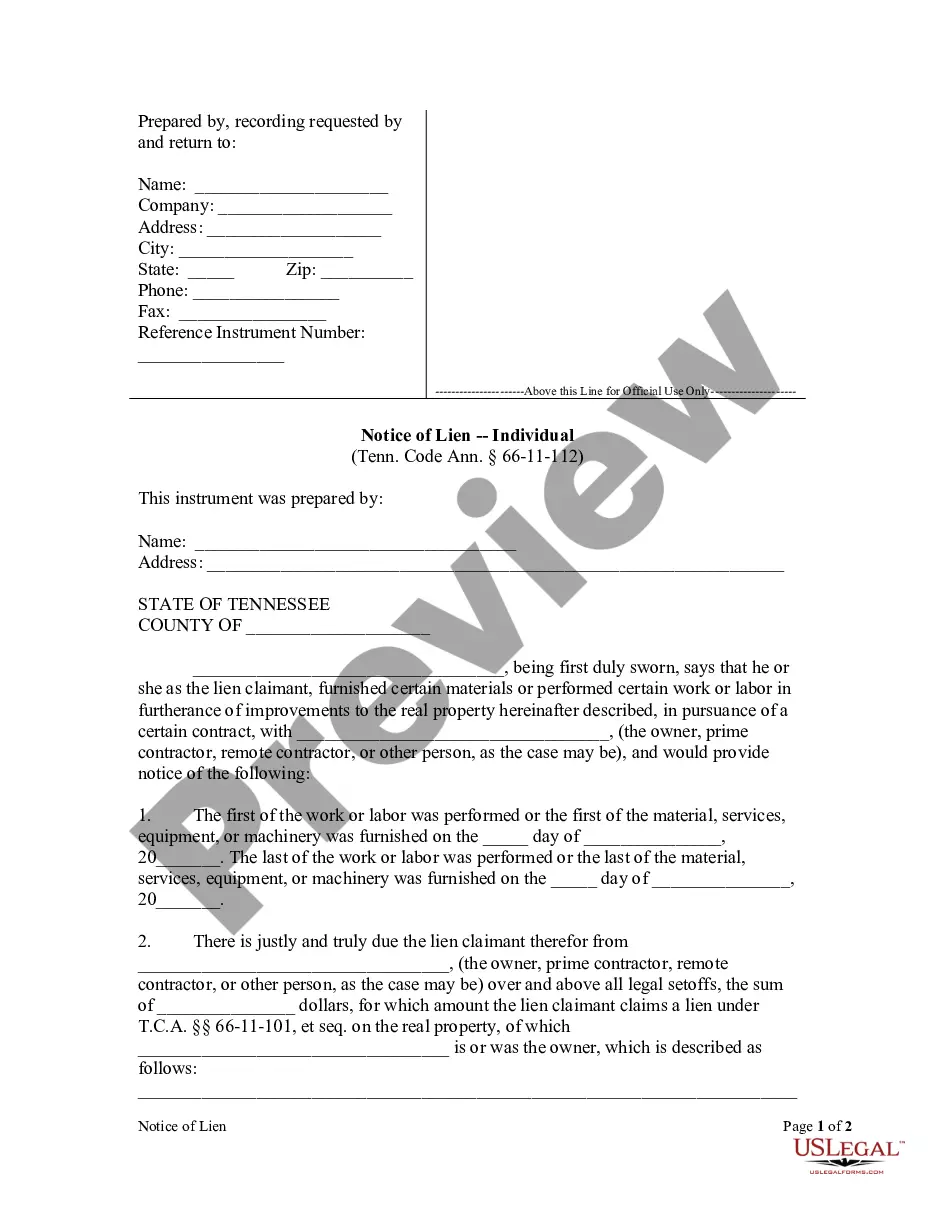

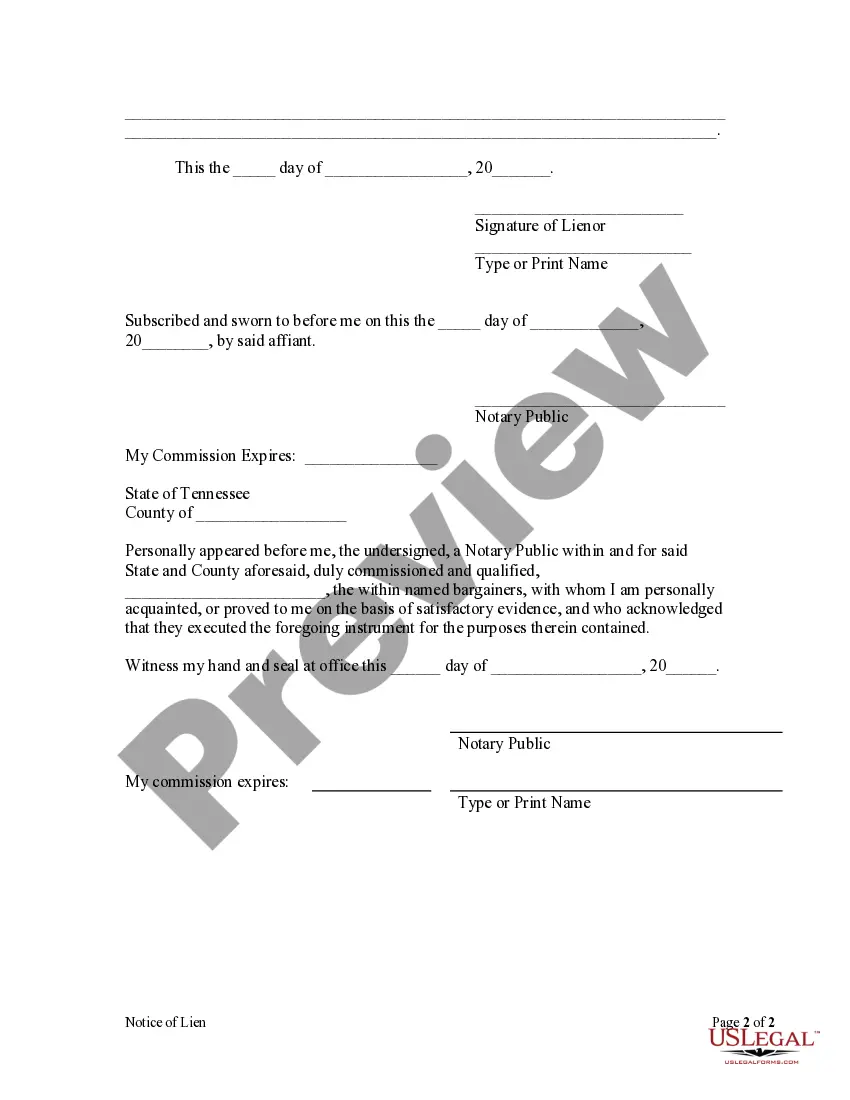

A mechanic's lien shall have precedence over all other subsequent liens or conveyances during such time; provided, that a sworn statement of the amount due and/or approximating that to accrue for such work, labor, or materials, and a reasonably certain description of the premises, shall be filed, within the ninety-day period referred to in § 66-11-115(b), or in the case of liens acquired by contract executed on or after April 17, 1972, by virtue of § 66-11-141, within ninety (90) days after completion of the structure which is or is intended to be furnished water by virtue of drilling a well, or abandonment of work on the structure, as the case may be, with the county register, who shall note the same for registration, and put it on record in the lien book in the office of the register, for which the register shall be entitled to the sums specified in § 8-21-1001, which sums shall be paid by the party filing the same; but such fees shall be receipted for on the statement of account, and shall be part of the indebtedness or charge secured by the lien, and this registration shall be notice to all persons of the existence of such lien.

