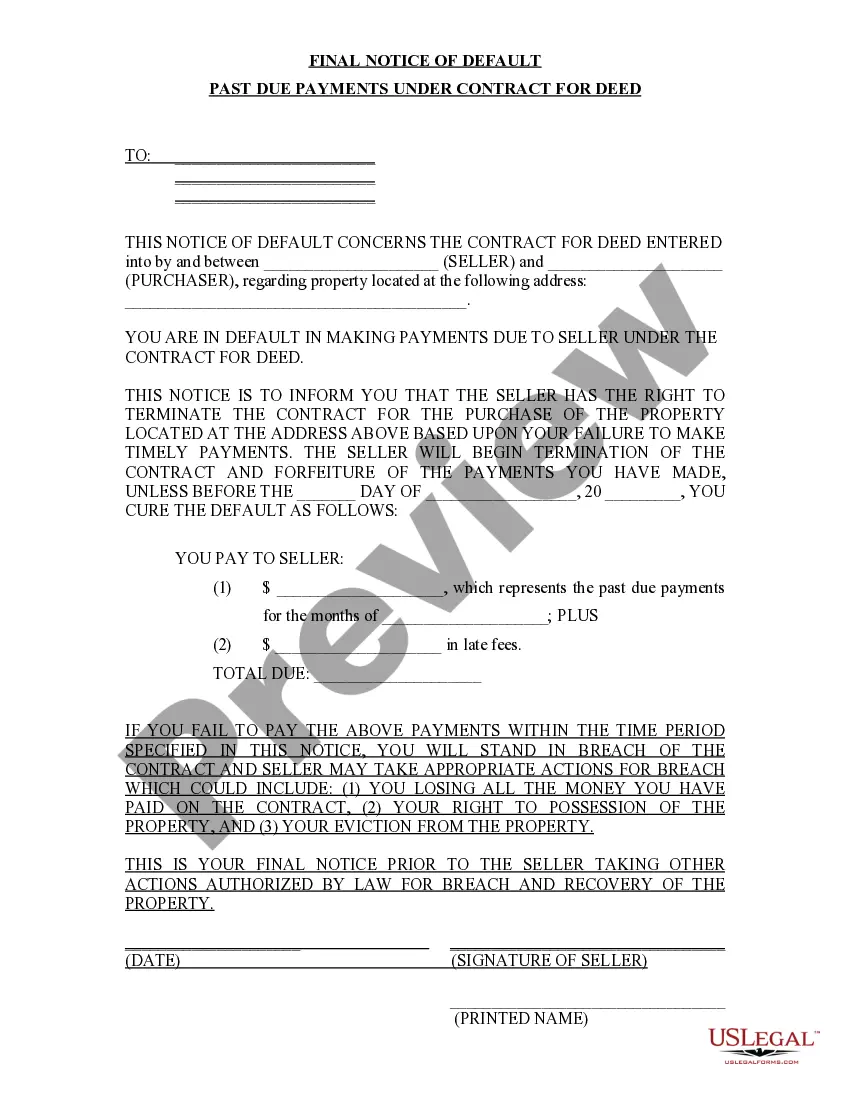

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Knoxville Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal communication indicating the borrower's failure to meet the necessary payment requirements outlined in the contract. This notice is generally issued when multiple payment due dates have been missed, prompting the lender to take action. In this context, Contract for Deed refers to a legal agreement where the buyer purchases a property directly from the seller. The buyer makes regular installments towards the purchase price over a predetermined period, while the seller holds the title and acts as the lender. The Final Notice of Default is a crucial step in the foreclosure process, and it signifies the lender's intent to proceed with legal action if the default is not rectified promptly. It is imperative for both parties involved in the Contract for Deed to be aware of their respective obligations and responsibilities to avoid reaching this point. Some common variations or types of Knoxville Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed are: 1. Notice of Default Regarding Missed Payments: This type of notice is issued when the borrower fails to make one or more monthly payments as agreed upon in the contract. 2. Notice of Acceleration: This notice is sent when the lender accelerates the remaining balance of the loan, making the full amount due immediately due to repeated or significant defaults. 3. Notice of Intent to Foreclose: Issued if the borrower fails to bring the account current or fails to establish a feasible plan to repay the past due amount within a given timeframe. 4. Notice of Sale: This notice is sent when the lender decides to proceed with foreclosure and sell the property at a public auction to recover the unpaid debt. In any case, receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed should be taken seriously. It is vital for the borrower to communicate with the lender to explore potential alternatives, such as loan modification or renegotiating the payment terms, to overcome the default and prevent foreclosure proceedings. Seeking legal counsel and understanding the specific terms outlined in the Contract for Deed can also prove beneficial during this challenging period.Knoxville Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal communication indicating the borrower's failure to meet the necessary payment requirements outlined in the contract. This notice is generally issued when multiple payment due dates have been missed, prompting the lender to take action. In this context, Contract for Deed refers to a legal agreement where the buyer purchases a property directly from the seller. The buyer makes regular installments towards the purchase price over a predetermined period, while the seller holds the title and acts as the lender. The Final Notice of Default is a crucial step in the foreclosure process, and it signifies the lender's intent to proceed with legal action if the default is not rectified promptly. It is imperative for both parties involved in the Contract for Deed to be aware of their respective obligations and responsibilities to avoid reaching this point. Some common variations or types of Knoxville Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed are: 1. Notice of Default Regarding Missed Payments: This type of notice is issued when the borrower fails to make one or more monthly payments as agreed upon in the contract. 2. Notice of Acceleration: This notice is sent when the lender accelerates the remaining balance of the loan, making the full amount due immediately due to repeated or significant defaults. 3. Notice of Intent to Foreclose: Issued if the borrower fails to bring the account current or fails to establish a feasible plan to repay the past due amount within a given timeframe. 4. Notice of Sale: This notice is sent when the lender decides to proceed with foreclosure and sell the property at a public auction to recover the unpaid debt. In any case, receiving a Final Notice of Default for Past Due Payments in connection with a Contract for Deed should be taken seriously. It is vital for the borrower to communicate with the lender to explore potential alternatives, such as loan modification or renegotiating the payment terms, to overcome the default and prevent foreclosure proceedings. Seeking legal counsel and understanding the specific terms outlined in the Contract for Deed can also prove beneficial during this challenging period.