This package of forms contains a pre-incorporation agreement for the formers of a corporation to sign agreeing on how the corporate will be operated, who will be elected as officers and directors, salaries and many other corporate matters.

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters.

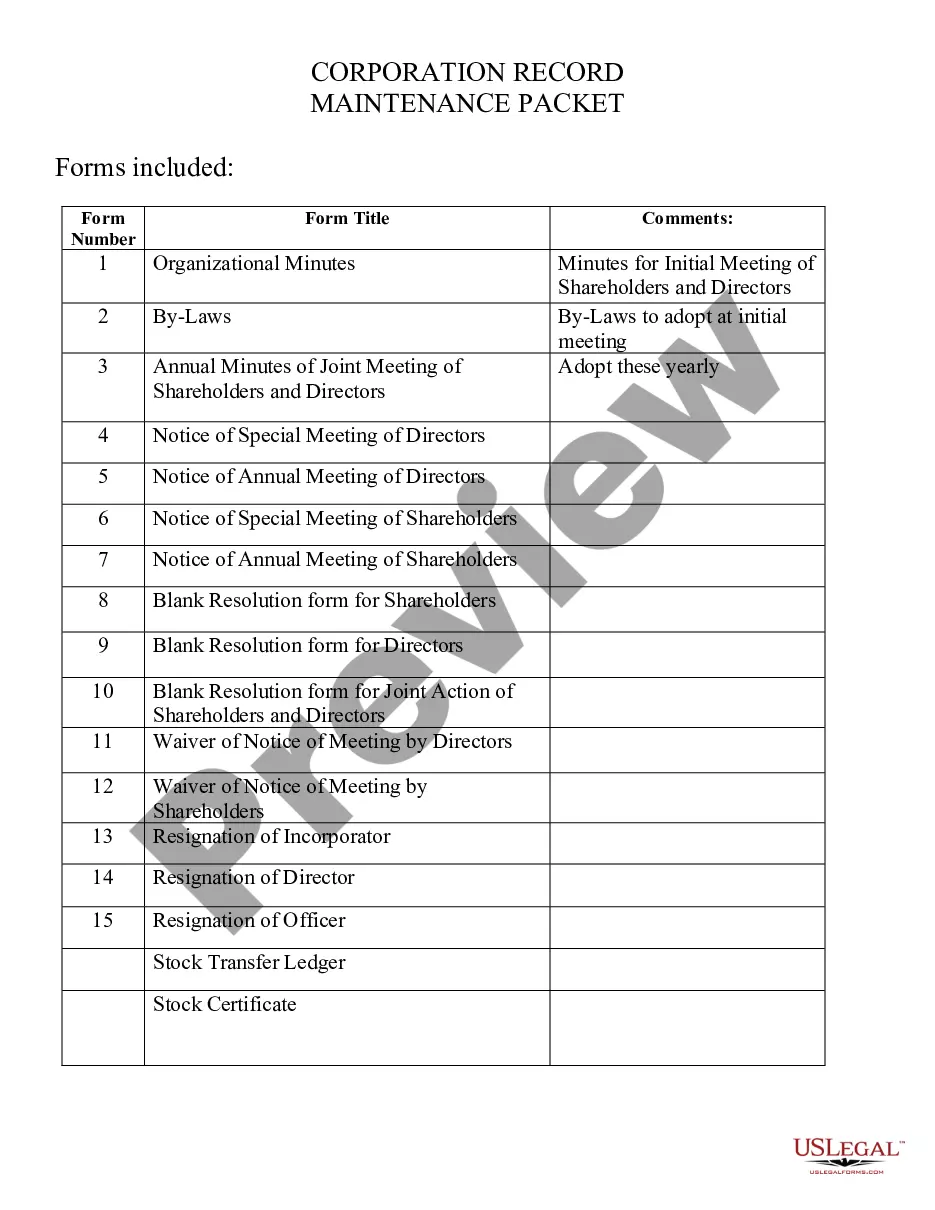

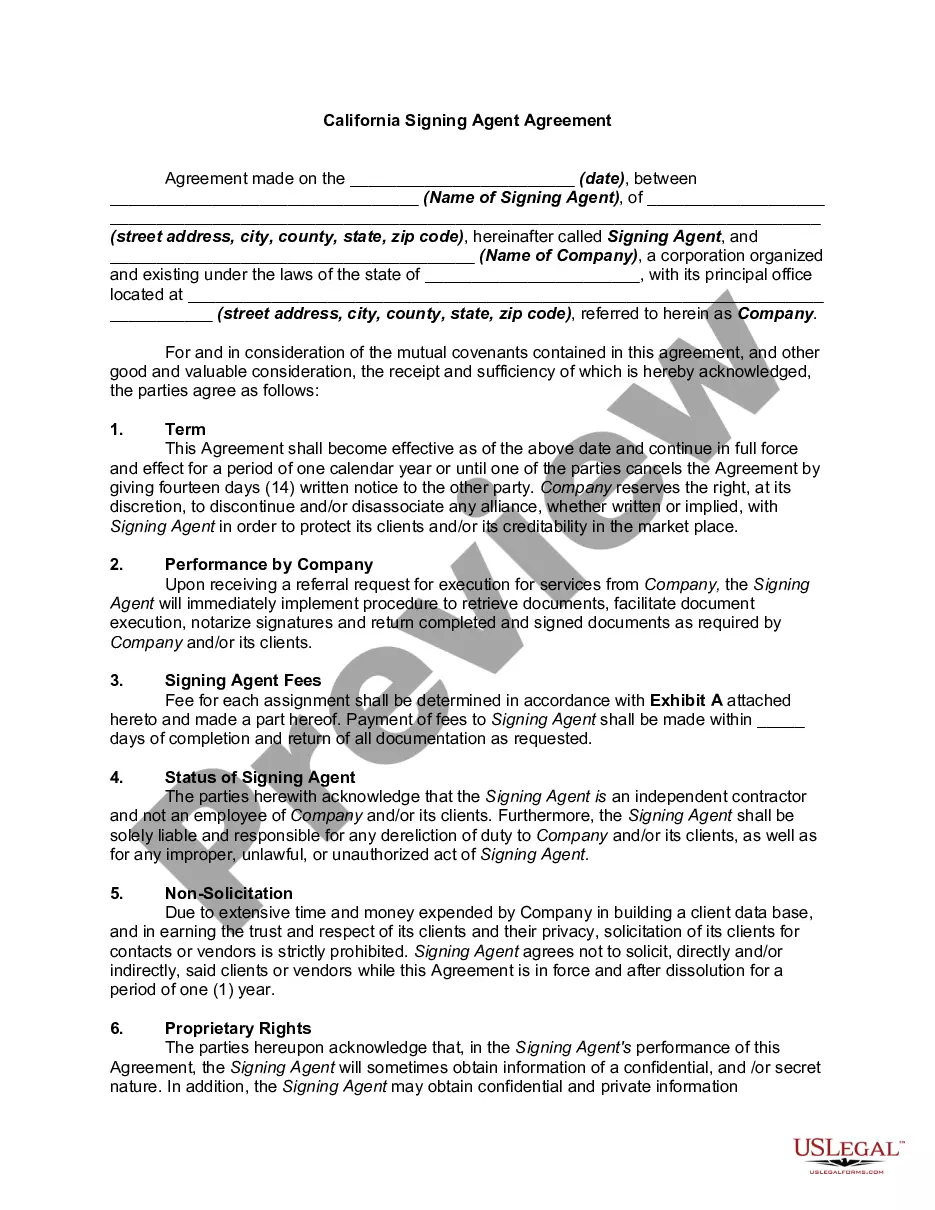

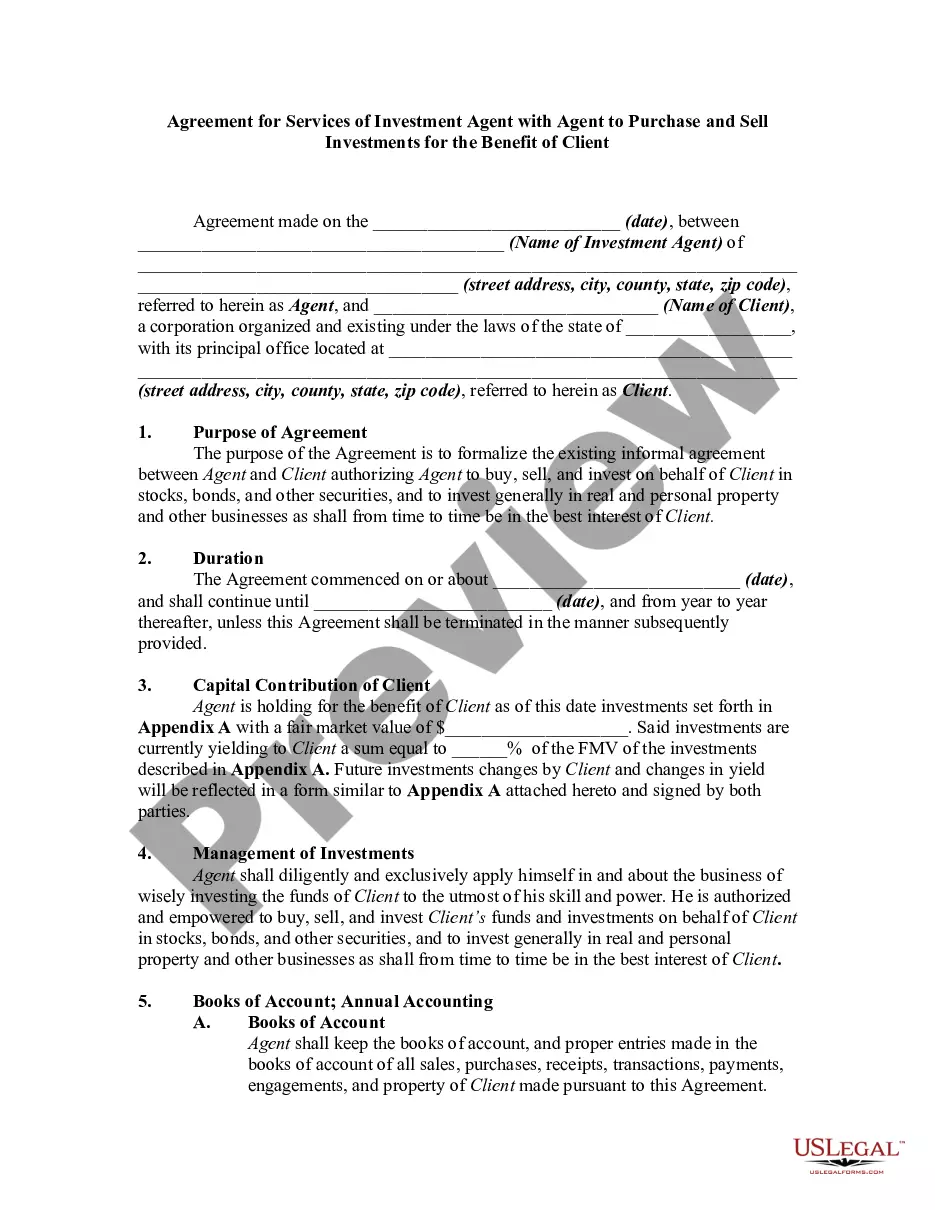

Memphis Tennessee Pre-Incorporation Agreement: The Memphis Tennessee Pre-Incorporation Agreement is a legal document that outlines the terms and conditions agreed upon by individuals or entities involved in the formation of a new corporation in Memphis, Tennessee. This agreement is typically drafted before the incorporation process begins and serves as a binding contract between the founders. The main purpose of the Pre-Incorporation Agreement is to establish the foundation of the corporation, detailing the rights, responsibilities, and ownership structure of each individual or entity involved. It sets forth essential provisions such as the purpose of the corporation, the initial capital contributions, voting rights, management structure, and any other relevant clauses agreed upon by the founders. While there may be variations in the details of different Memphis Tennessee Pre-Incorporation Agreements based on the specific needs of the corporation, they generally cover common elements necessary for starting a business. Memphis Tennessee Shareholders Agreement: The Memphis Tennessee Shareholders Agreement, also known as a Stockholders Agreement, is a legal framework that governs the relationship between the shareholders of a corporation. It outlines the rights, obligations, and restrictions of each shareholder and serves to protect their interests. This agreement is crucial for corporations to maintain a harmonious and fair environment among shareholders, as it sets out guidelines for decision-making processes, shareholder rights, voting