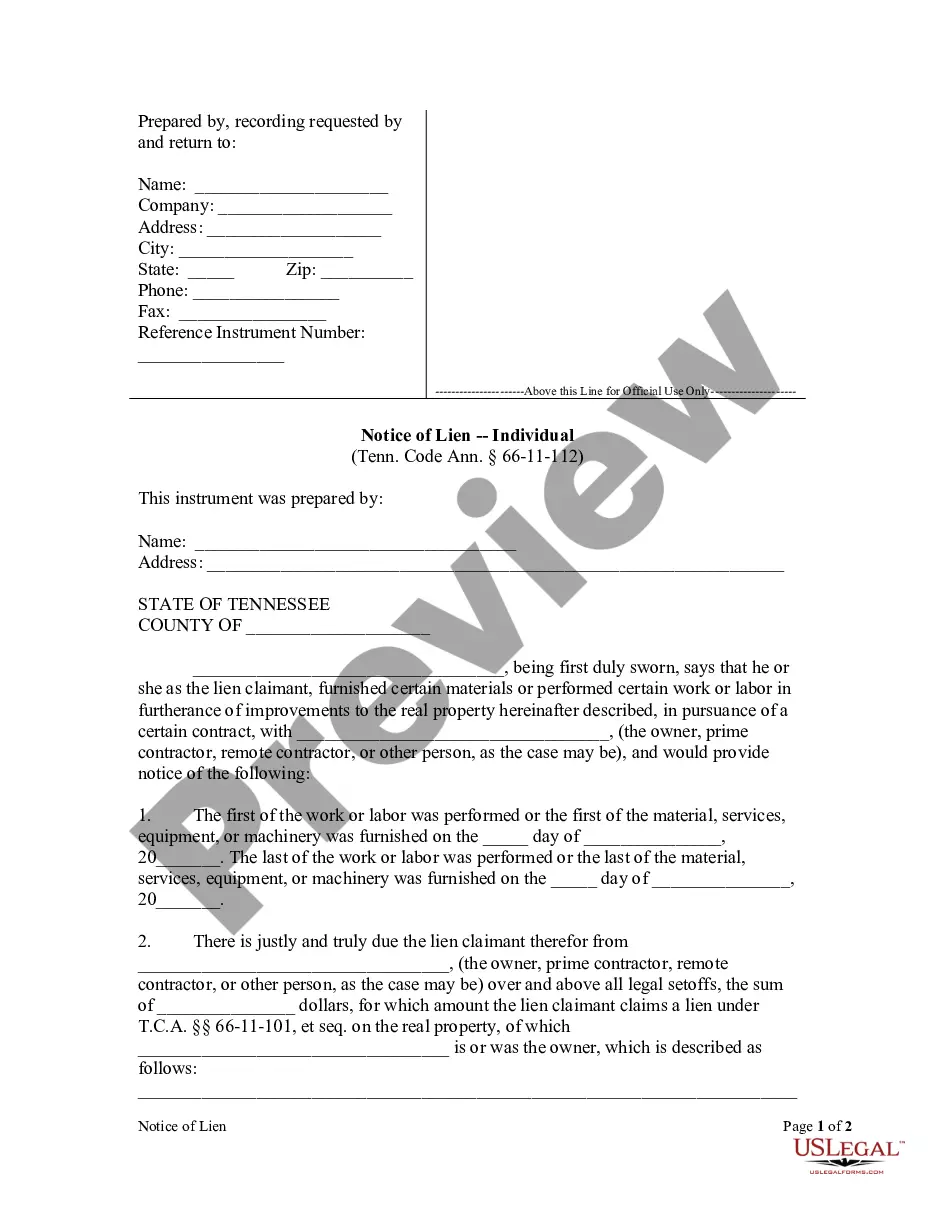

A mechanic's lien shall have precedence over all other subsequent liens or conveyances during such time; provided, that a sworn statement of the amount due and/or approximating that to accrue for such work, labor, or materials, and a reasonably certain description of the premises, shall be filed, within the ninety-day period referred to in § 66-11-115(b), or in the case of liens acquired by contract executed on or after April 17, 1972, by virtue of § 66-11-141, within ninety (90) days after completion of the structure which is or is intended to be furnished water by virtue of drilling a well, or abandonment of work on the structure, as the case may be, with the county register, who shall note the same for registration, and put it on record in the lien book in the office of the register, for which the register shall be entitled to the sums specified in § 8-21-1001, which sums shall be paid by the party filing the same; but such fees shall be receipted for on the statement of account, and shall be part of the indebtedness or charge secured by the lien, and this registration shall be notice to all persons of the existence of such lien.

