold, such as make, model, year, Vehicle Identification Number (VIN), and license plate number. This ensures there is no confusion about the specific vehicle tied to the promissory note. 3. Total Amount and Payment Terms: Clearly state the total purchase price of the vehicle, the amount financed (if any), interest rate (if applicable), and the agreed-upon payment terms (monthly, bi-weekly, etc.). Specify the due date and payment method (check, electronic transfer, etc.) for each payment. 4. Default and Collection Terms: Outline the consequences of defaulting on payments, including late fees, penalty interest rates, repossession rights, and any legal actions that may be taken to recover the debt. 5. Governing Law: Specify that the promissory note is subject to the laws of Chattanooga, Tennessee, ensuring that any dispute resolution or legal actions will be governed by the local jurisdiction. In conclusion, a Chattanooga Tennessee promissory note in connection with the sale of a vehicle or automobile is a vital legal document that protects both the buyer and the seller in the transaction. Whether it is a straight promissory note or a balloon promissory note, it is essential to include all relevant information to ensure clarity, enforceability, and a smooth transaction process.