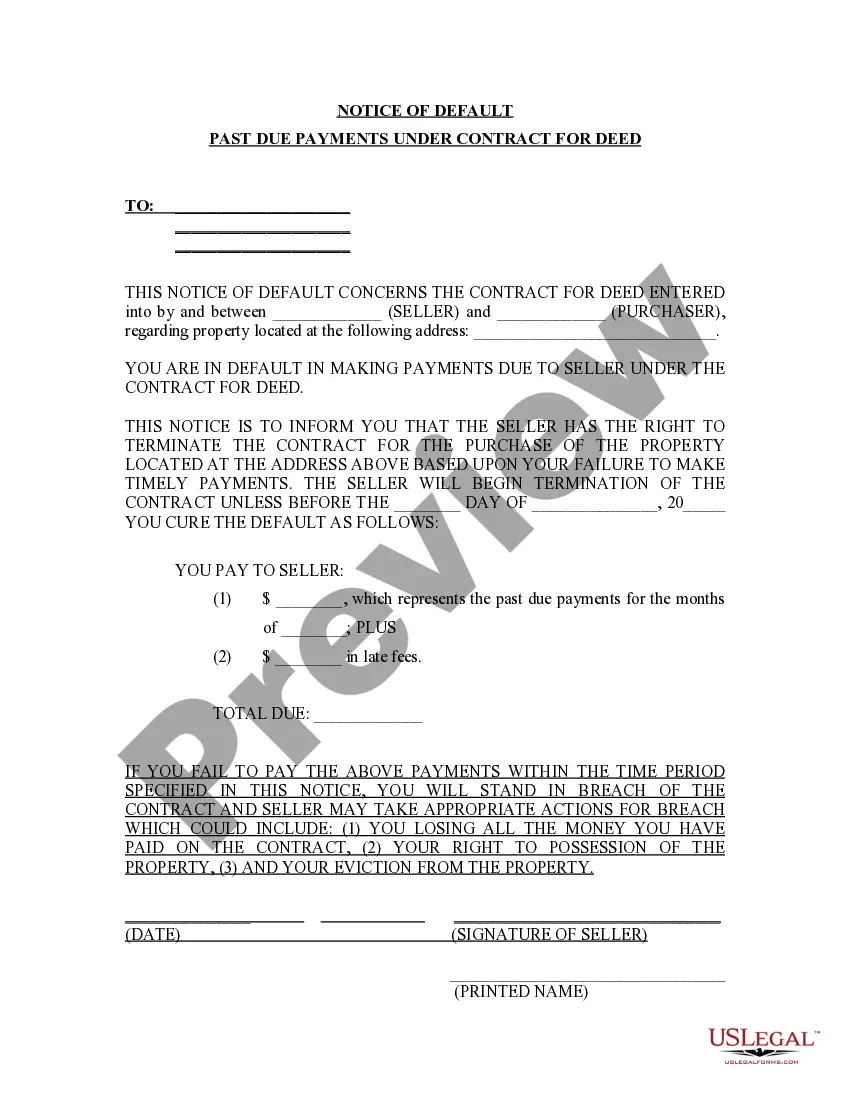

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

The Memphis Tennessee Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that notifies the buyer or lessee (also known as the "contract purchaser") of their failure to make timely payments on a property purchased through a Contract for Deed arrangement. A Contract for Deed, also known as a land contract or installment land contract, is a real estate agreement wherein the seller (also known as the "contract vendor") finances the purchase of the property, unlike a traditional mortgage where a lender provides the funds. In this arrangement, the contract purchaser takes immediate possession of the property but only gains legal title upon fulfilling all payment obligations. The Memphis Tennessee Notice of Default is typically issued by the contract vendor or their representative when the contract purchaser falls behind on their payment obligations. This document serves as a formal notification that the contract purchaser is in breach of the contract. It outlines the details of the missed payments, including the amounts owed, the due dates, and the length of the delinquency. The Notice of Default for Past Due Payments also informs the contract purchaser of the consequences of their non-payment. These consequences may include the potential for foreclosure proceedings, where the contract vendor can take legal action to regain possession of the property. Additionally, the notice may specify any penalties or fees associated with the default, such as late payment fees or additional legal costs. In Memphis, Tennessee, there may be variations of the Notice of Default for Past Due Payments. These variations can depend on specific clauses and conditions outlined in the original Contract for Deed agreement. Some possible variations could include: 1. Notice of Default with Cure Period: This type of notice gives the contract purchaser a specific deadline to cure the default by paying the past-due amounts and any associated fees before further action is taken. 2. Notice of Default without Cure Period: In situations where the contract agreement does not provide for a cure period, this notice emphasizes the immediate breach of contract and the potential commencement of foreclosure proceedings. 3. Notice of Intent to Accelerate: This type of notice informs the contract purchaser that if they fail to bring the payments up-to-date within a specified period, the contract vendor may accelerate the remaining balance of the contract, making it immediately due and payable in full. It is important to note that the specific content and format of the Memphis Tennessee Notice of Default may vary depending on local laws and regulations. It is always advisable for both parties involved in a Contract for Deed arrangement to seek legal counsel to ensure compliance with applicable laws and protect their interests.The Memphis Tennessee Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that notifies the buyer or lessee (also known as the "contract purchaser") of their failure to make timely payments on a property purchased through a Contract for Deed arrangement. A Contract for Deed, also known as a land contract or installment land contract, is a real estate agreement wherein the seller (also known as the "contract vendor") finances the purchase of the property, unlike a traditional mortgage where a lender provides the funds. In this arrangement, the contract purchaser takes immediate possession of the property but only gains legal title upon fulfilling all payment obligations. The Memphis Tennessee Notice of Default is typically issued by the contract vendor or their representative when the contract purchaser falls behind on their payment obligations. This document serves as a formal notification that the contract purchaser is in breach of the contract. It outlines the details of the missed payments, including the amounts owed, the due dates, and the length of the delinquency. The Notice of Default for Past Due Payments also informs the contract purchaser of the consequences of their non-payment. These consequences may include the potential for foreclosure proceedings, where the contract vendor can take legal action to regain possession of the property. Additionally, the notice may specify any penalties or fees associated with the default, such as late payment fees or additional legal costs. In Memphis, Tennessee, there may be variations of the Notice of Default for Past Due Payments. These variations can depend on specific clauses and conditions outlined in the original Contract for Deed agreement. Some possible variations could include: 1. Notice of Default with Cure Period: This type of notice gives the contract purchaser a specific deadline to cure the default by paying the past-due amounts and any associated fees before further action is taken. 2. Notice of Default without Cure Period: In situations where the contract agreement does not provide for a cure period, this notice emphasizes the immediate breach of contract and the potential commencement of foreclosure proceedings. 3. Notice of Intent to Accelerate: This type of notice informs the contract purchaser that if they fail to bring the payments up-to-date within a specified period, the contract vendor may accelerate the remaining balance of the contract, making it immediately due and payable in full. It is important to note that the specific content and format of the Memphis Tennessee Notice of Default may vary depending on local laws and regulations. It is always advisable for both parties involved in a Contract for Deed arrangement to seek legal counsel to ensure compliance with applicable laws and protect their interests.