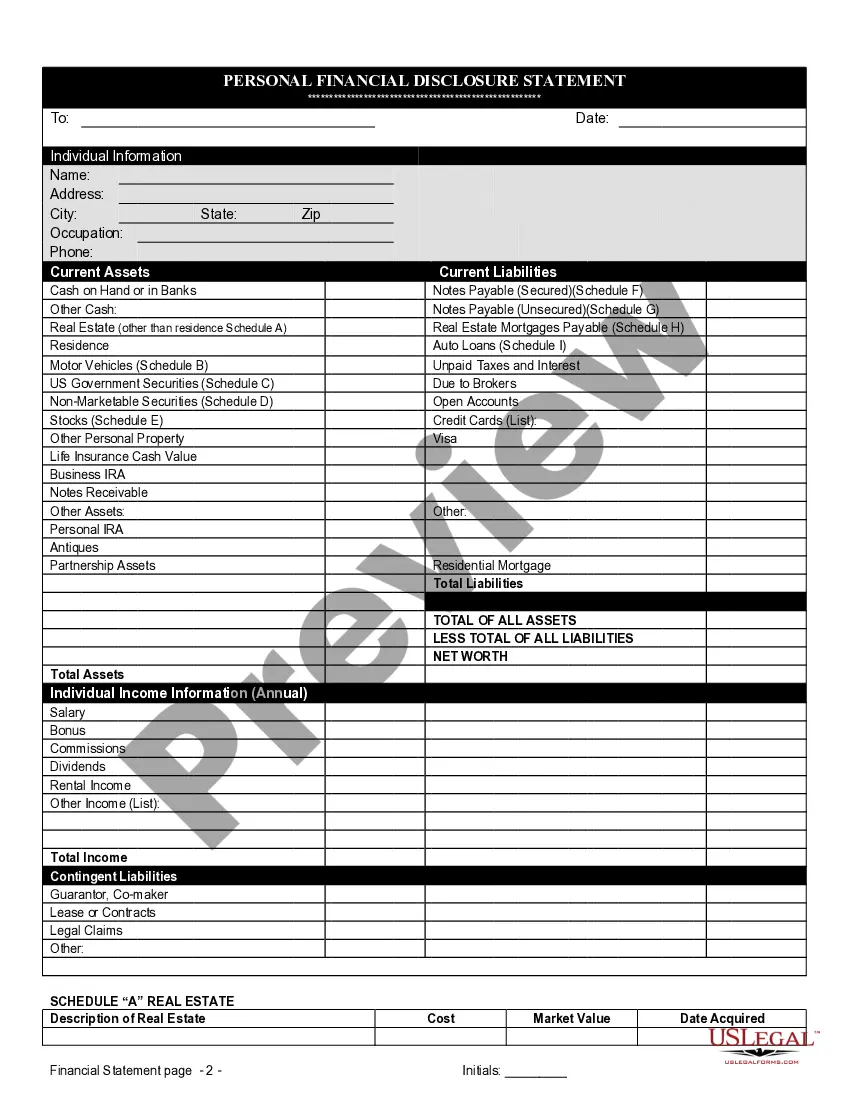

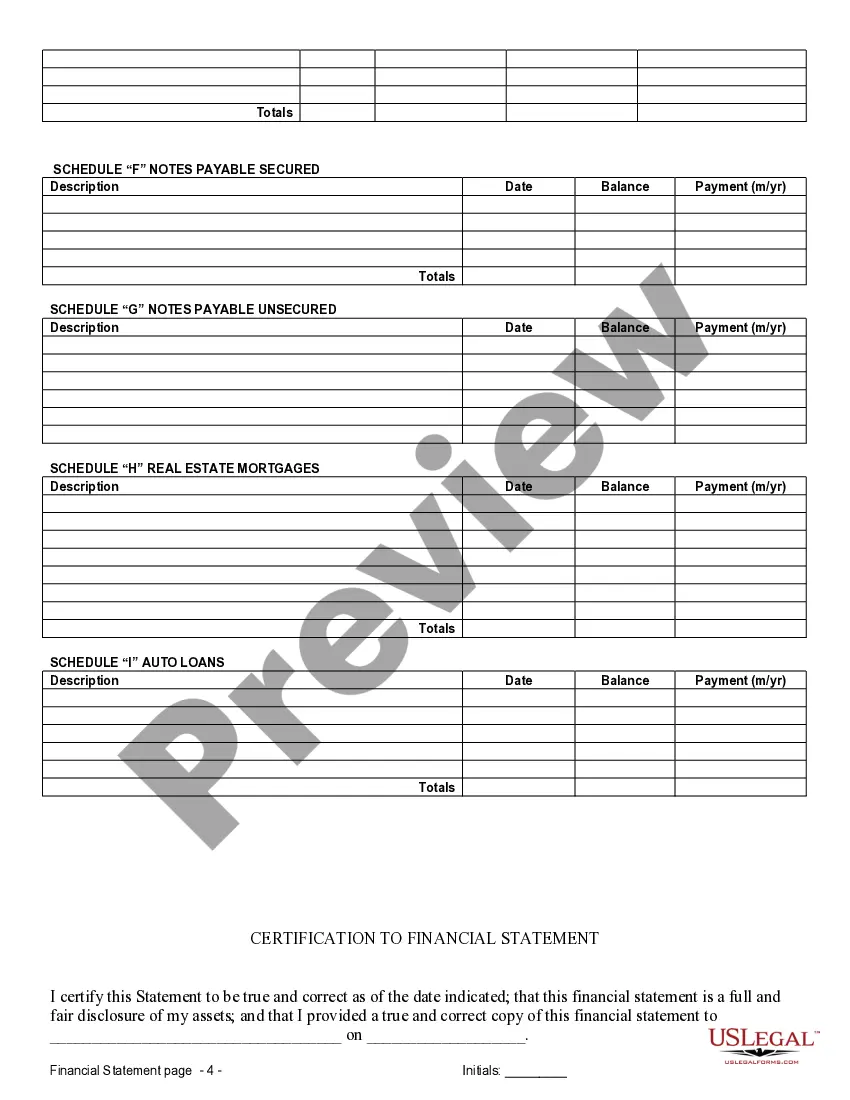

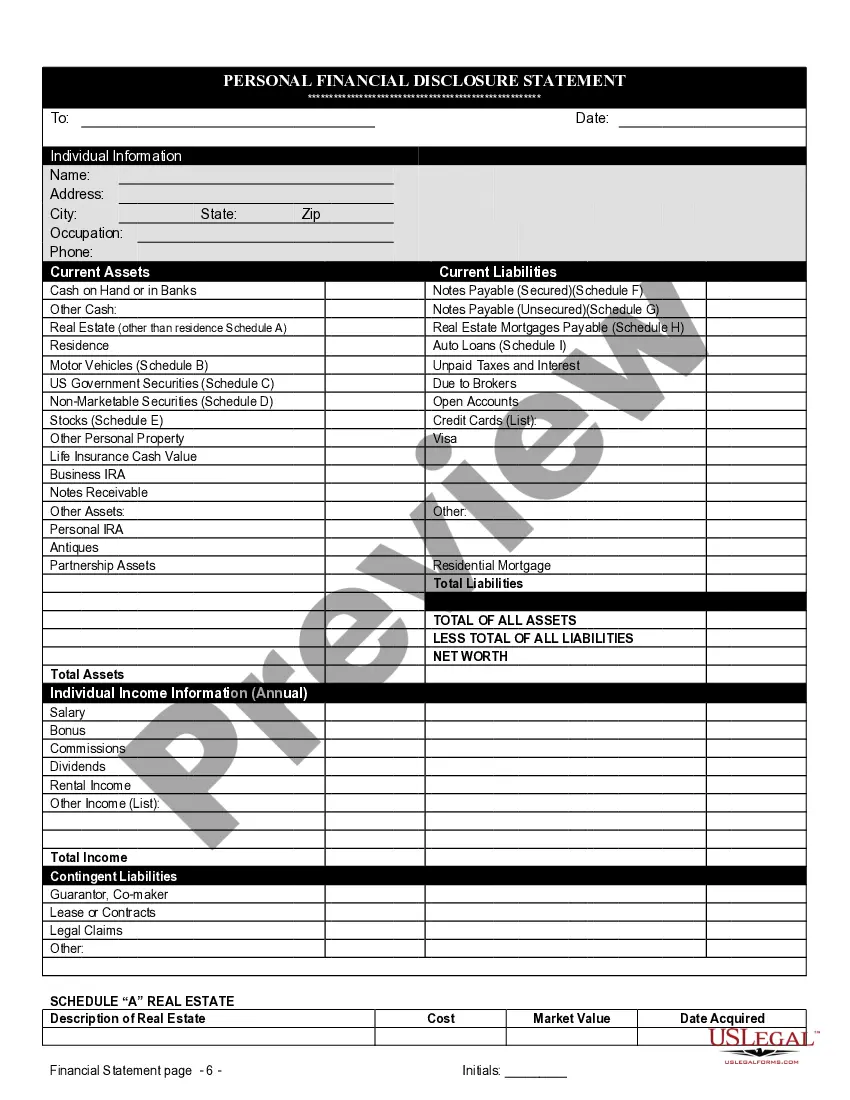

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

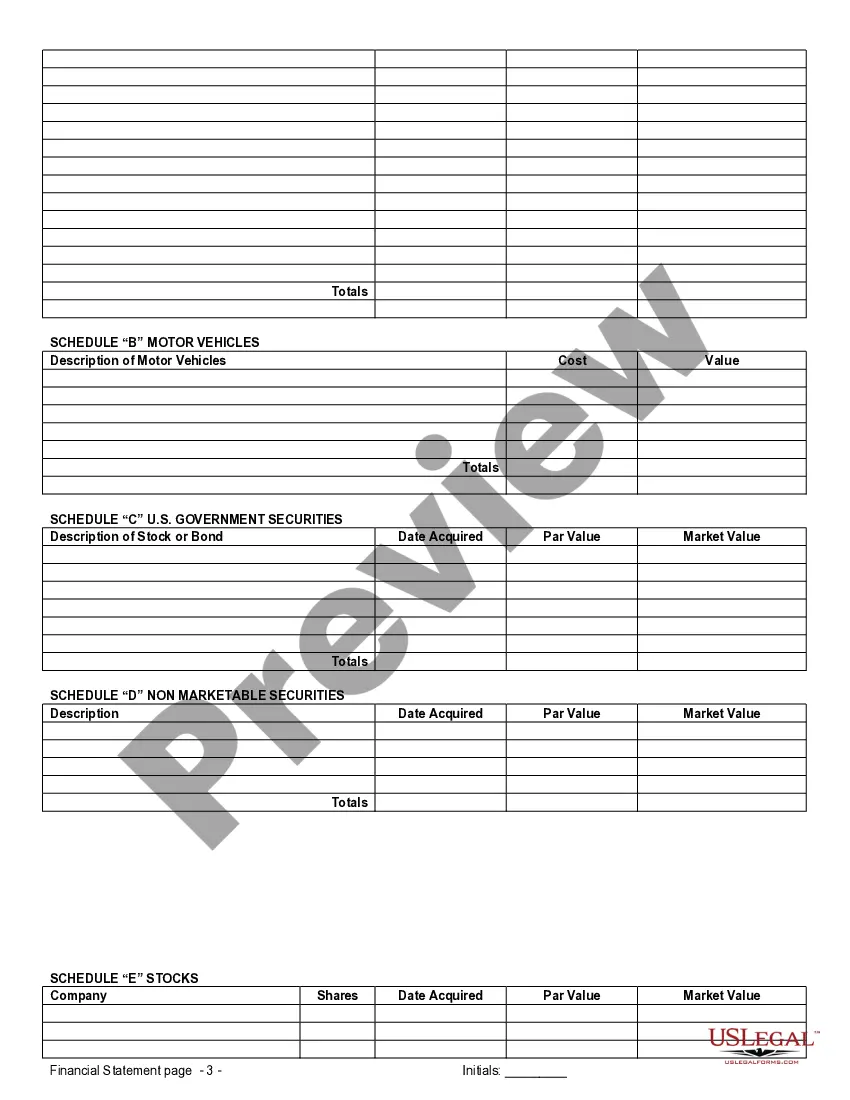

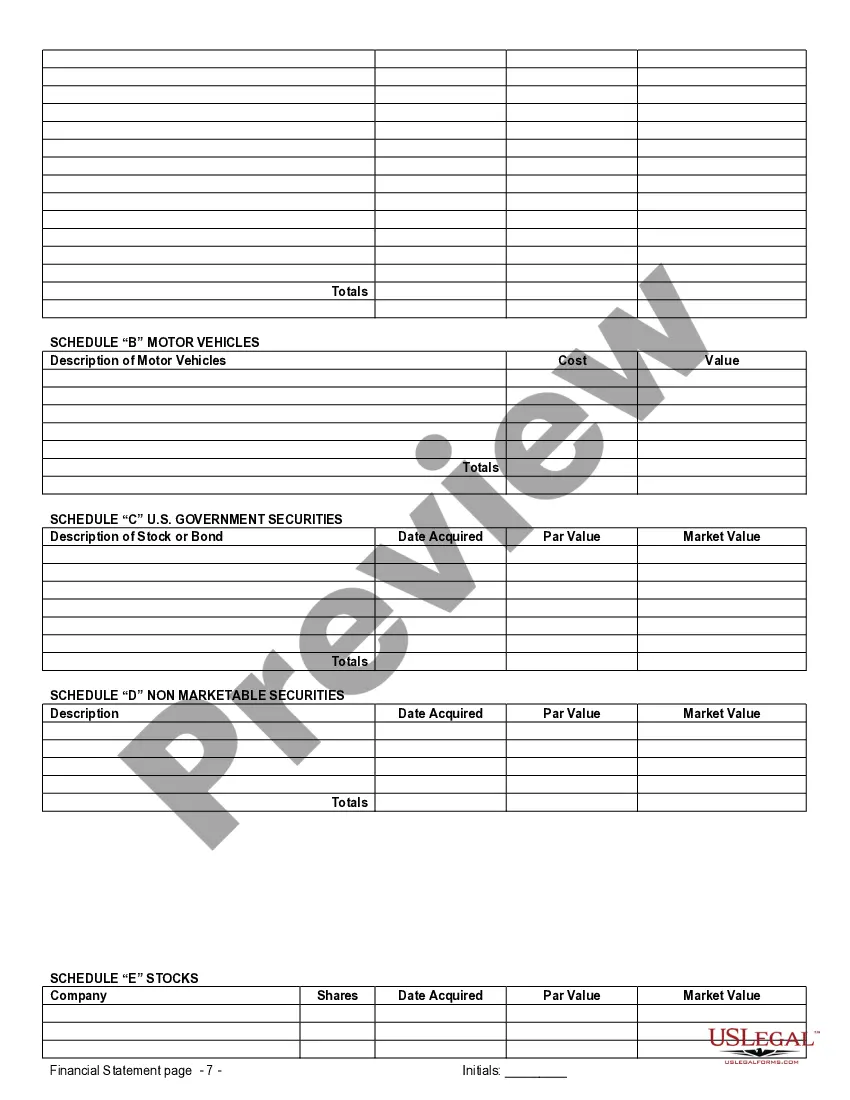

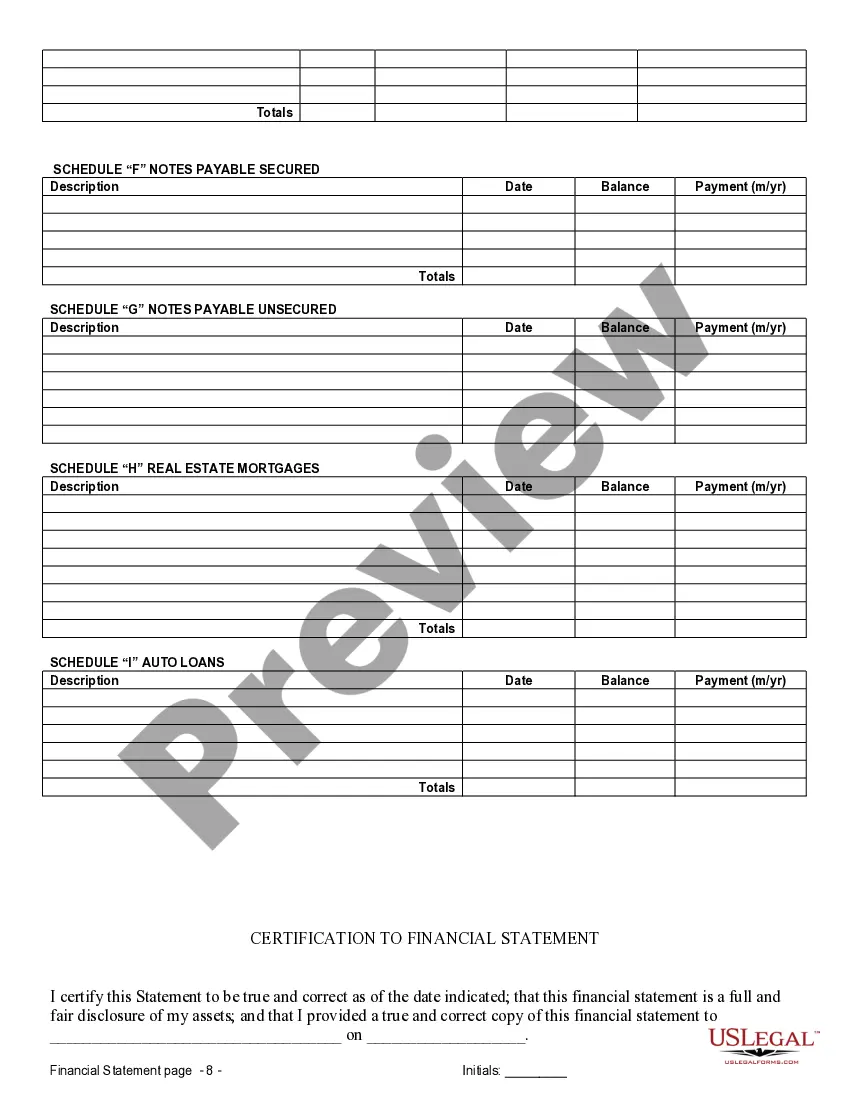

Nashville Tennessee Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Nashville, Tennessee, financial statements play a crucial role in prenuptial and premarital agreements. This detailed description will provide you with a comprehensive understanding of what Nashville financial statements entail, their significance in the context of prenuptial agreements, and explore various types of financial statements used in this legal process. Financial statements hold immense importance in prenuptial or premarital agreements as they allow couples to disclose their assets, liabilities, income, and expenses. These statements help establish transparency, promote fairness, and protect the interests of both parties involved. When preparing for a prenuptial agreement in Nashville, accurate and thorough financial statements are essential to ensure a successful and legally-binding agreement. Different types of financial statements