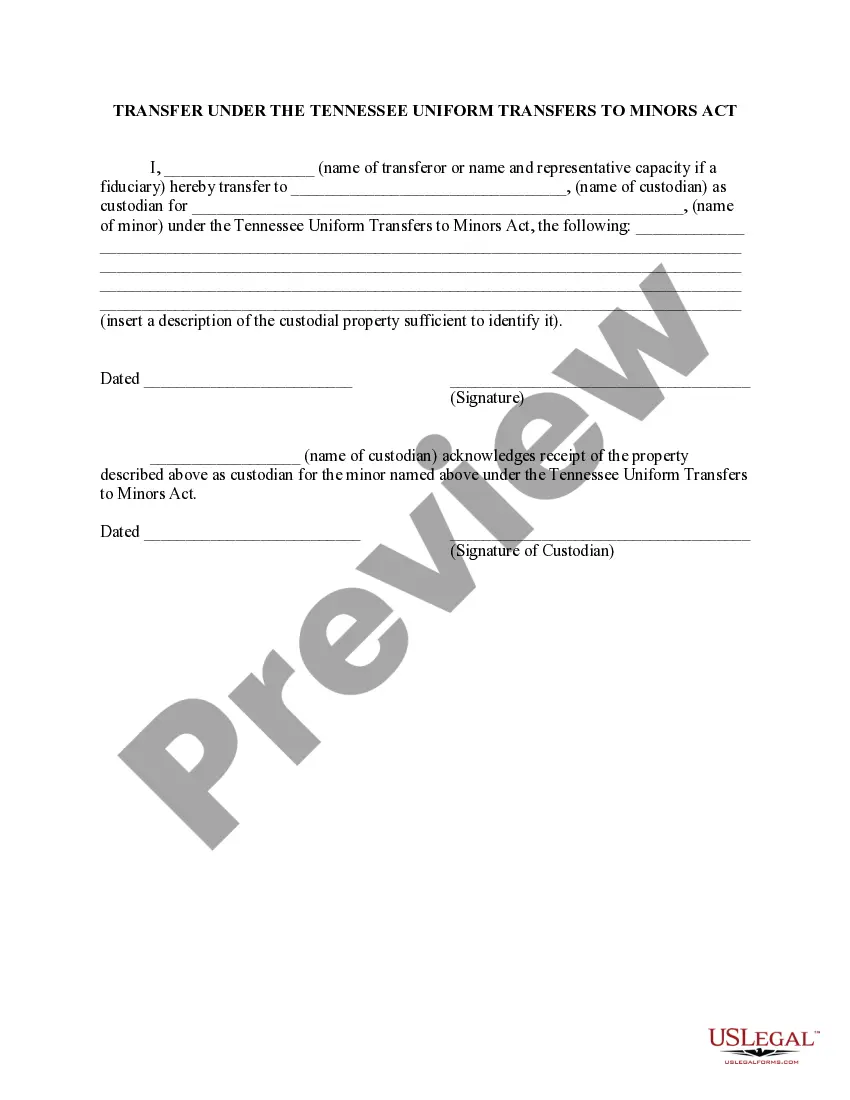

This is a sample form for use in Tennessee, a Transfer Under the Tennessee Uniform Transfers to Minors Act. Adapt to fit your circumstances. Available in standard formats.

