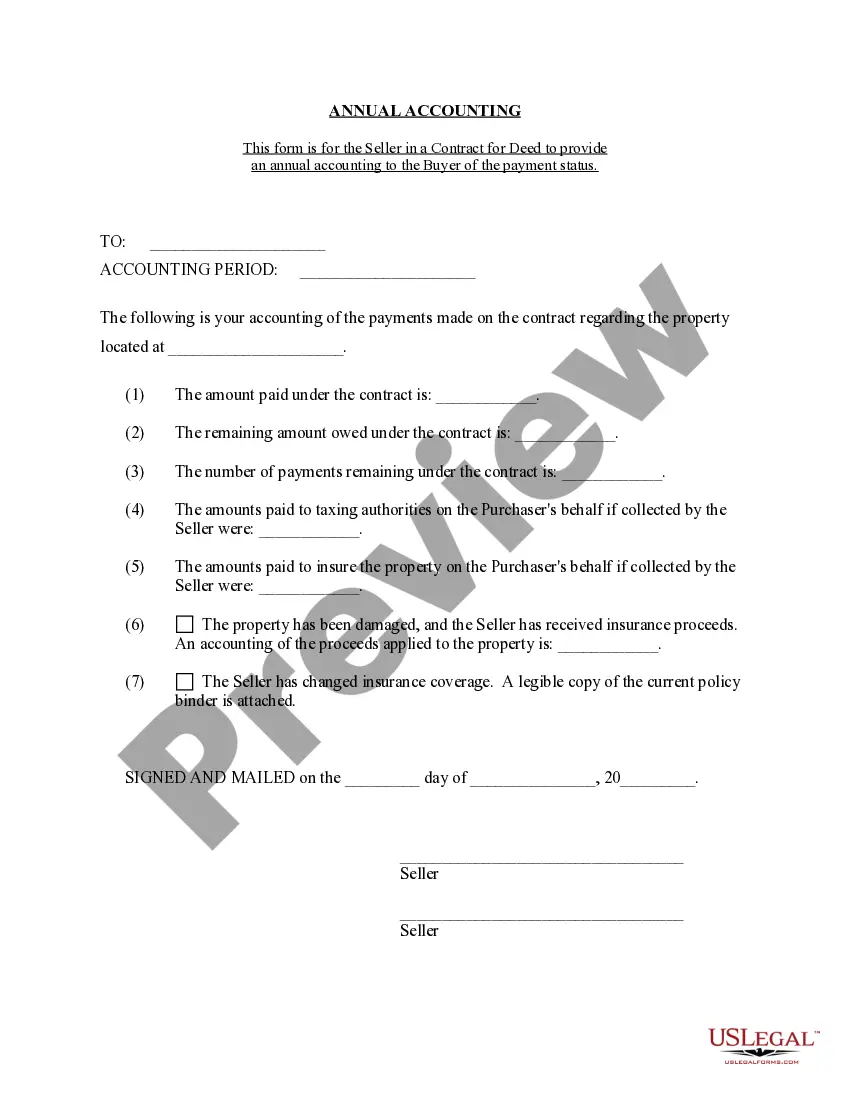

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of the financial transactions and obligations in a contract for deed real estate agreement in Memphis, Tennessee. This statement is typically prepared by the seller and serves as a crucial tool for ensuring transparency and accountability in the property transaction. Keywords: Memphis Tennessee, contract for deed, seller's annual accounting statement, financial transactions, obligations, real estate agreement, transparency, accountability. The Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement includes various sections to provide a comprehensive understanding of the financial aspects associated with the contract for deed. These sections may vary depending on the specific requirements of the agreement, but they generally cover the following key areas: 1. Property Information: This section includes details about the property, such as the address, legal description, and any relevant information regarding the land or building. 2. Names of Parties: The statement identifies the seller (also known as the vendor) and the buyer (also known as the Vendée) involved in the contract for deed. 3. Financial Summary: This section provides an overview of the financial aspects of the contract for deed, such as the purchase price, down payment, monthly payment amount, interest rate, and any applicable fees or charges. 4. Payment Schedule: The payment schedule outlines the timeline and structure of the payments made by the buyer to the seller. This includes the due dates, amount, and any penalties or late fees associated with missed or delayed payments. 5. Accounting of Payments: This section provides a detailed breakdown of all payments made by the buyer, including the principal amount, interest, taxes, insurance, and any other related expenses. It also highlights the remaining balance owed by the buyer. 6. Escrow Account: If an escrow account has been established to cover expenses like property taxes and insurance, this section will include details of the funds held in the account and their disbursement. 7. Assessment of Property: In some cases, the seller may include an assessment of the property's condition and value during the accounting statement. This helps ensure that the property is being maintained appropriately and may impact any potential adjustments to the contract terms. Different types of Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement may have specific variations or additional sections based on the specific agreements between the buyer and seller. For instance, some contracts for deed may include provisions for repairs or improvements made by the buyer and how they affect the financial calculations. Ultimately, the Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement serves as a critical document for both parties involved in a contract for deed transaction. It provides a clear record of the financial obligations and payments made, ensuring transparency and accountability in the process.The Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of the financial transactions and obligations in a contract for deed real estate agreement in Memphis, Tennessee. This statement is typically prepared by the seller and serves as a crucial tool for ensuring transparency and accountability in the property transaction. Keywords: Memphis Tennessee, contract for deed, seller's annual accounting statement, financial transactions, obligations, real estate agreement, transparency, accountability. The Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement includes various sections to provide a comprehensive understanding of the financial aspects associated with the contract for deed. These sections may vary depending on the specific requirements of the agreement, but they generally cover the following key areas: 1. Property Information: This section includes details about the property, such as the address, legal description, and any relevant information regarding the land or building. 2. Names of Parties: The statement identifies the seller (also known as the vendor) and the buyer (also known as the Vendée) involved in the contract for deed. 3. Financial Summary: This section provides an overview of the financial aspects of the contract for deed, such as the purchase price, down payment, monthly payment amount, interest rate, and any applicable fees or charges. 4. Payment Schedule: The payment schedule outlines the timeline and structure of the payments made by the buyer to the seller. This includes the due dates, amount, and any penalties or late fees associated with missed or delayed payments. 5. Accounting of Payments: This section provides a detailed breakdown of all payments made by the buyer, including the principal amount, interest, taxes, insurance, and any other related expenses. It also highlights the remaining balance owed by the buyer. 6. Escrow Account: If an escrow account has been established to cover expenses like property taxes and insurance, this section will include details of the funds held in the account and their disbursement. 7. Assessment of Property: In some cases, the seller may include an assessment of the property's condition and value during the accounting statement. This helps ensure that the property is being maintained appropriately and may impact any potential adjustments to the contract terms. Different types of Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement may have specific variations or additional sections based on the specific agreements between the buyer and seller. For instance, some contracts for deed may include provisions for repairs or improvements made by the buyer and how they affect the financial calculations. Ultimately, the Memphis Tennessee Contract for Deed Seller's Annual Accounting Statement serves as a critical document for both parties involved in a contract for deed transaction. It provides a clear record of the financial obligations and payments made, ensuring transparency and accountability in the process.