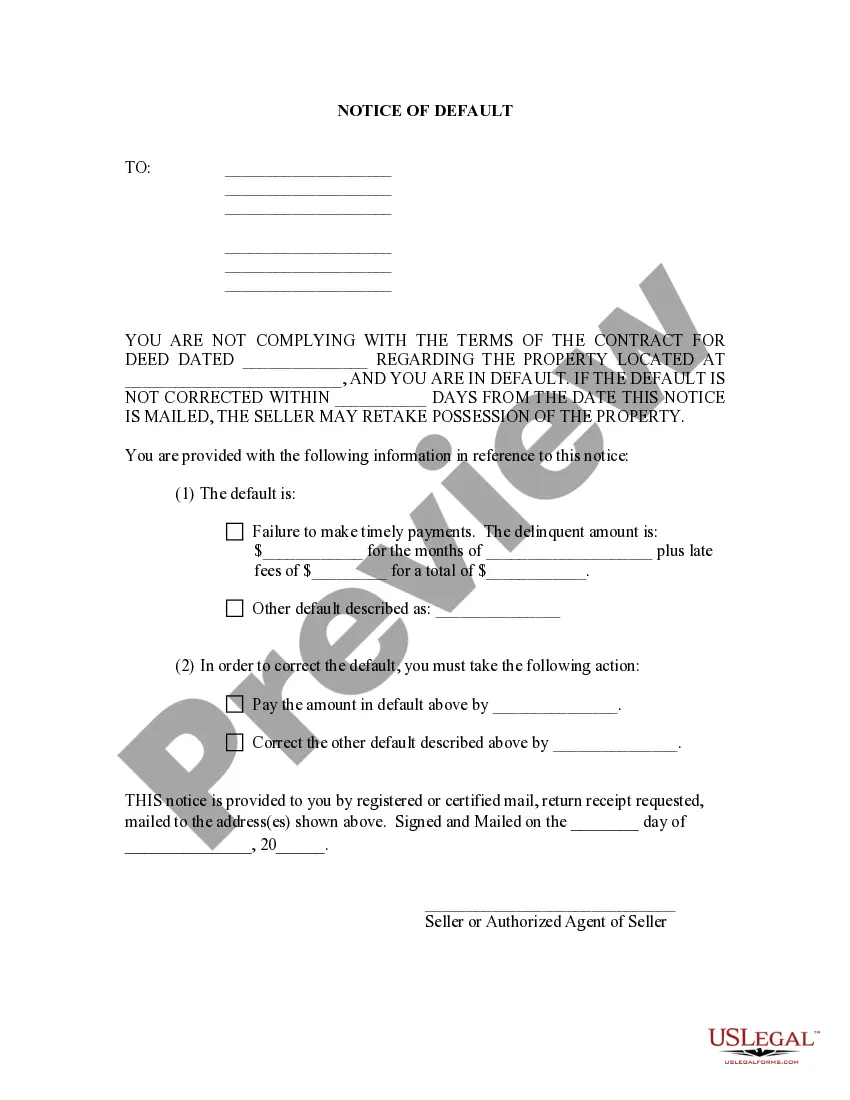

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

Title: Understanding the Murfreesboro Tennessee General Notice of Default for Contract for Deed Introduction: In Murfreesboro, Tennessee, the General Notice of Default for a Contract for Deed is a crucial legal document that plays a significant role in real estate transactions. It is important to fully comprehend its purpose, significance, and any variations that may exist. This article aims to provide a detailed description of the Murfreesboro Tennessee General Notice of Default for Contract for Deed, while highlighting different types if applicable. 1. Definition and Purpose: The Murfreesboro Tennessee General Notice of Default for Contract for Deed is a written notice that informs all parties involved in a contract for deed agreement about the default of one or more terms of the contract. Such defaults typically involve non-payment of installments, failure to maintain required property insurance, or violation of any other contractual obligations. 2. Key Components: a. Identification: The Notice of Default includes the legal names and addresses of both the defaulting party (buyer) and the non-defaulting party (seller). b. Contract Details: It outlines the specific contract for deed agreement, along with important information such as the property address, purchase price, and terms of payment. c. Defaulted Terms: The notice clearly specifies the terms that have been violated and the actions required to remedy the default. d. Cure Period: It allows the defaulting party a specified timeframe to rectify the default, usually stated as a certain number of days from the date of notice. e. Consequences of Failure to Cure: The notice outlines the consequences that may occur if the default remains unaddressed, which could include termination of the contract, forfeiture of any equity, or legal action initiated by the non-defaulting party. 3. Types of Murfreesboro Tennessee General Notice of Default: a. Financial Default Notice: This type of notice is issued when the defaulting party fails to make timely payments, including regular installments or property taxes. b. Non-compliance Notice: If the defaulting party violates any other provisions of the contract, such as property maintenance or insurance requirements, this notice may be issued. c. Multiple Default Notice: In cases where multiple defaults occur simultaneously or recurrently, this notice covers all the defaults in a comprehensive manner. d. Optional Variations: Depending on the specifics of the contract, additional types of notices may be utilized to address unique default scenarios. These variations should be mentioned in the original contract for deed agreement. Conclusion: Understanding the Murfreesboro Tennessee General Notice of Default for Contract for Deed is crucial to both buyers and sellers engaged in contract for deed agreements. By being familiar with the contents and purpose of this document, individuals can better navigate potential default scenarios and pursue appropriate