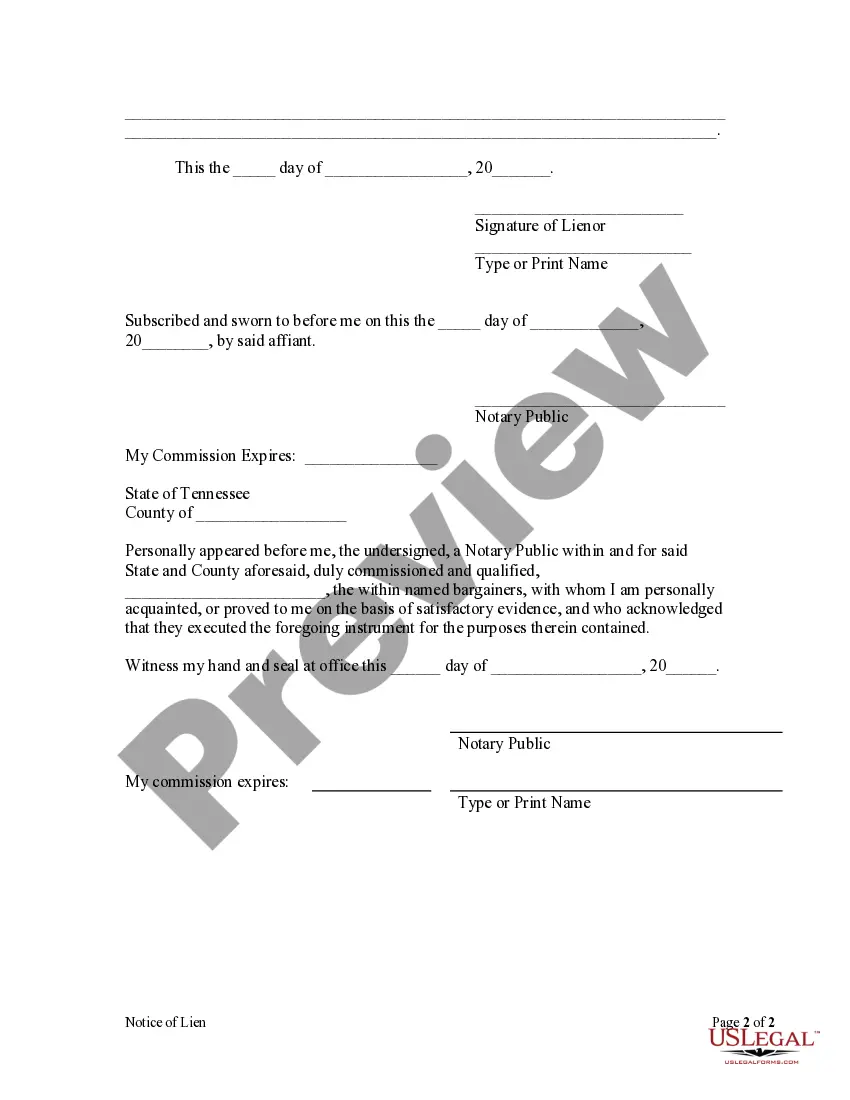

A Notice of Lien — Individual in Murfreesboro, Tennessee is a legally binding document that serves to notify individuals or entities of a lien placed on their property or assets by another individual. This notice indicates that a creditor has a legal claim to the property or asset until the debt owed to them is paid off. There are different types of Notice of Lien — Individual that can be filed in Murfreesboro, Tennessee, including: 1. Mechanic's Lien — This notice is typically filed by contractors, subcontractors, or suppliers who have not been paid for services rendered or materials provided for a construction or renovation project on a property in Murfreesboro, Tennessee. The mechanic's lien ensures that the unpaid party has a legal claim to the property until they are compensated for their work or materials. 2. Judgment Lien — When an individual wins a lawsuit against another individual in Murfreesboro, Tennessee, and is awarded a monetary judgment, they can file a judgment lien. This lien attaches to the debtor's property, including real estate, vehicles, or other valuable assets, to ensure eventual payment of the owed debt. 3. Tax Lien — A tax lien is filed by a governmental agency, typically the Internal Revenue Service (IRS) or the Tennessee Department of Revenue, in cases where an individual or business has unpaid taxes. This lien allows the government to claim the debtor's property or assets to satisfy the outstanding tax debt. 4. HOA Lien — Homeowners' associationsHasAs) in Murfreesboro, Tennessee can file a lien against a property owner who fails to pay dues or assessments. This HOA lien provides a legal claim on the property until the outstanding balance is settled. 5. Medical Lien — Medical providers in Murfreesboro, Tennessee may file a medical lien when a patient fails to pay for medical services rendered. This lien enables the healthcare provider to stake a claim on any personal injury settlement or legal judgment the patient may receive, ensuring that the medical debt is satisfied. It is important to note that each type of Notice of Lien — Individual in Murfreesboro, Tennessee has specific legal requirements and deadlines that must be followed to ensure its validity and enforceability. Consulting with a legal professional is advisable when dealing with notice of lien issues to ensure all necessary steps