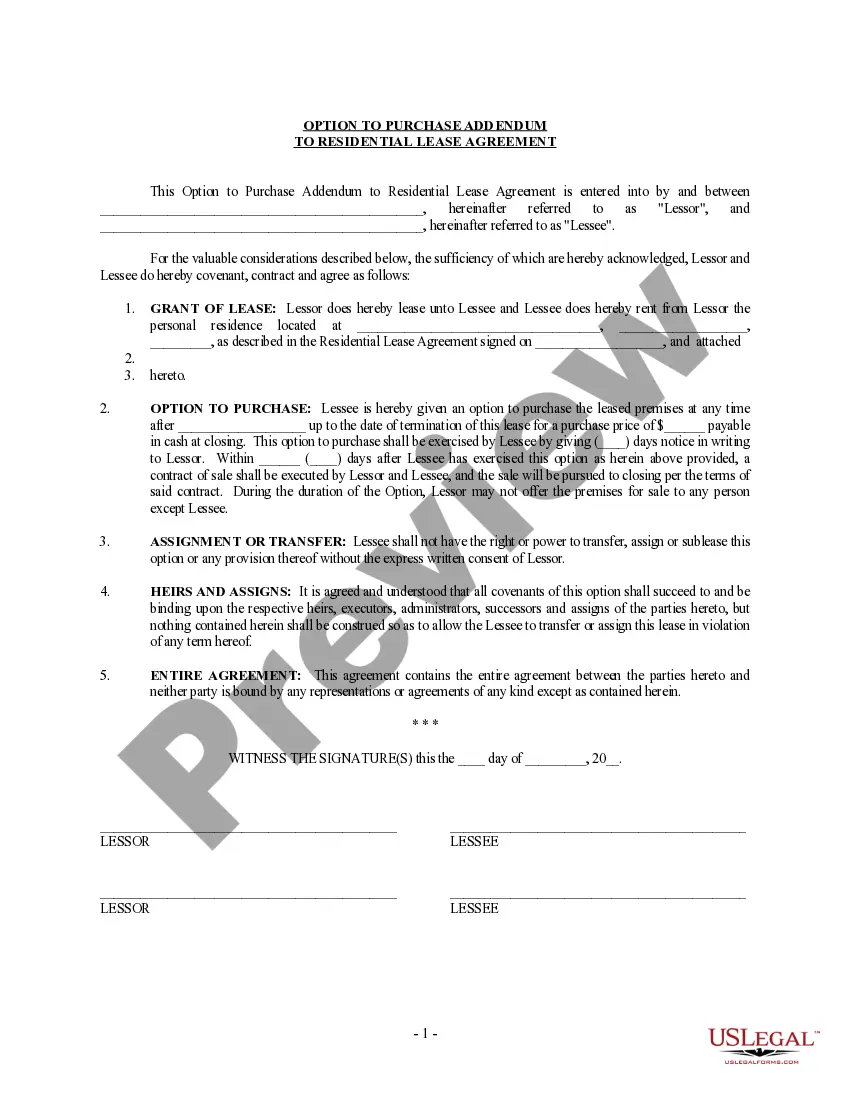

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legally binding agreement that provides tenants with the opportunity to eventually purchase the leased property. This option is particularly beneficial for individuals who aspire to become homeowners but may not have the immediate means to do so. This addendum acts as an additional clause to the standard residential lease agreement, outlining the terms and conditions of the lease-to-own arrangement. The Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own offerseveralnt types, which can be customized based on specific circumstances and preferences: 1. Fixed Purchase Price Addendum: This type stipulates a predetermined price at which the tenant can purchase the property upon fulfilling the lease term. The price remains unaffected by any fluctuations in the real estate market, offering stability and predictability to both parties involved. 2. Graduated Purchase Price Addendum: With this type, the purchase price is determined based on a graduated scale that factors in the length of the lease term. For instance, the longer the tenant remains in the property, the lower the purchase price may become. This incentivizes tenants to stay for longer periods, providing an opportunity to accumulate savings to secure financing. 3. Market Value Purchase Price Addendum: This type requires the property's purchase price to be determined based on the current market value at the time the tenant chooses to exercise the purchase option. The advantage of this addendum is that it allows tenants to potentially benefit from any appreciation in the property's value during the lease term. 4. Rent Credit Addendum: This addendum offers tenants the opportunity to accumulate credits with each rental payment, which can later be applied towards the down payment or closing costs when exercising the purchase option. The accumulated credits act as an incentive to encourage tenants to pursue eventual homeownership. 5. Non-Refundable Option Fee Addendum: Sometimes, landlords may request an upfront option fee to secure the tenant's exclusive option to purchase the property within a specified timeframe. This fee is non-refundable and serves as compensation for the landlord’s loss if the tenant chooses not to exercise the purchase option. It's important for both landlords and tenants to thoroughly understand and agree upon the terms specified in the Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own. Consulting with a reputable real estate attorney can provide invaluable guidance throughout the process to ensure the agreement meets all legal requirements and protects the interests of both parties.Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legally binding agreement that provides tenants with the opportunity to eventually purchase the leased property. This option is particularly beneficial for individuals who aspire to become homeowners but may not have the immediate means to do so. This addendum acts as an additional clause to the standard residential lease agreement, outlining the terms and conditions of the lease-to-own arrangement. The Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own offerseveralnt types, which can be customized based on specific circumstances and preferences: 1. Fixed Purchase Price Addendum: This type stipulates a predetermined price at which the tenant can purchase the property upon fulfilling the lease term. The price remains unaffected by any fluctuations in the real estate market, offering stability and predictability to both parties involved. 2. Graduated Purchase Price Addendum: With this type, the purchase price is determined based on a graduated scale that factors in the length of the lease term. For instance, the longer the tenant remains in the property, the lower the purchase price may become. This incentivizes tenants to stay for longer periods, providing an opportunity to accumulate savings to secure financing. 3. Market Value Purchase Price Addendum: This type requires the property's purchase price to be determined based on the current market value at the time the tenant chooses to exercise the purchase option. The advantage of this addendum is that it allows tenants to potentially benefit from any appreciation in the property's value during the lease term. 4. Rent Credit Addendum: This addendum offers tenants the opportunity to accumulate credits with each rental payment, which can later be applied towards the down payment or closing costs when exercising the purchase option. The accumulated credits act as an incentive to encourage tenants to pursue eventual homeownership. 5. Non-Refundable Option Fee Addendum: Sometimes, landlords may request an upfront option fee to secure the tenant's exclusive option to purchase the property within a specified timeframe. This fee is non-refundable and serves as compensation for the landlord’s loss if the tenant chooses not to exercise the purchase option. It's important for both landlords and tenants to thoroughly understand and agree upon the terms specified in the Chattanooga Tennessee Option to Purchase Addendum to Residential Lease — Lease or Rent to Own. Consulting with a reputable real estate attorney can provide invaluable guidance throughout the process to ensure the agreement meets all legal requirements and protects the interests of both parties.