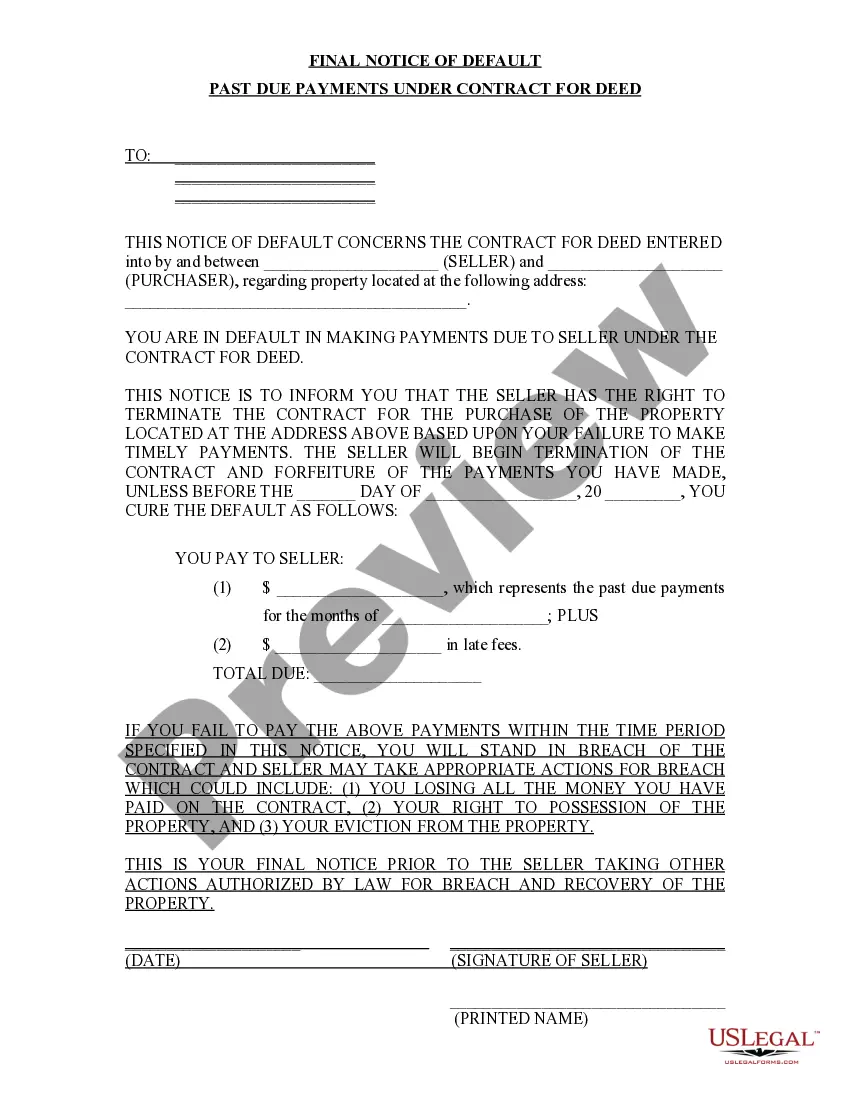

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

The Memphis Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legally binding document that serves as a notification to the party who entered into a contract for deed (also known as a land contract) that they have failed to make their agreed-upon payments on time and are now in default. This notice is a crucial step taken by the party entitled to receive the payments, such as the seller, lender, or designated party, to formally inform the debtor of their delinquency and to initiate the process of resolving the issue. It is vital to include specific keywords to ensure the notice is accurate and comprehensive. The notice should clearly state the exact nature of the default, specifying the payments that have gone unpaid and the respective due dates. It should mention the outstanding balance, including any interest or fees that may have accrued due to the late payments, and highlight the total amount required to bring the account up to date. It is essential to establish the timeline within which the debtor must rectify the default. This information should be explicitly stated in the notice to provide the debtor with a clear understanding of the gravity of the situation and the urgency for them to take immediate action. The deadline should be in line with the terms outlined in the original contract for deed or any subsequent agreements that have been made. If applicable, different types of Memphis Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed may include variations such as: 1. First Notice of Default: This notice is issued when the debtor fails to make a required payment for the first time. It acts as a warning and a reminder of the consequences of continued non-payment. 2. Second Notice of Default: If the debtor fails to rectify the initial default within the specified timeline, a second notice is issued. This notice emphasizes the seriousness of the situation and may provide additional information, such as potential legal actions or the involvement of collection agencies. 3. Final Notice of Default: The Final Notice of Default is the last formal communication before the initiation of legal proceedings or other drastic actions to enforce payment. It usually includes more explicit language and may warn of potential consequences such as foreclosure, repossession, or legal action to recover the property or collect the outstanding debt. All notices should be drafted in accordance with the laws and regulations governing contracts for deed in the state of Tennessee, specifically tailored to the unique circumstances of the individual agreement. It is crucial to consult legal professionals to ensure that the notice complies with all relevant rules to enforce the rights and remedies available to the party issuing the notice.The Memphis Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legally binding document that serves as a notification to the party who entered into a contract for deed (also known as a land contract) that they have failed to make their agreed-upon payments on time and are now in default. This notice is a crucial step taken by the party entitled to receive the payments, such as the seller, lender, or designated party, to formally inform the debtor of their delinquency and to initiate the process of resolving the issue. It is vital to include specific keywords to ensure the notice is accurate and comprehensive. The notice should clearly state the exact nature of the default, specifying the payments that have gone unpaid and the respective due dates. It should mention the outstanding balance, including any interest or fees that may have accrued due to the late payments, and highlight the total amount required to bring the account up to date. It is essential to establish the timeline within which the debtor must rectify the default. This information should be explicitly stated in the notice to provide the debtor with a clear understanding of the gravity of the situation and the urgency for them to take immediate action. The deadline should be in line with the terms outlined in the original contract for deed or any subsequent agreements that have been made. If applicable, different types of Memphis Tennessee Final Notice of Default for Past Due Payments in connection with Contract for Deed may include variations such as: 1. First Notice of Default: This notice is issued when the debtor fails to make a required payment for the first time. It acts as a warning and a reminder of the consequences of continued non-payment. 2. Second Notice of Default: If the debtor fails to rectify the initial default within the specified timeline, a second notice is issued. This notice emphasizes the seriousness of the situation and may provide additional information, such as potential legal actions or the involvement of collection agencies. 3. Final Notice of Default: The Final Notice of Default is the last formal communication before the initiation of legal proceedings or other drastic actions to enforce payment. It usually includes more explicit language and may warn of potential consequences such as foreclosure, repossession, or legal action to recover the property or collect the outstanding debt. All notices should be drafted in accordance with the laws and regulations governing contracts for deed in the state of Tennessee, specifically tailored to the unique circumstances of the individual agreement. It is crucial to consult legal professionals to ensure that the notice complies with all relevant rules to enforce the rights and remedies available to the party issuing the notice.