Title: Understanding Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act Keywords: Clarksville Transfer, Tennessee Uniform Transfers to Minors Act, TMA, minor's assets, custodial account, legal guardianship, financial management, estate planning Introduction: The Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act (TMA) is a legal process that allows individuals to transfer assets and property to minors while ensuring they are managed and protected until the minor reaches' adulthood. This article aims to provide a detailed insight into the various aspects of the Clarksville Transfer Under the Tennessee TMA, its types, and the importance of utilizing this legal mechanism for the benefit of minors. 1. Clarksville Transfer Under the Tennessee TMA: The Clarksville Transfer under the Tennessee Uniform Transfers to Minors Act, commonly known as TMA, is a set of laws designed to provide a framework for the transfer of assets, such as cash, securities, real estate, and other property rights, to minors. This legal mechanism offers a way to preserve, manage, and protect assets for the benefit of minors while allowing for the appointment of a custodian until the minor comes of age. 2. Types of Clarksville Transfer Under the Tennessee TMA: a. Cash Transfers: The TMA enables individuals to transfer monetary funds, including savings accounts, investments, or other liquid assets to a custodial account, designated for the minor's benefit. The custodian manages and invests these funds until the minor reaches the age of majority specified by state law. b. Securities Transfers: Under the TMA, securities such as stocks, bonds, mutual funds, or other financial instruments can be transferred to a custodial account in the minor's name. The custodian oversees these investments and ensures they benefit the minor, allowing them to assume full control over these assets upon reaching the age of majority. c. Real Estate Transfers: The TMA also permits the transfer of real estate assets, including land, houses, or rental properties, to a custodian for the minor's benefit. The custodian holds and manages the property until the minor turns of legal age, at which point the title can be transferred to the minor. 3. Benefits and Importance: a. Asset Protection: By utilizing the Clarksville Transfer under the Tennessee TMA, individuals can protect assets from potential risks or claims, ensuring they are safeguarded for the minor's future. b. Financial Management: The act promotes responsible financial management by allowing a custodian to oversee the minor's assets, making informed investment decisions and ensuring the funds are utilized appropriately. c. Estate Planning: The TMA provides a valuable estate planning tool, allowing individuals to distribute their assets to minors in a controlled manner, potentially reducing inheritance tax and probate costs. d. Tax Efficiency: Under the TMA, any income generated from the transferred assets is typically taxed at the minor's lower income tax rate, potentially reducing the overall tax burden. Conclusion: The Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act offers a comprehensive legal framework for transferring assets to minors in a controlled and protective manner. Whether it involves cash, securities, or real estate, this mechanism allows for efficient management and provides a range of advantages, including asset protection, financial management, estate planning benefits, and tax efficiency. Proper understanding and utilization of Clarksville Transfer under the Tennessee TMA can ensure the long-term financial stability and security of minors.Title: Understanding Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act Keywords: Clarksville Transfer, Tennessee Uniform Transfers to Minors Act, TMA, minor's assets, custodial account, legal guardianship, financial management, estate planning Introduction: The Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act (TMA) is a legal process that allows individuals to transfer assets and property to minors while ensuring they are managed and protected until the minor reaches' adulthood. This article aims to provide a detailed insight into the various aspects of the Clarksville Transfer Under the Tennessee TMA, its types, and the importance of utilizing this legal mechanism for the benefit of minors. 1. Clarksville Transfer Under the Tennessee TMA: The Clarksville Transfer under the Tennessee Uniform Transfers to Minors Act, commonly known as TMA, is a set of laws designed to provide a framework for the transfer of assets, such as cash, securities, real estate, and other property rights, to minors. This legal mechanism offers a way to preserve, manage, and protect assets for the benefit of minors while allowing for the appointment of a custodian until the minor comes of age. 2. Types of Clarksville Transfer Under the Tennessee TMA: a. Cash Transfers: The TMA enables individuals to transfer monetary funds, including savings accounts, investments, or other liquid assets to a custodial account, designated for the minor's benefit. The custodian manages and invests these funds until the minor reaches the age of majority specified by state law. b. Securities Transfers: Under the TMA, securities such as stocks, bonds, mutual funds, or other financial instruments can be transferred to a custodial account in the minor's name. The custodian oversees these investments and ensures they benefit the minor, allowing them to assume full control over these assets upon reaching the age of majority. c. Real Estate Transfers: The TMA also permits the transfer of real estate assets, including land, houses, or rental properties, to a custodian for the minor's benefit. The custodian holds and manages the property until the minor turns of legal age, at which point the title can be transferred to the minor. 3. Benefits and Importance: a. Asset Protection: By utilizing the Clarksville Transfer under the Tennessee TMA, individuals can protect assets from potential risks or claims, ensuring they are safeguarded for the minor's future. b. Financial Management: The act promotes responsible financial management by allowing a custodian to oversee the minor's assets, making informed investment decisions and ensuring the funds are utilized appropriately. c. Estate Planning: The TMA provides a valuable estate planning tool, allowing individuals to distribute their assets to minors in a controlled manner, potentially reducing inheritance tax and probate costs. d. Tax Efficiency: Under the TMA, any income generated from the transferred assets is typically taxed at the minor's lower income tax rate, potentially reducing the overall tax burden. Conclusion: The Clarksville Transfer Under the Tennessee Uniform Transfers to Minors Act offers a comprehensive legal framework for transferring assets to minors in a controlled and protective manner. Whether it involves cash, securities, or real estate, this mechanism allows for efficient management and provides a range of advantages, including asset protection, financial management, estate planning benefits, and tax efficiency. Proper understanding and utilization of Clarksville Transfer under the Tennessee TMA can ensure the long-term financial stability and security of minors.