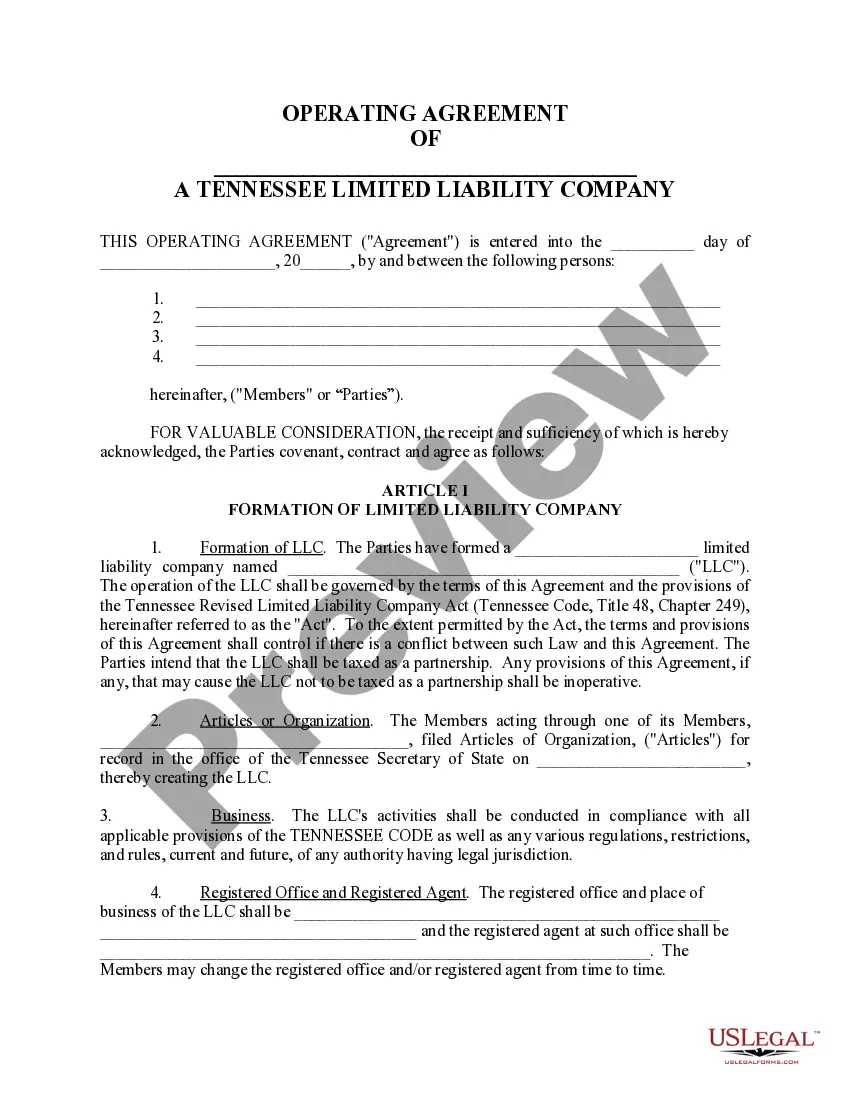

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

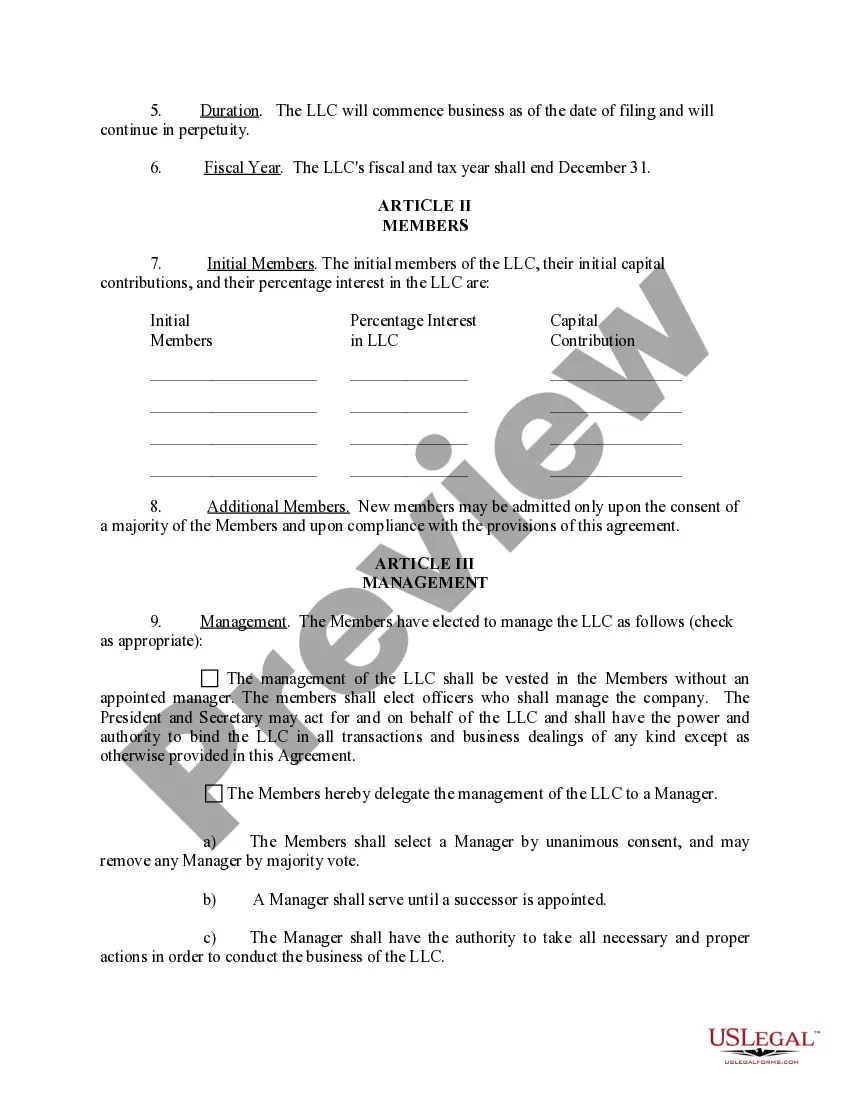

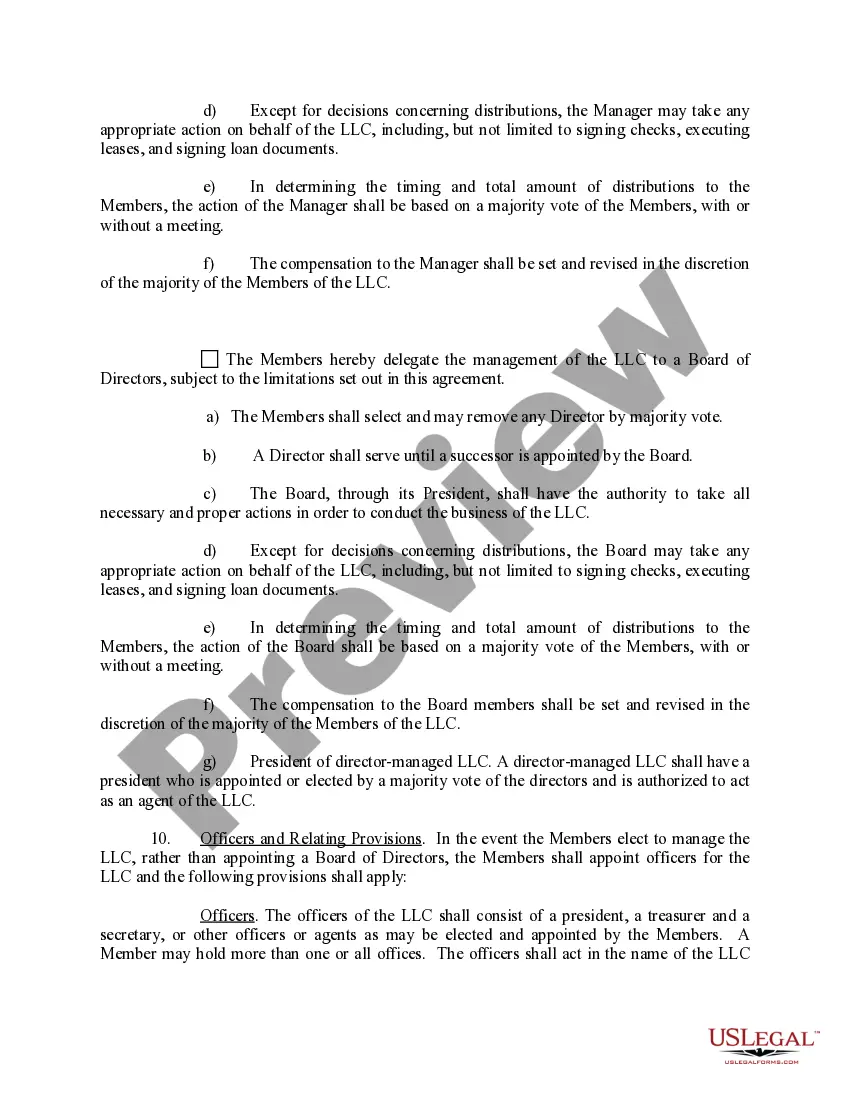

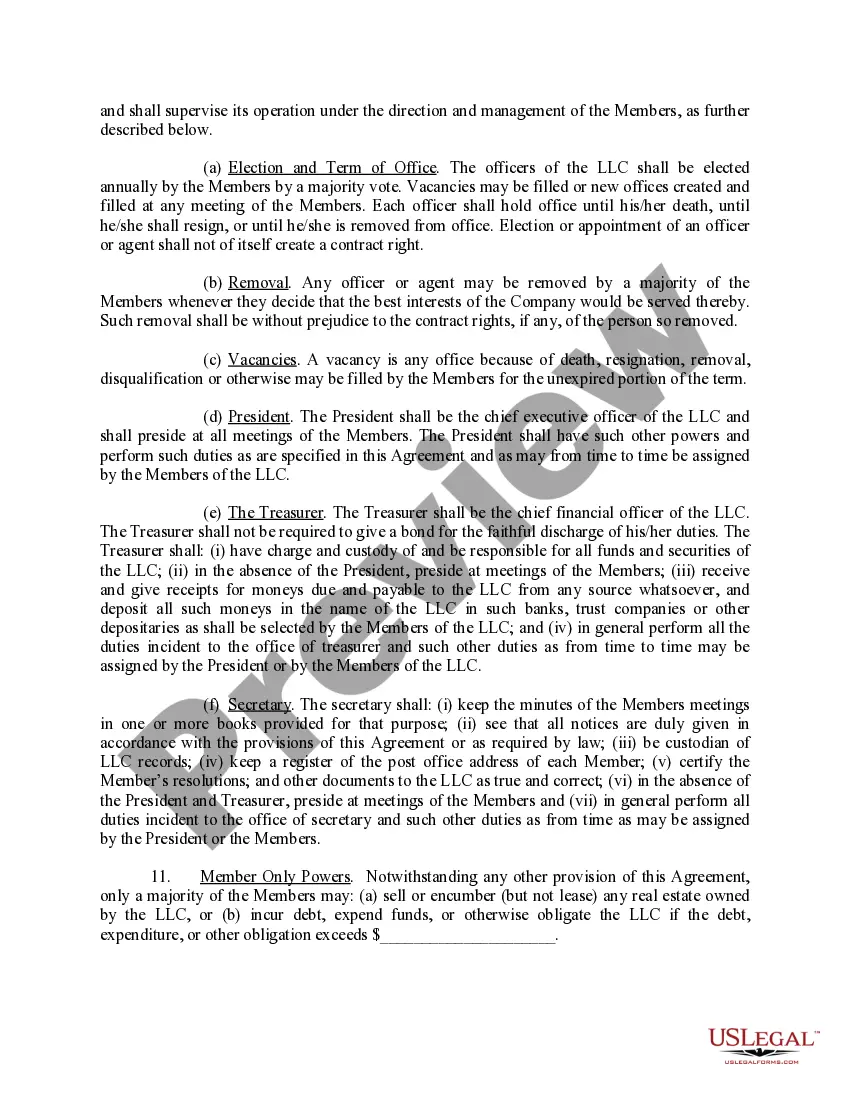

The Memphis Tennessee Limited Liability Company (LLC) Operating Agreement refers to the legal document that outlines the internal operations and structure of an LLC based in Memphis, Tennessee. This agreement is essential as it establishes the rights, duties, and responsibilities of the LLC members, defines the rules for decision-making, and governs the relationships and interactions among members. Keywords: Memphis Tennessee, Limited Liability Company, LLC, Operating Agreement. The Memphis Tennessee LLC Operating Agreement typically consists of several sections, each covering different aspects of the company's operations. The agreement may vary depending on the specific needs and requirements of the LLC, but common sections usually include: 1. Name and Purpose: This section typically includes the official name of the LLC and its primary purposes and objectives for conducting business. 2. Membership: This section explains the requirements and process for becoming a member of the LLC, as well as the rights, obligations, and restrictions associated with membership. 3. Capital Contributions: Here, the agreement outlines how initial capital contributions are made, how additional contributions are handled, and the rules regarding profit and loss distribution. 