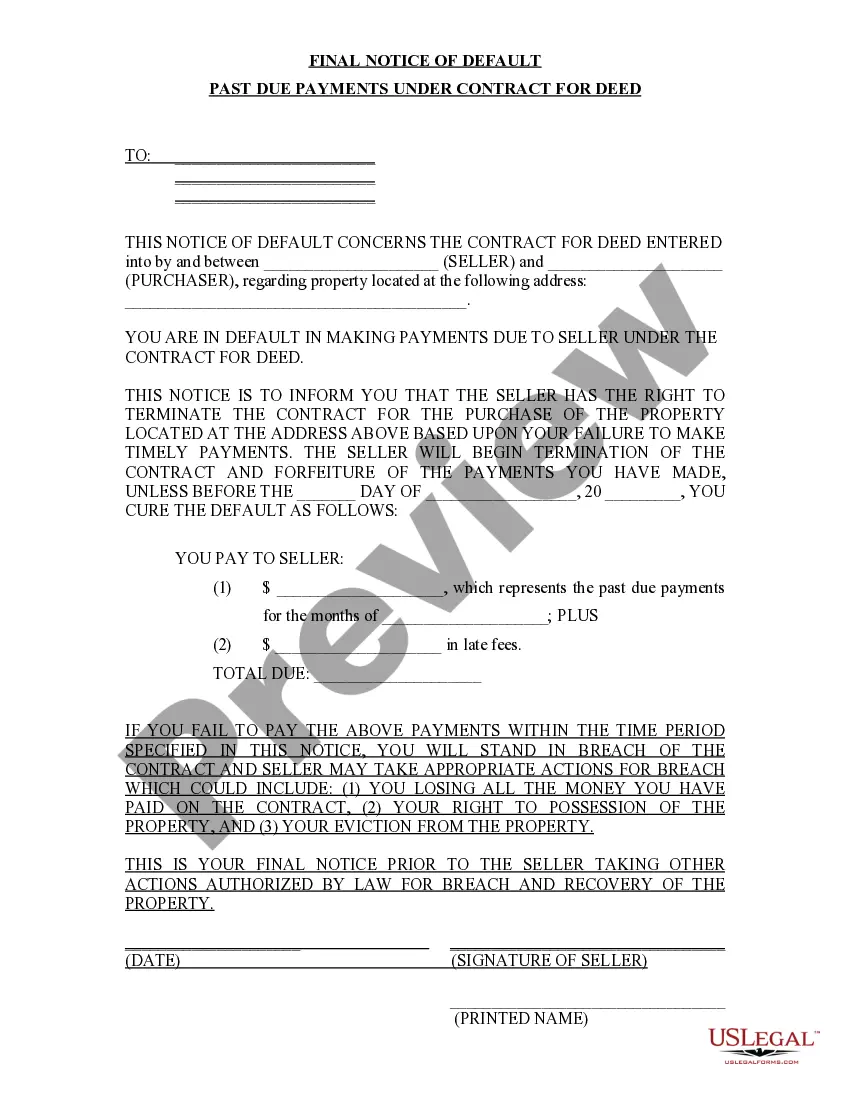

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Chattanooga Tennessee Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Chattanooga, Tennessee, individuals entering into a Contract for Deed may receive a Final Notice of Default for Past Due Payments if they have failed to meet their contractual obligations. This article aims to provide a detailed description of what this notice entails, its significance, and the potential consequences. Keywords: Chattanooga Tennessee, Final Notice of Default, Past Due Payments, Contract for Deed 1. Definition and Purpose: A Chattanooga Tennessee Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal communication sent by the contract holder to notify the buyer (also known as the Vendée) that they are in default for failing to make timely payments as specified in the contract terms. 2. Identifying Default: The notice will outline the overdue payment(s) and specify the date from which the default occurred. It will clearly stipulate the total past due amount owed by the Vendée. 3. Grace Period and Cure Period: The notice may denote a grace period, allowing the buyer to rectify the default within a specific timeframe. This period is referred to as the "cure period." 4. Consequences of Non-compliance: Failure to cure the default within the specified cure period may result in significant consequences, including foreclosure, termination of the Contract for Deed, and potential loss of equity or rights acquired through payments made towards the property. 5. Different Types of Final Notice of Default for Past Due Payments: a) Notice Type 1: Initial Notice of Default — Initial communication informing thVendéeee of the default and specifying the past due amount. b) Notice Type 2: Second Notice of Default — Follow-up notice sent if thVendéeee fails to cure the default within the grace period provided in the initial notice. c) Notice Type 3: Final Notice of Default — Sent if thVendéeee still fails to meet the contractual obligations within the cure period provided in the second notice. This notice typically marks a critical stage, as it may indicate the intention to initiate legal proceedings. 6. Legal Proceedings: If the Vendée does not cure the default within the cure period mentioned in the Final Notice of Default, the contract holder may pursue legal action, including foreclosure, to recover the property and outstanding payments. Conclusion: A Chattanooga Tennessee Final Notice of Default for Past Due Payments serves as a crucial warning to a buyer under a Contract for Deed who is not meeting their payment obligations. Understanding the implications and taking prompt action to address the default is essential to protect one's rights and avoid severe consequences of foreclosure. It is advised to seek legal guidance if faced with such a notice to ensure the best possible outcome.Title: Understanding Chattanooga Tennessee Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Chattanooga, Tennessee, individuals entering into a Contract for Deed may receive a Final Notice of Default for Past Due Payments if they have failed to meet their contractual obligations. This article aims to provide a detailed description of what this notice entails, its significance, and the potential consequences. Keywords: Chattanooga Tennessee, Final Notice of Default, Past Due Payments, Contract for Deed 1. Definition and Purpose: A Chattanooga Tennessee Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal communication sent by the contract holder to notify the buyer (also known as the Vendée) that they are in default for failing to make timely payments as specified in the contract terms. 2. Identifying Default: The notice will outline the overdue payment(s) and specify the date from which the default occurred. It will clearly stipulate the total past due amount owed by the Vendée. 3. Grace Period and Cure Period: The notice may denote a grace period, allowing the buyer to rectify the default within a specific timeframe. This period is referred to as the "cure period." 4. Consequences of Non-compliance: Failure to cure the default within the specified cure period may result in significant consequences, including foreclosure, termination of the Contract for Deed, and potential loss of equity or rights acquired through payments made towards the property. 5. Different Types of Final Notice of Default for Past Due Payments: a) Notice Type 1: Initial Notice of Default — Initial communication informing thVendéeee of the default and specifying the past due amount. b) Notice Type 2: Second Notice of Default — Follow-up notice sent if thVendéeee fails to cure the default within the grace period provided in the initial notice. c) Notice Type 3: Final Notice of Default — Sent if thVendéeee still fails to meet the contractual obligations within the cure period provided in the second notice. This notice typically marks a critical stage, as it may indicate the intention to initiate legal proceedings. 6. Legal Proceedings: If the Vendée does not cure the default within the cure period mentioned in the Final Notice of Default, the contract holder may pursue legal action, including foreclosure, to recover the property and outstanding payments. Conclusion: A Chattanooga Tennessee Final Notice of Default for Past Due Payments serves as a crucial warning to a buyer under a Contract for Deed who is not meeting their payment obligations. Understanding the implications and taking prompt action to address the default is essential to protect one's rights and avoid severe consequences of foreclosure. It is advised to seek legal guidance if faced with such a notice to ensure the best possible outcome.