mechanisms, dividend distribution, transfer of shares, and dispute resolution procedures. Depending on the corporation's specific requirements, the agreement may also include provisions regarding the appointment of directors, board meetings, and management responsibilities. Different types of Memphis Tennessee Shareholders Agreements may exist to address specific circumstances or tailor the agreement to meet the unique needs of the corporation. Examples may include agreements catering to minority shareholders' protections, agreements for corporations with different classes of shares, and agreements tailored for corporations with venture capital investments. Memphis Tennessee Confidentiality Agreement: The Memphis Tennessee Confidentiality Agreement, also referred to as a Non-Disclosure Agreement (NDA), is a legally binding document that governs the sharing of confidential information between parties involved in a business relationship. It ensures that sensitive information remains confidential and prevents its unauthorized use or disclosure. This agreement is crucial when two or more parties, such as individuals, corporations, or organizations, plan to share proprietary or confidential information for a specific purpose. It outlines the obligations and restrictions on the receiving party, prohibiting them from disclosing or using the shared information for any purpose other than what is specified in the agreement. Different types of Memphis Tennessee Confidentiality Agreements can be categorized based on their purpose or the parties involved. Some examples include unilateral NDAs (where only one party discloses information), mutual NDAs (where both parties share confidential information), and industry-specific NDAs tailored to protect particular intellectual property or trade secrets. In conclusion, the Memphis Tennessee Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are vital legal documents that establish the foundation, ownership structure, and