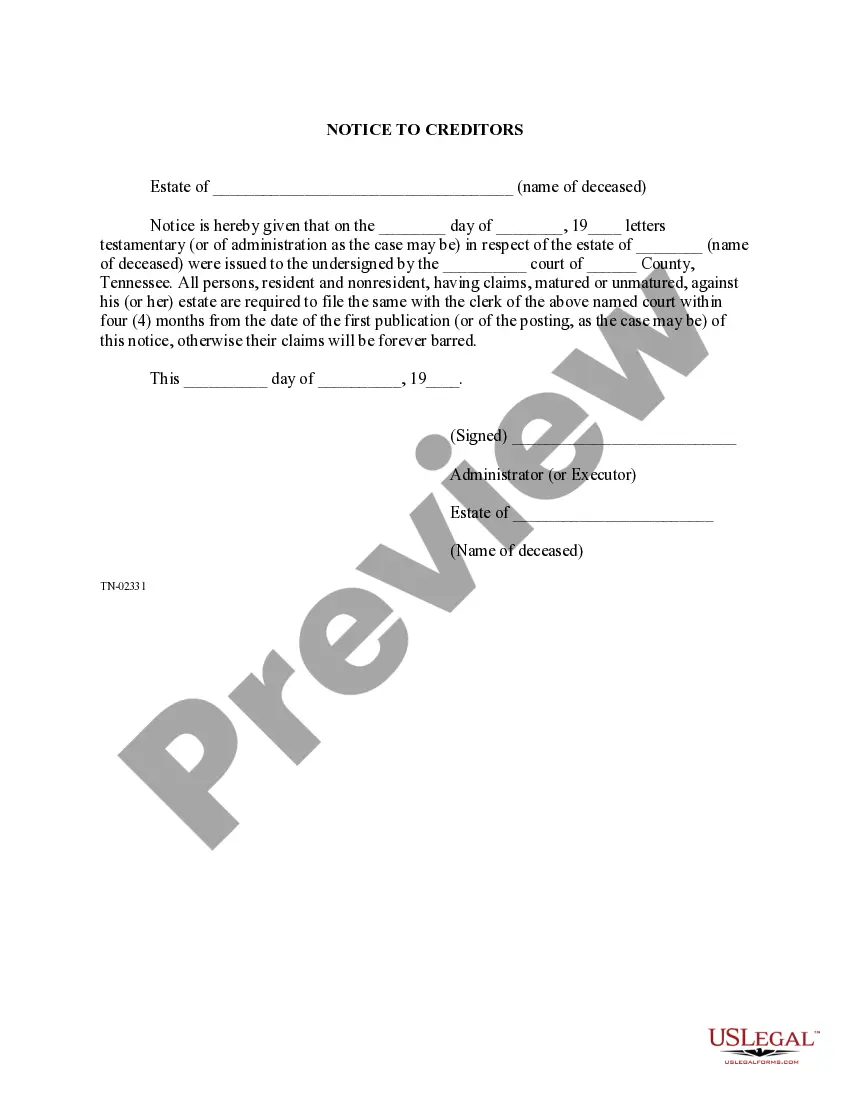

This is a sample form for use in Tennessee, a Notice to Creditors of Estate. Adapt to fit your circumstances. Available in standard formats.

Memphis Tennessee Notice to Creditors of Estate

Description

How to fill out Tennessee Notice To Creditors Of Estate?

If you are looking for a legitimate document, it's challenging to find a superior platform than the US Legal Forms site – one of the largest online databases.

With this collection, you can access numerous templates for business and personal use categorized by types and locations, or keywords.

With the excellent search capability, finding the most recent Memphis Tennessee Notice to Creditors of Estate is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the format and save it to your device. Edit as needed. Fill out, alter, print, and sign the received Memphis Tennessee Notice to Creditors of Estate.

- Additionally, the accuracy of each document is validated by a group of experienced lawyers who consistently assess the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Memphis Tennessee Notice to Creditors of Estate is to sign in to your account and select the Download option.

- If this is your first time using US Legal Forms, just adhere to the instructions below.

