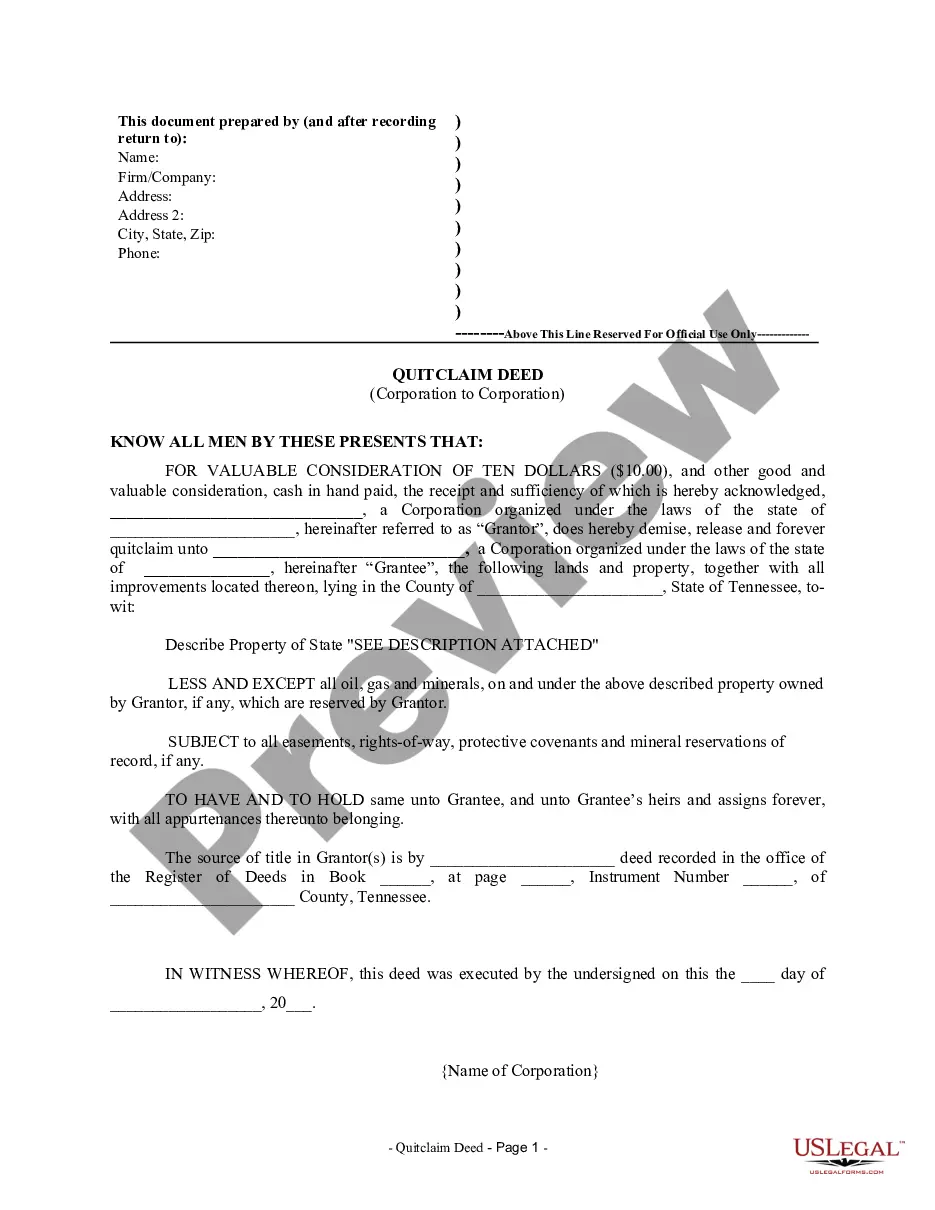

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Chattanooga Tennessee Quitclaim Deed from Corporation to Corporation refers to a legal document that allows a corporation to transfer ownership or interest in a property to another corporation without making any warranties regarding the title. This deed is recognized and regulated by the laws of the state of Tennessee. In this type of property transfer, the corporation conveying the property (granter) is essentially stating that they are relinquishing any rights or claims they may have to the property, but they are not guaranteeing that the property is free from any liens, encumbrances, or defects. It is important for both parties involved to understand that a quitclaim deed offers no guarantee of ownership or title validity, making due diligence crucial before executing the transfer. Some common situations that may involve a Chattanooga Tennessee Quitclaim Deed from Corporation to Corporation include: 1. Merger or Acquisition: When two corporations merge or one company acquires another, a quitclaim deed may be used to transfer ownership of specific properties from the acquired corporation to the acquiring corporation. This ensures that the new entity assumes ownership and control over the properties without making any warranties or assumptions about the title's quality. 2. Internal Restructuring: Corporations may use quitclaim deeds during internal restructuring processes, such as when a subsidiary or affiliated entity transfers property to its parent company or vice versa. This type of deed allows for efficient transfer of properties without the need for extensive title searches, as the transferring corporation already has knowledge of the property's status. 3. Dissolution of a Corporation: In the case of a corporation's dissolution, a quitclaim deed may be employed to transfer the property to another active corporation, ensuring a smooth transition of ownership without the need for elaborate title examinations or warranties. 4. Corporate Asset Reorganization: As part of an asset reorganization strategy, a corporation may choose to transfer certain properties to separate corporations within their corporate group. A quitclaim deed can facilitate this transfer process, enabling the corporation to convey the property rights without guaranteeing the title's validity. It is crucial for corporations involved in such property transfers to consult with experienced legal professionals specializing in real estate law to ensure compliance with Chattanooga's specific regulations and requirements.A Chattanooga Tennessee Quitclaim Deed from Corporation to Corporation refers to a legal document that allows a corporation to transfer ownership or interest in a property to another corporation without making any warranties regarding the title. This deed is recognized and regulated by the laws of the state of Tennessee. In this type of property transfer, the corporation conveying the property (granter) is essentially stating that they are relinquishing any rights or claims they may have to the property, but they are not guaranteeing that the property is free from any liens, encumbrances, or defects. It is important for both parties involved to understand that a quitclaim deed offers no guarantee of ownership or title validity, making due diligence crucial before executing the transfer. Some common situations that may involve a Chattanooga Tennessee Quitclaim Deed from Corporation to Corporation include: 1. Merger or Acquisition: When two corporations merge or one company acquires another, a quitclaim deed may be used to transfer ownership of specific properties from the acquired corporation to the acquiring corporation. This ensures that the new entity assumes ownership and control over the properties without making any warranties or assumptions about the title's quality. 2. Internal Restructuring: Corporations may use quitclaim deeds during internal restructuring processes, such as when a subsidiary or affiliated entity transfers property to its parent company or vice versa. This type of deed allows for efficient transfer of properties without the need for extensive title searches, as the transferring corporation already has knowledge of the property's status. 3. Dissolution of a Corporation: In the case of a corporation's dissolution, a quitclaim deed may be employed to transfer the property to another active corporation, ensuring a smooth transition of ownership without the need for elaborate title examinations or warranties. 4. Corporate Asset Reorganization: As part of an asset reorganization strategy, a corporation may choose to transfer certain properties to separate corporations within their corporate group. A quitclaim deed can facilitate this transfer process, enabling the corporation to convey the property rights without guaranteeing the title's validity. It is crucial for corporations involved in such property transfers to consult with experienced legal professionals specializing in real estate law to ensure compliance with Chattanooga's specific regulations and requirements.