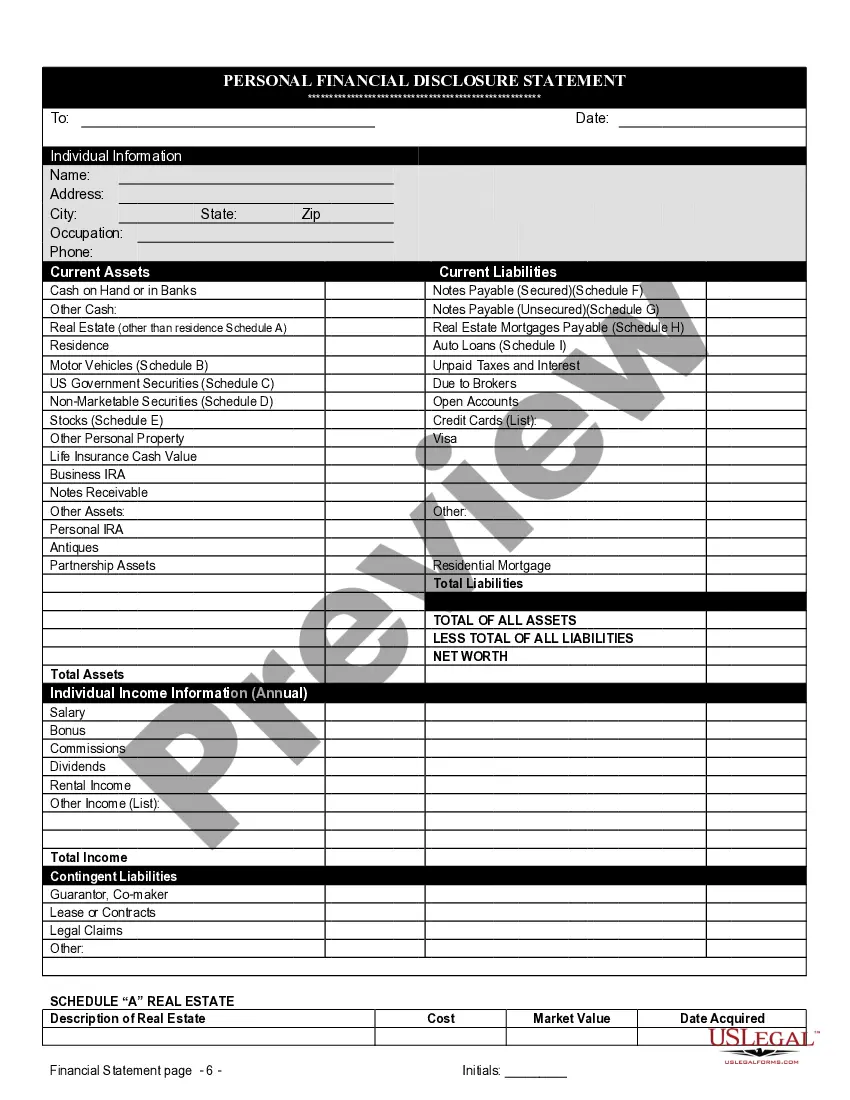

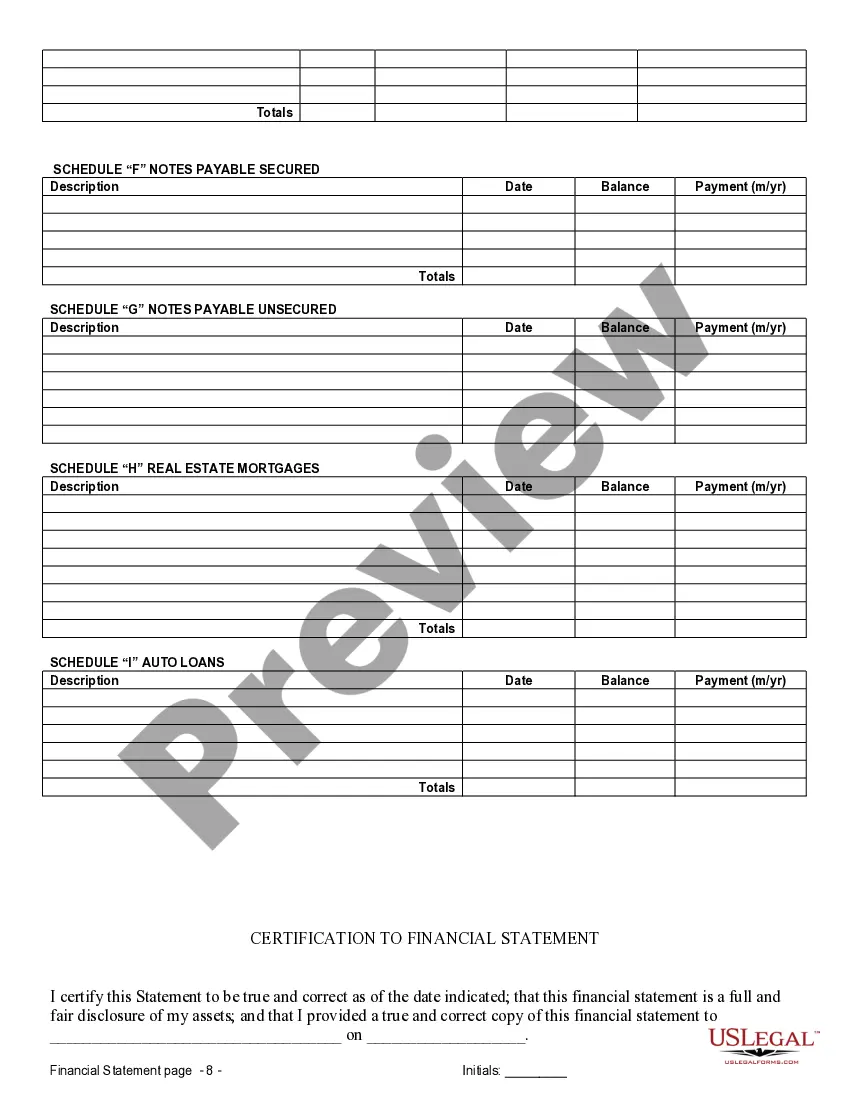

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

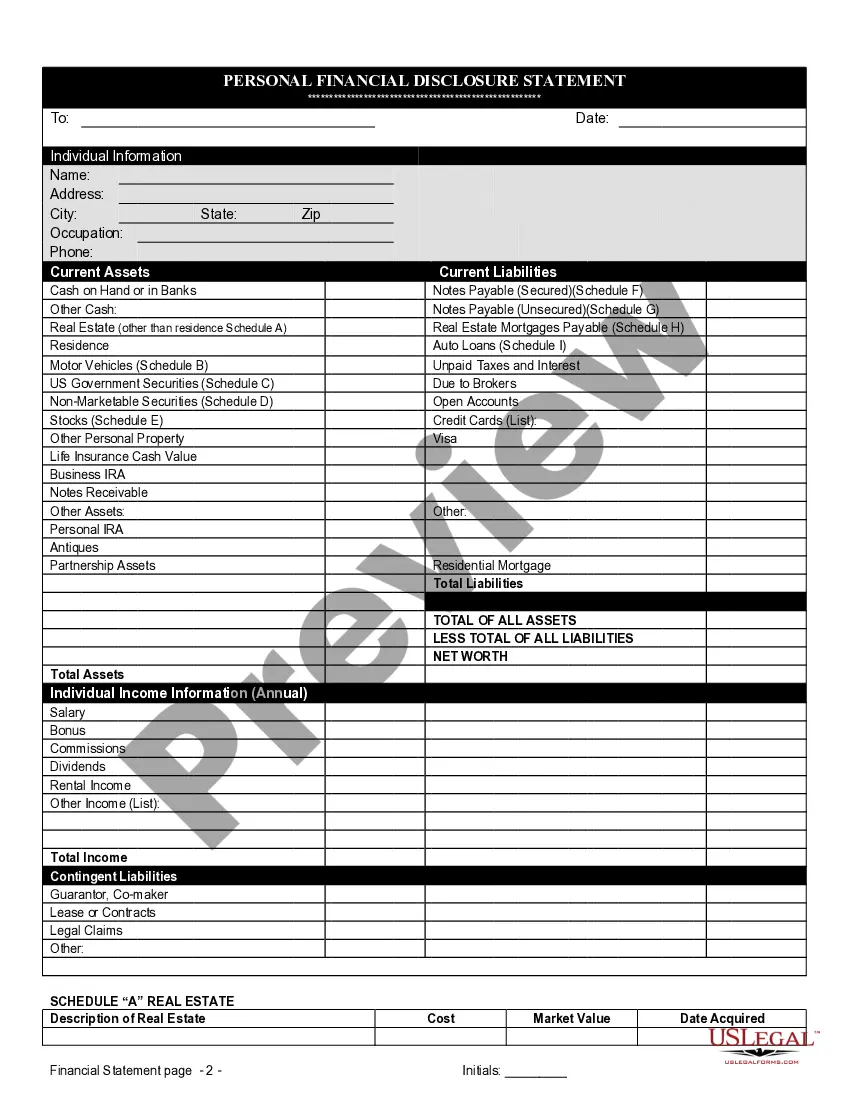

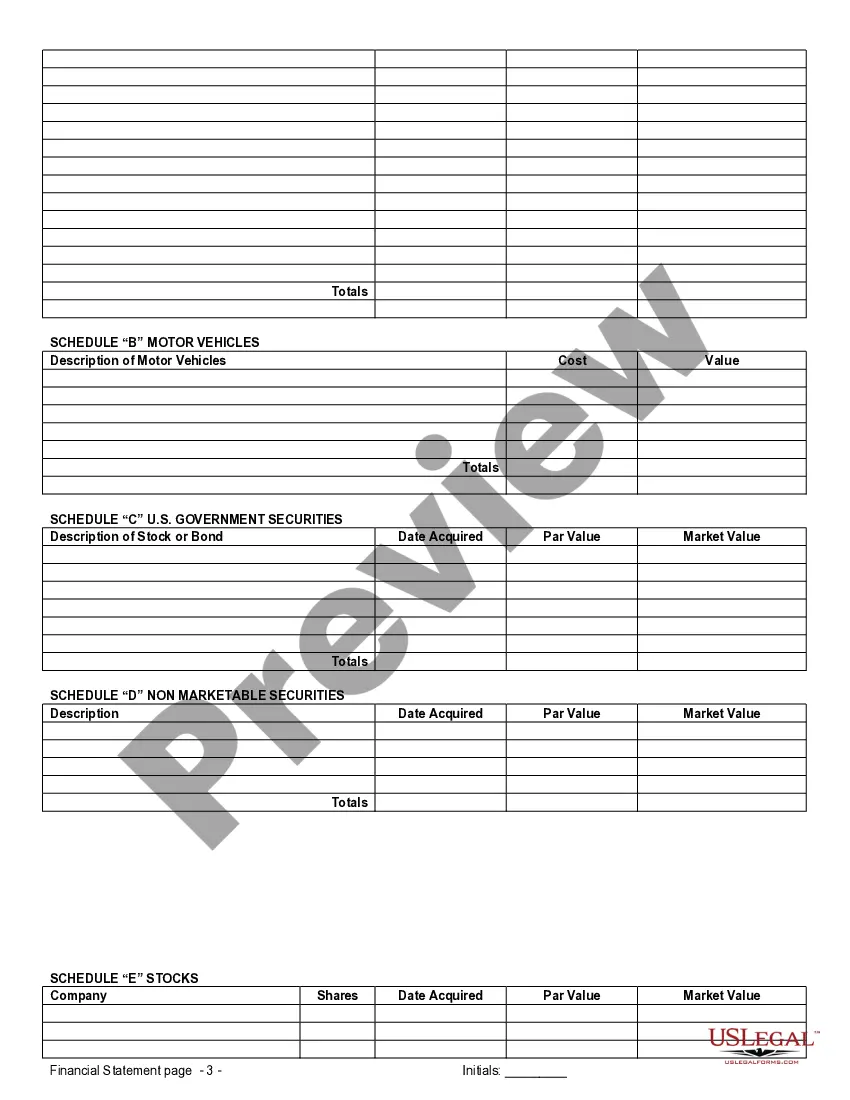

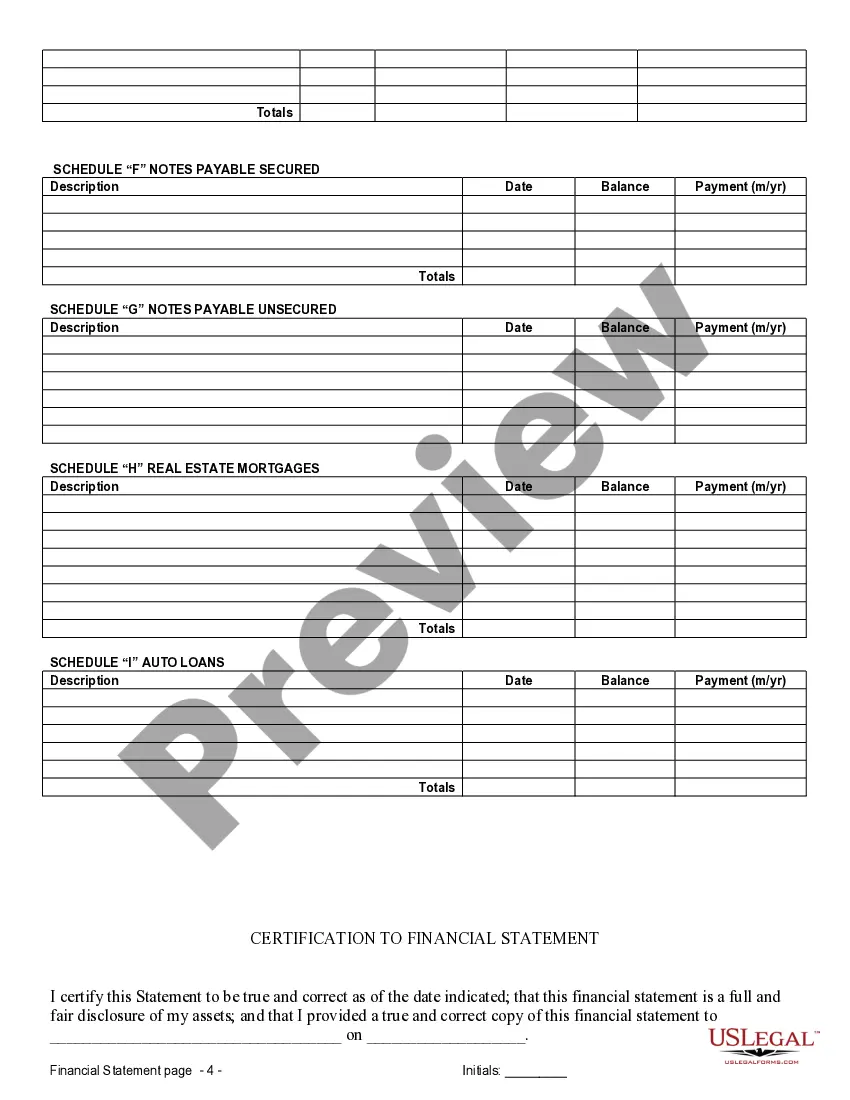

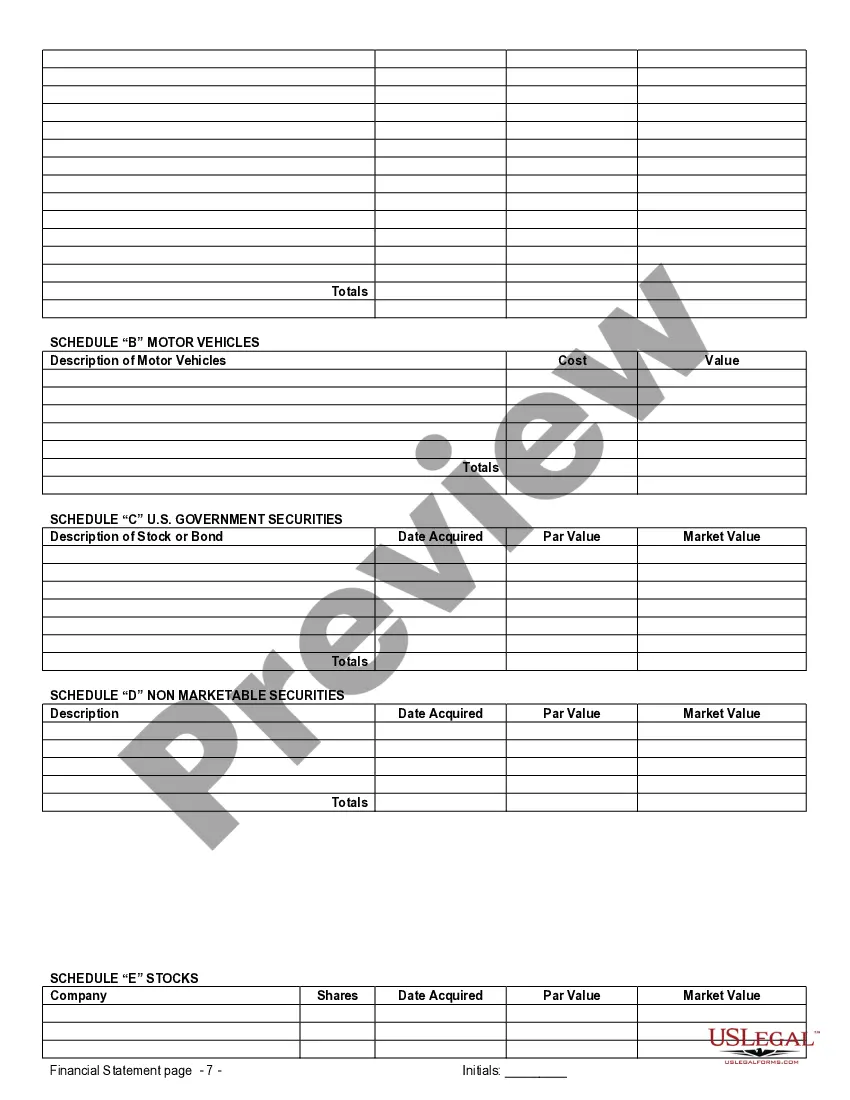

Clarksville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement In Clarksville, Tennessee, financial statements are essential when establishing a prenuptial or premarital agreement. These statements provide a comprehensive overview of each party's financial situation before entering into marriage, ensuring transparency and protecting both partners' interests in the event of any future disputes or divorce proceedings. Here is a detailed description of the different types of Clarksville Tennessee Financial Statements relevant to Prenuptial Premarital Agreements: 1. Personal Asset Statement: This type of financial statement outlines the individual's assets, including real estate properties, vehicles, bank accounts, investments, and any other valuable possessions. Each party must provide a detailed inventory of their personal assets along with their respective market values. 