permissible sharing of information within a corporation. While specific details may vary depending on the circumstances, these agreements are essential tools to ensure a smooth and protected business environment.Memphis Tennessee Pre-Incorporation Agreement: The Memphis Tennessee Pre-Incorporation Agreement is a legal document that outlines the terms and conditions agreed upon by individuals or entities involved in the formation of a new corporation in Memphis, Tennessee. This agreement is typically drafted before the incorporation process begins and serves as a binding contract between the founders. The main purpose of the Pre-Incorporation Agreement is to establish the foundation of the corporation, detailing the rights, responsibilities, and ownership structure of each individual or entity involved. It sets forth essential provisions such as the purpose of the corporation, the initial capital contributions, voting rights, management structure, and any other relevant clauses agreed upon by the founders. While there may be variations in the details of different Memphis Tennessee Pre-Incorporation Agreements based on the specific needs of the corporation, they generally cover common elements necessary for starting a business. Memphis Tennessee Shareholders Agreement: The Memphis Tennessee Shareholders Agreement, also known as a Stockholders Agreement, is a legal framework that governs the relationship between the shareholders of a corporation. It outlines the rights, obligations, and restrictions of each shareholder and serves to protect their interests. This agreement is crucial for corporations to maintain a harmonious and fair environment among shareholders, as it sets out guidelines for decision-making processes, shareholder rights, voting mechanisms, dividend distribution, transfer of shares, and dispute resolution procedures. Depending on the corporation's specific requirements, the agreement may also include provisions regarding the appointment