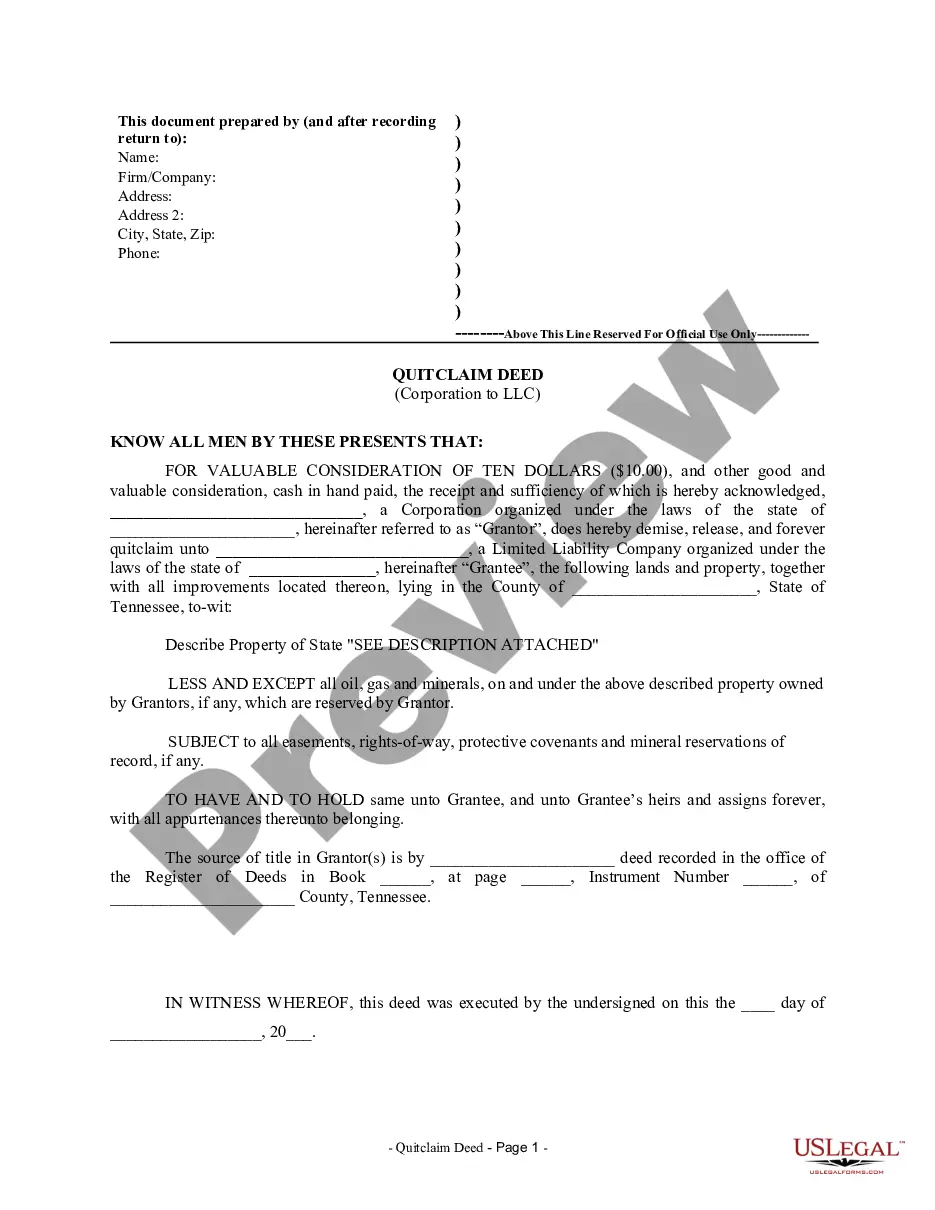

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Memphis Tennessee Quitclaim Deed from Corporation to LLC is a legal document utilized to transfer ownership of property from a corporation to a limited liability company (LLC) in the city of Memphis, Tennessee. This deed is specifically designed for corporations wishing to transfer property rights to an LLC. In this context, a quitclaim deed is a legal instrument used to transfer the corporation's interest, if any, in a given property to the LLC. It is important to note that a quitclaim deed only transfers the interest held by the corporation and does not provide any guarantee or warranty of the title or ownership status of the property. Different variations or types of Memphis Tennessee Quitclaim Deeds from Corporation to LLC may include: 1. Standard Quitclaim Deed: This type of quitclaim deed represents the typical transfer of property from a corporation to an LLC, where the corporation relinquishes any interest it may hold in the property to the LLC. 2. Special Warranty Quitclaim Deed: This variation provides a limited warranty from the corporation to the LLC, assuring that the corporation has not performed any actions that would impair the property's marketable title during its ownership. However, this does not protect against any issues before the corporation's ownership or actions taken by previous owners. 3. Trustee-to-LLC Quitclaim Deed: This specific type of quitclaim deed comes into play when a corporate property is held in a trust. In such cases, the trustee responsible for the trust transfers the property's interest to the LLC via a quitclaim deed. To complete the process, the Memphis Tennessee Quitclaim Deed from Corporation to LLC typically requires the legal description of the property, details of the corporation and LLC, as well as the consideration to be paid, if applicable. It must be executed and acknowledged by authorized representatives of both the corporation and the LLC. Additionally, the deed should be properly recorded in the appropriate county recorder's office to ensure the transfer is legally effective and enforceable.A Memphis Tennessee Quitclaim Deed from Corporation to LLC is a legal document utilized to transfer ownership of property from a corporation to a limited liability company (LLC) in the city of Memphis, Tennessee. This deed is specifically designed for corporations wishing to transfer property rights to an LLC. In this context, a quitclaim deed is a legal instrument used to transfer the corporation's interest, if any, in a given property to the LLC. It is important to note that a quitclaim deed only transfers the interest held by the corporation and does not provide any guarantee or warranty of the title or ownership status of the property. Different variations or types of Memphis Tennessee Quitclaim Deeds from Corporation to LLC may include: 1. Standard Quitclaim Deed: This type of quitclaim deed represents the typical transfer of property from a corporation to an LLC, where the corporation relinquishes any interest it may hold in the property to the LLC. 2. Special Warranty Quitclaim Deed: This variation provides a limited warranty from the corporation to the LLC, assuring that the corporation has not performed any actions that would impair the property's marketable title during its ownership. However, this does not protect against any issues before the corporation's ownership or actions taken by previous owners. 3. Trustee-to-LLC Quitclaim Deed: This specific type of quitclaim deed comes into play when a corporate property is held in a trust. In such cases, the trustee responsible for the trust transfers the property's interest to the LLC via a quitclaim deed. To complete the process, the Memphis Tennessee Quitclaim Deed from Corporation to LLC typically requires the legal description of the property, details of the corporation and LLC, as well as the consideration to be paid, if applicable. It must be executed and acknowledged by authorized representatives of both the corporation and the LLC. Additionally, the deed should be properly recorded in the appropriate county recorder's office to ensure the transfer is legally effective and enforceable.