2. Liability Statement: A liability statement discloses any outstanding debts or financial obligations that each party may have, such as mortgages, loans, credit card debts, or tax liabilities. This statement is crucial as it allows both individuals to be fully aware of their future spouse's financial responsibilities. 3. Income Statement: An income statement presents an overview of each party's annual and monthly income from all sources, including employment, investments, self-employment, or any other means of generating income. This statement is crucial for determining the financial contributions of each partner during the marriage and any potential spousal support in case of a divorce. 4. Tax Returns and W-2 Forms: Providing copies of recent tax returns and W-2 forms adds credibility to the financial statements and ensures accurate reporting of income and tax obligations. These documents can also help establish financial patterns and reveal any potential discrepancies in the provided statements. 5. Business Financial Statements: If either party owns a business or is self-employed, additional financial statements related to the business may be required. These may include balance sheets, profit and loss statements, cash flow statements, and other relevant financial documents related to the business's operations and assets. It is important to note that these financial statements must be prepared accurately and diligently, reflecting the current financial standing of each individual involved. Additionally, seeking the guidance of a qualified attorney or financial professional experienced in prenuptial agreements is highly recommended ensuring compliance with local laws and regulations and to maximize the agreement's effectiveness and enforceability. By detailing and disclosing their financial backgrounds through these statements, couples residing in Clarksville, Tennessee, can enter into a prenuptial or premarital agreement with clarity and confidence, safeguarding their assets and ensuring a fair resolution in case of unforeseen circumstances.Clarksville Tennessee Financial Statements only in Connection with Prenuptial Premarital Agreement In Clarksville, Tennessee, financial statements are essential when establishing a prenuptial or premarital agreement. These statements provide a comprehensive overview of each party's financial situation before entering into marriage, ensuring transparency and protecting both partners' interests in the event of any future disputes or divorce proceedings. Here is a detailed description