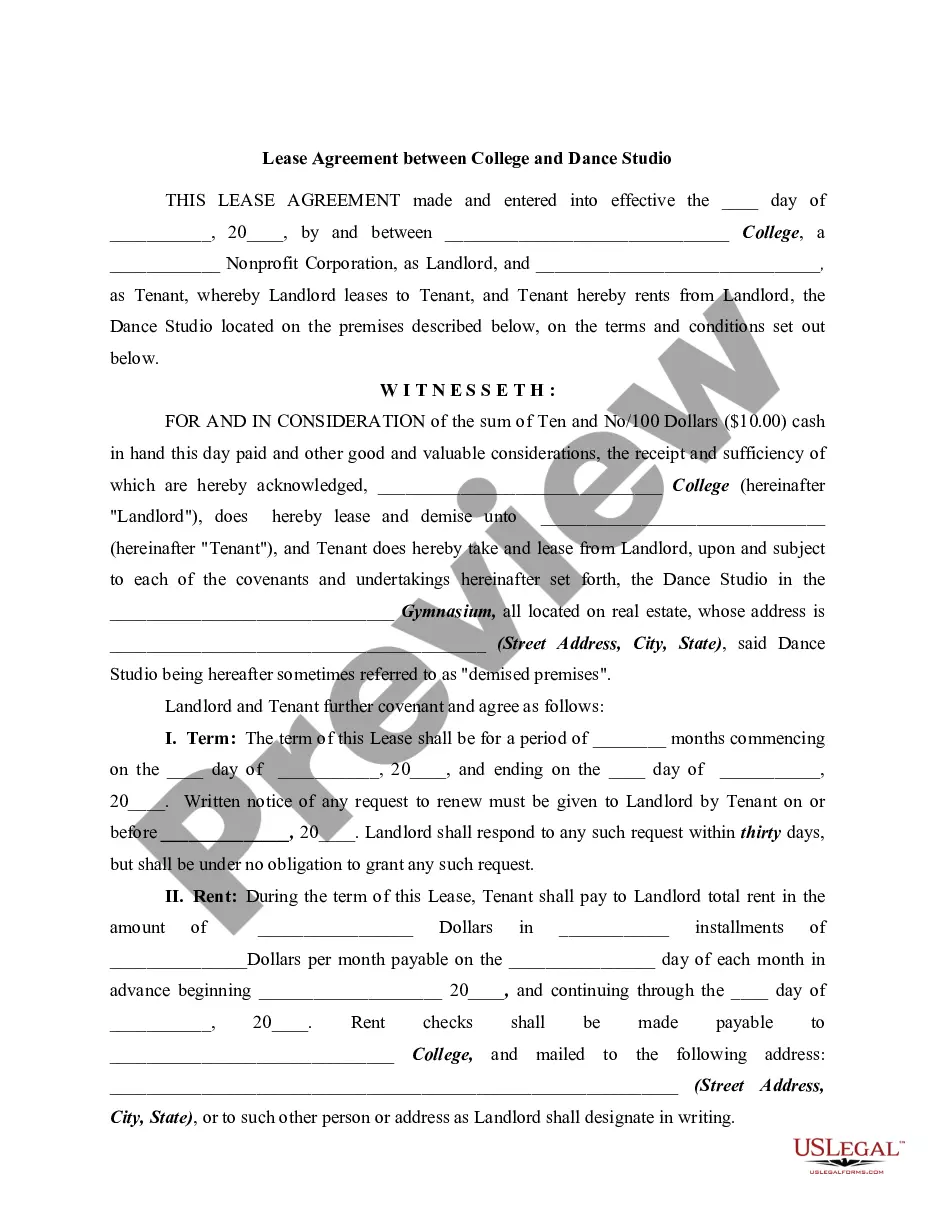

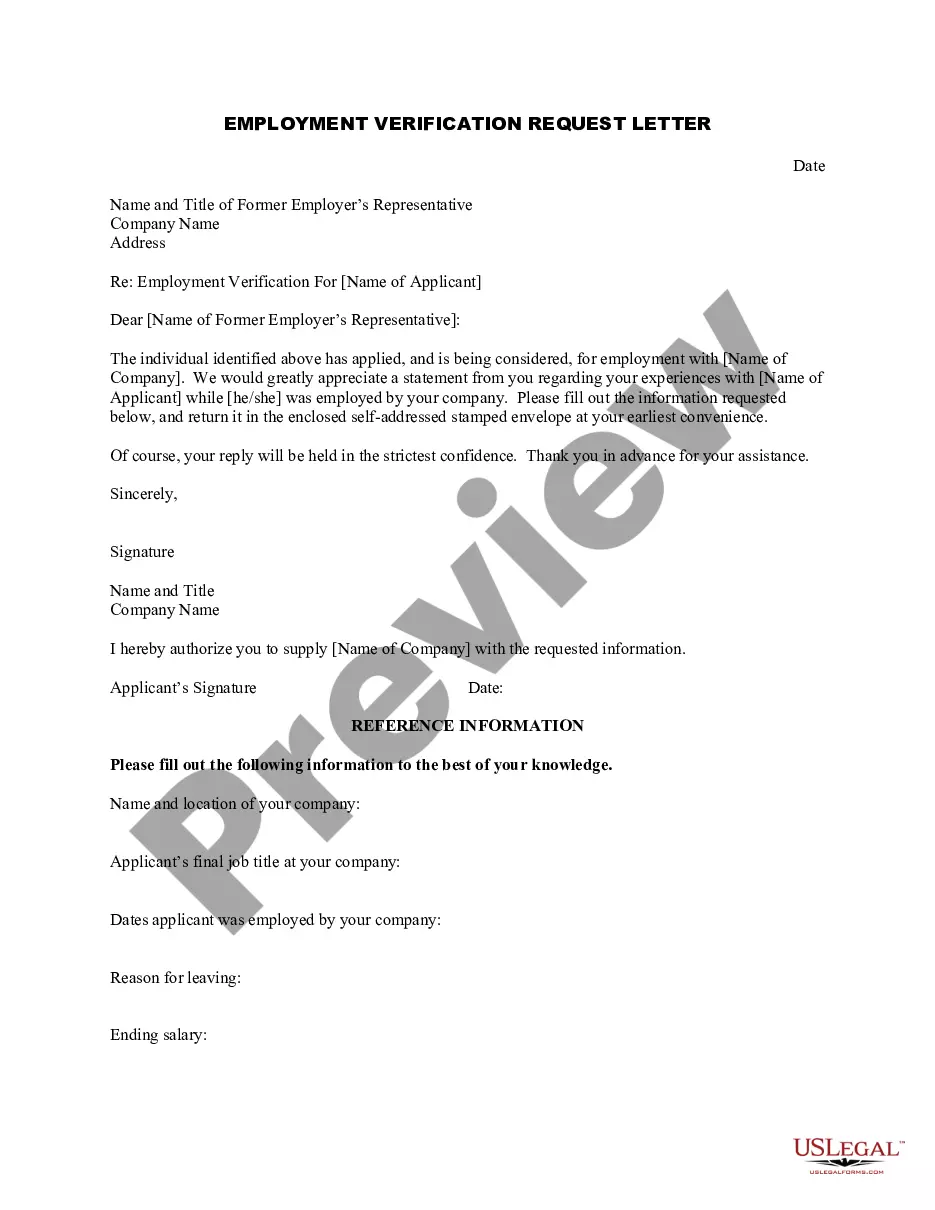

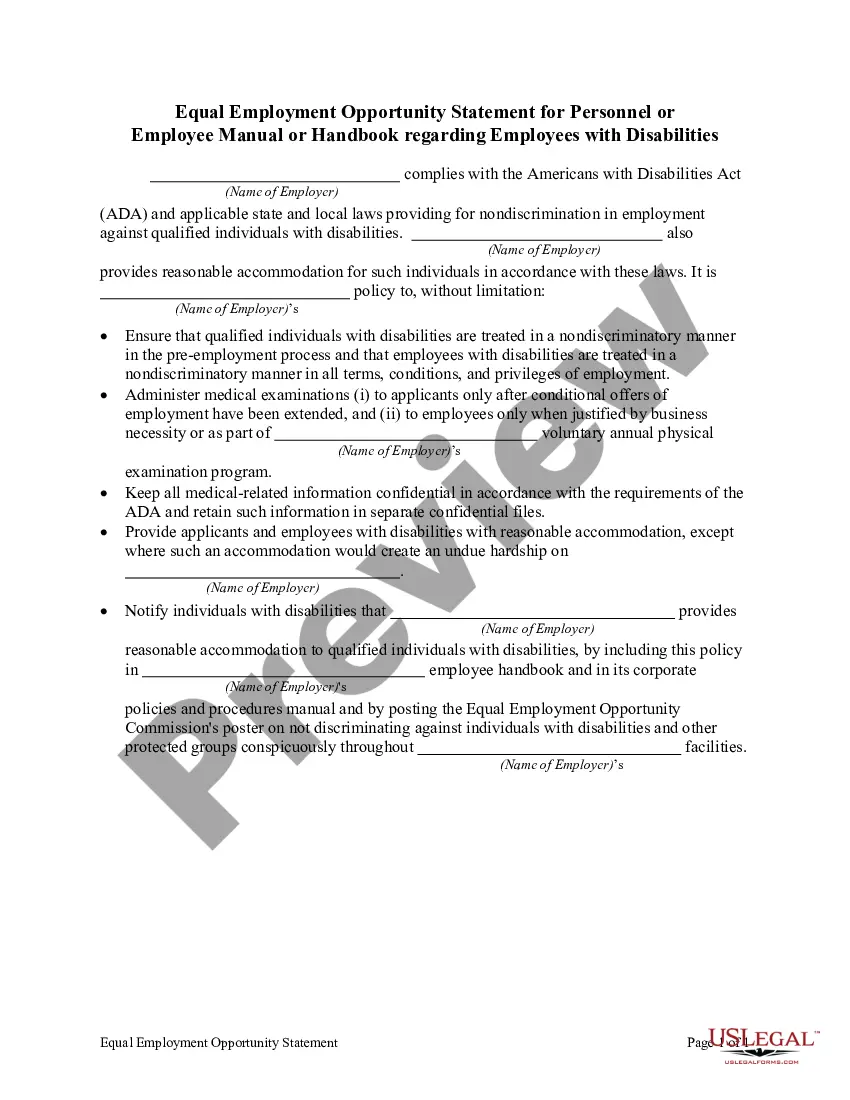

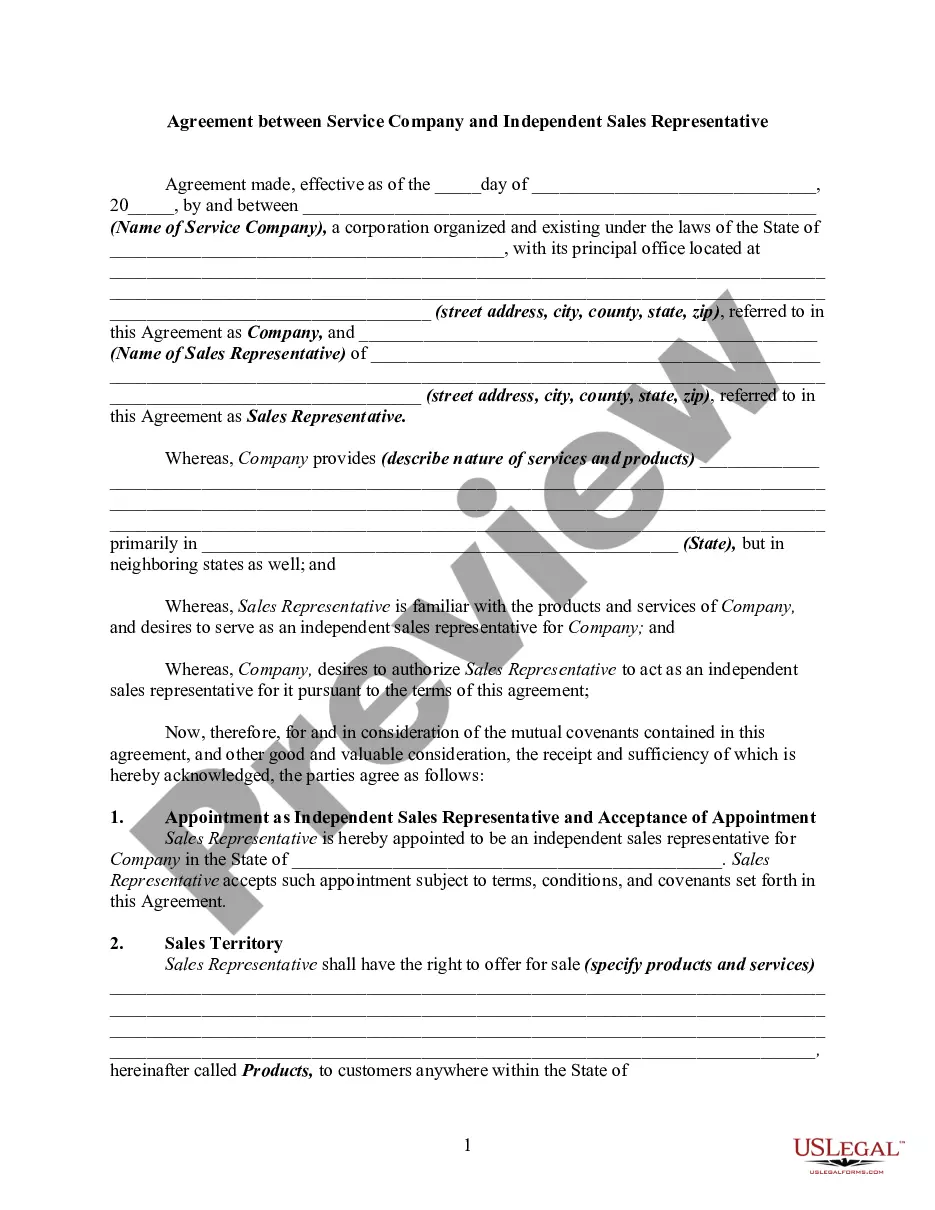

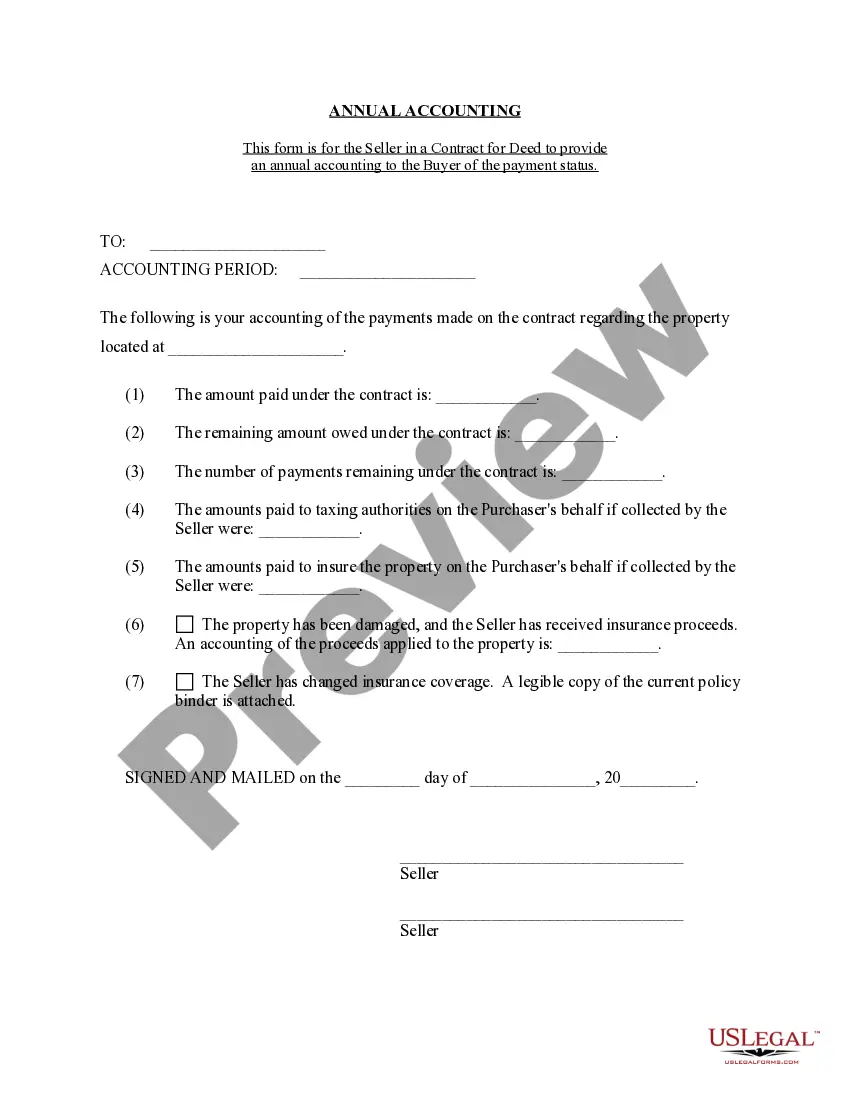

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Chattanooga Tennessee Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Tennessee Contract For Deed Seller's Annual Accounting Statement?

If you are seeking a legitimate form, it’s exceptionally challenging to locate a superior service than the US Legal Forms site – likely the most comprehensive repositories on the internet.

Here you can discover countless form templates for both business and personal use by categories and states, or key terms.

With our high-caliber search functionality, finding the most recent Chattanooga Tennessee Contract for Deed Seller's Annual Accounting Statement is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the account registration process.

Obtain the form. Select the file format and save it to your device. Edit. Fill in, modify, print, and endorse the acquired Chattanooga Tennessee Contract for Deed Seller's Annual Accounting Statement.

- Furthermore, the accuracy of every document is confirmed by a team of skilled attorneys who consistently assess the templates on our platform and adjust them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Chattanooga Tennessee Contract for Deed Seller's Annual Accounting Statement is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have located the form you require. Review its details and utilize the Preview feature to assess its content. If it doesn’t fulfill your requirements, use the Search function near the top of the page to find the required document.

- Validate your selection. Select the Buy now option. Subsequently, choose your preferred pricing plan and provide details to create an account.