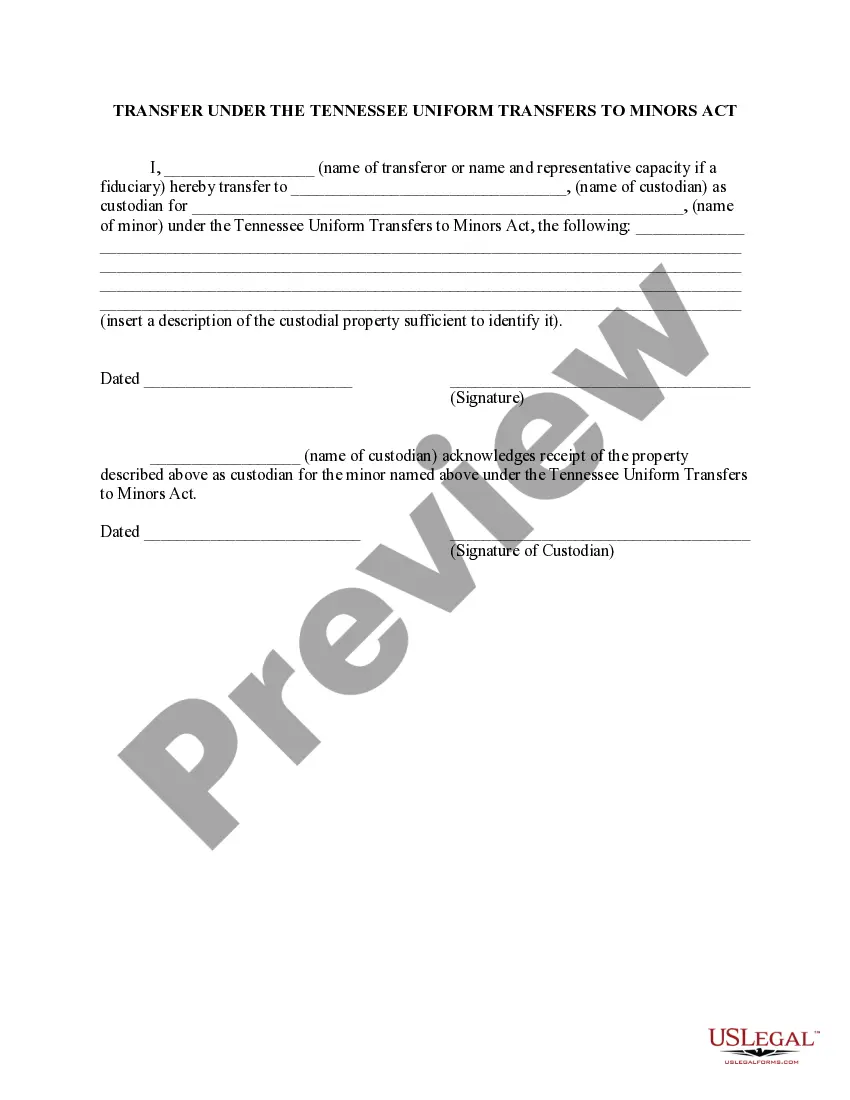

This is a sample form for use in Tennessee, a Transfer Under the Tennessee Uniform Transfers to Minors Act. Adapt to fit your circumstances. Available in standard formats.

The Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act is a legal mechanism that allows individuals to transfer assets to a minor beneficiary while appointing a custodian to manage those assets until the minor reaches the age of majority. This act is designed to protect the minor's interests and ensure that the assets are used for their benefit. Under this act, there are two types of transfers that can be made: outright transfers and custodial transfers. Outright transfers involve gifting assets directly to the minor beneficiary, while custodial transfers appoint a custodian to manage the assets until the minor reaches a specified age, usually 21. The Murfreesboro Transfer under this act provides several advantages. Firstly, it allows for the seamless transfer of assets to a minor without the need for a formal trust. It simplifies the process and saves time and costs associated with the creation and management of a trust. Secondly, it offers flexibility in choosing the custodian who will manage the assets on behalf of the minor beneficiary. The custodian can be a trusted family member, friend, or a financial institution, ensuring that the assets are properly handled until the minor becomes an adult. Moreover, the Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act provides tax benefits as the assets transferred are considered completed gifts, potentially reducing estate and gift tax liabilities. Additionally, this act ensures that the assets are protected from potential creditors or legal claims against the custodian, shielding the minor's assets from unnecessary risk. To initiate a Murfreesboro Transfer under this act, the transferor needs to execute a legal document, such as a deed or a financial account registration, clearly stating the intention to transfer the assets to the minor, along with appointing a custodian and specifying the age at which the minor will gain control over the assets. In conclusion, the Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act provides a streamlined and efficient method to transfer assets to a minor beneficiary while safeguarding their best interests. Whether through outright transfers or custodial transfers, this act ensures a smooth transition and proper management of assets until the minor reaches' adulthood.The Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act is a legal mechanism that allows individuals to transfer assets to a minor beneficiary while appointing a custodian to manage those assets until the minor reaches the age of majority. This act is designed to protect the minor's interests and ensure that the assets are used for their benefit. Under this act, there are two types of transfers that can be made: outright transfers and custodial transfers. Outright transfers involve gifting assets directly to the minor beneficiary, while custodial transfers appoint a custodian to manage the assets until the minor reaches a specified age, usually 21. The Murfreesboro Transfer under this act provides several advantages. Firstly, it allows for the seamless transfer of assets to a minor without the need for a formal trust. It simplifies the process and saves time and costs associated with the creation and management of a trust. Secondly, it offers flexibility in choosing the custodian who will manage the assets on behalf of the minor beneficiary. The custodian can be a trusted family member, friend, or a financial institution, ensuring that the assets are properly handled until the minor becomes an adult. Moreover, the Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act provides tax benefits as the assets transferred are considered completed gifts, potentially reducing estate and gift tax liabilities. Additionally, this act ensures that the assets are protected from potential creditors or legal claims against the custodian, shielding the minor's assets from unnecessary risk. To initiate a Murfreesboro Transfer under this act, the transferor needs to execute a legal document, such as a deed or a financial account registration, clearly stating the intention to transfer the assets to the minor, along with appointing a custodian and specifying the age at which the minor will gain control over the assets. In conclusion, the Murfreesboro Transfer under the Tennessee Uniform Transfers to Minors Act provides a streamlined and efficient method to transfer assets to a minor beneficiary while safeguarding their best interests. Whether through outright transfers or custodial transfers, this act ensures a smooth transition and proper management of assets until the minor reaches' adulthood.