Nashville Tennessee Notice of Lien — Individual: A Comprehensive Guide In Nashville, Tennessee, a Notice of Lien — Individual is an important legal document that establishes a claim against a property owned by an individual for an unpaid debt or obligation. This document is typically filed by creditors or individuals seeking to enforce their rights and secure payment. Understanding the intricacies and different types of Nashville Tennessee Notice of Lien — Individual is crucial for both debtors and creditors. Below, we delve into the key aspects of this notice and the various types that exist. 1. General Overview: A Notice of Lien — Individual is designed to provide public notice of a creditor's claim against a debtor's property. It serves as a warning to potential buyers or lenders that there is an outstanding debt associated with the property. Filing a Notice of Lien — Individual acts as a proactive step to protect the creditor's rights and ensure that they may receive the payment owed to them. 2. Nashville Tennessee Notice of Lien — Individual Types: a. Mechanic's Lien: A mechanic's lien is a type of Notice of Lien — Individual commonly filed by contractors, subcontractors, or suppliers who haven't been paid for their labor, materials, or services on a construction project. This type of lien grants them a legal right to sell the property to recover the outstanding debt. b. Tax Lien: The Nashville Tennessee Notice of Tax Lien — Individual is issued by the state or local authorities to collect unpaid taxes, including property taxes, income taxes, or sales taxes. Tax liens take priority over other liens and can significantly impact the property owner's ability to sell or refinance. c. Judgment Lien: Judgment liens are filed when a creditor who has obtained a court judgment against an individual seeks to enforce that judgment by placing a lien on the debtor's property. This type of lien can be filed for various reasons, such as unpaid debts or damages awarded in a lawsuit. d. Personal Lien: Personal liens can be filed against an individual's property for various reasons, including unpaid child support, alimony, or other court-ordered obligations. These liens are designed to ensure compliance with legally mandated payments. 3. Filing Process and Legal Requirements: To file a Nashville Tennessee Notice of Lien — Individual, specific legal requirements must be met. These can vary based on the type of lien being filed. Generally, the creditor must complete a notice form accurately, referencing the debtor's name, the amount owed, and a description of the property involved. The lien must then be properly recorded with the appropriate county or state office to ensure its validity. It is crucial for both creditors and debtors to understand the impact of a Notice of Lien — Individual. Creditors may leverage the lien to secure repayment or initiate legal actions, while debtors should take the necessary steps to address the underlying obligations to avoid potential hardships and complications in their financial affairs. In conclusion, a Nashville Tennessee Notice of Lien — Individual is a powerful tool utilized by creditors to claim the debt owed to them. Understanding the different types of liens and the associated legal requirements is essential for all parties involved. Whether it's a mechanic's lien, tax lien, judgment lien, or personal lien, individuals in Nashville should be well-informed of the implications and act responsibly to protect their interests.Nashville Tennessee Notice of Lien — Individual: A Comprehensive Guide In Nashville, Tennessee, a Notice of Lien — Individual is an important legal document that establishes a claim against a property owned by an individual for an unpaid debt or obligation. This document is typically filed by creditors or individuals seeking to enforce their rights and secure payment. Understanding the intricacies and different types of Nashville Tennessee Notice of Lien — Individual is crucial for both debtors and creditors. Below, we delve into the key aspects of this notice and the various types that exist. 1. General Overview: A Notice of Lien — Individual is designed to provide public notice of a creditor's claim against a debtor's property. It serves as a warning to potential buyers or lenders that there is an outstanding debt associated with the property. Filing a Notice of Lien — Individual acts as a proactive step to protect the creditor's rights and ensure that they may receive the payment owed to them. 2. Nashville Tennessee Notice of Lien — Individual Types: a. Mechanic's Lien: A mechanic's lien is a type of Notice of Lien — Individual commonly filed by contractors, subcontractors, or suppliers who haven't been paid for their labor, materials, or services on a construction project. This type of lien grants them a legal right to sell the property to recover the outstanding debt. b. Tax Lien: The Nashville Tennessee Notice of Tax Lien — Individual is issued by the state or local authorities to collect unpaid taxes, including property taxes, income taxes, or sales taxes. Tax liens take priority over other liens and can significantly impact the property owner's ability to sell or refinance. c. Judgment Lien: Judgment liens are filed when a creditor who has obtained a court judgment against an individual seeks to enforce that judgment by placing a lien on the debtor's property. This type of lien can be filed for various reasons, such as unpaid debts or damages awarded in a lawsuit. d. Personal Lien: Personal liens can be filed against an individual's property for various reasons, including unpaid child support, alimony, or other court-ordered obligations. These liens are designed to ensure compliance with legally mandated payments. 3. Filing Process and Legal Requirements: To file a Nashville Tennessee Notice of Lien — Individual, specific legal requirements must be met. These can vary based on the type of lien being filed. Generally, the creditor must complete a notice form accurately, referencing the debtor's name, the amount owed, and a description of the property involved. The lien must then be properly recorded with the appropriate county or state office to ensure its validity. It is crucial for both creditors and debtors to understand the impact of a Notice of Lien — Individual. Creditors may leverage the lien to secure repayment or initiate legal actions, while debtors should take the necessary steps to address the underlying obligations to avoid potential hardships and complications in their financial affairs. In conclusion, a Nashville Tennessee Notice of Lien — Individual is a powerful tool utilized by creditors to claim the debt owed to them. Understanding the different types of liens and the associated legal requirements is essential for all parties involved. Whether it's a mechanic's lien, tax lien, judgment lien, or personal lien, individuals in Nashville should be well-informed of the implications and act responsibly to protect their interests.