of directors, board meetings, and management responsibilities. Different types of Memphis Tennessee Shareholders Agreements may exist to address specific circumstances or tailor the agreement to meet the unique needs of the corporation. Examples may include agreements catering to minority shareholders' protections, agreements for corporations with different classes of shares, and agreements tailored for corporations with venture capital investments. Memphis Tennessee Confidentiality Agreement: The Memphis Tennessee Confidentiality Agreement, also referred to as a Non-Disclosure Agreement (NDA), is a legally binding document that governs the sharing of confidential information between parties involved in a business relationship. It ensures that sensitive information remains confidential and prevents its unauthorized use or disclosure. This agreement is crucial when two or more parties, such as individuals, corporations, or organizations, plan to share proprietary or confidential information for a specific purpose. It outlines the obligations and restrictions on the receiving party, prohibiting them from disclosing or using the shared information for any purpose other than what is specified in the agreement. Different types of Memphis Tennessee Confidentiality Agreements can be categorized based on their purpose or the parties involved. Some examples include unilateral NDAs (where only one party discloses information), mutual NDAs (where both parties share confidential information), and industry-specific NDAs tailored to protect particular intellectual property or trade secrets. In conclusion, the Memphis Tennessee Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are vital legal documents that establish the foundation, ownership structure, and permissible sharing of information within a corporation. While specific details may vary depending on the circumstances, these agreements are essential tools to ensure a smooth and protected business environment.