of the different types of Clarksville Tennessee Financial Statements relevant to Prenuptial Premarital Agreements: 1. Personal Asset Statement: This type of financial statement outlines the individual's assets, including real estate properties, vehicles, bank accounts, investments, and any other valuable possessions. Each party must provide a detailed inventory of their personal assets along with their respective market values. 2. Liability Statement: A liability statement discloses any outstanding debts or financial obligations that each party may have, such as mortgages, loans, credit card debts, or tax liabilities. This statement is crucial as it allows both individuals to be fully aware of their future spouse's financial responsibilities. 3. Income Statement: An income statement presents an overview of each party's annual and monthly income from all sources, including employment, investments, self-employment, or any other means of generating income. This statement is crucial for determining the financial contributions of each partner during the marriage and any potential spousal support in case of a divorce. 4. Tax Returns and W-2 Forms: Providing copies of recent tax returns and W-2 forms adds credibility to the financial statements and ensures accurate reporting of income and tax obligations. These documents can also help establish financial patterns and reveal any potential discrepancies in the provided statements. 5. Business Financial Statements: If either party owns a business or is self-employed, additional financial statements related to the business may be required. These may include balance sheets, profit and loss statements, cash flow statements, and other relevant financial documents related to the business's operations and assets. It is important to note that these financial statements must be prepared accurately and diligently, reflecting the current financial standing of each individual involved. Additionally, seeking the guidance of a qualified attorney or financial professional experienced in prenuptial agreements is highly recommended ensuring compliance with local laws and regulations and to maximize the agreement's effectiveness and enforceability. By detailing and disclosing their financial backgrounds through these statements, couples residing in Clarksville, Tennessee, can enter into a prenuptial or premarital agreement with clarity and confidence, safeguarding their assets and ensuring a fair resolution in case of unforeseen circumstances.