A mechanic's lien shall have precedence over all other subsequent liens or conveyances during such time; provided, that a sworn statement of the amount due and/or approximating that to accrue for such work, labor, or materials, and a reasonably certain description of the premises, shall be filed, within the ninety-day period referred to in § 66-11-115(b), or in the case of liens acquired by contract executed on or after April 17, 1972, by virtue of § 66-11-141, within ninety (90) days after completion of the structure which is or is intended to be furnished water by virtue of drilling a well, or abandonment of work on the structure, as the case may be, with the county register, who shall note the same for registration, and put it on record in the lien book in the office of the register, for which the register shall be entitled to the sums specified in § 8-21-1001, which sums shall be paid by the party filing the same; but such fees shall be receipted for on the statement of account, and shall be part of the indebtedness or charge secured by the lien, and this registration shall be notice to all persons of the existence of such lien.

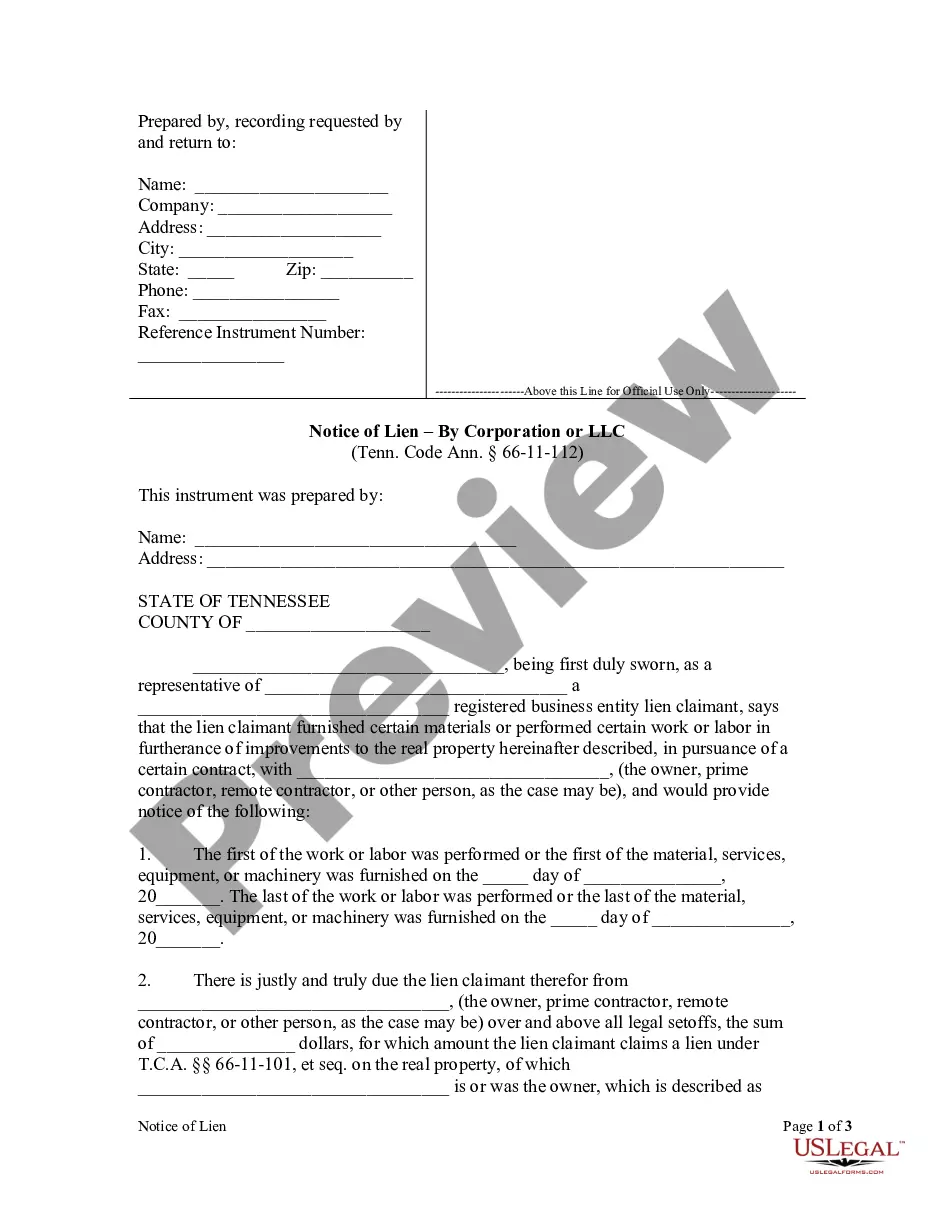

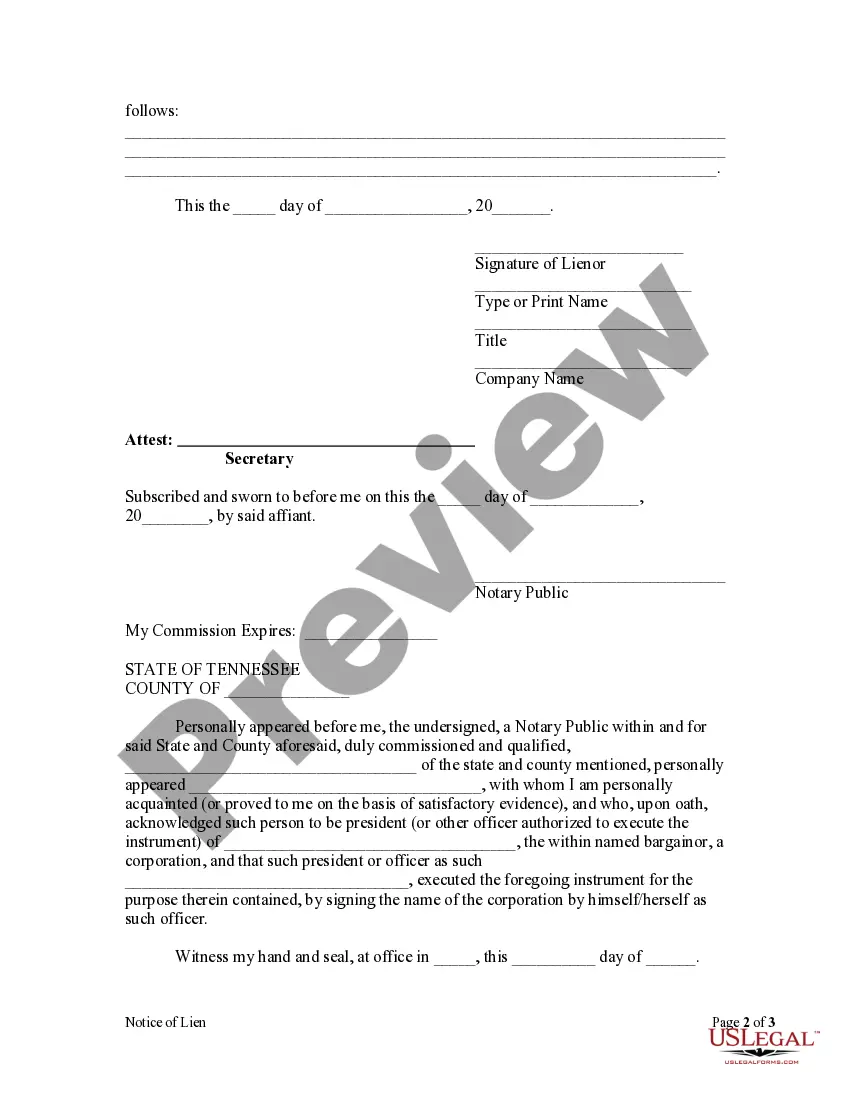

Memphis Tennessee Notice of Lien - Corporation

Description

How to fill out Tennessee Notice Of Lien - Corporation?

Irrespective of one's societal or occupational position, finalizing legal paperwork is a regrettable requirement in the current professional landscape.

Frequently, it becomes nearly impossible for an individual lacking legal training to generate such documents from scratch, primarily due to the intricate language and legal intricacies they encompass.