are taken correctly.A Notice of Lien — Individual in Murfreesboro, Tennessee is a legally binding document that serves to notify individuals or entities of a lien placed on their property or assets by another individual. This notice indicates that a creditor has a legal claim to the property or asset until the debt owed to them is paid off. There are different types of Notice of Lien — Individual that can be filed in Murfreesboro, Tennessee, including: 1. Mechanic's Lien — This notice is typically filed by contractors, subcontractors, or suppliers who have not been paid for services rendered or materials provided for a construction or renovation project on a property in Murfreesboro, Tennessee. The mechanic's lien ensures that the unpaid party has a legal claim to the property until they are compensated for their work or materials. 2. Judgment Lien — When an individual wins a lawsuit against another individual in Murfreesboro, Tennessee, and is awarded a monetary judgment, they can file a judgment lien. This lien attaches to the debtor's property, including real estate, vehicles, or other valuable assets, to ensure eventual payment of the owed debt. 3. Tax Lien — A tax lien is filed by a governmental agency, typically the Internal Revenue Service (IRS) or the Tennessee Department of Revenue, in cases where an individual or business has unpaid taxes. This lien allows the government to claim the debtor's property or assets to satisfy the outstanding tax debt. 4. HOA Lien — Homeowners' associationsHasAs) in Murfreesboro, Tennessee can file a lien against a property owner who fails to pay dues or assessments. This HOA lien provides a legal claim on the property until the outstanding balance is settled. 5. Medical Lien — Medical providers in Murfreesboro, Tennessee may file a medical lien when a patient fails to pay for medical services rendered. This lien enables the healthcare provider to stake a claim on any personal injury settlement or legal judgment the patient may receive, ensuring that the medical debt is satisfied. It is important to note that each type of Notice of Lien — Individual in Murfreesboro, Tennessee has specific legal requirements and deadlines that must be followed to ensure its validity and enforceability. Consulting with a legal professional is advisable when dealing with notice of lien issues to ensure all necessary steps are taken correctly.