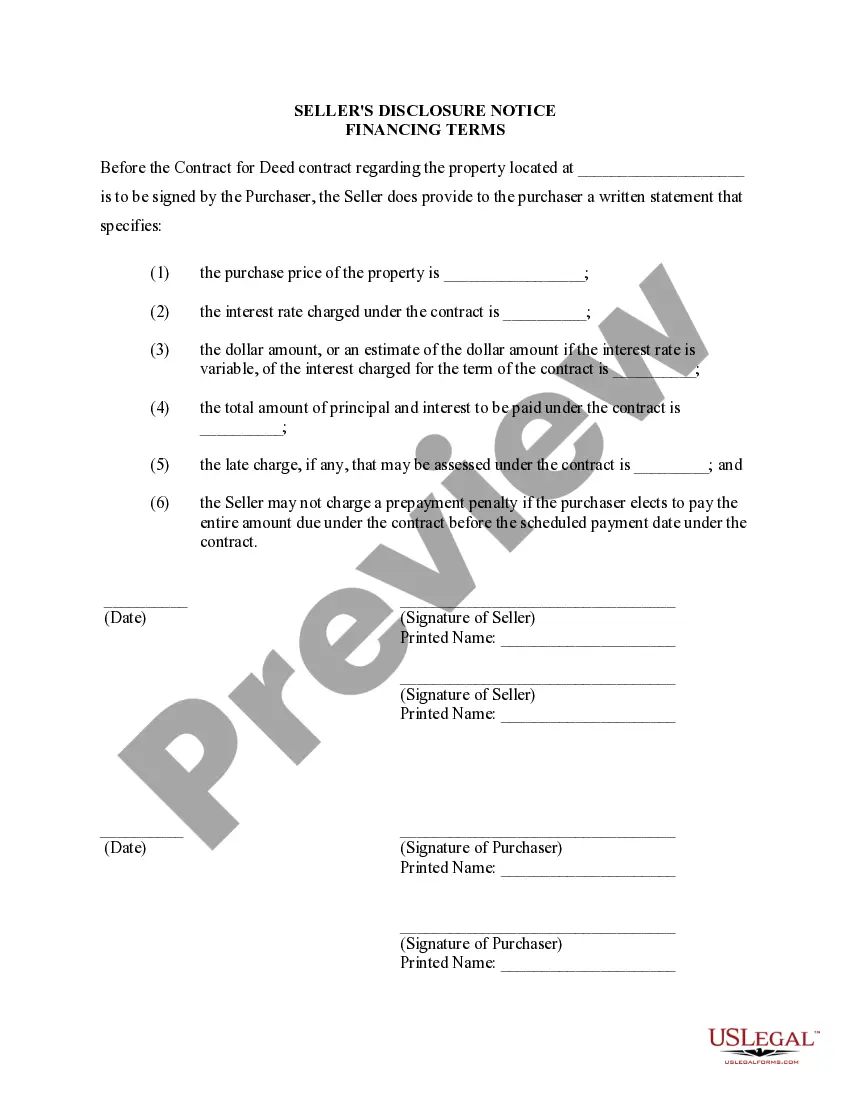

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Knoxville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with the Contract or Agreement for Deed, also known as a Land Contract, plays a vital role in real estate transactions. It is a legally binding document that outlines the terms and conditions of the financing agreement between the seller and the buyer. This disclosure ensures transparency and helps both parties understand their responsibilities and obligations. Here are some relevant keywords and different types of disclosure forms: 1. Seller's Disclosure: The seller must provide a detailed and accurate account of the financing terms in writing to the buyer. This disclosure ensures that the buyer knows exactly what they are getting into before entering the contract. 2. Financing Terms: The disclosure should include the relevant financing terms, such as the purchase price, down payment amount, interest rate, payment schedule, and any adjustable or fixed-rate terms. This information helps the buyer understand the financial implications of the agreement. 3. Residential Property: The disclosure is specifically applicable to residential properties, including houses, condominium units, townhouses, or any other residential real estate. Commercial or industrial properties are not typically covered by this disclosure. 4. Contract or Agreement for Deed: The disclosure pertains to situations where the financing arrangement involves a Contract or Agreement for Deed, also known as a Land Contract. This type of arrangement allows the buyer to make payments directly to the seller over an extended period, after which the ownership is transferred. 5. Different Types: Depending on the specific requirements and regulations of Knoxville, Tennessee, there may be different variations of the Seller's Disclosure of Financing Terms. For example, there could be separate forms for different types of residential properties, such as single-family homes, multi-unit buildings, or condominiums. 6. Applicable Laws and Regulations: It's crucial for both the buyer and the seller to comply with all applicable laws and regulations related to real estate transactions in Knoxville, Tennessee. The disclosure form should adhere to local, state, and federal laws governing real estate finance. 7. Required Disclosures: In addition to the financing terms, the disclosure form may include other relevant information such as contingencies, potential penalties, disclosures about property condition, and any potential encumbrances or liens on the property. When engaging in a real estate transaction in Knoxville, Tennessee, it is essential to ensure that the Seller's Disclosure of Financing Terms for Residential Property is properly completed, reviewed, and understood by both parties. Seeking professional legal and real estate advice is advisable to ensure compliance with all the necessary regulations and to protect the interests of both the buyer and the seller.The Knoxville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with the Contract or Agreement for Deed, also known as a Land Contract, plays a vital role in real estate transactions. It is a legally binding document that outlines the terms and conditions of the financing agreement between the seller and the buyer. This disclosure ensures transparency and helps both parties understand their responsibilities and obligations. Here are some relevant keywords and different types of disclosure forms: 1. Seller's Disclosure: The seller must provide a detailed and accurate account of the financing terms in writing to the buyer. This disclosure ensures that the buyer knows exactly what they are getting into before entering the contract. 2. Financing Terms: The disclosure should include the relevant financing terms, such as the purchase price, down payment amount, interest rate, payment schedule, and any adjustable or fixed-rate terms. This information helps the buyer understand the financial implications of the agreement. 3. Residential Property: The disclosure is specifically applicable to residential properties, including houses, condominium units, townhouses, or any other residential real estate. Commercial or industrial properties are not typically covered by this disclosure. 4. Contract or Agreement for Deed: The disclosure pertains to situations where the financing arrangement involves a Contract or Agreement for Deed, also known as a Land Contract. This type of arrangement allows the buyer to make payments directly to the seller over an extended period, after which the ownership is transferred. 5. Different Types: Depending on the specific requirements and regulations of Knoxville, Tennessee, there may be different variations of the Seller's Disclosure of Financing Terms. For example, there could be separate forms for different types of residential properties, such as single-family homes, multi-unit buildings, or condominiums. 6. Applicable Laws and Regulations: It's crucial for both the buyer and the seller to comply with all applicable laws and regulations related to real estate transactions in Knoxville, Tennessee. The disclosure form should adhere to local, state, and federal laws governing real estate finance. 7. Required Disclosures: In addition to the financing terms, the disclosure form may include other relevant information such as contingencies, potential penalties, disclosures about property condition, and any potential encumbrances or liens on the property. When engaging in a real estate transaction in Knoxville, Tennessee, it is essential to ensure that the Seller's Disclosure of Financing Terms for Residential Property is properly completed, reviewed, and understood by both parties. Seeking professional legal and real estate advice is advisable to ensure compliance with all the necessary regulations and to protect the interests of both the buyer and the seller.