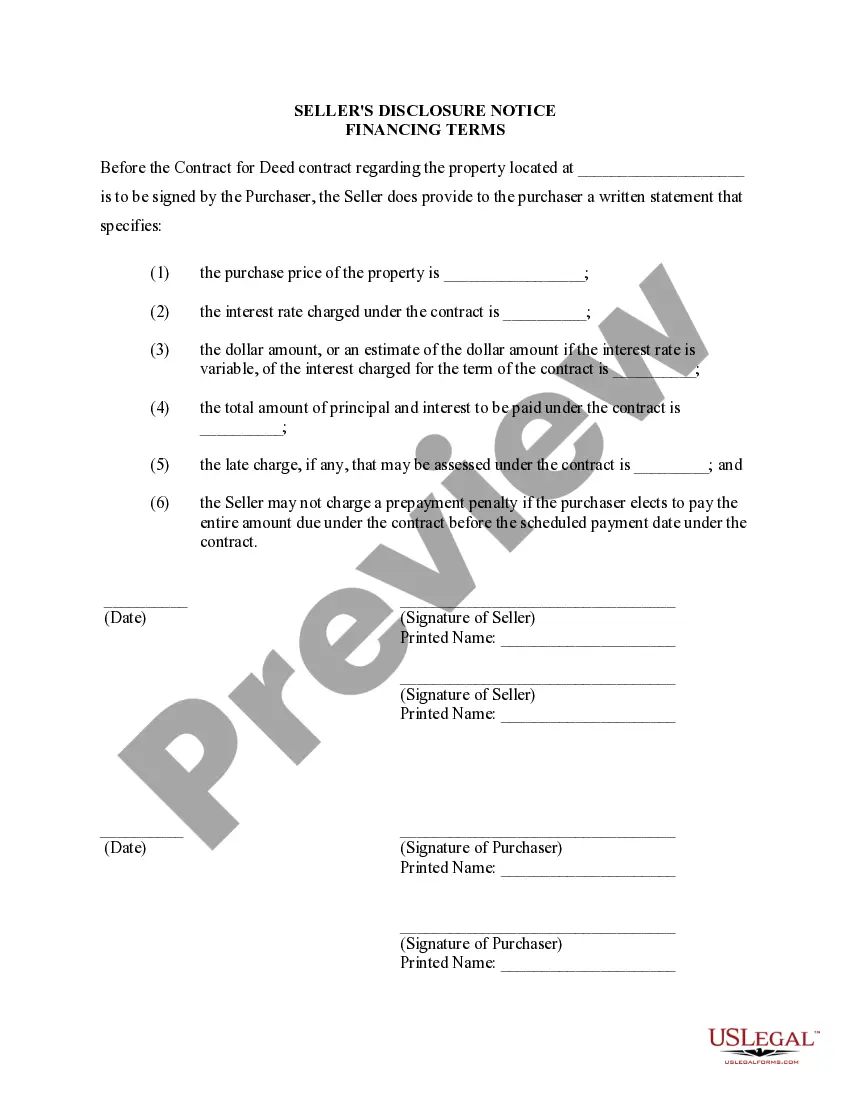

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

In Nashville, Tennessee, a Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the terms and conditions related to the financial aspect of purchasing a residential property. This disclosure serves to provide transparency and ensure both parties involved in the transaction are aware of the financing arrangements. There are various types of Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. These may include: 1. Interest Rate and Payment Schedule: This disclosure will specify the interest rate applicable to the financing agreement and how the payments will be structured. It may outline whether the interest rate is fixed or adjustable, the frequency of payments (monthly, bi-monthly, etc.), and the duration of the financing arrangement. 2. Down Payment: The disclosure will detail the amount of down payment required by the buyer to initiate the contract or agreement for deed. It may also mention if any specific terms or conditions are associated with the down payment. 3. Balloon Payment: In some cases, a Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property may include a balloon payment clause. This means that at a specific point in the agreement, the buyer will be required to make a lump-sum payment to complete the purchase. The disclosure will clarify the amount and timing of the balloon payment, ensuring that the buyer is aware of this financial obligation. 4. Closing Costs: This disclosure may outline which party, either the buyer or the seller, is responsible for various closing costs associated with the purchase. It will specify if the buyer is responsible for appraisal fees, inspection costs, title insurance, or any other expenses. 5. Default and Foreclosure: The seller's disclosure should contain information on the consequences of defaulting on payments and the subsequent foreclosure process if applicable. It will define the actions that can be taken by the seller to recover the property in case of non-payment by the buyer. 6. Other Financing Terms: The disclosure document may also cover additional financing terms, such as early payment penalties or prepayment options, should either party wish to make changes to the agreement before the agreed-upon duration has elapsed. It is important for both the buyer and the seller to carefully review and understand the Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property. Consulting with a legal professional or real estate agent who is experienced in land contracts can be beneficial to ensure all terms and conditions are clear and all parties are protected throughout the transaction.In Nashville, Tennessee, a Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the terms and conditions related to the financial aspect of purchasing a residential property. This disclosure serves to provide transparency and ensure both parties involved in the transaction are aware of the financing arrangements. There are various types of Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed. These may include: 1. Interest Rate and Payment Schedule: This disclosure will specify the interest rate applicable to the financing agreement and how the payments will be structured. It may outline whether the interest rate is fixed or adjustable, the frequency of payments (monthly, bi-monthly, etc.), and the duration of the financing arrangement. 2. Down Payment: The disclosure will detail the amount of down payment required by the buyer to initiate the contract or agreement for deed. It may also mention if any specific terms or conditions are associated with the down payment. 3. Balloon Payment: In some cases, a Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property may include a balloon payment clause. This means that at a specific point in the agreement, the buyer will be required to make a lump-sum payment to complete the purchase. The disclosure will clarify the amount and timing of the balloon payment, ensuring that the buyer is aware of this financial obligation. 4. Closing Costs: This disclosure may outline which party, either the buyer or the seller, is responsible for various closing costs associated with the purchase. It will specify if the buyer is responsible for appraisal fees, inspection costs, title insurance, or any other expenses. 5. Default and Foreclosure: The seller's disclosure should contain information on the consequences of defaulting on payments and the subsequent foreclosure process if applicable. It will define the actions that can be taken by the seller to recover the property in case of non-payment by the buyer. 6. Other Financing Terms: The disclosure document may also cover additional financing terms, such as early payment penalties or prepayment options, should either party wish to make changes to the agreement before the agreed-upon duration has elapsed. It is important for both the buyer and the seller to carefully review and understand the Nashville Tennessee Seller's Disclosure of Financing Terms for Residential Property. Consulting with a legal professional or real estate agent who is experienced in land contracts can be beneficial to ensure all terms and conditions are clear and all parties are protected throughout the transaction.