This is where US Legal Forms comes to provide assistance.

Ascertain that the template you selected is appropriate for your locality since the regulations of one state or area do not apply to another.

Review the document and read through a brief overview (if available) of the situations for which the document might be relevant.

- Our service offers a vast array of over 85,000 ready-to-utilize, state-specific forms applicable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to save time by utilizing our DIY documents.

- Whether you require the Memphis Tennessee Notice of Lien - Corporation or LLC, or any other paperwork that is suitable in your state or region, everything is readily available with US Legal Forms.

- Here's how to obtain the Memphis Tennessee Notice of Lien - Corporation or LLC within minutes using our reliable service.

- If you are already a subscriber, proceed to Log In to your account to access the required form.

- However, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Memphis Tennessee Notice of Lien - Corporation or LLC.

Form popularity

FAQ

All prime and remote contractors must file their Notice of Lien within 30 days of your Notice of Completion, or their liens are extinguished. Tenn.

How long does a judgment lien last in Tennessee? A judgment lien in Tennessee will remain attached to the debtor's property (even if the property changes hands) for ten years.

You can sell your property with a lien attached as long as the buyer is willing to pay off the lien at closing or the proceeds of the sale satisfy the lien before you receive your portion. Many buyers don't like the thought of buying a property with a lien attached, but you can find cash buyers who won't hesitate.