may be included in a prenuptial or premarital agreement, varying based on individual circumstances. The key types include: 1. Personal Financial Statements: These statements outline an individual's financial standing, including details about their assets (such as real estate, investment portfolios, cash, or personal property) and liabilities (such as mortgages, loans, or credit card debts). This provides a clear snapshot of an individual's overall financial situation. 2. Business Financial Statements: If either party owns a business, business financial statements should be included. These statements detail the company's financial health, including revenues, expenses, assets, liabilities, and any potential disputes or outstanding litigation. Clear visibility into the business's financial state helps determine how marital property may be treated in case of a divorce. 3. Tax Returns and Tax-Related Financial Statements: Tax returns are crucial financial documents that provide an overview of an individual's income, deductions, and other relevant information. When preparing a prenuptial agreement in Nashville, providing copies of recent tax returns is essential for understanding an individual's financial situation and full disclosure of their financial obligations. 4. Retirement Account Statements: Detailed statements from retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, or pension plans, should be included. These statements show the current value of the accounts, contributions made during the marriage, and any other pertinent information. 5. Bank Statements and Investment Account Statements: Providing bank statements and investment account statements helps verify an individual's income, savings, investments, and any debts related to these accounts. These statements ensure transparency, allowing both parties to make informed decisions regarding the division of assets and liabilities in a prenuptial agreement. 6. Pay Stubs and Employment Contracts: Including recent pay stubs and employment contracts ensures accurate disclosure of an individual's income, bonuses, benefits, and future earning potential. This information helps determine potential alimony or support obligations in the event of a divorce. When drafting a prenuptial or premarital agreement in Nashville, Tennessee, it is crucial to consult with a qualified attorney specializing in family law and ensure the accuracy and completeness of the financial statements