4. Management and Voting: This section clarifies how the LLC is managed, whether by members or managers, and the decision-making process, including voting rights and procedures. 5. Meetings: This section details the rules and requirements for both regular and special meetings of members, including notice requirements and how meetings can be conducted (in-person or remotely). 6. Allocation of Profits and Losses: This part outlines how profits and losses are allocated among LLC members and may include proportionate distribution based on capital contributions or other agreed-upon criteria. 7. Transfer of Membership Interests: This section covers the process and restrictions for transferring an LLC membership interest, including rights of first refusal, buy-sell agreements, and admission of new members. 8. Dissolution and Termination: This section addresses the procedures and circumstances under which the LLC may be dissolved, as well as the winding-up and liquidation of its assets. There may be different types of Memphis Tennessee LLC Operating Agreements tailored to different purposes, such as single-member LLC operating agreements or multi-member LLC operating agreements. The specific content and provisions in these agreements may vary based on the number of members involved and their specific needs and objectives. In conclusion, the Memphis Tennessee LLC Operating Agreement is a crucial legal document governing the internal affairs and structure of an LLC in Memphis, Tennessee. It outlines the rights, responsibilities, and relationships among members, covers topics such as membership, capital contributions, decision-making, and distribution of profits and losses, and may vary based on the type and purpose of the LLC.The Memphis Tennessee Limited Liability Company (LLC) Operating Agreement refers to the legal document that outlines the internal operations and structure of an LLC based in Memphis, Tennessee. This agreement is essential as it establishes the rights, duties, and responsibilities of the LLC members, defines the rules for decision-making, and governs the relationships and interactions among members. Keywords: Memphis Tennessee, Limited Liability Company, LLC, Operating Agreement. The Memphis Tennessee LLC Operating Agreement typically consists of several sections, each covering different aspects of the company's operations. The agreement may vary depending on the specific needs and requirements of the LLC, but common sections usually include: 1. Name and Purpose: This section typically includes the official name of the LLC and its primary purposes and objectives for conducting business. 2. Membership: This section explains the requirements and process for becoming a member of the LLC, as well as the rights, obligations, and restrictions associated with membership. 3. Capital Contributions: Here, the agreement outlines how initial capital contributions are made, how additional contributions are handled, and the rules regarding profit and loss distribution. 4. Management and Voting: This section clarifies how the LLC is managed, whether by members or managers, and the decision-making process, including voting rights and procedures. 5. Meetings: This section details the rules and requirements for both regular and special meetings of members, including notice requirements and how meetings can be conducted (in-person or remotely). 6. Allocation of Profits and Losses: This part outlines how profits and losses are allocated among LLC members and may include proportionate distribution based on capital contributions or other agreed-upon criteria. 7. Transfer of Membership Interests: This section covers the process and restrictions for transferring an LLC membership interest, including rights of first refusal, buy-sell agreements, and admission of new members. 8. Dissolution and Termination: This section addresses the procedures and circumstances under which the LLC may be dissolved, as well as the winding-up and liquidation of its assets. There may be different types of Memphis Tennessee LLC Operating Agreements tailored to different purposes, such as single-member LLC operating agreements or multi-member LLC operating agreements. The specific content and provisions in these agreements may vary based on the number of members involved and their specific needs and objectives. In conclusion, the Memphis Tennessee LLC Operating Agreement is a crucial legal document governing the internal affairs and structure of an LLC in Memphis, Tennessee. It outlines the rights, responsibilities, and relationships among members, covers topics such as membership, capital contributions, decision-making, and distribution of profits and losses, and may vary based on the type and purpose of the LLC.