action to protect their rights and investments.Title: Understanding the Murfreesboro Tennessee General Notice of Default for Contract for Deed Introduction: In Murfreesboro, Tennessee, the General Notice of Default for a Contract for Deed is a crucial legal document that plays a significant role in real estate transactions. It is important to fully comprehend its purpose, significance, and any variations that may exist. This article aims to provide a detailed description of the Murfreesboro Tennessee General Notice of Default for Contract for Deed, while highlighting different types if applicable. 1. Definition and Purpose: The Murfreesboro Tennessee General Notice of Default for Contract for Deed is a written notice that informs all parties involved in a contract for deed agreement about the default of one or more terms of the contract. Such defaults typically involve non-payment of installments, failure to maintain required property insurance, or violation of any other contractual obligations. 2. Key Components: a. Identification: The Notice of Default includes the legal names and addresses of both the defaulting party (buyer) and the non-defaulting party (seller). b. Contract Details: It outlines the specific contract for deed agreement, along with important information such as the property address, purchase price, and terms of payment. c. Defaulted Terms: The notice clearly specifies the terms that have been violated and the actions required to remedy the default. d. Cure Period: It allows the defaulting party a specified timeframe to rectify the default, usually stated as a certain number of days from the date of notice. e. Consequences of Failure to Cure: The notice outlines the consequences that may occur if the default remains unaddressed, which could include termination of the contract, forfeiture of any equity, or legal action initiated by the non-defaulting party. 3. Types of Murfreesboro Tennessee General Notice of Default: a. Financial Default Notice: This type of notice is issued when the defaulting party fails to make timely payments, including regular installments or property taxes. b. Non-compliance Notice: If the defaulting party violates any other provisions of the contract, such as property maintenance or insurance requirements, this notice may be issued. c. Multiple Default Notice: In cases where multiple defaults occur simultaneously or recurrently, this notice covers all the defaults in a comprehensive manner. d. Optional Variations: Depending on the specifics of the contract, additional types of notices may be utilized to address unique default scenarios. These variations should be mentioned in the original contract for deed agreement. Conclusion: Understanding the Murfreesboro Tennessee General Notice of Default for Contract for Deed is crucial to both buyers and sellers engaged in contract for deed agreements. By being familiar with the contents and purpose of this document, individuals can better navigate potential default scenarios and pursue appropriate action to protect their rights and investments.