provided. By doing so, couples can create a fair and legally binding agreement that protects their respective assets and interests in the event of a divorce.Nashville Tennessee Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Nashville, Tennessee, financial statements play a crucial role in prenuptial and premarital agreements. This detailed description will provide you with a comprehensive understanding of what Nashville financial statements entail, their significance in the context of prenuptial agreements, and explore various types of financial statements used in this legal process. Financial statements hold immense importance in prenuptial or premarital agreements as they allow couples to disclose their assets, liabilities, income, and expenses. These statements help establish transparency, promote fairness, and protect the interests of both parties involved. When preparing for a prenuptial agreement in Nashville, accurate and thorough financial statements are essential to ensure a successful and legally-binding agreement. Different types of financial statements may be included in a prenuptial or premarital agreement, varying based on individual circumstances. The key types include: 1. Personal Financial Statements: These statements outline an individual's financial standing, including details about their assets (such as real estate, investment portfolios, cash, or personal property) and liabilities (such as mortgages, loans, or credit card debts). This provides a clear snapshot of an individual's overall financial situation. 2. Business Financial Statements: If either party owns a business, business financial statements should be included. These statements detail the company's financial health, including revenues, expenses, assets, liabilities, and any potential disputes or outstanding litigation. Clear visibility into the business's financial state helps determine how marital property may be treated in case of a divorce. 3. Tax Returns and Tax-Related Financial Statements: Tax returns are crucial financial documents that provide an overview of an individual's income, deductions, and other relevant information. When preparing a prenuptial agreement in Nashville, providing copies of recent tax returns is essential for understanding an individual's financial situation and full disclosure of their financial obligations. 4. Retirement Account Statements: Detailed statements from retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, or pension plans, should be included. These statements show the current value of the accounts, contributions made during the marriage, and any other pertinent information. 5. Bank Statements and Investment Account Statements: Providing bank statements and investment account statements helps verify an individual's income, savings, investments, and any debts related to these accounts. These statements ensure transparency, allowing both parties to make informed decisions regarding the division of assets and liabilities in a prenuptial agreement. 6. Pay Stubs and Employment Contracts: Including recent pay stubs and employment contracts ensures accurate disclosure of an individual's income, bonuses, benefits, and future earning potential. This information helps determine potential alimony or support obligations in the event of a divorce. When drafting a prenuptial or premarital agreement in Nashville, Tennessee, it is crucial to consult with a qualified attorney specializing in family law and ensure the accuracy and completeness of the financial statements provided. By doing so, couples can create a fair and legally binding agreement that protects their respective assets and interests in the event of a divorce.