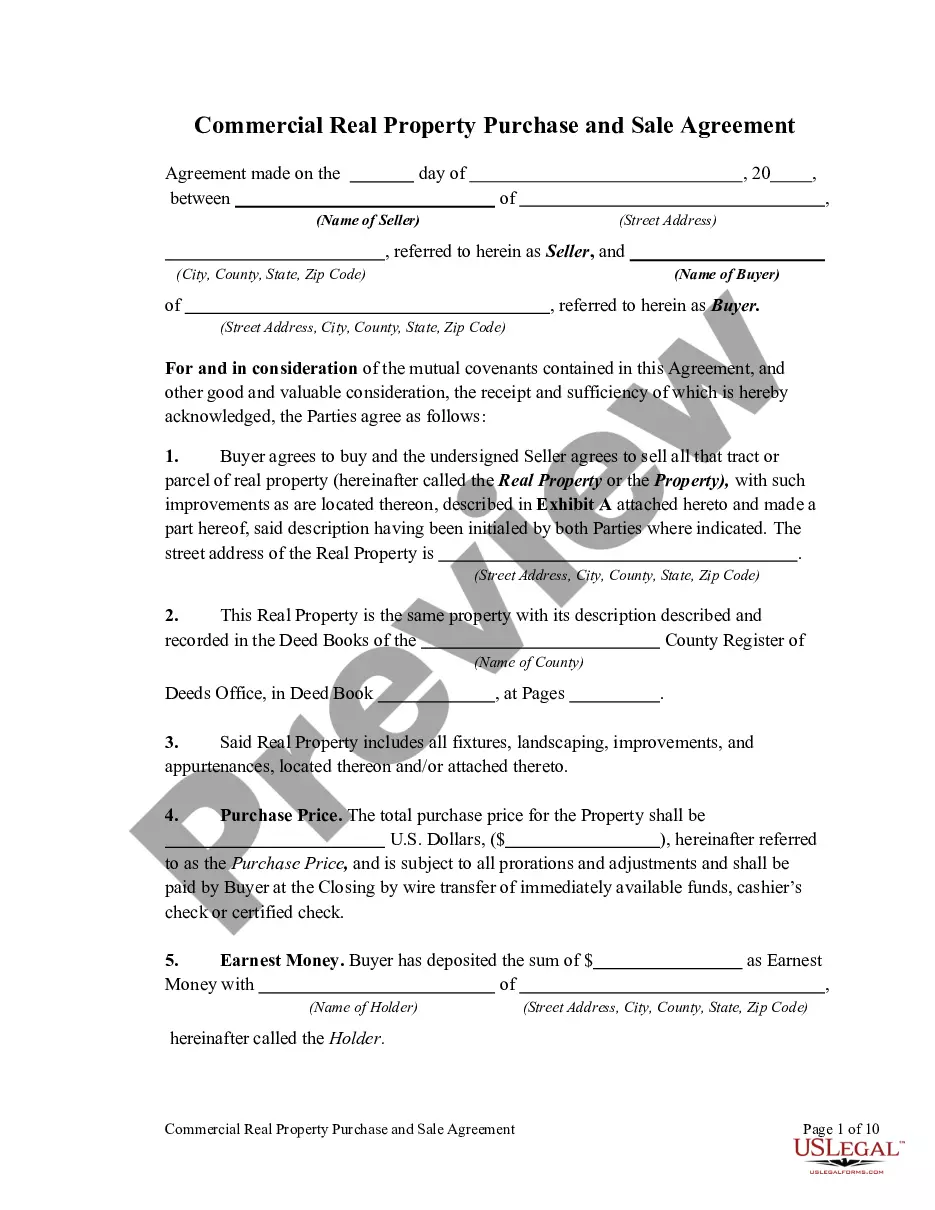

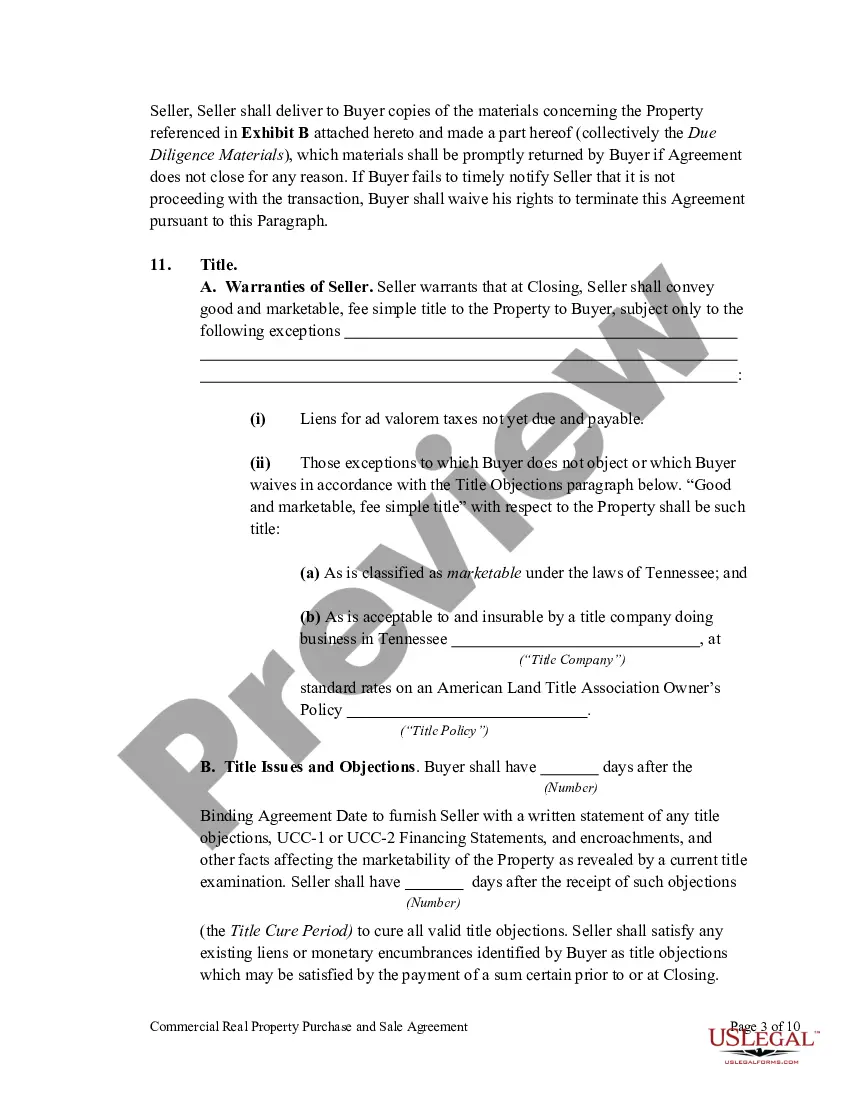

This form is a purchase and sale agreement for the sale of commercial property. In includes detailed handling of the issues common to the purchase and sale of commercial real estate.

A Clarksville Tennessee Commercial Real Property Purchase and Sale Agreement is a legally binding contract between a buyer and seller for the purchase and sale of a commercial property in Clarksville, Tennessee. This agreement outlines the terms and conditions of the transaction and protects the interests of both parties involved. Various types of purchase and sale agreements can be found in Clarksville, catering to different commercial real estate needs, such as: 1. Standard Purchase and Sale Agreement: This type of agreement covers the basic terms of the transaction, including the purchase price, property description, closing date, and contingencies. 2. As-Is Purchase and Sale Agreement: With this agreement, the property is sold in its current condition, irrespective of any defects or issues. It often places the responsibility of conducting inspections on the buyer and allows them to back out of the deal if significant issues arise. 3. Installment Purchase and Sale Agreement: In some cases, the parties may agree on an installment payment plan, where the buyer pays the purchase price in multiple installments over a specified period. This type of agreement may also include interest charges and a default clause. 4. Lease-Purchase Agreement: This agreement combines a commercial lease with an option to purchase the property at a later date. It allows the buyer to lease the property for a predetermined term while having the option to buy it within a specific timeframe. 5. Assignment Purchase and Sale Agreement: In this agreement, the buyer assigns their rights and obligations under the contract to another party. This type of agreement is often used when the buyer intends to assign their interest to a new buyer before the closing date. 6. 1031 Exchange Purchase and Sale Agreement: Specifically used in cases of property exchanges, this agreement allows the seller to defer capital gains taxes by reinvesting the proceeds from the sale into a similar commercial property within a set timeframe. 