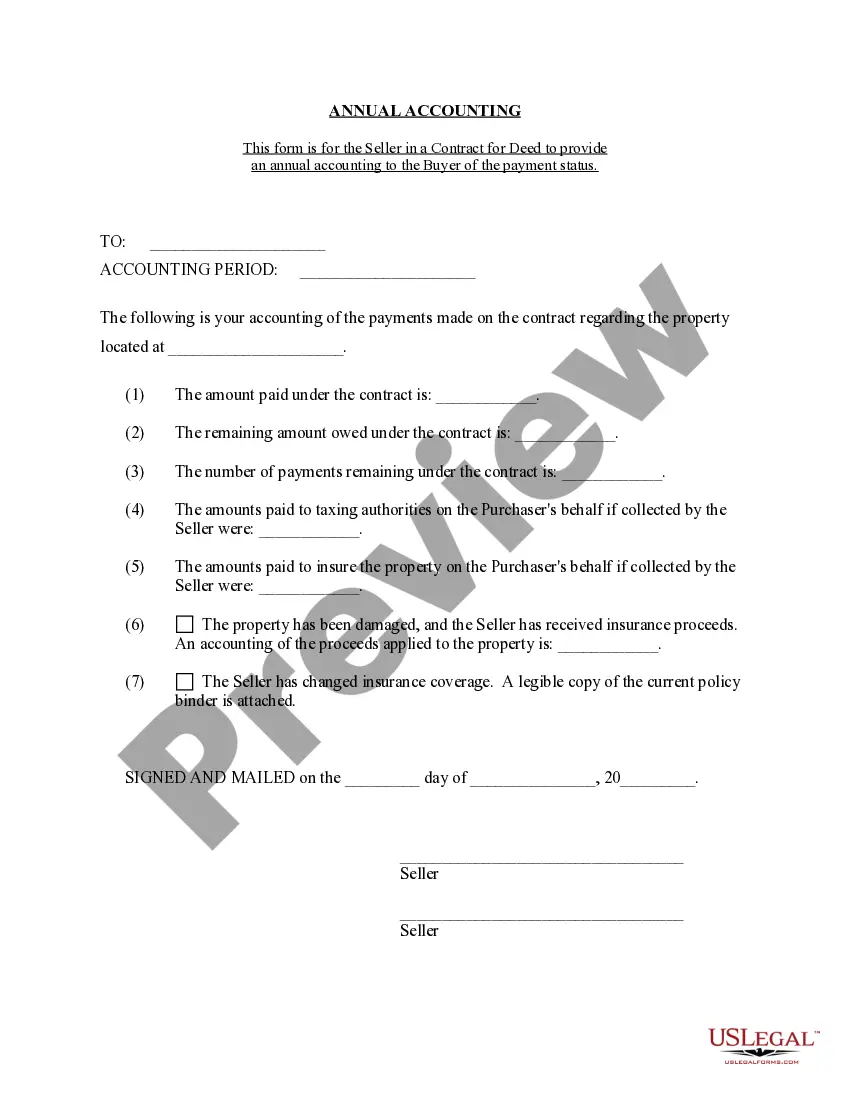

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Knoxville, Tennessee Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document prepared by sellers to disclose the financial performance and status of a property purchased through a contract for deed arrangement in Knoxville, Tennessee. This statement provides vital information to both the buyer and seller about the income and expenses associated with the property, ensuring transparency and accountability in the agreement. Keywords: Knoxville, Tennessee, Contract for Deed, Seller's Annual Accounting Statement, financial document, property, purchased, income, expenses, transparency, accountability. Types of Knoxville, Tennessee Contract for Deed Seller's Annual Accounting Statements: 1. Income Statement: This statement provides a detailed breakdown of all income generated by the property during the accounting period. It includes rental income, late fees, and any other revenue sources associated with the property. 2. Expense Statement: The expense statement outlines all the costs incurred during the accounting period. It includes expenses such as property taxes, insurance premiums, maintenance and repairs, utilities, and management fees. 3. Profit and Loss Statement: This statement summarizes the financial performance of the property by calculating the net profit or loss for the accounting period. It takes into account both the income and expenses associated with the property, providing an overview of its profitability. 4. Cash Flow Statement: The cash flow statement outlines the inflow and outflow of cash associated with the property during the accounting period. It tracks cash received from rent and other sources and deducts expenses to determine the net cash flow. 5. Balance Sheet: The balance sheet provides a snapshot of the property's financial position at a specific point in time, usually at the end of the accounting period. It includes assets (such as the property's value) and liabilities (such as outstanding debts), providing an overview of the property's net worth. 6. Escrow Statement: In some cases, contract for deed arrangements involve an escrow account where the seller holds funds for specific purposes, such as property taxes or insurance payments. The escrow statement details the inflow and outflow of funds from this account, ensuring transparency and accountability. Content for each statement should include relevant financial figures, clear descriptions of income and expenses, and any additional details required by the contract for deed agreement in Knoxville, Tennessee. It is crucial for sellers to provide accurate and comprehensive statements to maintain trust and satisfy legal obligations under the contract for deed arrangement.Knoxville, Tennessee Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document prepared by sellers to disclose the financial performance and status of a property purchased through a contract for deed arrangement in Knoxville, Tennessee. This statement provides vital information to both the buyer and seller about the income and expenses associated with the property, ensuring transparency and accountability in the agreement. Keywords: Knoxville, Tennessee, Contract for Deed, Seller's Annual Accounting Statement, financial document, property, purchased, income, expenses, transparency, accountability. Types of Knoxville, Tennessee Contract for Deed Seller's Annual Accounting Statements: 1. Income Statement: This statement provides a detailed breakdown of all income generated by the property during the accounting period. It includes rental income, late fees, and any other revenue sources associated with the property. 2. Expense Statement: The expense statement outlines all the costs incurred during the accounting period. It includes expenses such as property taxes, insurance premiums, maintenance and repairs, utilities, and management fees. 3. Profit and Loss Statement: This statement summarizes the financial performance of the property by calculating the net profit or loss for the accounting period. It takes into account both the income and expenses associated with the property, providing an overview of its profitability. 4. Cash Flow Statement: The cash flow statement outlines the inflow and outflow of cash associated with the property during the accounting period. It tracks cash received from rent and other sources and deducts expenses to determine the net cash flow. 5. Balance Sheet: The balance sheet provides a snapshot of the property's financial position at a specific point in time, usually at the end of the accounting period. It includes assets (such as the property's value) and liabilities (such as outstanding debts), providing an overview of the property's net worth. 6. Escrow Statement: In some cases, contract for deed arrangements involve an escrow account where the seller holds funds for specific purposes, such as property taxes or insurance payments. The escrow statement details the inflow and outflow of funds from this account, ensuring transparency and accountability. Content for each statement should include relevant financial figures, clear descriptions of income and expenses, and any additional details required by the contract for deed agreement in Knoxville, Tennessee. It is crucial for sellers to provide accurate and comprehensive statements to maintain trust and satisfy legal obligations under the contract for deed arrangement.