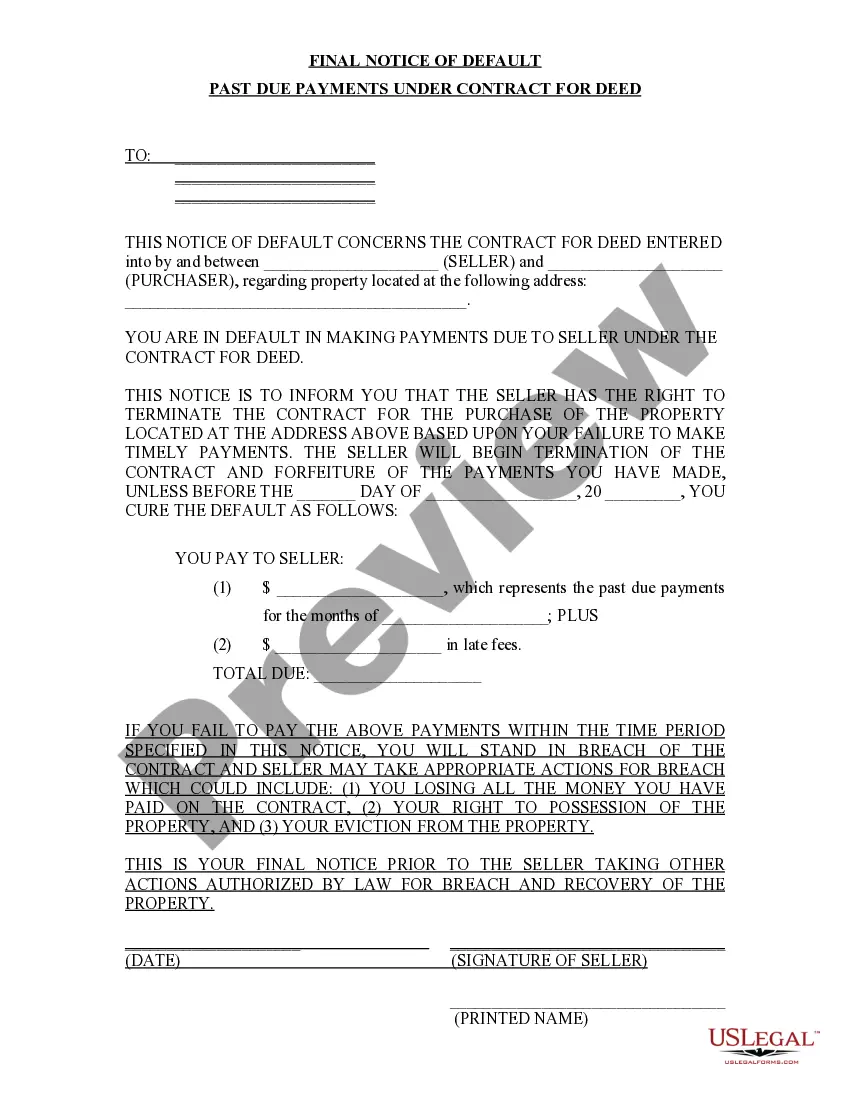

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

A Clarksville Tennessee Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document issued by a lender or seller to inform the buyer that they have failed to make their scheduled payments on time. This notice serves as a final warning to the buyer that they are at risk of losing their ownership rights to the property unless they take immediate action to remedy the past due payments. In Clarksville Tennessee, there are two main types of Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. Notice of Default: This notice is typically sent after the buyer has missed multiple payments and failed to respond to previous warnings or requests for payment. It outlines the specific amount owed, the payment due date, and provides a detailed explanation of the consequences of continued non-payment. The notice also specifies a deadline by which the buyer must bring the payments up to date or face further legal action. 2. Notice of Intent to Accelerate: If the buyer fails to cure the delinquent payments within the given timeframe, the lender or seller may issue a Notice of Intent to Accelerate. This notice informs the buyer that the entire remaining balance on the Contract for Deed will become due immediately if they do not fulfill their obligations. It outlines the total amount owed, including principal, interest, and any penalties or fees that have accrued due to the past due payments. Keywords: Clarksville Tennessee, Final Notice of Default, Past Due Payments, Contract for Deed, legal document, lender, seller, buyer, ownership rights, immediate action, remedy, warning, consequences, non-payment, Notice of Default, Notice of Intent to Accelerate, delinquent payments, timeframe, balance, principal, interest, penalties, fees.