7. Auction Purchase and Sale Agreement: When a commercial property is sold at an auction, a specific purchase and sale agreement is used, outlining the terms of the auction, bidding process, and payment terms. Overall, a Clarksville Tennessee Commercial Real Property Purchase and Sale Agreement acts as a comprehensive legal document that ensures both parties are on the same page regarding the terms and conditions of the transaction, ultimately facilitating a smooth commercial property sale in Clarksville, Tennessee.A Clarksville Tennessee Commercial Real Property Purchase and Sale Agreement is a legally binding contract between a buyer and seller for the purchase and sale of a commercial property in Clarksville, Tennessee. This agreement outlines the terms and conditions of the transaction and protects the interests of both parties involved. Various types of purchase and sale agreements can be found in Clarksville, catering to different commercial real estate needs, such as: 1. Standard Purchase and Sale Agreement: This type of agreement covers the basic terms of the transaction, including the purchase price, property description, closing date, and contingencies. 2. As-Is Purchase and Sale Agreement: With this agreement, the property is sold in its current condition, irrespective of any defects or issues. It often places the responsibility of conducting inspections on the buyer and allows them to back out of the deal if significant issues arise. 3. Installment Purchase and Sale Agreement: In some cases, the parties may agree on an installment payment plan, where the buyer pays the purchase price in multiple installments over a specified period. This type of agreement may also include interest charges and a default clause. 4. Lease-Purchase Agreement: This agreement combines a commercial lease with an option to purchase the property at a later date. It allows the buyer to lease the property for a predetermined term while having the option to buy it within a specific timeframe. 5. Assignment Purchase and Sale Agreement: In this agreement, the buyer assigns their rights and obligations under the contract to another party. This type of agreement is often used when the buyer intends to assign their interest to a new buyer before the closing date. 6. 1031 Exchange Purchase and Sale Agreement: Specifically used in cases of property exchanges, this agreement allows the seller to defer capital gains taxes by reinvesting the proceeds from the sale into a similar commercial property within a set timeframe. 7. Auction Purchase and Sale Agreement: When a commercial property is sold at an auction, a specific purchase and sale agreement is used, outlining the terms of the auction, bidding process, and payment terms. Overall, a Clarksville Tennessee Commercial Real Property Purchase and Sale Agreement acts as a comprehensive legal document that ensures both parties are on the same page regarding the terms and conditions of the transaction, ultimately facilitating a smooth commercial property sale in Clarksville, Tennessee.