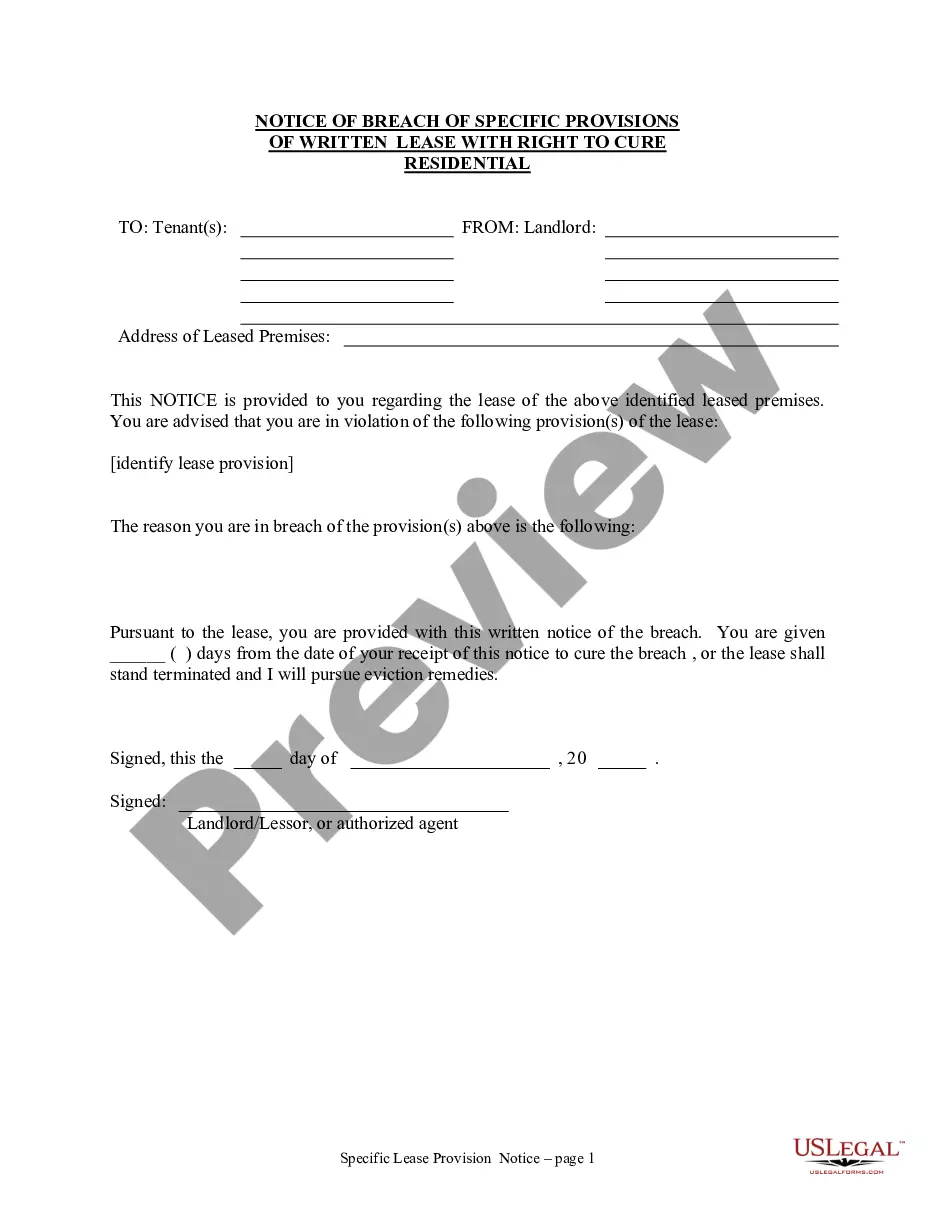

- Ensure you have selected the template you desire. Review its description and utilize the Preview function to examine its contents. If it does not fulfill your requirements, use the Search bar at the top of the page to find the right document.

- Validate your choice. Click on the Buy now button. Then, select your desired subscription plan and provide information to set up an account.

Form popularity

FAQ

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

Tennessee has a simplified probate process for small estates. To use it, an executor files a written request (affidavit) with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

In Tennessee, the longest period that a creditor ever has to file a claim against an estate is twelve months from the date of the death of the deceased.

Generally, in Tennessee, probate can take anywhere from six months to a year. However, the process can take longer if there is a dispute over the deceased person's will or any unusual assets or debts involved.

Tennessee has no statutory time limit on submitting a will for probate. Generally, however, wills are considered void ten years after the decedent's death, with some exceptions.

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.

Probate in Tennessee commonly takes six months to a year. It may take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

The executor has 60 days to start the process by submitting an inventory of the estate's assets, notifying heirs and creditors and asking the state's tax authorities and the Medicaid agency, TennCare, for a release of any claims.