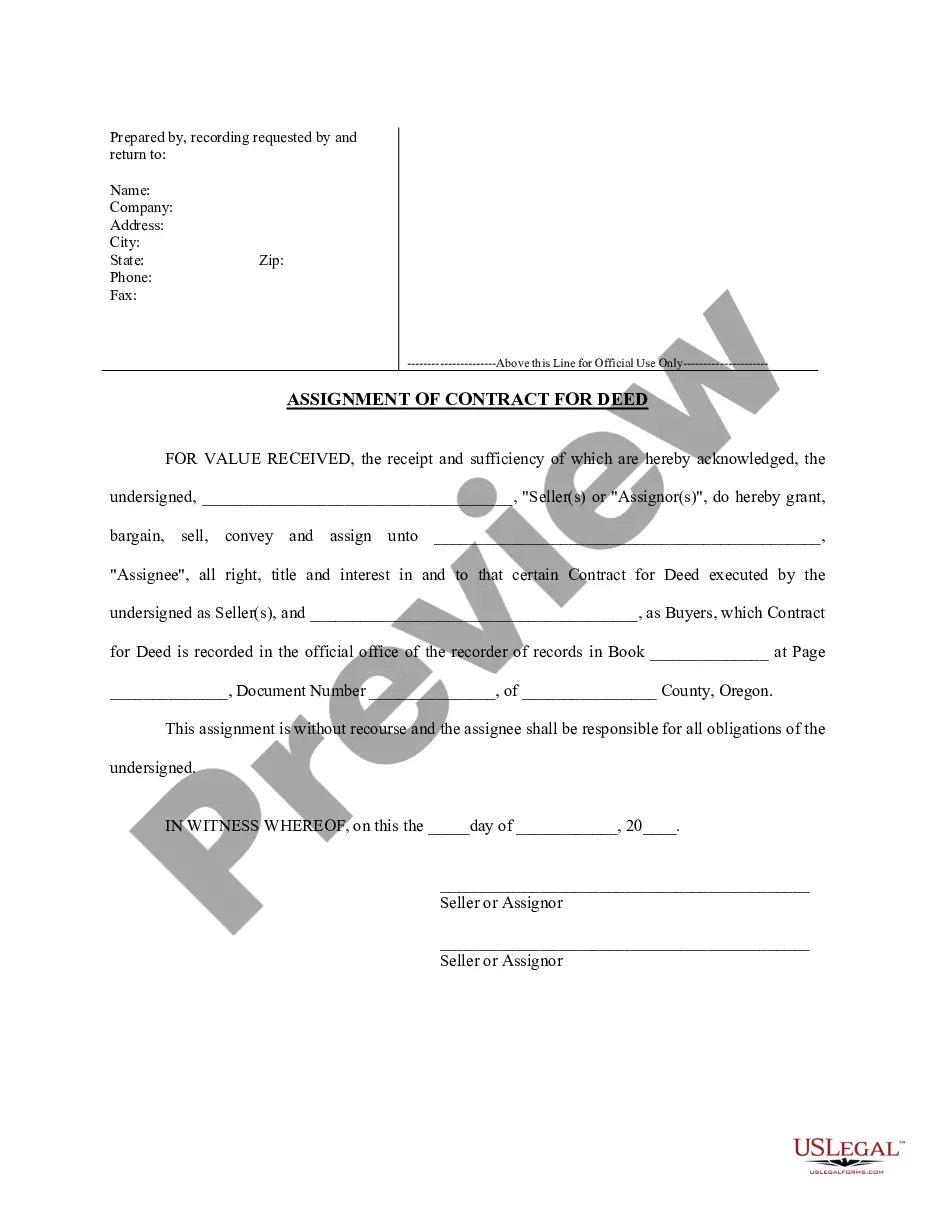

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

Lien Notation Send the completed form. Include all necessary support documentation.Include all fees. Lien notation fee: $11 per lien. County clerk fee: $8.50. State title fee: $5.50. Additional county fees may also apply.Information should be submitted to your local county clerk's office.

File Your Lien Parties with a direct contract with the property owner must initiate a lawsuit to enforce a mechanics lien within 1 year after the completion of the work. Parties without a direct contract with the property owner must initiate an action to enforce their lien within 90 days of the lien's filing.

Can a lien be placed on your property without you knowing? Yes, it happens. Sometimes a court decision or settlement results in a lien being placed on a property, and for some reason the owner doesn't know about it? initially.

Generally, a lien must be filed within 90 days of the completion of the work or improvement. Parties with a direct contract with the property owner must initiate a lawsuit to enforce a mechanics lien within 1 year after the completion of the work.

The best way to know if a property has a lien is to conduct a title deed search online via the county recorder, county assessor, county clerk's website, or visit their office. Also, real estate buyers can choose to work with a title agent to conduct a lien search on the property.